GBP/USD retreated before reaching 1.3200 towards 1.3170s as market sentiment improves

The pound/dollar recovered some of its earlier weekly losses as the Bank of England (BoE) opted to raise borrowing rates for the third time in the same number of monetary policy meetings since December 2021, bringing the pair back into positive territory. The pound to the dollar is currently trading at 1.3176 at the time of writing.

Wall Street ended the week with gains, a reflection of the abrupt increase in investor risk appetite. Peace negotiations between Russia and Ukraine are expected to continue; however, there have been conflicting signals from both sides of the conflict, making it difficult to achieve an agreement that would result in a truce or ceasefire being declared.

President Biden of the United States and Chinese President Xi Jinping met via videoconference late in the New York session. China has communicated its position on the Russia-Ukraine crisis to the United States. "This is not something we want to see," Chinese President Xi Jinping stated, adding that "the events once again demonstrate that nations should not come to the point of meeting on the battlefield."

In other news, after the Federal Reserve raised interest rates by 0.25 percent on Wednesday, marking the first time in three years that rates had been raised, the Fed speakers parade kicked off.

Bullard, the president of the St. Louis Federal Reserve, was the first official to voice his dissatisfaction with the meeting because he wanted the Fed to pursue a balance sheet reduction strategy in addition to a 50 basis point rate rise. In a similar vein, Fed Chairman Waller said that the US central bank should contemplate a 50 basis point rate rise at some time in the future, while also stating that he expected QT to begin by July.

Late in the day, President Neil Kashkari of the Minneapolis Federal Reserve said that the central bank should begin reducing its balance sheet as soon as the following meeting.

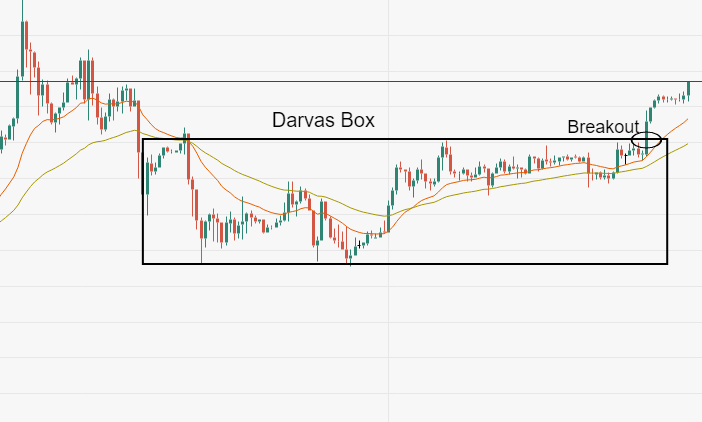

GBP/USD Price Forecast: Technical outlook

Overnight, the GBP/USD traded in a narrow range between the 1.3110s and the 1.3200s, however as the New York session came to a close, the pair had steadied around 1.3176 (see chart).

Because the daily moving averages (DMAs) are located above the exchange rate, the GBP/USD is sloping downward. Despite the fact that cable has returned its ability to trade inside the lower confines of the declining channel, it remains susceptible until the GBP/USD pair is able to retake the 1.3300 resistance level. If that scenario plays out, then a higher rise in the GBP/USD to the 1.3415-40 level, where the 50- and 100-day moving averages are located, is likely. The route of least resistance, on the other hand, goes downhill.

The first point of support for the GBP/USD would be on December 8, 2021, around 1.3160. A breach of the latter would expose November 13, 2020, at 1.3105 on the global financial markets. Once the bottom-trendline of the falling channel around 1.3040 is broken, the GBP/USD will find support around the 1.3000 level, which is just ahead of the 1.3000 mark.