How to set up Fibonacci Stop loss level

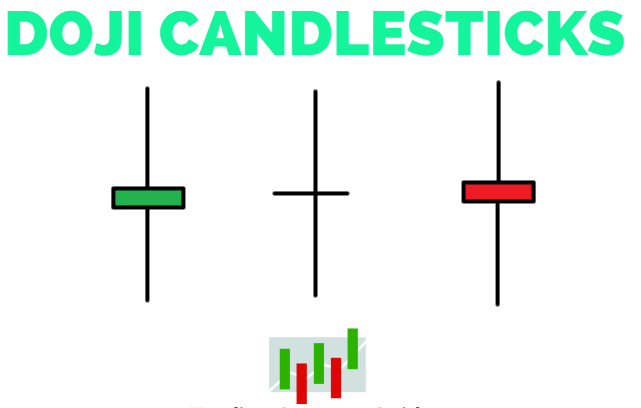

We look at Chart 6 below as an example, the chart below shows the levels of Retracement in a Downtrend Market with Fibonacci Retracement tool and it is noticed that at the 50.0% Retracement level a Bullish Candlestick has appeared in the market with Upper Shadow. Slightly elongated. Candlesticks with such large Upper Shadow signals a bearish trend in the market in many cases (however, not in all cases).

We can treat this signal at 50.0% Retracement level as a signal of Bearish trend and provide Sell Entry at this level and set Stop Loss just above 61.8% Retracement level. Note that in the case of Uptrend market we can set Stop Loss level in the same way.

The rule we set up Stop Loss above is the way to set a very small amount of Stop Loss. But there are many conservative traders among us who are not at all inclined to set such a low Stop Loss, because they do not want to see their Profitable Trading closing by hitting on Unnecessary Stop Loss in any way. Such conservative traders usually prefer the level above 100.0% Retracement level to set Stop Loss, we notice the chart below.

As we can see in the chart above, hardcore conservative traders have chosen the level above 100.0% Retracement as the acceptable level to set the level of Stop Loss in their trades, although it is advantageous to set such a large amount of Stop Loss. And the difficulty is both. We look at the chart below to know the status of the next few days of the Sell Entry trade that we provided at the 50.0% Retracement level of the market in the above chart.

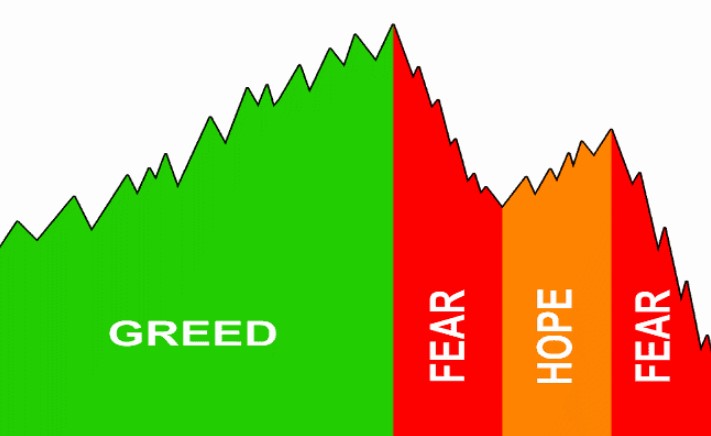

As we can see in the chart above, the trade given by our Sell Entry was profitable, although it was not surprising that the opposite happened, because the Forex market is a "Totally Unpredictable" or "completely unthinkable" business. In fact, if there was a loss in our top Sell Entry trade, then the amount of loss would be much higher for the conservative traders than for the ordinary traders.

Therefore, we need to use the adjective "acceptable" specifically to set the amount of Stop Loss in any trade, because we have already mentioned that - there are both advantages and disadvantages of setting such a large amount of Stop Loss. The first is the advantage - if the trade is correct, it will not hit Stop Loss in any way before hitting Take Profit, and the second is the disadvantage - if the trade is wrong, hitting Stop Loss will cause a lot of loss.

Note: Not all traders follow the same rules to determine the amount of Stop Loss, but each trader sets the amount of Stop Loss according to the same rules. For example, there are many traders who follow a fixed rule of 25-50 Pips (Fixed) to set the Stop Loss amount. Therefore, determining the amount of Stop Loss is a personal matter for each trader. To know more about this there are many important articles on Stop Loss at forexadvisor.org which is enough to gain knowledge of a trader.