Part 5: What is Fundamental Analysis?

What is Fundamental Analysis?

* Fundamental Analysis

Fundamental analysis refers to the analysis of the ways that world economic and news events impact markets for financial instruments. Fundamental analysis covers any news event, event of social forces, economic announcements, Federal policy change, news and company earnings as well as the most significant aspect of the Fundamental data is that it applies for that of the Forex marketplace, that includes the country's interest rates and the policy on interest rates.

The concept of the fundamental concept follows that when a country's present or projected economic outlook is strong, its currency will be stronger. A strong economy will attract foreign business and investment which means that foreign investors have to buy a currency in a country to invest or establish the business there. It is all about demand and supply; a country that has a robust and growing economy will see an increased demand for its currency, which can reduce supply and increase prices for the currency.

In the case of example, if you consider that the Australian economy is growing the Australian dollar will rise in value compared against other currencies. The main reason why a country's currency is worth more when its economy expands and expands is due to the fact that it is common for countries to raise interest rates in order to manage the rate of growth and inflation. A higher interest rate is attractive for foreign investors, and as a the result, they'll have to purchase Aussie dollars to fund their investments Australia This, of course, can increase the demand and cost of the currency, and reduce the supply.

Major economic events that impact Forex

Let's look through some of the major economic events that influence Forex price fluctuations. This is to help make you aware of some of the terminology you'll likely encounter when you embark on your Forex journey. You do not have to think about these important economic things, other than knowing the time they are announced each month. They are available daily on my Forex trading setups and commentary.

Gross Domestic Product (GDP)

It is among the most significant of economic indicators. It is the largest measure of the overall health of economic activity. The GDP figure is announced in the morning at 8:15 am on the final day of each quarter . it represents the performance of the preceding quarter. It is an sum (total) amount of all the products and services that are produced by the entire economy over the time period that is being measured. however, it doesn't include international trade however. The rate of growth of GDP is the primary value to consider.

The Balance of Trade

Trade balance is the measure of the differences between the exports and imports of tangible products and services. The amount of a country's balance of trade and the variations in exports against. imports are closely watched and is an important indicator of the country's economic strength overall. It's best for a country to be more successful in exports than it is with imports since exports can boost an economy, and they show how well it is performing overall in the manufacturing sector.

Consumer Price Index (CPI)

It is believed that the CPI Report is one of the commonly utilized measurement of the rate at which inflation is rising. The report is published at 8:30 am EST on the 15th day of every month. It also reflects the data from the previous month. CPI is a measure of the variation in the price of a package of consumer items and services between months.

The Producer Price Index (PPI)

Together with along with the CPI In addition to the CPI, as well as the CPI, the PPI is among the two primary indicators of inflation. This report is announced at 8:30 am Eastern Standard Time during the second week in every month, and is a reflection of the previous month's figures. The producer price index is the cost of items at the wholesale level. In contrast to CPI The PPI determines the amount that producers get for their items, while the CPI determines the cost that consumers pay for goods.

Employment Indicators

The most significant announcement on employment is every Friday on the 1st day of each month at 8:30 am Eastern Standard Time. The announcement will include the unemployment rate which is the proportion of the population who are unemployed as well as the number of jobs that are being created, the number of working hours per week and the average hourly wage. This report usually results in major market movements. It is common to hear analysts and traders talking about "NFP" which is the acronym for Non-Farm Employment report, and it's perhaps the only monthly report that has the most influence on the markets.

Durable Goods Orders

The report on durable goods provides a measure of how much consumers are spending on purchases that last longer which are items that are anticipated to last for more than 3 years. The report is published at 8:30 am EST on the 26th of every month. It is believed that it will give a glimpse into what the next steps for the production industry.

Retail Sales Index

The Retail Sales Index measures goods that are sold by retailers that ranges from big chains to smaller stores. It uses a sample from several retail stores across the nation. It is released every month. Retail Sales Index is released at 8:30 am Eastern Standard Time around the 12th day of the month. It is based on figures that was reported in the preceding month. The report is usually modified quite significantly after the numbers are released.

House Data

The housing data include the number of homes that the country built this month and current home sales. Construction activity in the residential sector is the main source of economic growth for a nation, and as such it is extensively followed by Forex participants. Home sales in the past are a great indicator of the economic strength of a nation and a low number of existing home sales as well as low new home launches are generally the sign of a slow or weak economy.

Interest Rates

The interest rate is the principal driving force in Forex markets. All of the above-mentioned economic indicators are monitored by the Federal Open Market Committee in to assess the general economic health. The Fed is able to use the tools available to it to reduce, increase, or even leave interest rates the same according to the data it gathers about the economic health. While rates of interest are the principal driving force behind Forex price movements, all economic indicators mentioned above are important too.

* Technical Analysis. Fundamental Analysis

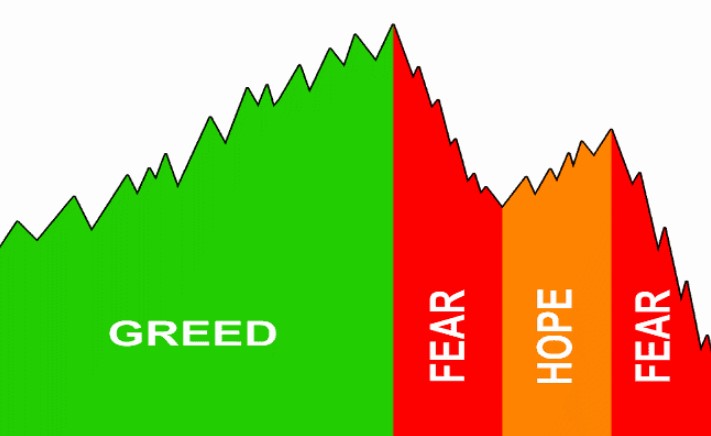

Technical analysis and fundamental analysis are the two major theories of investing and trading in the financial markets. Analysts in technical analysis analyze the price movements of a market, and they use this data to forecast the future direction of its price. Fundamental analysts study economic news, which is also known as fundamentals. In the event that nearly every world news event has the potential to have an consequences for global financial markets, any news event could be considered economic news. This is a crucial issue I'm trying to highlight that most fundamental analysts not pay attention to...

One of the primary reasons that I and all my clients prefer trading predominantly by using the use of technical analyses is that there are millions of various variables across the world that could impact financial markets at moment. Today, Forex is more affected by macro events such as the interest rate policy of a country or GDP figures, however other important news events, such as natural catastrophes or wars could affect an Forex market to change. Therefore, as I, along with many others, believe that all the world's events are incorporated into price and easily visible when you analyze it and analyzing it, there is no reason to be a follower of all the economic news that happen every day in order to trade on the markets.

One of the arguments that fundamental analysts use for technical analysts, is historical prices cannot be used to forecast or predict the future price movements and that you should instead make use of news that is coming up (fundamentals) to forecast the price movements of the market. Therefore I thought it was an excellent idea to provide my opinion on the two arguments that are made in favor of the technical approach:

1.) If fundamental analysts are trying to tell me that historical prices aren't relevant in the market, I'd like them to tell me the reason why horizontal levels of support as well as resistance are clearly important. I'd like to inquire about what they think I and more price action traders could effectively trade markets understanding how to trade using the following simple but extremely reliable price action signals.

When we look at the daily spot Gold chart it is clear that resistance and support levels are crucial to keep an eye on. Anyone who says that charts aren't important is simply wrong and you'll arrive at this conclusion independently if you study various price charts.

2.) The second argument Fundamental analysts make is that it is possible to better predict a market's price movements by studying the upcoming news developments. Anyone that has been trading for any amount of time is aware that markets are often and typically react differently to what a news event suggests. There are instances where the market goes according to the direction that is implied by a news story? Absolutely however, can you create a trading strategy or trading strategy around? No.

The reason for this is that markets are based on expectations of the future. This is a common reality of investing and trading and it's odd that individuals still don't consider the technical aspect of analysis or do not primarily pay attention to it when they are analyzing or trading the markets. Let me explain: If the report on non-farm payrolls comes to an end (the major economic indicator of the month that is released by the U.S.) and the market expects an increase of 100,000 jobs last month it is likely that the market would already have risen to anticipate this number. Therefore, if the real number is even at 100,000 it is likely that the market will be lower instead of higher...since there was not more jobs added than what was expected. Therefore, although 100,000 new jobs may be a great number, the fact that the report didn't meet expectations is a problem for investors and traders (can you notice how this information is confusing? I nearly got lost in writing this.

And now for my Final point: Since all of the previous expectations of the news release have been fulfilled and can be seen as price charts, how can you not study and learn how to trade on the price actions in the chart of prices? This is a great concept! It is true that even after news releases, it is still possible to utilize analytical techniques to trade the price movements, which is why technical analysis is the most clear and most practical and efficient method to study and trade markets. Are I saying that there's no need for fundamental analysis in an Forex trader's toolbox? Absolutely not. However, what I'm saying is that it is best viewed and utilized as a complement to technical analysis. It is best used sparingly. when in doubt , look at the charts and look at the price action. You should only employ Fundamentals to back up your technical opinion or for pure curiosity. Never rely entirely on Fundamentals to make predictions or trade in the markets.