Analysis of the Bitcoin, Ethereum, Dogecoin Chart

Analysis of the Bitcoin Chart

Following a successful surge to 45,000 dollars on Wednesday, the price of Bitcoin is now in a new bearish trend, returning towards 40,000 dollars. The Ukraine situation continues to occupy investors' attention, diverting them away from risky investments such as cryptocurrencies.

Optimistic scenario:

• We'll need positive price growth above $ 42,000 and positive consolidation.

• After that, we should expect the price to rise to $ 45,000, which was the previous resistance zone.

• A break above $ 46,000 would take us farther higher.

Optimistic scenario:

• Negative consolidation is required, as well as a price drop below $41,000.

• Our MA50 and MA200 moving averages provide additional support at that level.

• Break prices below us to $ 40,000, and if that zone holds, we can expect a dip to $ 38,000.

• Depending on the bearish pressure, our next goal and support could be the $ 35,000-36,000 zone on the bottom trend line.

Analysis of the Ethereum chart

After soaring to $ 3040 on March 2, the price of ethereum is likewise in a bearish trend. Since then, the price has dropped by 10% to the current $ 2,700. We are now looking at past support zones as ETH has retreated below all moving averages.

Optimistic scenario:

• New positive consolidation is required, as well as price growth above $ 2,800.

• After that, we advance to $ 3,000, which was the prior resistance zone.

• By going to the bullish side, moving averages might provide additional support.

• The $ 3200 level and the $ 3280 high from February are our next goals.

Optimistic scenario:

• We need to keep this negative consolidation going and push the price up to $ 2600.

• The next support zone is in the $ 2,400 range, and if that doesn't hold, we'll move to the $ 2,200 range in January.

Analysis of the Dogecoin chart

Dogecoin's price has been following the trend of major cryptocurrencies, falling from a high of 0.140000 on March 1 to a low of 0.12630. By flipping to the bearish side, moving averages enhance bearish pressure once more. Our previous support was at 0.12000, and there's a high probability we'll test it again, possibly even reaching the February low of 0.11100. For a potential rebound, prices must rise above the MA20 and MA50 moving averages. Only then can we anticipate a probable recovery and break above the MA200 moving average and the price of 0.140000.

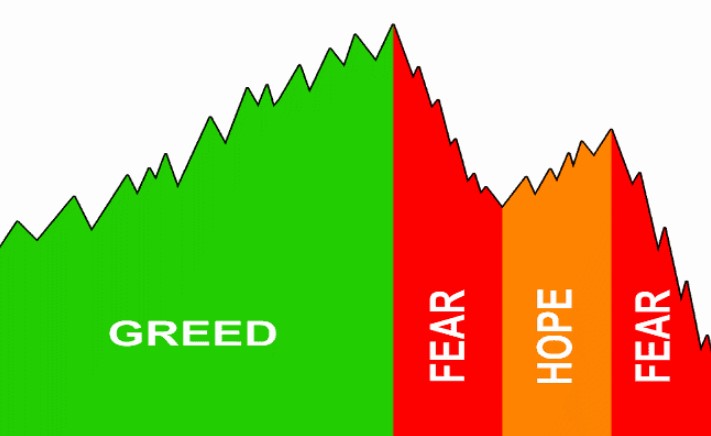

Overview of the Market

Bitcoin can be viewed as a form of insurance for investors. According to cryptocurrency research firm Delphi Digital, the cryptocurrency was sold at a 40% premium in Russia earlier this week, as citizens looked for a way to protect value amid sanctions. The quantity of bitcoin flowing between addresses in a 24-hour period has climbed to almost 565,000 BTC, according to the offer of "active" bitcoin.

"It's the greatest level we've seen in over a year." According to Delphi experts, just two events saw more activity: Black Thursday in March 2020 and May 2020. As a result of a capital flight from the ruble to bitcoin, the supply of bitcoin at smaller addresses (0.001 – 10 BTC) increased dramatically.

In a message to clients earlier this week, Nigel Green, CEO of financial services firm deVere Group, predicted that bitcoin may hit $ 50,000 by the end of March.

"The conflict between Ukraine and Russia has wreaked havoc on the financial system, and individuals, businesses, and even government agencies – not just in the region but around the world – are seeking alternatives to traditional methods," Green said.