Part 3: Long or Short ? Order Types And Calculating Profits & Losses

• Buying and selling

In order to make money in the markets, one must either buy cheap and sell high, or sell high and purchase low. Because you are probably wondering "how can I sell something that I don't own?" I understand that this may seem a bit strange to you. Basically, when you sell a currency pair in the Forex market, you are really purchasing the quote currency (the second currency in the pair) and selling the base currency (the currency that is being sold) (the first currency in the pair).

Selling short seems to be a bit more complicated in non-Forex situations, such as when selling a stock or commodity on the open market. The main concept here is that your broker loans you the stock or commodity to sell, and then you must purchase it back from him later in order to complete the trade. It is feasible to sell a security with your broker since you will essentially "give" the security back to them at a later period, ideally at a cheaper price, due to the lack of a physical transfer of ownership.

• Long vs. Short

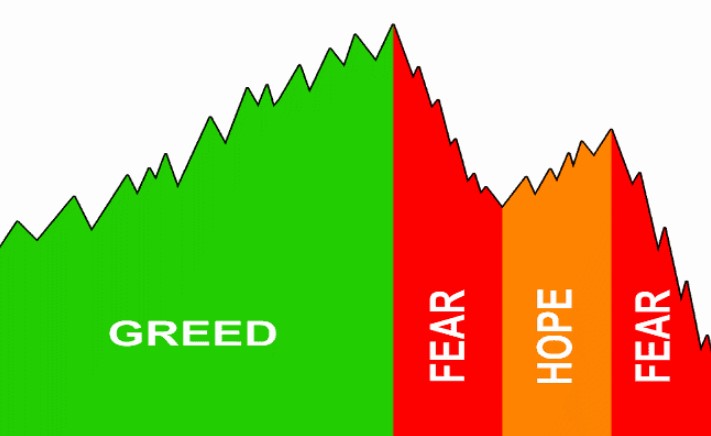

Another advantage of trading in the Forex market is that you have a greater chance of profiting in both rising and falling markets because there is no market bias, such as the bullish bias that exists in the stock market. Anyone who has traded for a long knows that the most money can be earned in falling markets, so if you learn to trade both bull and bear markets, you will have a plethora of possibilities to make money throughout your trading career.

LONG – When we go long, it implies that we are purchasing the market, and as a result, we want the market to grow in value so that we can sell back our position at a greater price than we paid to purchase it. We are therefore purchasing the first currency in the pair and selling the second currency in the pair. Consequently, if we purchase the EURUSD and the euro increases against the US dollar, we will be in a lucrative position.

SHORT – In order to purchase back our position at a lower price than we sold it for, we must first sell the market. If the market falls, we will buy back our position at a lower price than we sold it for. We are thus selling the first currency in the pair and purchasing the second. Consequently, if we sell the GBPUSD during a time when the British pound is weakening compared to the US dollar, we will be in a lucrative position.

• Order types

It's time to talk about the different order kinds. When you place an order to trade in the Forex market, it is referred to as a 'order'. There are many distinct order types, and they might differ across brokers. Some fundamental order types are provided by all brokers; however, there are some unique' order kinds that are not provided by all brokers, and we will cover them all in further detail below:

Market order – A market order is an order that is placed ‘at the market’ and it’s executed instantly at the best available price.

Limit Entry order – A limit entry order is set to either purchase below the current market price or sell above the current market price, depending on which direction the market is moving. This is a little difficult to comprehend at first, so allow me to explain:

If the EURUSD is now trading at 1.3200 and you want to sell the market if it hits 1.3250, you may post a limit sell order, and the market will fill your short position when / if it reaches 1.3250, as long as the market is above 1.3200. As a result, the limit sell order is put ABOVE the current market price of the stock. If you wish to purchase the EURUSD at 1.3050 and the market is trading at 1.3100, you would post a limit buy order at 1.3050, and if the market reaches that level, the order would be filled, giving you a long position in the currency pair. As a result, the limit purchase order is placed BELOW the current market price of the stock.

Stop Entry order – A stop-entry order is issued in order to purchase above the current market price or sell below the current market price. You may put your buy stop slightly above a resistance level in order to be filled when the price rises up into your stop entry order if you want to trade long but want to enter on a breakout of a resistance region, as seen below. If you wish to sell the market, the converse is true for a sell-stop entry, which is the opposite of what you desire.

Stop Loss order –

Trailing Stop – The trailing stop-loss order is an order that is connected to a trade like the standard stop-loss, but a trailing stop-loss moves or ‘trails’ the current market price as your trade moves in your favor. You can typically set your trailing stop-loss to trail at a certain distance from current market price, it will not start moving until or unless the price moves greater than the distance you specify. For example, if you set a 50 pip trailing stop on the EURUSD, the stop will not move up until your position is in your favor by 51 pips, and then the stop will only move again if the market moves 51 pips above where your trailing stop is, so this way you can lock in profit as the market moves in your favor while still giving the trade room to grow and breath. Trailing stops are best used in strong trending markets.

Good till Cancelled order (GTC) – A good till cancelled order is exactly what it says…good until you cancel it. If you place a GTC order it will not expire until you manually cancel it. Be careful with these because you don’t want to set a GTC and then forget about it only to have the market fill you a month later in a potentially unfavorable position.

Good for the Day order (GFD) – A good for day order remains active in the market until the end of the trading day, in Forex the trading day ends at 5:00pm EST or New York time. The exact time a GFD expires might vary from broker to broker, so always check with your broker.

One Cancels the Other order (OCO) – A one cancels the other order is essentially two sets of orders; it can consist of two entry orders, two stop loss orders, or two entry and two stop-loss orders. Essentially, when one order is executed the other is cancelled. So, if you want to buy OR sell the EURUSD because you are anticipating a breakout from consolidation but you don’t know which way the market will break, you can place a buy entry and stop-loss above the consolidation and a sell entry with stop-loss below the consolidation. If the buy entry gets filled for example, the sell entry and its connected stop loss will both be cancelled instantly. A very handy order to use when you are not sure which direction the market will move but are anticipating a large move.

One Triggers the Other order (OTO) – This order is the opposite of an OCO order, because instead of cancelling an order upon filling one, it will trigger another order upon filling one.

• Lot size / Contract size

In Forex, positions are quoted in terms of ‘lots’. The common nomenclature is ‘standard lot’, ‘mini lot’, ‘micro lot’, and ‘nano lot’; we can see examples of each of these in the chart below and the number of units they each represent:

• How to calculate pip value

You probably already know that currencies are measured in pips, and one pip is the smallest increment of price movement that a currency can move. To make money from these small increments of price movement, you need to trade larger amounts of a particular currency in order to see any significant gain (or loss). This is where leverage comes into play; if you don’t understand leverage totally please go read Part 1 of the course where we discuss it.

So we need to know now how lot size affects the value of one pip. Let’s work through a couple examples:

We will assume we are using standard lots, which control 100,000 units per lot. Let’s see how this affects pip value.

1) EUR/JPY at an exchange rate of 100.50 (.01 / 100.50) x 100,000 = $9.95 per pip

2) USD/CHF at an exchange rate of 0.9190 (.0001 / .9190) x 100,000 = $10.88 per pip

In currency pairs where the U.S. dollar is the quote currency, one standard lot will always equal $10 per pip, one mini-lot will equal $1 per pip, one micro-lost will equal .10 cents per pip, and a nano-lot is one penny per pip.

• How to calculate profit and loss

Now, let’s move on to calculating profit and loss:

Let’s use a pair without the U.S. dollar as the quote currency since these are the trickier ones:

1) The rate for the USD/CHF is currently quoted at 0.9191 / 0.9195. Let’s say we are looking to sell the USD/CHF, this means we will be working with the ‘bid’ price of 0.9191, or the rate at which the market is prepared to buy from you.

2) You then sell 1 standard lot (100,000 units) at 0.9191

3) A couple of days later the price moves to 0.9091 / 0.9095 and you decide to take your profit of 96 pips, but what dollar amount is that??

4) The new quote price for the USD/CHF is 0.9091 / 0.9095. Since you are now closing the trade you are working with the ‘ask’ price since you are going to buy the currency pair to offset the sell order you previously initiated. So, since the ‘ask’ price is now 0.9095, this is the price the market is willing to sell the currency pair to you, or the price that you can buy it back at (since you initially sold it).

5) The difference between the price you sold at (0.9191) and the price you want to buy back at (0.9095) is 0.0096, or 96 pips.

6) Using the formula from above, we now have (.0001 / 0.9095) x 100,000 = $10.99 per pip x 96 pips = $1055.04

For currency pairs where the U.S. dollar is the quote currency, calculating profit or loss is pretty simple really. You simply take the number of pips you gained or lost and multiple that by the dollar per pip you are trading, here’s an example:

Let’s say you trade the EURUSD and you buy it at 1.3200 but the price moves down and hits your stop at 1.3100….you just lost 100 pips.

If you are trading 1 standard lot you would have lost $1,000 because 1 standard lot of pairs with the U.S. dollars as the quote currency = $10 per pip, and $10 per pip x 100 pips = $1,000

If you had traded 1 mini-lot you would have lost $100 since 1 mini-lot of USD quote pairs is equal to $1 per pip and $1 x 100 pips = $100

You can also use our Forex Trade Position Size Calculator.

Always remember: when you enter or exit a trade you have to deal with the spread of the bid/ask price. Thus, when you buy a currency you will use the ask price and when you sell a currency you use the bid price.