Part 7: Introduction to Forex Charting

The Introduction Forex Charting

The course will provide you an overview of the three major kinds of charts that you'll come across on your Forex trading adventure. The kind of chart that I employ, and my students use is the candlestick chart. I believe that forex candlestick charts are the most effective in depicting the dynamic of prices in a market since their design allows you to see the "force" or lack thereof, the price of a certain item is displaying. Let's look at the three kinds of charts you'll probably see when you trade in the markets:

* Line charts

Line charts are excellent in providing a quick overview of the overall trend in addition to the levels of support and resistance. They're not a good option to trade on since it is difficult to see the price bars in isolation however, if you wish to observe the trends and market's direction in a concise way, then you must take a look at these line graphs of most popular markets periodically.

Line charts are constructed by connecting the highest price of one time period to the high price of the nextperiod, low to high or open to open and close-to-close. The line charts that indicate a connection between one price closing to the next one are the most efficient and most frequently used. This is due to the fact that the closing price for a particular market considered to be to be the most crucial, as it is the one that decides who wins the war with the bulls or bears in that time. Let's examine an example of a line chart of EURUSD:

* Bar chart

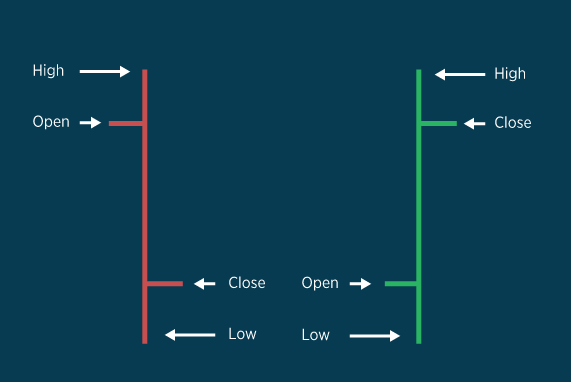

Bar charts show us an individual price bar for each duration of time. For instance, if you're looking through a chart for the day,, you will have a price bar that is displayed for every day, while a 4-hour chart will show a price bar for every 4 hours of time...etc. A price bar provides an investor four types of data which can assist us in making trading choices: The open, high closing, low and open You may also see bar charts, also known as OHLC charts (open low, high and and close charts) Here's an example of a price bar:

This is an illustration of the EURUSD chart that we used in the line chart illustration, but with an example of a bar chart:

Candlestick charts

Candlestick charts provide similar information to bar charts, however in a graphic format that is more enjoyable to view. Candlestick charts display the high and lowest of the specified time interval similar to bar charts using the vertical line. The vertical line at the top is referred to as the upper shadow, while the lower vertical line is known as the lower shadow. You may also notice the shadows of the upper and lower called "wicks". The major difference is how charts of candlesticks display the closing and opening price. The big block that is located in the middle of a candlestick is the area between the closing and opening price. This block is often referred to as"the real body" "real part".

In general, if the body is filled in or darker in color , the currency will close lower than when it opened. However, when the actual body is not filled or is a light shade, the currency ended up closing higher than it had opened. For instance, if your actual body color is white, or some other lighter color it is likely that its top portion of body could indicate the closing price while its bottom body is the price that was open. If the actual body is black or a dark shade The top of the actual body is likely to indicate that it is open and the bottom is the closing price (I have used the term "likely" because you are able to create the body in any colour you prefer). It will be easy to understand by illustrating:

Here's the exact EURUSD daily chart I presented in bar and line form in candlestick charts. You'll notice that I've created the candles in white and black, but you can choose the colors you prefer, just ensure that they're pleasing to your eyes but also communicate bullish and bearishness to you. Candles that are bullish are white ones (close to open higher than close) while bearish candles will be one in black (close to open lower):

Candlestick charts are among the most popular of the three types of charts which is why they're the kind that you'll encounter the most when you trade as well as the ones I suggest to use when learning and trade using price actions strategies. I have used candlestick charts in my Forex trading class and recommended that my students to make use of them when posting charts on the forum for members due to their aesthetic appeal and simplicity makes it easy for everyone to master.