USD/CAD Rate Reverses Ahead of January Low to Defend 2022 Opening Range

CANADIAN DOLLAR TALKING POINTS

It looks as if the USD/CAD is defending the starting range for 2022, as it reverses ahead of the January low, putting an end to a string of lower highs and lows that had been in place for nine straight sessions (1.2450).

USD/CAD RATE REVERSES AHEAD OF JANUARY LOW TO DEFEND 2022 OPENING RANGE

USD/CAD continues to rise from its monthly low of 1.2465 as the United States dollar strengthens against all of its major counterparts. The exchange rate is expected to track the yearly range in the coming months as both the Federal Reserve and the Bank of Canada (BoC) plan to further normalize monetary policy in 2022, according to the Federal Reserve.

There is a strong possibility that the Federal Open Market Committee (FOMC) will adjust its exit strategy, as Chairman Jerome Powell acknowledges that the central bank could "move more aggressively by raising the federal funds rate by more than 25 basis points." It is unclear whether the Bank of Canada (BoC) will do the same, as Deputy Governor Sharon Kozicki insists that "the timing and pace of further increases in the policy rate, as well as the beginning of QT (quantitative tightening), will

While speaking at the Federal Reserve Bank of San Francisco Macroeconomics and Monetary Policy Conference, Deputy Governor Kozicki stated that "the pace and magnitude of interest rate increases, as well as the start of QT, will be active parts of our deliberations at our next decision in April." It appears that the Bank of Canada will unveil a more detailed exit strategy as "the Bank will use its monetary policy tools to return inflation to the 2 percent target and to keep inflation under control."

As long as the pair maintains the starting range for 2022, it may continue to retrace the slide from the monthly high (1.2901), but the shift in retail attitude is set to continue, as retail traders have been net-long the pair for much of this month.

As reported by the Interactive Brokers Client Sentiment survey, 73.18 percent of traders are presently net-long USD/CAD, with the ratio of traders long to short standing at 2.73 to 1.

The number of traders who are net-long is 3.26 percent lower today than it was yesterday and 5.54 percent lower than it was last week, while the number of traders who are net-short is 1.21 percent higher today than it was yesterday and 13.19 percent higher than it was last week.

The reduction in net-long positions comes as the USD/CAD is experiencing its worst losing streak since 2016. Meanwhile, the decline in net-short interest has spurred the shift in retail sentiment, with 65.85 percent of traders holding net-long positions in the pair over the last week.

After all is said and done, the USD/CAD exchange rate may continue to extend its recovery from the monthly low (1.2465) as it breaks through the series of lower highs and lows from last week, and the exchange rate may further retrace its decline from the yearly high (1.2901) as it defends the opening range for the year 2022.

- USD/CAD appeared to be on track to test the January low (1.2450) as it depreciated for nine consecutive sessions, but the exchange rate appears to be defending the opening range for 2022 as it extends the rebound from the monthly low (1.2465).

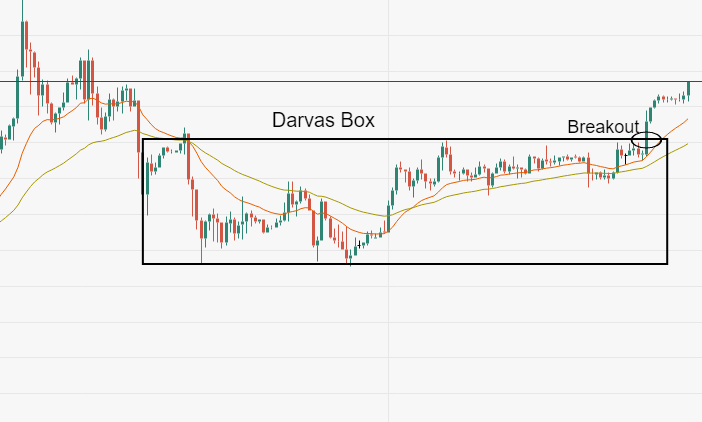

- The failed attempt to test the Fibonacci overlap around 1.2410 (23.6% expansion) to 1.2440 (23.6% expansion) has pushed USD/CAD back above the 1.2510 (78.6% retracement) region, with a move above the 1.2620 (50% retracement) to 1.2650 (78.6% expansion) zone bringing the 1.2770 (38.2% expansion) back on the radar.

- Next area of interest comes in around 1.2830 (38.2% retracement) to 1.2880 (61.8% expansion), with a break above the yearly high (1.2901) opening up the December high (1.2964).

Written by Kevin Smith, Currency Strategist