Gold Price Forecast: XAU/USD is attempting to move higher, but bears are are lurking

- XAU/USD is marching towards $1,960.00 as DXY has slipped amid uncertainty over the release of the US CPI.

- Fed’s Mester stated that inflation will remain at elevated levels even next year.

- Moscow’s positive comments on the Russia-Ukraine peace may underpin the risk-on impulse going forward.

Following a brief rise in Asia at the start of the week, gold (XAU/USD) has been unable to sustain its gains as the dollar rebounds from the initial negative gap resulting from the French elections and euro's relief bounce. Nonetheless, as the bears swarmed in, the gold price has plateaued at a high of $1,950 and is again back under pressure, having fallen back into the red as of the time of writing.

For the bulls to have a realistic chance of breaking higher and beyond daily resistance near $1,970, they will need the price to maintain its position in the $1,930s in the near future. If the price remains in the $1,930s, it will have a realistic chance of breaking higher and beyond daily resistance near $1,970.

The update has come to an end.

The price of gold (XAU/USD) is steadily rising towards $1,960.00, as the US dollar index (DXY) has been unable to maintain its position above the psychological resistance level of 100.00. The latter saw a negative gap emerge on Monday, owing to growing anxiety around the publication of the Consumer Price Index (CPI) in the United States on Tuesday.

The preliminary reading of the Consumer Price Index (CPI) in the United States is 8.3 percent, indicating that the Federal Reserve (Fed) would lower the interest rate decision in May's monetary policy decision to limit inflationary pressures. Furthermore, the balance sheet reduction will be accelerated in order to reduce the amount of available liquidity in the economy. During an appearance with CBS's Face the Nation on Sunday, Cleveland Federal Reserve President Loretta Mester said that inflation would continue to be high in the coming year and next year, despite the Federal Reserve's efforts to slow the rate of price rises. This suggests that a more restrictive policy environment will prevail in the future than in the past.

Meanwhile, market mood is expected to improve as a result of the de-escalation of the Russian-Ukrainian conflict. A representative for the Russian government said on Friday that "Russia's special operation in Ukraine might be concluded in the near future," given that the objectives have been met and work is being carried out by the military and peace negotiators, according to Reuters news agency.

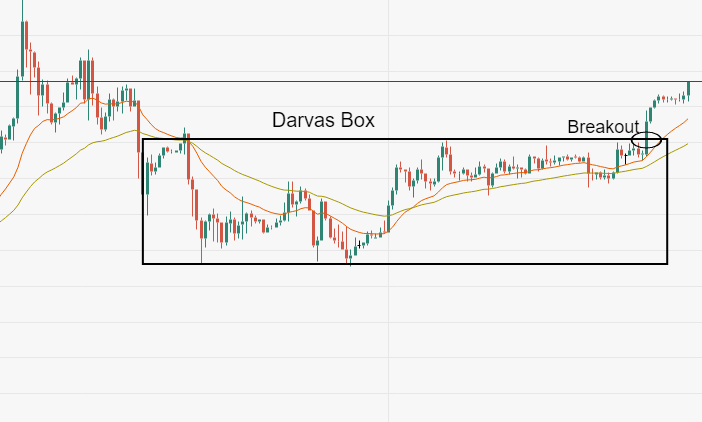

Gold Technical Analysis

On an hourly basis, the gold-to-dollar exchange rate is on the brink of blowing out of the consolidation, which is now located in a limited range of $1,915.50-1,950.00. When the 20-period and 200-period Exponential Moving Averages (EMAs) reach $1,940.00 and $1,931.45 respectively, they begin to scale higher, adding to the upside filters. The Relative Strength Index (RSI) (14) has moved into a bullish area of 60.00-80.00, indicating that there is more upward potential ahead.

Gold hourly chart

XAU/USD

| OVERVIEW | |

|---|---|

| Today last price | 1947.86 |

| Today Daily Change | 0.23 |

| Today Daily Change % | 0.01 |

| Today daily open | 1947.63 |

| TRENDS | |

|---|---|

| Daily SMA20 | 1933.88 |

| Daily SMA50 | 1909.43 |

| Daily SMA100 | 1855.63 |

| Daily SMA200 | 1824.68 |

| LEVELS | |

|---|---|

| Previous Daily High | 1948.23 |

| Previous Daily Low | 1927.74 |

| Previous Weekly High | 1948.23 |

| Previous Weekly Low | 1915.31 |

| Previous Monthly High | 2070.54 |

| Previous Monthly Low | 1890.21 |

| Daily Fibonacci 38.2% | 1940.4 |

| Daily Fibonacci 61.8% | 1935.57 |

| Daily Pivot Point S1 | 1934.17 |

| Daily Pivot Point S2 | 1920.71 |

| Daily Pivot Point S3 | 1913.68 |

| Daily Pivot Point R1 | 1954.66 |

| Daily Pivot Point R2 | 1961.69 |

| Daily Pivot Point R3 | 1975.15 |