Gold Price Forecast: XAU/USD holds steady around $1,970, just below multi-week high

- Gold price is mitigating some of the bullish impulse from Tuesday.

- The USD remains on firm footing and capped the upside for the metal.

- Ukraine's geopolitical risk is offering some support to the XAU/USD.

In the early European session, gold prices were restricted to a small trading band, around $1,970, as the metal saw subdued/range-bound price activity on Wednesday. Despite the fact that the core consumer price index in the United States fell for the second consecutive month in March, the markets are certain that the Federal Reserve would tighten monetary policy at a quicker pace in order to contain rising inflation. It was this, along with a little increase in the rates on US Treasury bonds, that served as a drag on the price of the non-yielding yellow metal.

A Westpac analyst noted that "Fed governor Brainard (governors always vote) underlined that managing inflation is the FOMC's top goal." In addition, she anticipates some tightening in financial conditions to aid in the moderation of demand, as well as some loosening in supply limitations, which will all work together to assist drive inflation down." She expressed satisfaction with the decrease in core goods prices seen in the March CPI report, but cautioned against putting too much stock in a single piece of data."

With a 50 basis point rate rise expected next month, the US dollar is expected to maintain its trajectory toward a March 2020 high of about 103, as assessed by the DXY index. In fact, it has already set a new cycle high for the day at 100.333, which was seen as another reason that limited the upward potential of the dollar-denominated gold price.

The metal's downside, on the other hand, has been cushioned by fears about the persistence of inflationary forces, which has served to increase its attractiveness as a hedge against increasing costs. In reality, the headline consumer price index (CPI) in the United States showed no signs of slowing in March and soared to levels not seen since 1981. Apart from serving as an inflation hedge, gold has continued to gain from rising geopolitical threats, with the Russian president, Vladimir Putin, ratcheting up the ante in this regard.

The United States will announce an additional $750 million in arms for Ukraine.

Putin said on Tuesday that peace negotiations with Ukraine had reached a stalemate. Putin, on the other hand, has pledged that Russia would fulfill all of its "noble" objectives in Ukraine. "We have once again found ourselves in a dead-end position," Putin said at a press conference during a visit to the Vostochny Cosmodrome, which is 3,450 miles (5,550 kilometers) east of Moscow. "We have no intention of becoming isolated," Putin said. "It is difficult to severely isolate somebody in the current world - particularly in a nation as large as Russia," says the author. Prices of gold should be supported in 2022 as a result of this.

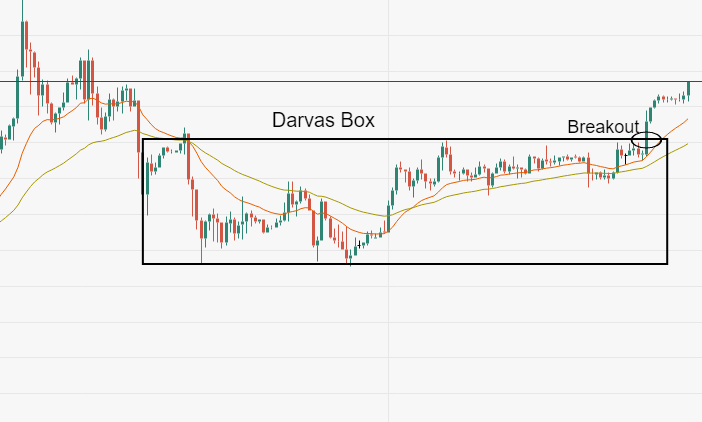

Gold technical analysis

Following a period of range trading since mid-March, the gold price may now be poised for another bullish leg higher. This is seen on the daily chart below, which suggests the price is building on the 2022 surge:

An effort to break out has occurred, but as is normal, a retreat is taking place, and it is now a matter of how far the price can neutralize the bullish impulse before bulls re-enter the market. Although it is unlikely, a strong US dollar might put more pressure on $1,930 in the short term, and if that level is breached, the chances of a move higher in the near term would be much lessened.