Part 12: The Psychology of Forex Trading

The Psychology of Forex Trading

I've been a trader for long enough to learn some things about the way people think when trading in the market. The truth is that the majority of traders have similar patterns of thinking and emotions when they trade the market, and we can gain a lot from the difference in the ways that traders who lose think and the way successful traders think.

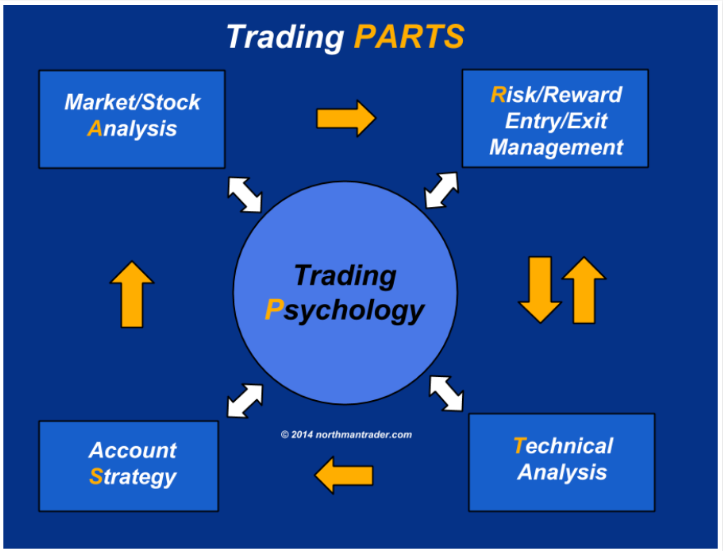

I'd be lying to say that the you can make money in Forex markets is purely dependent on the method or system that you choose to use, as it's not true, it is largely based on your attitude and how you perceive and react to the market. But, the majority of Forex websites that try to sell an algorithm or trading robot don't say this because they insist that you can earn money on the markets by purchasing their trading software. I prefer to inform people of the reality, and the fact is that having a reliable and simple trading strategy is crucial but it's just one part from the whole. The larger part is managing your trading correctly and controlling your emotions appropriately If you fail to perform these two tasks, you'll never earn money on the market for the long term.

* Why traders often fail to make money

It is likely that most people who take on Forex trading will lose funds. There's a reason behind this, and it's due to the fact that people view trading in a negative way. Many people enter markets having unrealistic goals, like believing that they will leave their job after a month of trading or believing they will transform $1,000 into $100,000 within just a few months. These unrealistic expectations cause a negative mindset towards trading among traders who are under too much pressure and "need" to earn profits in the market. If you begin trading using the "need" or the pressure to earn money, you will get into trading with a sense of urgency, which is the most efficient method of losing your money.

* What are the emotions you be looking for when trading?

To get a more specific on "emotional" trading we'll go over the most commonly made emotional trading mistakes traders make:

Greed There's an old adage that you've heard about trading on the markets that goes something similar to this: "Bulls make money, bears earn profit, while the pigs are killed". This generally means that if are an uncaring "pig" in the market it is almost certain that you're losing your money. The greedy traders do not take profit because they believe that they will remain in their favor forever. Another thing greedy traders will do is adding to their positions simply because the market has changed in their favor. You could add trades to your portfolio when you have rational reasons based on price action however, doing it just because the market has been able to move in your favor just slightly and is typically that is a result of the desire to be greedy. It is obvious that putting too much risk on a trade right from the beginning is an extremely risky decision to make. The key point is that you should be aware of your own greed as it can be sneaky on you and rapidly ruin any trading bank account.

fear – traders become scared of entering into the market when they are brand new to trading and haven't yet learned a reliable trading strategy, such as the price-action trading (in this case, they should not be trading with real money at this point anyways). The fear can also manifest for traders after they have lost a string of trades, or when they have to suffer an amount of loss that is greater than they're emotionally capable of taking. To overcome the fear of trading first, you must be sure that you're never placing more money at risk than you're comfortable to lose on trading. If you're completely comfortable with the loss of the funds you are putting at risk then there's nothing to worry about. Fear is often a negative emotion for traders since it can cause them to lose out on great trading opportunities.

Revenge traders feel a sense of needing "revenge" at the price after they have suffered the loss of a trade they believed to be "sure" would be successful. The most important thing to remember is that there isn't a "sure" thing to do in trading...never. If you've taken on too much risk in trading (starting to notice a pattern here? ) If you do are able to lose the money, there's a high likelihood that you'll be tempted to get back into the market to earn the money back ....which typically will result in another loss (and often a larger one) since you're trading again emotionally.

Euphoria While feeling happy is typically a positive thing it could cause some damage to the account of a trader after they have an enormous winner or several winners. It is possible for traders to become overly confident after having a few successful trades in the market. For this reason many traders find their most sever losses after they have a string or a lot of winnings in the markets. It's tempting to go back into the market after an "perfect" trading setup or after you've won 5 trades in five trades in a row...there's an important distinction between being grounded and believing that whatever that you put into the market can be turned into gold.

A lot of traders go into an emotional trance of trading and lose money when they've landed a string winners. The reason for this is because they are at peace and happy and do not realize the actual risks of the market and that any trade is liable to lose. One of the most important things to keep in mind is the fact that it is a long-term sport of probabilities. If you are able to identify a high-probability trading edge that you can eventually earn profit over the long haul if you adhere to your edge by following a disciplined. Even the edge you have is 70 percent successful in the long run, it might be able to lose 30 trades in a row , out of 100 ....so keep this in your mind and remember that you will never know which trade will end up being a loser and which one will turn out to be a win.

* How to develop and maintain a successful trading mentality

Maintaining an efficient Forex trading mindset is the result doing things right. It generally requires an effort of concentration by the trader's side to achieve this. It's not difficult to achieve, however, when you are looking to build an effective mindset to trade you must accept certain truths about trading, and then begin trading using these knowledge points...

You must know the strategy you use to trade (trading edge) is and how to learn the art of trading. You have to be an "sniper" on the marketplace, not being a "machine gunner" which means knowing your strategy for trading in and out, and not having any doubts about what the market requires to be like prior to putting your hard-earned cash in it.

You must always take care to manage your risk appropriately. If you do not manage your risk for every single trade, you are opening the possibility for emotions to take over your thoughts, and I'm able to assure that once you've started downwards on the downward slope of emotional Forex trades, it will be very difficult to stop the slide or even realize that you're trading emotionally to begin with. You can greatly reduce the chance of becoming an emotional trader only by putting your money into an amount of money for each trade that you're completely comfortable losing. It is best to anticipate losing in any particular trade in order to be aware of the real possibility of it occurring.

It is important not to be a slave to trading. Most traders trade excessively. You must know the edge you have in trading with absolute certainty, and only trade when it is present. If you begin trading simply because the "feel you like doing it" or it seems like you "sort of" know your trading edge...you start an emotional rollercoaster of trading that is difficult to stop. Do not start trading again and you'll probably not be an emotionally driven Forex trader.

You must be a structured trading. If there is something that acts as an element that acts as the "glue" that connects the various points I've talked about in this article together, it's being an organised trader. When I say organized, I'm referring to using a trading strategy and a journal of trading and employing both. You must consider Forex trading as an enterprise, not going into a casino. Stay calm and objective in your interactions with the market, and you will have no trouble keeping the tyrants of trading emotions at the back of your mind.