Windsor Brokers Broker Reviews and Full Information

What is Windsor?

The long-standing company Windsor Brokers was established back in 1988and is among the longest-running brokers in the region. The overall growth and their capital adequacy ratio of 56% is more than the requirements of regulatory authorities and is the sole way to confirm that they have a safe trading environment.

Windsor broker Pros and Cons

Windsor is a reputable broker with a good reputation. different types of account and pricing incorporated into commission or spreads. There are different platforms and professional training.

In the event of negative side effects, Windsor does not provide support 24/7 and The standard account spreads for customers are more than the industry.

10 Points Summary

| Headquarters | Belize |

| Regulation and License | CySEC, IFSC, JSC |

| Instruments | Cryptocurrencies, CFDs, Futures, Metals and Bonds |

| Platforms | MT4 |

| EUR/USD Spread | 1.5 pips |

| Demo Account | Provided |

| Base currencies | AUD, USD, GBP, EUR |

| Minimum deposit | 500$ |

| Education | Support for education, along with an analytical data center |

| Customer Support | 24/5 |

Is Windsor secure or is it a scam?

Yes, Windsor is not a fraud.

Windsor Brokers established its services by registering two major registrations in order to provide the world as well as providing a distinct product to meet the regulations in every jurisdiction.

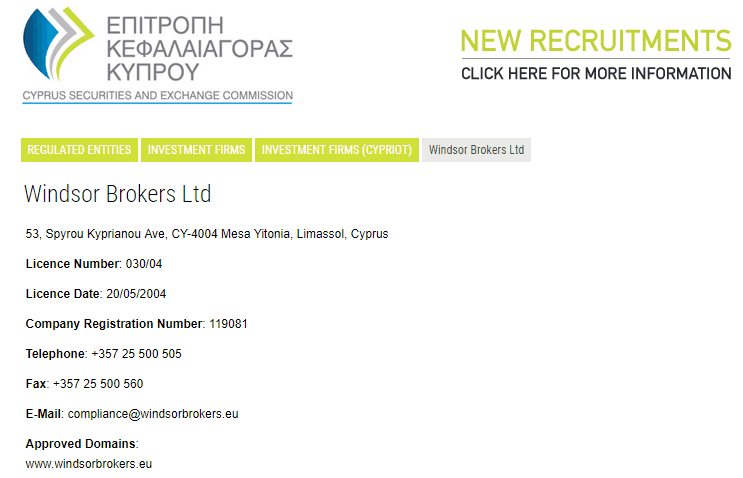

Windsor Brokers is licensed and is regulated under the I Internternational Financial Service Commission ("IFSC") of Belize it is an offshore jurisdiction. However, Windsor Brokers Ltd is licensed and controlled through the Cyprus Securities and Exchange Commission as well as EEA licensed and MiFID compliant to provide trading solutions across Europe. Additionally, Windsor is registered to provide legal trading services in Jordan which opens the door for Muslim traders to participate in Forex through the Islamic Accounts.

We do not recommend trading with brokers that are not licensed, because their offshore registration is extremely poor and, therefore, dangerous, any additional regulation from a trustworthy authorities can change their status to a safer one. Simply put, it implies that the broker has put a lot of effort to comply with the regulations while every necessary method of protection are followed and submitted.

The money of the client is always kept in separate accounts at top banks and are protected by data and a secure trading environments.

Instruments

The mission of the company from the beginning and till this point has been to provide investors' access to global markets through a range of trading instruments , which include more than 600,000 financial assets for Forex include CFDs, Cryptocurrencies futures, Metals and Bonds.

In addition to the extremely market conditions and protection provided by the risk management system of our own each trading experience is protected by the appropriate tools, that focus on transparent practices in trading and capital reserve, along with countless safeguards.

Leverage

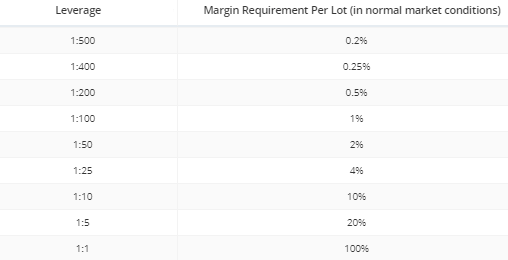

With Windsor Brokers, you're able to work using a powerful tool leverage that can boost your potential gains by allowing multiple balances at the beginning. But, it is important to learn how to utilize leverage effectively since it can increase the risk of losses and also.

Windsor provides higher leverage rates such as 1:200 or 1:400 , or even 1:500for professionals who have been proven to be successful retailers or traders who deal with a global entity of Windsor. Also, a lower limit of 1:30 maximum for European residents, as CySEC together with ESMA prohibits the use in high leverage.

Types of accounts

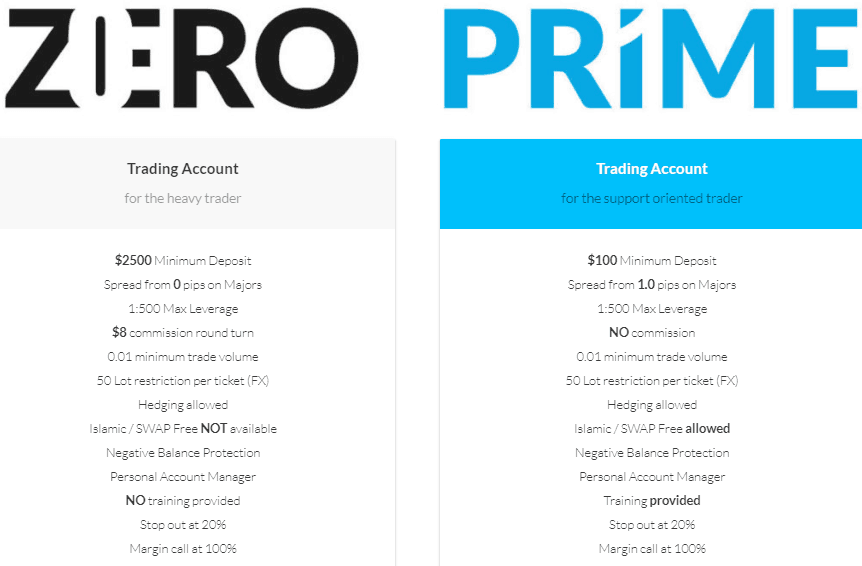

You can choose between two kinds of accounts that are divided based on the platforms and the amount of trading you'll be operating. Additionally, accounts feature negative balance protection as well as multilingual customer support as well as other benefits for education that bring a variety of advantages to the process.

The Prime Account type can be a good choice for the beginning or mid-sized traders. Zero accounts are ideal for active traders and professionals due to its more compact spreads.

Fees

Fees vary based on the type of account you choose to use. They are either incorporated into the spread or commission. Check out the fee table below.

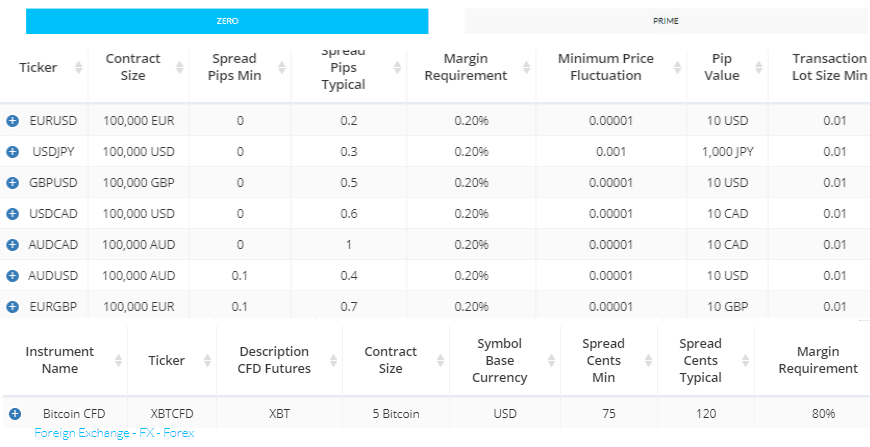

Spreads

Windsor spreads are presented according to the type of account you trade on, as an example, you could use the table below to see an averaged spreads, beginning at 0.01 pip spread on Zero Account. It is greater for Prime account. Prime account around 1.5 in EUR/USD.

Deposit and Withdrawal Methods

To start live trading, you will need to fund your account, which should be easy and without any issues due to the many options available.

Minimum deposit

Windsor minimum amount to deposit will be 100$ on a the Prime Account and Zero Account. The account must maintain 2,500$ for more favorable trading conditions and less spreads.

Windsor minimal deposit, compared to other brokers

| Windsor | Most Other Brokers | |

| Minimum Deposit | $100 | $500 |

Withdrawal

Optional Deposit Methods and withdrawal methods which include the card payment method and Skrill, Neteller with processing fees of the 3% fee, WebMoney will include 0.8 percent, and Bank transfers could incur with different fees depending on the bank and your location.

Trading Platforms

Windsor selects the world's most renowned platform to execute their powerful software for trading known as the MT4 platform is a perfect option for traders at any level due to its charting features and a variety of indicators to suit any strategy. In addition, it has trading algorithms that make the platform user-friendly in addition to being one of the fastest-growing platforms.

Multi-device capability allows traders to trade on desktops WebTrader, Mobile/ Tablet apps.

Additionally, another platform is a rich AMO-based platform that is designed with multiple features and is ideal with Desktop, Web or Mobile use. There are multiple products accessible from a single account and include sophisticated Algos as well as trading instruments including in-depth news access along with technical and financial analysis advanced risk analysis tools, and complete customisation with spreads that start at 0 pips.

The mobile version of the app is extremely efficient as well offering the same capabilities as the computer versions together with price alerts along with streaming quote quotes.

Education

Additionally, the company takes great care of the skills that their trader. This is why the education support and an analytical data center are available, while offering various solutions for traders at any degree.

In all, throughout the many years of operation, Windsor Brokers have received numerous successes awards, which are backed by their unbeatable service and innovations and is recognized by the amount of clients they have served and their an excellent reputation in the business.

Conclusion

While some of these companies have seen changes in the last few years, Windsor Brokers remaining one of the oldest brokerage businesses. It was able to achieve this through their seamless trading service and the well-established seamless trading process. With its competitive market access as well as the technological improvements and options, brokers offers not just a well-known platform for MT4 but also a highly-technical AMO system. Customer support provides a top-quality service however, make sure to know exactly what you are referring to.

| Properties | Values |

|---|---|

|

Name

|

Windsor Brokers |

|

Minimum Diposit

|

$ 500 |

|

Leverage

|

1:50 |

|

Regulation

|

IFSC (Belize),CySEC (Cyprus),JSC (Jordan),,,,,,, |

|

Headquarters

|

Belize |

|

Established

|

1988 |

|

Address

|

35 Barrack Road, 3rd floor, Belize City, Belize |

|

Platform

|

MT4,,,,,, |

|

Payment Method

|

Visa,Mastercard,Wire,Skrill,Neteller,Webmoney,Union Pay,Local bank transfer, |

| Properties | Values |

|---|---|

|

Spreads

|

1.5 pips |

|

Min Position size

|

0.01 |

|

Broker Type

|

STP (Straight Through Processing),,,,, |

|

Account Type

|

Mini account,Fixed Spread,Scalping,Standard,, |

|

Brokers by Country

|

US Forex Brokers,All Offshore Brokers,,,,,,, |

|

Techniques

|

Scalping Forex Brokers,,,,,, |

|

Instruments

|

Forex Trading Brokers,Gold Trading Brokers,Stock Trading Broke,Oil Trading Brokers,Metal Trading Brokers,Indexes Trading Brokers,,,,,, |

|

Account currency

|

USD,EUR,GBP,AUD,CAD,JPY,NZD,,USD, |

|

Tools

|

Economic Calendar,Charting Software,, |

|

Website Languages

|

en,,,,,, |

|

Support languages

|

en,,,,,, |

|

Bonus

|

Yes |

|

Reviews Rating

|

4.1 |

|

Withdrawal Fee

|

No |

|

Trading Signals

|

Yes |

|

Free Education

|

Yes |

|

Daily News

|

No |

|

Demo account

|

Yes |

|

Swapsr

|

Yes |

|

Pors

|

1. Regulated broker 2. Wide range of trading instruments 3. Modern platforms suitable for traders of all experience levels 4. Multilingual customer support 5. Trader educational resources & expert marekt analysis |

|

Cors

|

1. Market maker broker 2. Best conditions require larger deposit 3. Traders from United States, Japan, & Belgium are not allowed to register 4. Deposit & withdrawal fees are charged 5. Commission charges not the lowest |

|

Display Analysis

|

Yes |

|

Serving country

|

BZ,CY,JO,, |

|

Not Serving country

|

BE,BZ,JP,US,, |

|

Contests

|

Yes |

|

Market analysis

|

Yes |

|

Copy Trading Brokers

|

No |

|

Bitcoin Forex Brokers

|

Yes |

|

Social trading

|

Yes |

|

Web trading

|

Yes |

|

Forex pairs

|

Yes |

|

CFDs

|

Yes |

|

Crypto

|

Yes |

|

Hedging

|

Yes |

|

PAMM

|

Myfxbook Auto trade,Mql5 signals,, |

|

Mobile Trading

|

Yes |

|

Scalping

|

Yes |

|

Automated Trading

|

Yes |

|

Partnership Programs

|

Yes |

|

Free Phone

|

+41 215 880 524 |

|

Customer Support

|

24/5 |

Exness Broker reviews & comments (0)

Add a review

Your email address will not be published. Required fields are marked *