What Is an ECN Broker?

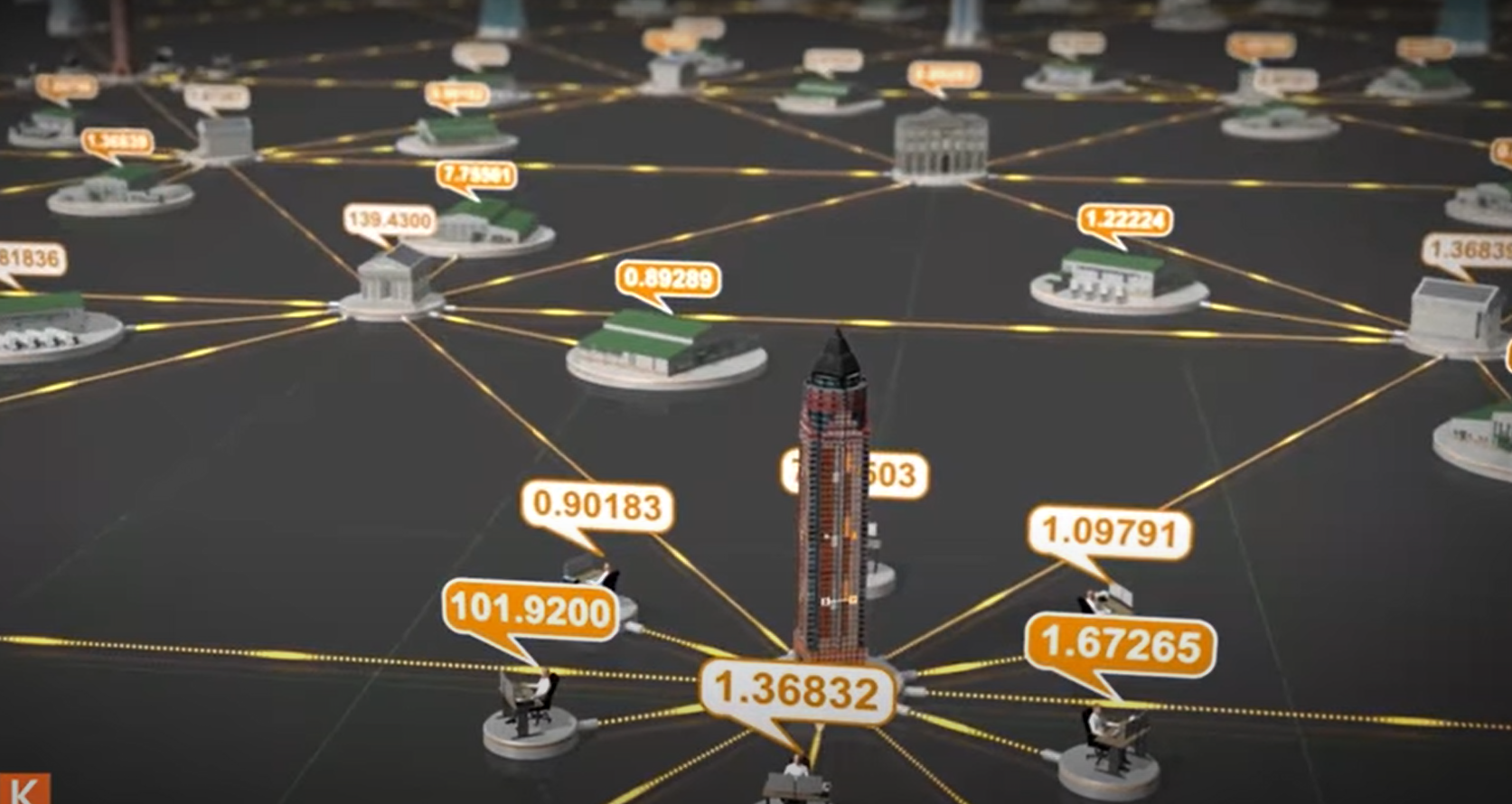

When it comes to the stock and currency markets, an ECN broker is a financial intermediary that employs electronic communications networks (ECNs) to provide clients with direct access to other players in the equities and foreign exchange markets. An ECN broker is able to give its clients tighter bid/ask spreads than they would otherwise be able to obtain because it consolidates price quotations from a number of different market participants.

An ECN broker is only permitted to match trades with other market participants; it is not permitted to trade directly against the client. Spreads on electronic communication networks (ECNs) are frequently narrower than those used by conventional brokers, although ECN brokers still charge a fixed commission per transaction.

KEY TAKEAWAYS

• ECN brokers are individuals who facilitate transactions that take place on electronic communication networks (ECNs).

• These brokers assist clients in gaining direct access to stock or currency markets on ECNs that they would not otherwise be able to access.

• While ECN systems provide transparency and deep liquidity, they are more expensive when compared to traditional exchange systems.

Understanding ECN Brokers

The usage of an electronic communication network (ECN) allows investors to trade outside of typical trading hours, offering a means for those who are unable to participate actively in the market during normal trading hours or who prefer the flexibility provided by greater availability. It also avoids the greater spreads that are usual when dealing with a traditional broker, as well as providing overall lower commissions and costs than dealing with a traditional broker.

ECN can provide a level of anonymity to individuals who choose it, which is beneficial for those who are concerned about privacy. This can be particularly appealing to investors who are looking to make larger deals.

ECN brokers are non-dealing desk brokers, which means that they do not pass on order flow to market makers, as is the case with traditional brokers. Instead, they electronically match participants in a transaction and then transfer the orders to liquidity providers, who fill the orders.

An ECN broker is a financial institution that arranges trades for interested investors across the ECN. Because of the way the ECN operates, working with a broker of this caliber frequently results in lower fees as well as more trading time availability for the client.

Understanding the Electronic Communications Network

The electronic communication network (ECN) facilitates the exchange of information between buyers and sellers for the purpose of performing trades. Through giving access to information about orders that have been entered, as well as by enabling the execution of these orders, it does this. In order to match buy and sell orders currently available on the exchange, the network was created. When precise order information is not accessible, it provides prices based on the highest bid and lowest ask displayed on the open market at the time the information is not made available.

Benefits of Electronic Communications Networks

In addition, because of the manner in which the information is conveyed, many people perceive price feed transparency to be a positive. Everyone who trades on an ECN platform has access to the same data feed and trades at the exact same price as the provider. Furthermore, a certain amount of pricing history is readily available, allowing for more straightforward study of specific trends in the market. This serves to limit price manipulation because current and historical information is easily available to everyone, making it more difficult to engage in unethical trading practices.

Furthermore, because all traders have equal access to the same information, no trader has a special built-in edge over the others.

Disadvantages of Electronic Communications Networks

One of the most significant disadvantages of employing an ECN is the cost associated with doing so. Most of the time, the fees and commissions associated with using an ECN are higher than those associated with using non-ECN services. Per-trade commissions can be expensive, and they can have a negative impact on a trader's bottom line and profitability.

Topforexrating does not provide tax, investment, or financial services or advice to its customers. Investment objectives, risk tolerance, and financial circumstances of any single person are not taken into consideration when presenting the material, and the information may not be suitable for all investors in all situations. Investing involves risk, which includes the possibility of losing one's initial investment.