EUR/USD Price Analysis: 1.0900 giving way although bulls eye correction to 1.0950

- EUR/USD bears are in control but the bulls are putting up a fight.

- Bulls eye a correction in towards 1.0920 and 1.0950 key levels.

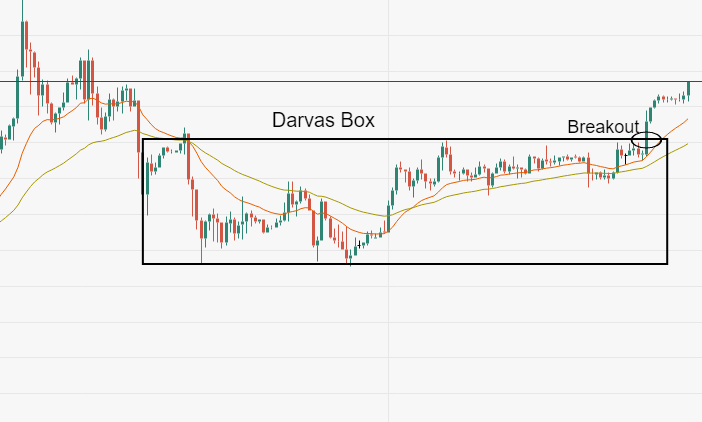

EUR/USD is under pressure but has halted slightly below 1.0900 on the offer. This gives rise to the likelihood of a major correction of the hourly bearish impulse where bears might be drawn to the discount. The following displays the daily and hourly stricture from a bearish viewpoint.

EUR/USD daily chart

The daily chart shows the price in free fall and the March lows are in sight so long as the bears can get below 1.09 the figure, 11 March low where the price is stalling.

EUR/USD H1 chart

The bulls need to commit and 1.09 the figure, although we are seeing some pressures moving in with a current low of 1.0895 so far. Should the price hold up, then there will be prospects of a correction towards 1.0920 and 1.0950 for the coming sessions at which point the bears could be lurking.