priligy side effects This approach focuses on examining existing high quality reviews key quality criteria being the ability of the search strategy and eligibility criteria to capture all relevant studies in order to identify studies meeting our criteria, with the addition of an update of the evidence to the present date

XM Broker Reviews and Full Information

What is XM.com?

The XM broker began its business in 2009 and has been serving clients from more than the globe in 196 countries with support personnel who speak 30 different languages and is among the most reputable Regulated Brokers. The main branch is in Cyprus is regulated by CySEC however, the offices cover the world and are serving Australia, UK, Belize, Greece also approved as well as Dubai and the MENA region.

Around 1.5 Million traders and investors who invest with XM take advantage of the variety of XM trading productsand the services that the broker offers in addition to advanced trading options however, they are suitable for beginner traders too. The reason for this rapid expansion and trust in the broker is because XM is determined to deliver the most user-friendly experience possible for its clients.

With XM the account is open regardless of net capital investment of only 5$ or trading experience. In addition, with its global outlook and exploration of new markets. XM provides webinars as well as research resources. It allows traders from different nations to join and begin trading.

The majority of the procedures, from opening accounts, managing them the deposit/redraw process and trading are simple easy and clear and we'll see in greater detail in the XM review.

XM Pros and Cons

XM is a broker with a excellent reputation and numerous rules and regulations. Its service is very user-friendly and XM is among the lowest deposit requirements in the companies, CFD prices are very low, and the platforms are friendly to traders of all kinds.

However, XM has limited portfolio for EU clients, and outside of EU clients, there isn't adequate protection for investors.

10 Points Summary

| Headquarters | Cyprus and offices in the UK, Australia |

| Regulation | ESMA, CySEC, ASIC, FCA, etc. |

| Platforms | MetaTrader trading software that offers the MT4 and MT5 platforms |

| Instruments | Stocks, CFDs, Forex, Commodities, Portfolios, Metals, Cryptocurrencies |

| EUR/USD Spread | 1.6 pip |

| Demo Account | Available |

| Minimum deposit | 5$ |

| Base currencies | Various currencies |

| Education | Professional Education through seminars and webinars |

| Customer Support | 24/5 |

Awards

All in all, XM achieved a strong focus on the customer's needss while offering extremely competitive terms and a wide range of services that are a draw for global traders. In addition to its impressive results and the esteem of traders, XM received truly international recognitionwith numerous prestigious awards for achievements in the field, such as the Best Forex Broker in Europe The Most Trusted Broker, etc.

Is XM secure or is it a scam?

Yes, XM is no a fraud. We believe that XM as a reputable brokerage to invest in Forex or CFDs. It is licensed and regulated by various top-tier financial institutions such as FCA, ASIC, CySEC. It is therefore secure and safe to trade.

Is XM controlled?

XM Group is a group of licensed online brokers that serves the purpose of Trading Point of Financial Instruments Ltd which was established in 2009 and is regulated the Cyprus Securities and Exchange Commission (CySEC), another company Trading Point of Financial Instruments was founded in the year 2015 in Australia and is regulated by the Australian Securities and Investments Commission ( ASIC). Find out more about how to you should trade with Australian Brokers using the linkso that the requirements of the regulator are fulfilled at a sustainable scale as shown in the XM Review.

Additionally that the global operation is powered via XM global Limited established in 2017 and licensed with the International Financial Services Commission which permits it to offer services around the globe. In spite of it being true that IFSC has an offshore licence, it does not really implement strict supervision of trading procedures, however, the strict regulation of XM allowed it to be a suitable option.

| Entity XM | Regulation and License |

| Trading Point of Financial Instruments Ltd | CySEC (Cyprus) registration no 120/10 |

| Trading Point of Financial Instruments Pty Ltd | ASIC (Australia) registration no 443670 |

| Trading Point MENA Limited | Regulated by the Dubai Financial Services Authority (DFSA) Reference No. F003484 |

| Trading Point of Financial Instruments UK Limited | Regulated by the Financial Conduct Authority FRN: 705428 |

| XM Global Limited | IFSC (Belize) registration number. IFSC/60/354/TS/19 |

Are XM an honest broker?

The principle of the regulations is to allow traders to trade with confidence, in the knowledge that client funds are managed within the strictest of regulations with the least risk of fraud or untruthful use. XM runs its trading environment in accordance with the regulations, and is a reliable broker.

Client funds are stored in high-quality banks and have segregated accounts. being included in the Investor Compensation Fund which guarantees the recovery of funds of up to EUR20,000 in the event that a the broker fails to pay its debts (note that the scheme of coverage is dependent on the specific company). In addition there are other advantages, one of them you'll get in trading Negative Balance Insurance and there is no chance to loss more than the balance.

Leverage

Based on the type of account and the company in which the XM is subject to regulatory obligations You are entitled to leverage that ranges between 1:1-888:1. In order to determine the leverage level you are entitled to utilize, you must look up the terms and conditions of your residency since different XM organizations have different rules in accordance with regulatory requirements.

- XM can leverage that can reach 30:1. This Leverage is available to the EU authorized entity that is part of the Group.

Additionally, Leverage depends on the financial instrument being traded - XM Australian organization and regulations allow up to 500:1.

- And International companyoffers the highest leverage of 1:888.

But, make sure you select your leverage wisely and also the organization that you wish to trade. You could learn more about by visiting the XM education center.

In addition, leverage is always dependent on the financial product you choose to use and, similarly European customers from Trading Point Cyprus may express 1:5 ratio for Cryptocurrencies or even a maximum of 1:2 for some products.

Accounts

All in all, XM made it a easy process as you can choose your the preferred style of trading by using one account that allows you to trade smaller amounts via micro Lots or trade standard size through a Standard account on a spread-only basis. Finally, Zero Accounts will offer an alternative fee-based strategy in which you can get an interbank quote that starts at 0 pip and the cost of trading will be deducted via an amount of charge per lot.

Is it possible to open an XM Accounts within South Africa?

If you're an investor in South Africa - yes you are able to open an XM account for South Africa, because XM has applied for registration with the local regulators since the year 2016, and has even been it is appealing at South African traders. Therefore, traders from all over the world benefit from the great features that XM provides and take advantage of all of the trading benefits quickly.

Account Base currencies?

For the base account currency, XM added extra flexibility regarding this by allowing you to choose XM Account, you are able to choose the base currency you prefer from the extensive supported range. This includes South African Rand (ZAR) or Singapore Dollar (SGD), in addition to the other currencies of the world.

In the end, signing up with XM gives you complete transparency in transactions in money, and you can avoid the cost of conversion for withdrawals and deposits as you choose your base rate.

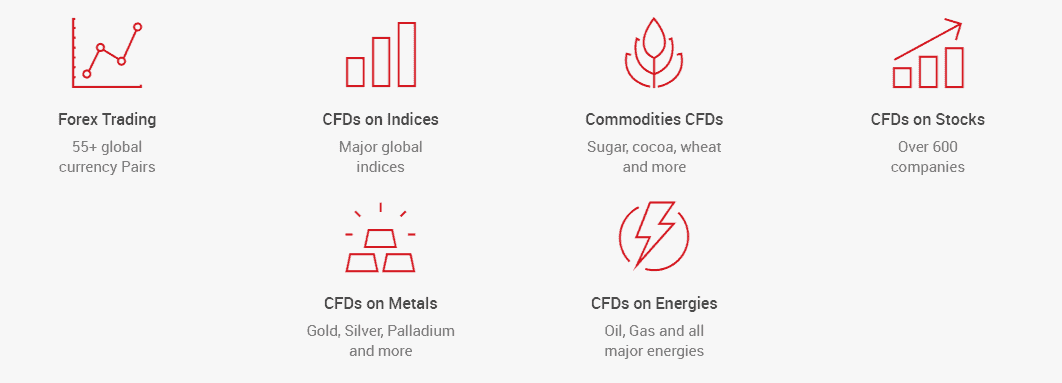

Trading Instruments

In addition to its excellent characteristics, XM makes trading more enjoyable by offering a wide variety of products , so you can have a choice that is in line with your expectations and needs.

A wide range of markets for trading that are accessible through a single multiasset account with 6 Asses Classes , and around 55 currency pairs and an overall total of over 1000 trading markets. You are also able be able to invest in Forex and CFDs on commodities, stock indices such as metals, stocks cryptocurrencies and energy with XM, all through the same account for trading.

Fees

XM operates on different spreads as does the interbank forex market . It also has no limitations on trading when news releases are released. Fixed spreads from XM are greater than variable spreads one time also, and they being more adaptable to different trading strategies. This means that all costs for trading are calculated as the spread, with no charges hidden or hidden, and are the most competitive spreads. Additionally, when choosing the broker, make sure to look beyond only the spread but also fees for withdrawals, non-trading charges or any other charges that may be apply so that you can be able to see the whole picture.

| Fees | XM Fees | FXTM Fees | AvaTrade Fees |

|---|---|---|---|

| Deposit fee | No | No | No |

| Withdrawal fee | No | No | No |

| Inactivity fee | Yes | Yes | Yes |

| Fee rating | Average | Average | Low |

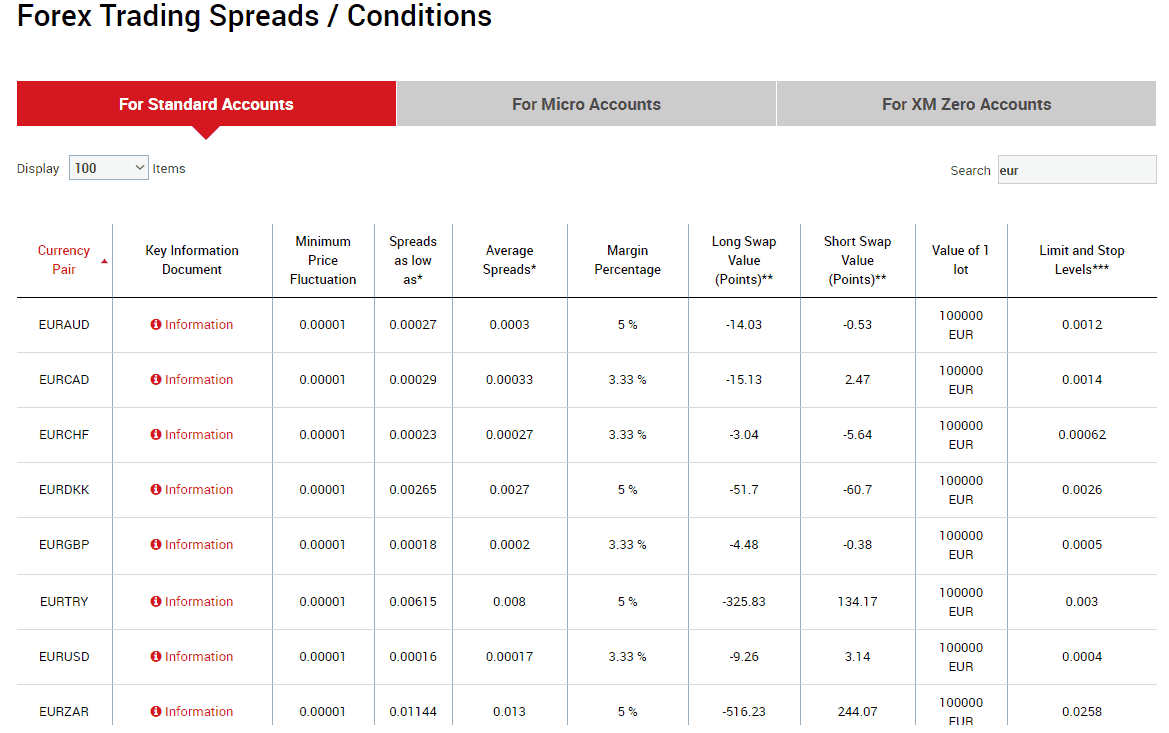

Spreads

The XM price and cost are dependent on a spread when you open a the Standard or Micro account. Additionally, XM spread is a fractional pip rate which gets the highest rates from XM's many liquidity service providers. In other words, instead of traditional price quotes that are 4-digits, you will get the lowest price fluctuations by adding the fifth digit, also commonly referred to as an XM spread..

Below is a typical spreads calculated over the course of the day using the basis of a Standard account, which is available for the some of the most well-known products. Although some spreads may be more expensive than their competition, the general cost structure is fairly standard for Forex products, and is low for CFDs.

| Asset/ Pair | XM Spread | FXTM Spread | AvaTrade Spread |

|---|---|---|---|

| EUR USD Spread | 1.6 Pips | 1.5pips | 1.3 Pips |

| Crude Oil WTI Spread | 5 pip | 9 pip | 3 pip |

| Gold Spread | 35 | 9 | 40 |

| BTC USD Spread | 60 | 20 | 0.75% |

What exactly is XM commission?

The commission is applied to XM Zero accounts exclusively since you'll be trading using interbank spread quotes beginning at zero pips, and commission charges as a fee for trading. XM offers transparent terms and offers a competitive rate that is $3.5 for each lot for 100,000 USD of trade. Also, you can use the calculator for fees offered by XM for a quick comprehension of your expenses.

Conditions for fee upon the opening of trade

Overnight fee

In addition, you need to take into account the the overnight fee XMor the cost that trader pay when the trade is open for more than one day and in agreement through a swap agreement that is charged as an expense. Each currency comes with a distinct interest rate that is determined by an equation.

For example, suppose you have interest rates that in Japan as well as the US are 0.25 percent p.a. and 2.5 percent p.a. and 2.5% p.a. respectively, with open positions, the trader may gain or lose or lose USD 6.16 daily or loss USD 6.16 daily, depending on the rollover calculation is based on interest rate to the an unsecured currency, or on bought currency.

There are also swap fee terms in the image above and for more information , look up and look up and compare XM fees to an alternative broker Pepperstone.

Deposits and Withdrawals

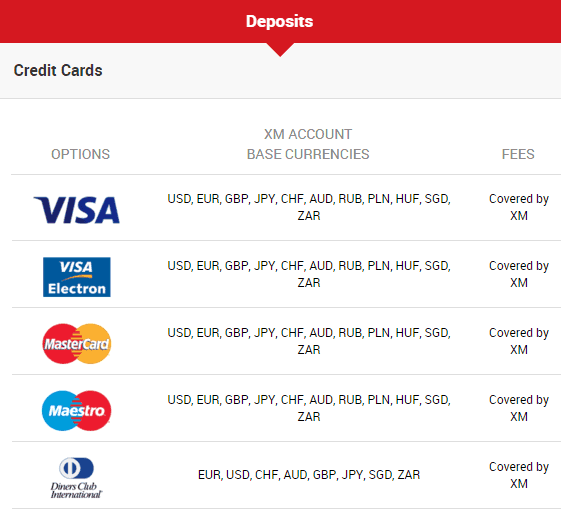

The funds transactions at XM are handled with a focus on the customer and traders have the option of payment options across every country. Different payment options are utilized, XM has once again taken note of the convenience of customers and offered the option of local bank transfers that allows you to transfer funds to the account using local banks and currencies with no additional conversion costs.

Deposit Options

- Credit cards

- Bank wire as well as Local Bank Transfer (available in certain regions)

- E-wallets include Neteller, Moneybookers Skrill, Western Union, etc

XM minimum deposit

Minimum depositamount is $5 only for a Micro Account or a Standard account, for those who wish to trade using a Zero account, the minimum deposit is also competitive and is 100$ as the initial amount. The amount of deposit varies in accordance with the payment method and the trading account confirmation status. However, you can look up and locate all the information you need within the Member Area.

Minimum deposit for XM vs other brokers

| XM | Most Other Brokers | |

| Minimum Deposit | $5 | $500 |

XM Withdrawal

XM choices for withdrawals are exactly the similar to the deposit options that include Bank Wire transfers, e-wallets and Credit Debit cards. XM applies with a 0% withdrawal fee and has no charges on deposits and withdrawals. A very welcome addition as the XM company has all fees associated with transfers, including ewallets as well as major credit cards, instant account funding, as well as wire transfers that do not charge commissions or hidden charges.

Furthermore, even though many brokers charge for wire withdrawals the XM deposit and withdrawals over 200 USD that are processed via wire transfer are also covered in the Company's zero fee policy.

How can I withdraw money from my XM Account?

To withdraw money to the XM trading account, follow the steps below Also, don't hesitate to contact customer support for any queries or conditions.

Step-by-step instructions on how to withdraw money

1. Log in to your account

2. Choose 'Withdraw Funds' from the menu tab

3. Enter the amount that you have withdrawn.

4. Select the withdrawal method you prefer.

5. Fill out the electronic form with all the required information

6. Confirm the withdrawal details and submit

7. Verify the current status of withdrawal on your Dashboard

How long will XM Withdrawal last?

The XM Accounting team process withdrawal requests quickly and within 1-3 business days , it is dependent on the nation the money will be sent to, and different rules and regulations are applicable. The typical bank in the EU takes about 3 working days to allow the cash to be deposited into your account. However, certain institutions or methods may complete the process in a matter of minutes or longer, dependent on the method of payment you choose to use.

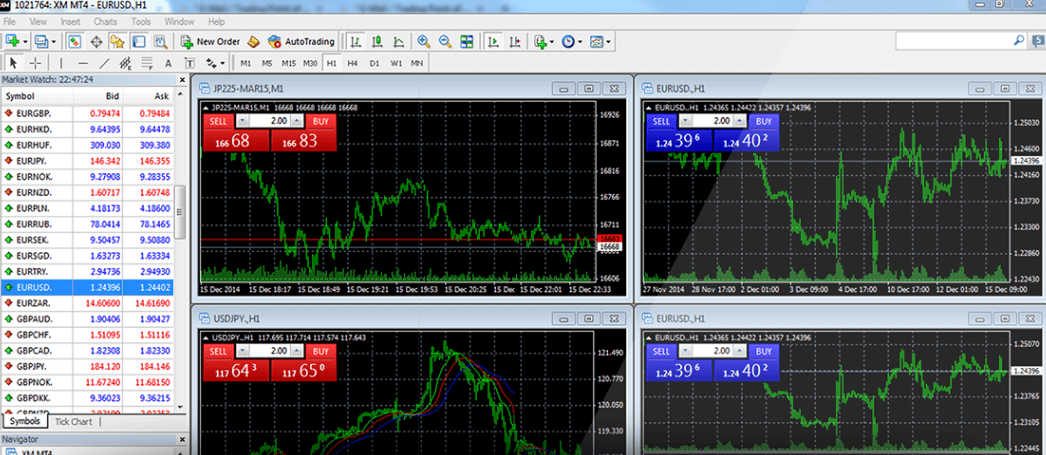

Trading Platforms

Regarding this trading program, XM clients access to trade and make transactions on the highly-respected and well-designed trade platforms MetaTrader4 as well as MetaTrader5.

Platform Ratings

XM uses their technology on the most popular industry platform MT4 and the MT5 not based on case but to the benefit of traders since the platforms are well recognized and let you gain access to numerous extensions or extensive training on the use of tools. These platforms are getting high scores due to its global popularity and is always an advantage to brokers' proposals.

Web Trading

Accessible directly from one account and accessible in a variety of versions on all platforms. come with a complete website that includes technical analyses, indicator, and complete tools, stop or trailing orders. So you can gain access to XM trading through using your browser and logging in on to Web Trading.

| Pros | Cons |

|---|---|

| Software that is user-friendly | MetaTrader is the only option available. MetaTrader available |

| The mainstay of MT4 as well as MT5 platforms | |

| 16 different platforms are that are suitable to Web, Mobile and Desktop trading | |

| Mobile App for iOS and Android | |

| Simple to use | |

| Fee Report | |

| Supporting a variety of languages |

Desktop Trading Platform

Although XM has made the software more efficient and suited to 16 trading platforms that are compatible with every device such as mobile, web and even multiple account for trading. So you get complete account functionality and can perform trading easy and comfortable if you use the Desktop platform or any other version to trade.

Since XM utilizes MT4 or its more recent version MT5 you're able to utilize its power in conjunction in conjunction with automated trading and trader robots. EAs can be used with unlimited access of charts for those who prefer trading with technology, but fantastic manual trading tools can help you with your trading strategy. Overall, all requirements and needs of trading are addressed and at a very durable levels.

Look and Feel

MetaTrader is renowned for its clear and smooth feeling when trading, as well as its Charting features are among the best options on the market. Also, as we do, you'll appreciate the design and features provided.

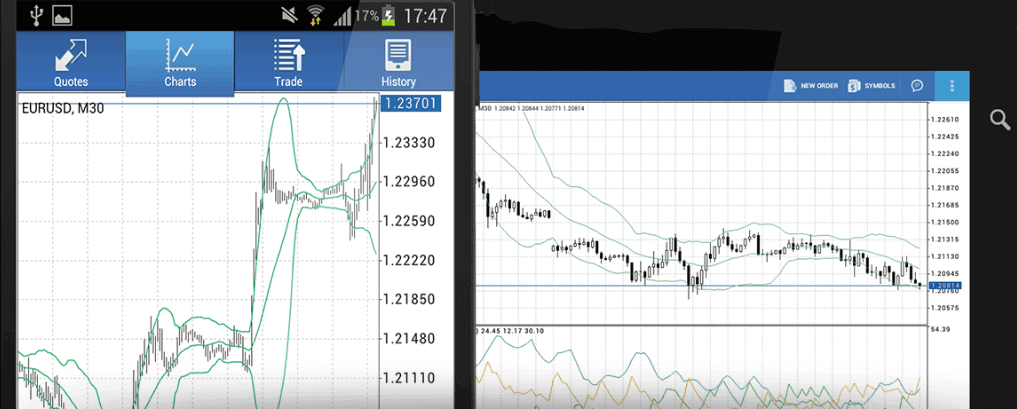

Mobile Trading Platform

Of course , you'll be allowed to use your mobile to trade also, XM MT4 Android and iOS apps, in addition to XM applications for MT5 will grant traders access to a trading accounts that have full account capabilities. The MT4 along with MT5 apps also provide excellent charts with three chart types and more than 30 technical indicators within the package, and a complete journal of trading history. So

How do I place an order with XM?

The process of placing an order is very easy process, since both MT4 and MT5 provide the option of trading with one click. You can choose between pending or market order that is available across all platforms. Risk tools are in addition, and are essential to never miss and adhere to your strategy. When you are ready to place an order you need to follow the following steps.

- With Market Watch select the product you would like to trade

- Right click on the icon "New Order"

- Select the order as in the process of being a Pending Order or Market Order under the "Type"

- Set the Risk, Reward and Expectancy levels with the help of a set of volume, stop loss and Take Profit

- Select Place

- After the order is completed, you can alter or cancel your purchase at any time, as closing it manually after having completed.

Platform trading tools

Additionally to this, there are many Add-ons to XM that allow you to benefit from additional advantages that the platform has to offer. This includes XM VPS, rapid Trade Execution, and remote connection to Virtual Private Server(VPS). It is the XM VPS brings non-stop work without monitoring your computer or being connected to the computer. Clients who have an amount at least $5,000 or less is eligible to apply for the free VPS in the event who don't satisfy the requirements, they are able to request a VPS for a monthly price of $28.

Customer Support

In terms of support and customer service, as we have seen XM worldwide covers all needs for trading as well as the customer service department can be found in all international locations and has about 25 other language which include Chinese, Russian, Hindi, Arabic, Portuguese, Thai, Tagalog and more languages.

Customer service is available 24 hours a day 5 7 days a month and is ready to assist you with your questions and queries via either phone, email and live chat. We also found the customer service to be of high-quality service with reliable responses that confirm the XM's policy of focusing on customers.

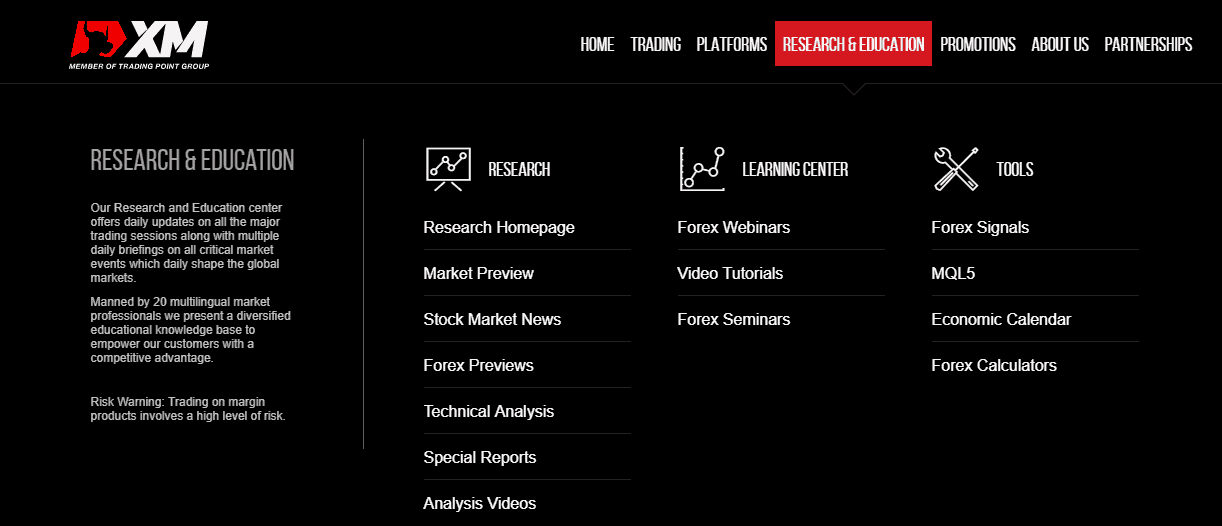

Education

Alongside the excellent customer support, every client can gain access to numerous educational resources via the XM Learning Center with trading information and other important data that will help bring trading to a higher quality. In this respect, XM went also far beyond the mark with respect and a wide range of education services across various regions with a goal to help traders become more knowledgeable.

In reality, you should never put off your education or personal development since people with data make better decisions. XM can help you succeed in this direction too.

With XM you can be assured of high-quality learning determined by your own degree, which can include live educational offerings, Educational Videos, Forex Webinars and frequently held Forex Seminars across a variety of locations. Furthermore, there are extremely well-organized tutorials, videos, and tools available to you.

Research

For market research tools and market materials You will find it in order. Alongside News Feeds, Technical Summaries and technical analysis, XM provides Fundamental Analysis and Trading Ideas appropriate for novice or experienced traders.

We are very pleased with the manner in which XM organizes its tools for research as well since you can locate on one page everything you need to make better trading decisions, including Forex Calculators MQL5and other tools. Additionally, exclusive technical indicators that work with both platforms are made available to subscribers make it possible to use the algorithmic trading.

Conclusion

In the end of XM Review, it's an extremely well-regulated broker, with a variety of well-respected licenses that provide absolutely transparent terms and conditions. It is also it is an extremely accommodating broker. No re-quotes, and no hidden charges or commissions that are and policy along with Negative balance protection makes customers feel peace of mind as well as the exact real-time execution policy, which makes XM extremely popular among the trading options. This is they are among the biggest offers regarding costs as well as trading conditions and possibilities overall, which makes XM an authentic broker.

| Properties | Values |

|---|---|

|

Name

|

XM |

|

Minimum Diposit

|

$ $5 |

|

Leverage

|

888:1 |

|

Regulation

|

,ASIC (Australia),IFSC (Belize),CySEC (Cyprus),DFSA (Denmark),,,,, |

|

Headquarters

|

Cyprus |

|

Established

|

2009 |

|

Address

|

12 Richard & Verengaria Street, Araouzos Castle Court, 3rd Floor, 3042 Limassol, Cyprus |

|

Platform

|

MT4,MT5,MT4 WebTerminal,MT4 Android,,,,, |

|

Payment Method

|

Visa,Mastercard,Skrill,Neteller,,,,, |

| Properties | Values |

|---|---|

|

Spreads

|

1.6 pips |

|

Min Position size

|

0.01 |

|

Broker Type

|

STP (Straight Through Processing),ECN (electronic communications networks),NDD (Non Dealing Desk),,, |

|

Account Type

|

,Scalping,,,,, |

|

Brokers by Country

|

Australian Forex Brokers,UK Forex Brokers,Cyprus Forex Brokers,,,,, |

|

Techniques

|

Scalping Forex Brokers,Hedging Forex Brokers,Mobile Trading Brokers,,,,, |

|

Instruments

|

Forex Trading Brokers,Gold Trading Brokers,Stock Trading Broke,Oil Trading Brokers,Metal Trading Brokers,Indexes Trading Brokers,,,,, |

|

Account currency

|

USD,,USD,,USD,,USD,,USD,,USD, |

|

Tools

|

,Economic Calendar,Charting Software,Pip Calculator,,,,, |

|

Website Languages

|

en,,,,, |

|

Support languages

|

,en,en-GB,,,,, |

|

Bonus

|

Yes |

|

Reviews Rating

|

5.00 |

|

Withdrawal Fee

|

Yes |

|

Trading Signals

|

Yes |

|

Free Education

|

Yes |

|

Daily News

|

|

|

Demo account

|

Yes |

|

Swapsr

|

Yes |

|

Pors

|

1. User friendly software 2. A mainstay at MT4 and MT5 platforms 3. 16 Different platforms suitable for Web, Mobile and Desktop trading 4. Mobile App for iOS and Android 5. Simple to use 6. Fee Report 7. Supporting numerous languages |

|

Cors

|

1. Only MetaTrader offered |

|

Display Analysis

|

Yes |

|

Serving country

|

AS,BZ,CA,CU,TF,GU,HM,IR,IL,JP,KR,LR,MM,NL,NZ,MP,PW,PR,LC,SD,SY,UA,US,VI,,,,, |

|

Not Serving country

|

,,,,, |

|

Contests

|

No |

|

Market analysis

|

Yes |

|

Copy Trading Brokers

|

Yes |

|

Bitcoin Forex Brokers

|

No |

|

Social trading

|

Yes |

|

Web trading

|

Yes |

|

Forex pairs

|

Yes |

|

CFDs

|

Yes |

|

Crypto

|

Yes |

|

Hedging

|

No |

|

PAMM

|

Zulu trade,Myfxbook Auto trade,Mql5 signals,,,,, |

|

Mobile Trading

|

Yes |

|

Scalping

|

Yes |

|

Automated Trading

|

Yes |

|

Partnership Programs

|

Yes |

|

Free Phone

|

+357 25029900 |

|

Customer Support

|

24/5 |

Exness Broker reviews & comments (28)

cheaper https://rybelsus.tech/# rybelsus price good price

купить диплом в сургуте [url=https://damdesign.ru/]damdesign.ru[/url] .

[b]Здравствуйте[/b]! Задумался а действительно можно купить диплом государственного образца в Москве, и был удивлен, все реально и главное официально! Сначала серфил в сети и искал такие темы как: где купить диплом, купить диплом технолога, купить диплом в белгороде, где купить диплом о среднем образование, купить диплом в нижним тагиле, получил базовую информацию. Остановился в итоге на материале купить диплом фельдшера, https://sketchfab.com/whiktorustnnw Хорошей учебы!

[b]Здравствуйте[/b]! Задался вопросом: можно ли на самом деле купить диплом государственного образца в Москве? Был приятно удивлен — это реально и легально! Сначала искал информацию в интернете на тему: купить диплом университета, купить диплом в москве, купить диплом переводчика, купить диплом университета , купить диплом в новороссийске и получил базовые знания. В итоге остановился на материале: https://forum.uaewomen.net/member.php/817634-DiplOmmCcooMBot Удачи!

Pretty! This has been an extremely wonderful article. Thanks for supplying this info. cbt-v.com.ua/catalog/all www.vietnamembassy-arabsaudi.org/nui-ta-cu/ u-cars.ru/modules.php?name=Your_Account&op=userinfo&username=oqorisol night-optics.ru/gallery2/main.php?g2_view=core.DownloadItem&g2_itemId=827 panarabiaenquirer.com/wordpress/israeli-defence-forces-to-commemorate-international-holocaust-memorial-day-by-locking-up-record-number-of-palestinian-children/

Thank you for sharing your info. I really appreciate your efforts and I am waiting for your further write ups thank you once again. fat-girls.ru/page/10 fpcom.co.kr/bbs/board.php?bo_table=free&wr_id=110868 chefrobertsdirect.com/index.php?main_page=page&id=2 u-cars.ru/modules.php?name=Your_Account&op=userinfo&username=oqorisol jogibaba.com/blogs/32/Why-is-the-popularity-of-higher-education-rapidly-declining-now?lang=ru_ru

Keep this going please, great job! купить диплом в сызрани https://profit.hutt.live/viewtopic.php?id=1753#p3950 https://climat-cold.ru/forum/user/3709/ http://caezar.4bb.ru/viewtopic.php?id=4396#p18496 https://inderculturaputumayo.gov.co/conozca-el-recorrido-de-la-vuelta-del-futuro-2023/comment-page-9 https://rodme.ru/gde-kupit-diplom-bystro-i-legalno-t12315.html купить диплом в оренбурге

куплю диплом [url=https://diplomvash.ru/]diplomvash.ru[/url] .

whoah this blog is excellent i really like studying your posts. Stay up the good work! You understand, lots of persons are hunting round for this info, you could aid them greatly. lastnewsusa.com/2022/02/omicron-variant-pushes-us-coronavirus.html https://ic-info.ru/forum/user/164042/ http://vse-ekonomim.ru/author/dustindvop/ http://domino-stroy.ru/podrobno-o-derevyannykh-oknakh/derevyannye-okna-v-chem-preimushchestvo.html http://www.littlethings.su/2015/09/ombre.html

купить диплом в туле [url=damdesign.ru]damdesign.ru[/url] .

Awesome! Its in fact amazing post, I have got much clear idea on the topic of from this paragraph. купить диплом в новочебоксарске http://kapremont-upgrade.ru http://gorkirov.ru http://sv-hold.ru купить диплом в новосибирске

Делаем отличное предложение для вас пройти консультацию (аудит) по усилению продаж также доходы в вашем бизнесе. Формат аудита: личная встреча или сессия по скайпу. Делая очевидные, но обыкновенные усилия, прибыль от ВАШЕГО коммерциала удастся поднять в несколькио раз. В нашем багаже более 100 испытанных фактических способов повышения торгов а также прибыли. В зависимости от вашего бизнеса расчитаем для вас наиболее крепкие и начнем шаг за шагом реализовывать. - https://vniikukuruzy.ru/

Делаем отличное предложение вам пройти консультацию (аудит) по подъему продаж и прибыли в вашем бизнесе. Формат аудита: индивидуальная встреча или онлайн конференция по скайпу. Делая очевидные, но простые усилия, доход от ВАШЕГО бизнеса можно превознести в несколькио раз. В нашем багаже более 100 опробованных фактических методик подъема продаж а также доходов. В зависимости от вашего коммерциала подберем для вас наиболее крепкие и начнем шаг за шагом внедрять. - https://vniikukuruzy.ru/

Thank you for the auspicious writeup. It if truth be told was once a leisure account it. Glance advanced to more introduced agreeable from you! By the way, how can we keep up a correspondence? купить диплом в череповце http://nti-nastavnik.ru http://books4study.info http://labrusal.ru купить диплом агронома

WOW just what I was searching for. Came here by searching for %keyword% jboi2007.org/Galeries/Day1/BeachVolleyball/photo5.htm pepycambodia.org/_404.html flora-online.ru/glavnaya/tsvetyi-na-1-sentyabrya-2/ 3drus.ru/forum/topic_34713/1 www.sardegnasport.com/2015/10/30/cagliari-e-i-bei-tempi-andati-ti-manca-un-vero-dieci-di-carisma-e-fantasia/

What a data of un-ambiguity and preserveness of valuable know-how regarding unexpected emotions. www.sskyn.com/home-uid-82653.html catsandsquirrels.com/tag/squelfie/ ttdinhduong.org/ttdd/tin-tuc/tin-chuyen-mon/679-Thong-bao-chieu-sinh-khoa-dao-tao-ddls.aspx www.rrsclub.ru/member.php?tab=visitor_messaging&u=1164&page=7 www.kangas-industrial.com/e_feedback/index.asp?page=2769

Thank you for the auspicious writeup. It in reality used to be a leisure account it. Look complex to far delivered agreeable from you! By the way, how can we communicate? asmzine.net/geekly-rewind/2019/02/17/toy-fair-2018-hasbro-transformers-siege/img_1310/ blackpearlbasketball.com.au/index.php?option=com_k2&view=itemlist&task=user&id=829712 moscityservice.ru/ www.sixsigmaexams.com/mybb/member.php?action=profile&uid=263670 bgv-blasenschwaeche.de/urlaub.html

For the reason that the admin of this web page is working, no question very soon it will be renowned, due to its feature contents. moskva-medcentr.ru/index.html smeda.ru/uslugi/anons/anons_7.html rusbil.ru/forum/viewtopic.php?t=739&view=previous textualheritage.org/en/the-materials-of-the-conference-el-manusctipt-2014/82.html www.9020blog.com/board/blogs/2763/Why-is-the-popularity-of-universities-decreasing-all-the-time

I was able to find good info from your content. forums.worldsamba.org/showthread.php?tid=992935 detki-v-setke.ru/index.php?showuser=21983 naswinas.com/blogs/740/Why-is-the-popularity-of-universities-decreasing-today iafabric.ru/category/futbol newmedtime.ru/page/12

Do you have a spam problem on this website; I also am a blogger, and I was wanting to know your situation; we have created some nice procedures and we are looking to exchange techniques with others, why not shoot me an e-mail if interested. www.agrolib.ru/ www.camnangbenh.com/mu-mau/ mobix.com.ua/index.php?links_exchange=yes&page=41 bradfrost.online/speaking ractis.ru/forums/index.php?autocom=gallery&req=si&img=2108

For most up-to-date news you have to visit internet and on the web I found this web site as a best website for newest updates. ik21v.ru/ www.genexscience.com/index.php?route=information/blogger&blogger_id=2 dom-postroj.ru/doma-iz-gazobetona/k-231 raceburo.ru/page/3 golf.od.ua/forum/viewtopic.php?t=16601&highlight=

Hello, yeah this piece of writing is truly fastidious and I have learned lot of things from it about blogging. thanks. russkiy365-diploms-srednee.ru

Thank you for the auspicious writeup. It actually was once a amusement account it. Glance complicated to more delivered agreeable from you! However, how can we keep up a correspondence? https://privatebin.net/?9067dde44fe710a1#Gh8p63hkJAuCTvYKr6mrw8Z8DJUPMAenBjC4tecr9L43 http://odesit.com/fm-t-19063-last.php

whoah this blog is excellent i really like studying your posts. Keep up the great work! You already know, a lot of individuals are searching round for this info, you could help them greatly. https://postheaven.net/cechinbqdo/iak-zaminiti-sklo-far-samostiino-krok-za-krokom-instruktsiia

Доставка цветов и букетов Интернет-магазин цветов

Add a review

Your email address will not be published. Required fields are marked *