How to Control Your Greed and Fear as a Trader

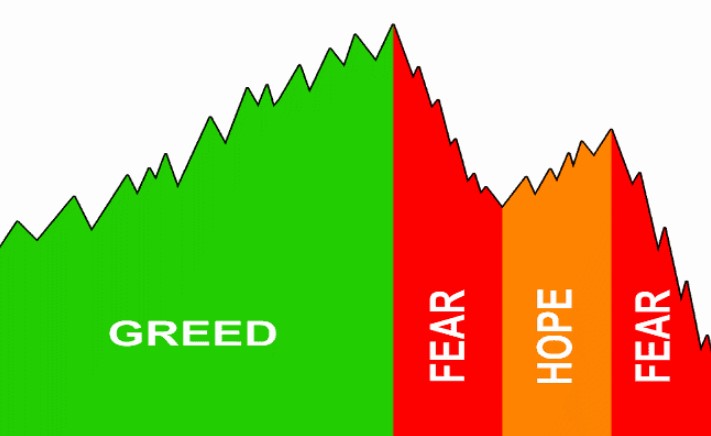

On Wall Street, there is an old adage that the market is driven by just two emotions: fear and greed. This is true to some extent. Despite the fact that this is an oversimplification, it may frequently be applied. Succumbing to these emotions, on the other hand, may have serious consequences for investor portfolios, the stability of the stock market, and even the health of the economy as a whole. Market psychology is the subject of a large body of academic literature known as behavioral finance, which is dedicated to the study of market psychology.

Fear and greed are discussed in detail here, as well as what occurs when these two emotions become the driving force behind financial choices.

IMPORTANT TAKEAWAYS

- Allowing your emotions to dictate your financial behavior often results in illogical decision-making that may be quite costly.

- It's typically preferable to disregard the current trend, whether it's bullish or bearish, and adhere to a long-term strategy based on strong fundamentals rather than following it.

- Understanding your level of risk aversion and adjusting your asset allocations in response to market volatility is especially crucial when fear and greed dominate the market.

The Influence of Greed

The majority of people desire to get wealthy as rapidly as possible, and bull markets encourage us to do so. The Internet explosion in the late 1990s is an excellent illustration of this. At the time, it seemed that all an advisor needed to do was propose any investment with the word "dotcom" at the end of the name, and investors would jump at the chance. The accumulation of internet-related equities, many of which were still in the early stages of development, reached a fever pitch. Investors were excessively greedy, causing prices for purchasing and bidding to rise at an alarming rate, eventually reaching exorbitant amounts. It finally burst, as have many previous asset bubbles throughout history, causing stock values to plummet from 2000 to 2002. 1

When it comes to investing, greed is a good thing, as fictional investor Gordon Gekko memorably said in the film Wall Street. However, this "get-rich-quick" mentality makes it difficult to maintain a disciplined, long-term investing strategy, particularly in the face of what former Federal Reserve Chair Alan Greenspan dubbed "irrational exuberance." 2 It is at times like these that it is critical to have a level head and adhere to the principles of investing, which include maintaining a long-term view, dollar-cost averaging, and ignoring the herd, regardless of whether the herd is buying or selling stocks.

A Lesson From the "Oracle of Omaha"

One of the best examples of long-term investment is Warren Buffett, who mainly disregarded the dotcom boom and ended up having the last laugh on those who thought he was erroneous in his predictions. Buffett kept to his tried-and-true value investment strategy, which has worked for him for decades. This is purchasing firms that the market seems to have underpriced, which necessitates ignoring speculative fads in order to do so.

The Influence of Fear

In the same way that the market may become overwhelmed by greed, it can also become overwhelmed by fear. When equities experience significant losses over a prolonged period of time, investors may become collectively scared of additional losses and begin to liquidate their holdings. It goes without saying that this has the self-fulfilling consequence of guaranteeing that prices continue to decline. Herd behavior is the term economists use to describe what occurs when investors purchase or sell because everyone else is doing so: it is a phenomenon known as herd behavior.

Similarly to how greed rules the market during a boom, fear rules the market during a crash. In order to limit their losses, investors sell their equities and invest in safer assets such as money-market securities, stable-value funds, and principal-protected funds, which are all low-risk but low-return investments.

Following the Herd vs. Investing Based on Fundamentals

Because of the massive exodus from stocks, it is clear that investors have lost all respect for long-term investments based on sound fundamentals. Granted, losing a significant portion of your stock portfolio is a difficult pill to swallow, but missing out on the ultimate recovery just serves to aggravate the hurt. When looking at the long term, low-risk investments impose an opportunity cost on investors in the form of forfeited earnings and compounding growth, which eventually outweighs the losses suffered in the event of a market collapse.

Just as abandoning your investing plan in favor of the latest get-rich-quick craze may cause a significant hole in your portfolio, leaving the market with the rest of the herd, which typically leaves the market at the worst possible time, can cause a significant hole in your portfolio. Except if you're already totally invested, you should be purchasing while the herd is fleeing. Otherwise, you should sell. In such a circumstance, all you have to do is hold on.

The Importance of Comfort Level

All of this rhetoric of fear and greed has to do with the volatility that exists in the stock market today. As a consequence of losses or market volatility, investors find themselves forced out of their comfort zones, making them more exposed to their emotions, which may lead to expensive blunders.

Continue to focus on the fundamentals and avoid getting caught up in the dominating market mood of the day, which may be influenced by excessive fear or greed. Select an appropriate asset allocation strategy. Those who are severely risk averse are more vulnerable than those who have a high tolerance for risk, and as a result, their exposure to equities should be lower than those who have a high tolerance for risk.

Buffett once observed, "Unless you have the ability to see your stock position decrease by 50% without feeling panicked, you should not be in the stock market."

This isn't as straightforward as it seems. You have to walk a narrow line between managing your emotions and simply being difficult out of defiance. Keep in mind that you should re-evaluate your plan from time to time as well. Flexibility is important, but only to a degree. You should maintain your rationale while making choices to alter your course of action.

Frequently Asked Questions

Why are fear and greed so important to market psychology?

Many investors are emotional and reactive, and fear and greed are major players in this domain. Fear and greed are particularly powerful in this arena. According to some experts, greed and fear have the ability to influence our brains in such a manner that we are compelled to disregard common sense and self-control, resulting in the instigator of change. When it comes to people and money, the emotions of fear and greed may be quite strong.

How do fear and greed affect markets?

It is possible for overreactions to occur in a market when individuals are overcome by the strength of greed or fear that has grown widespread. These overreactions may cause price distortions. Taking the side of greed, asset bubbles may expand well beyond their intrinsic value. Sales may be prolonged and prices may go much below where they should be depending on the extent of the fear.

How can traders take advantage of fear and greed in the market?

Overreactions are caused by fear and greed, and as a result, skilled traders may profit by purchasing oversold assets and selling overbought assets. Following a contrarian strategy, in which you purchase when others are panicking - buying up assets when they are "on sale," and sell when excitement leads to bubbles, may be an excellent approach. The fact is that it is human nature to want to be a part of a group, and it may be tough to resist the temptation to divert from your original plan towards the end of the day.

How can one measure the level of fear or greed in the stock market?

One may examine various market mood indicators, but two stand out for their ability to probe for the feelings of fear and greed in particular. As an example, the CBOE's VIX index, which measures changes in volatility in the S&P 500, gauges the implied amount of fear or greed in the market and is released every day. Another useful tool is the CNNMoney Fear & Greed Index, which monitors variations in fear and greed on a daily, weekly, monthly, and annual basis, as well as in the stock market. In order to determine how much fear and greed exist in the market, it is employed as a contrarian indicator that analyses seven distinct elements and scores investor mood on the basis of a scale ranging from 0 to 100.

The Bottom Line

If you make the ultimate choice about your portfolio, you will be held accountable for any profits or losses resulting from your investments. Keeping to smart investment judgments while regulating your emotions (whether they are greed- or fear-based) and not mindlessly following market sentiment is critical to achieving financial success and preserving your long-term investment plan.