USD/CHF oscillates in a 0.9330-0.9350 range as the DXY finds a cushion around 99.70

- USD/CHF is auctioning in a narrow range of 0.9330-0.9350 as investors await US Retail Sales.

- Fed Waller has advocated a 50 bps interest rate to corner the risks of inflation.

- The Swiss docket will report Real Retail Sales later this month.

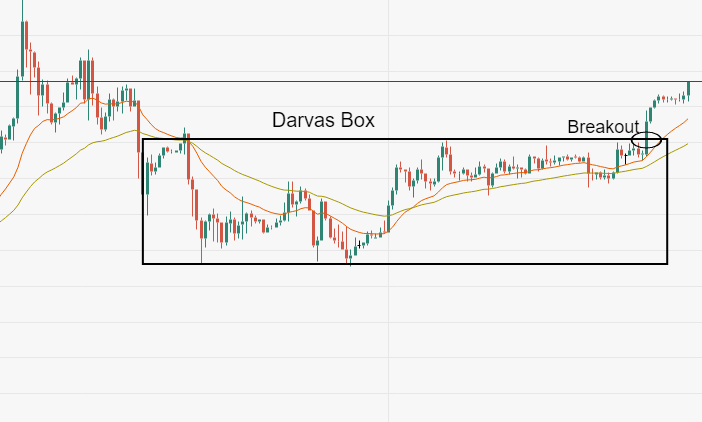

The USD/CHF pair is seeing back-and-forth movements in a band of 0.9325-0.9356 as the US dollar index (DXY) finds bids at 99.70 after taking a major dive earlier in the day Wednesday. With each passing day, the asset is getting closer to its weekly high of 0.9370.

The pair is aiming higher as the probability of a 50 basis point (bps) interest rate increase by the Federal Reserve rises in the near future (Fed). The Federal Reserve is expected to dictate monetary policy in May, and a rising consumer price index (CPI) in the United States, along with a strong labor market, is increasing the likelihood of an aggressively hawkish attitude for May and the remainder of the year.

In a speech on Wednesday, Federal Reserve Governor Christopher Waller advocated for aggressive interest rate hikes in the future, but he cautioned that aggressiveness should not be combined with abruptness, since this may lead to the US economy entering a recession. The adoption of a more abrupt approach to interest rates will have a significant impact on aggregate demand and job prospects, and this might constitute a severe danger to the US economy.

Investors will be paying close attention to monthly retail sales in the United States, which are expected to increase by 0.6 percent in comparison to the previous print of 0.3 percent. In contrast, the Swiss docket will release its annual Real Retail Sales data later this month. Earlier this year, the 12-month real retail sales in Switzerland were reported at 12.8 percent.

USD/CHF

| OVERVIEW | |

|---|---|

| Today last price | 0.9349 |

| Today Daily Change | 0.0003 |

| Today Daily Change % | 0.03 |

| Today daily open | 0.9346 |

| TRENDS | |

|---|---|

| Daily SMA20 | 0.9309 |

| Daily SMA50 | 0.9273 |

| Daily SMA100 | 0.9238 |

| Daily SMA200 | 0.9217 |

| LEVELS | |

|---|---|

| Previous Daily High | 0.9356 |

| Previous Daily Low | 0.9314 |

| Previous Weekly High | 0.9374 |

| Previous Weekly Low | 0.9238 |

| Previous Monthly High | 0.946 |

| Previous Monthly Low | 0.915 |

| Daily Fibonacci 38.2% | 0.934 |

| Daily Fibonacci 61.8% | 0.933 |

| Daily Pivot Point S1 | 0.9321 |

| Daily Pivot Point S2 | 0.9297 |

| Daily Pivot Point S3 | 0.9279 |

| Daily Pivot Point R1 | 0.9364 |

| Daily Pivot Point R2 | 0.9381 |

| Daily Pivot Point R3 | 0.9406 |