Part 4: What is professional Forex Trading?

What is professional Forex trading? Earning money

What exactly is a professional Forex trader?

An experienced Forex trader makes use of price movement in the foreign Exchange market to generate profits. The goal of every Forex trader is to make the most trades possible and to increase the number of profitable trades. Professional Forex chart technician makes use of price charts to study and trade in the market. Through trading using an EDGE on the market, experienced traders can make sure that the odds are to their advantage and be successful in trading price movements from A to B.

Beware: Forex trading is not an easy-to-make-money scheme. In fact, it's much more difficult to earn money from Forex than many popular Forex website selling system claim to be. For a profitable trading experience, we should not only be able to make winning trades, but cut our losses in such a way that our winners are more successful than our losing traders. It is a normal aspect of trading in the Forex markets. You should learn to minimize your losses by taking losses of a small amount relative to your wins. That means you have to be able to S trade using the stop loss of the trades you make and be sure the amount of money that you risk is a sum you're completely confident about losing.

Professional Forex price-chart trader have an edge that is created through the use of the use of technical analysis (more about the subject in part 4). There are as well Fundamental Analysis traders and traders who employ a mix of two analysis methods We will look at each of them in the future.

A skilled Forex trader knows that understanding the price chart is an art and a skill, and therefore, they don't try to automatize or streamline the process of trading since every moment of the market is different, which is why it is necessary to have an agile and flexible trading strategy to be able to trade markets with the highest probability.

* How do professional traders trade on the Forex markets?

There are a variety of trading strategies and methods which professional traders employ to trade markets however, generally speaking professional traders don't employ complicated trading strategies and rely mostly on basic price data of the market to formulate their forecasts and analysis. To make it as comprehensive as possible I'd like to give you an overview of all the types of styles and strategies used to trade on the Forex market:

Automated or Robot Trading: Software-based systems for trading often referred to as forex robots are created by changing an entire set of trading regulations into code that computers could use. The computer then runs the code through trading software that scans the market to find trades that fulfill the criteria of the rules for trading that are contained inside the codes. The trades then are executed in a way that is automated by the trader's broker.

Discretionary Trading: It is a discretionary Forex trading is based on the trader's "gut" trading experience or discretionary trading ability to understand and trade markets. The use of discretionary trading permits an easier approach to trading than automated trading, but it requires an amount of time to improve your discretionary trading skills. The majority of professionals Forex traders are considered discretionary traders since they are aware that the market is an ever-changing and continuously flowing system that can be traded only by the human brain.

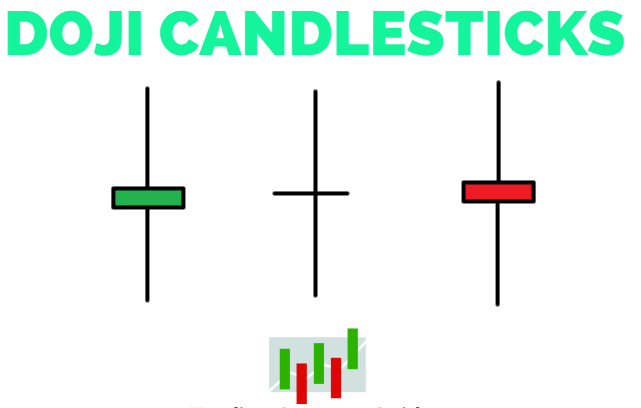

Technical Trading: Trading that is technical, which is also known as technical research, involves the analysis of a price chart in order to make trading decision. Technical analysts use technical signals or price patterns to make trades to gain an advantage. The most common belief among traders using technical analysis is that every economic variable is considered and incorporated into the price movements on an underlying price chart.

Fundamental Trading: The fundamental trading also known as news-based trading, can be described as a strategy where traders heavily rely on market information to develop their trading predictions and analyses. Fundamental news drives price movements, but most times , the market reacts differently to what a news story implies because market participants usually buy on speculation about future events, and then sell when the actuality of the future event happens. This is one of the main reasons the majority of professional traders rely in the area of technical research over fundamental analysis, though some do combine of both.

Day-Trade: The traders who trade day in the Forex market can be entering and exiting the market within a day. That means they generally trade and buy currencies over the course of a short time. They may also be able to enter and exit multiple trades within the same day.

Scalping: It is similar to day trading, but it is based on shorter and more frequent trades than day-trading. It's a type of trading that involves jumping in and out of markets frequently throughout the day in order to "scalp" some pips in one spot and then a couple of pip there, usually with no consideration for the placement of sensible stop-losses. It is not generally recommended by professionals or experienced traders since it's basically gambling.

Swing Trading or Position Trading: This kind of trading takes an immediate to mid-term perspective of the market. Traders who trade swings are usually in a trading position for a period of time ranging from a few minutes to a few days or weeks. Swing traders or position traders typically trade on the momentum of the chart and usually take anywhere between 2 and 10 trades each month in the average.

Rang Trading: Range trading is trading in a market that's in a state of consolidation between obvious resistance and support levels. By observing for signals of trading in the vicinity of the support and resistance edges within the range of trading traders can enter into a high-probability situation with clear risks and rewards.

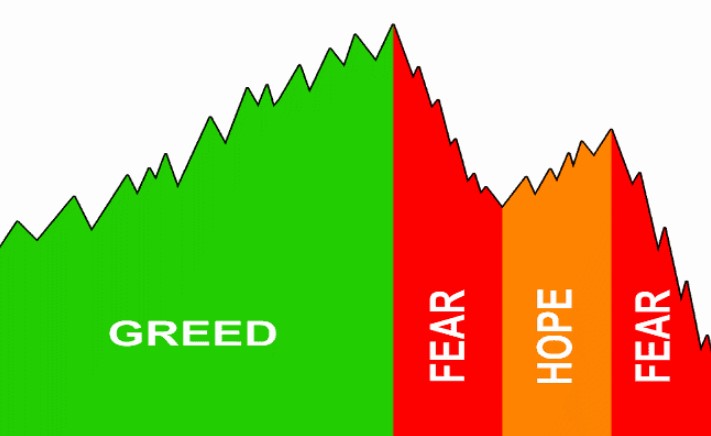

Trend Trading Trend traders are waiting for the market's trend to develop and then profit from the high probability movement by searching for entry points in the direction of trend. An uptrend is believed to be in effect when markets are producing higher highs and lower lows, while a downtrend occurs when markets are producing lower lows and higher highs. If you look for new entries in the market that are trending traders stand the best chance of making a huge profit on the risk they take. People who continuously seek to be in opposition to the market trend by trying to determine the highest and lowest points of the market, usually make a loss very quickly. Professional Fx traders tend to be trend-traders.

Trade Counter-trends: Trends can indeed come to an end. If you're a smart and proficient trader, you are able to successfully trade a counter-trend movement however, this should not be attempted until you have mastered trend trading since counter-trend trading is more risky than trading in trend and it is possible to have false tops and bottoms within trends before the true one is revealed.

Carry Trading Carry trading or the carry trade, as it's known is the method of buying a higher interest rate currency against a lower interest-rate currency , and keeping the position open for typically a lengthy duration. Forex brokers pay traders the difference in interest rates that they swap among the currencies every day that the position is in place. The problem is that high yielding currencies are prone to massive losses if markets lose its appetite for risk, as they are typically viewed as more risky than safe-haven currencies such as such as the U.S. dollars or Japanese yen. It's recommended to follow your stop loss until you ensure that you are making money when the carry trade shifts to your advantage.

* Professional Forex traders vs. amateur Forex traders

Professional Forex trading may seem like something that is elusive or a difficult task for those who struggle to make money trading or starting to trade. However, there are a few important differences between professional traders and those who are amateurs that you must be aware of in order to help you become more successful in trading skills or start in the right direction in case you're a novice:

* The importance of banks in Forex trading

Banks play a significant part when it comes to FOREX trading. In reality, the majority of the market's players are bigger banks hedge funds, big-money players. Commercial banks (such as Deutsche Bank and Barclays) supply liquidity to the Forex market because of their volume of trading daily. A portion of this trading involves the conversion of foreign currencies for customers needing them, and some are performed by banks' own trading desks for speculation purposes. In the end, the retail Forex traders are comparatively small as compared to larger players such as commercial banks, hedge fund companies, as well as the other major players. We can benefit from the movements these large players make in the market by identifying our own advantage on the marketplace and when trading in a disciplined manner.