Fundamental Out look on Gold Details

Fundamental Out look on Gold

- Gold prices saw their worst weekly performance since June 2021, plunging 3.5 percent on a weekly basis.

- In the absence of mounting Ukraine threats, a rising rate environment might be detrimental to XAU.

- Federal Reserve Chairman Jerome Powell and his colleagues will be speaking in the next week.

- Despite a jump in the yellow metal that happened initially in the wake of Russia's war on Ukraine, gold prices fell by nearly 3.5 percent this week, marking the worst weekly performance since June 2021. Current price movement in the gold-to-dollar exchange rate continues to highlight the difficult path ahead for it to be able to acquire substantial upward price action, even in the absence of any escalation in the Ukraine crisis.

- Because of the widespread high inflation that has lately been exacerbated by geopolitical tensions in Europe, central banks throughout the globe have been ramping up their efforts. This past week, the Federal Reserve started its rate rise cycle, while the Bank of England resumed its own round of interest rate increases. The price of gold is often seen as an anti-fiat asset, due to the fact that the yellow metal offers no intrinsic return to traders who hold onto their holdings.

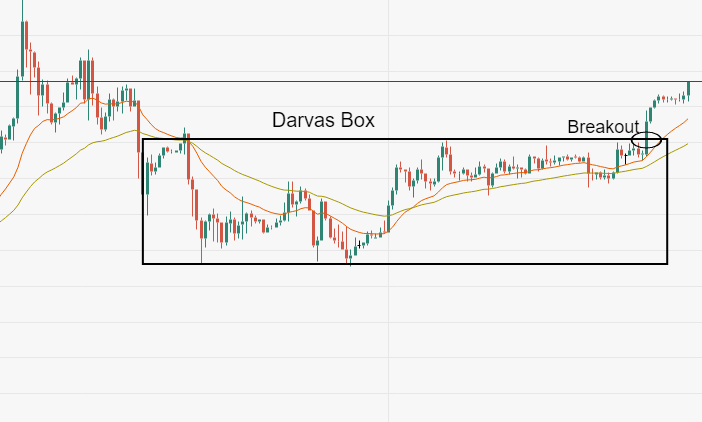

- Holding XAU/USD becomes less tempting in a rising interest rate environment, particularly in the context of global economic growth. On the chart below, gold can be seen aiming downward in recent days, as the US Dollar and 10-year real rates have both risen in recent weeks. The latter is computed by removing the difference between the nominal and breakeven rates, which results in the inflation-adjusted return on the investment.

- With nothing in the way of economic event risk in the next week, gold's attention will be drawn to larger fundamental issues in the coming week. In particular, the direction in which Ukraine is moving and the direction in which bond rates are heading are important factors. Fedspeak will be heard on the wires from everyone from Chair Jerome Powell to San Francisco branch president Mary Daly to St. Louis branch president James Bullard and everyone in between.

- The markets will be paying careful attention to what the public thinks about inflation and Ukraine. By the end of last week, the odds of a 50-basis point rate rise at the May meeting had grown to almost 50 percent. Meanwhile, Chinese President Xi Jinping talked with his American counterpart, Joe Biden, in which he said that the invasion "is not something we want to see happen." In the absence of escalating tensions in Ukraine, gold may struggle to gain upward impetus in the near future.

- Take a look at the DailyFX Economic Calendar to find out when Federal Reserve officials will be speaking this coming week.