Valbury Capital Broker Reviews and Full Information

What exactly is Valbury Capital?

Valbury Capital is a financial investment company established under legislation of UK operating through an international financial hub , London. Valbury Capital bringing a flexible but dependable model to compete in the world of trading since the broker provides customer service with the most strong trading technology.

Valbury Capital investment service and proposal can also be adapted to investors of various sizes and portfolios with a custom solution and a personalized service that we will further discuss during the Valbury Capital Review.

Valbury Capital Pros and Cons

Valbury Capital is a reliable broker with a top-tier license. account opening is 100% digital and the trading environment excellent, with a customized options for spreads, platforms, and conditions suitable for investors.

In the Cons there is no 24-hour support , and the proposal could be more appropriate for advanced traders.

10 Points Summary

| Headquarters | UK |

| Regulation | FCA |

| Instruments | 170 Forex pair CFDs Futures and Options, Commodities, Equities, Fixed Incomes, as well as ETFs |

| Platforms | The MT4, IRESS, CQG Trader PATS J-Trader, MT4, IRESS, CQG Trader |

| Spread EUR/USD | Custom Tight spread |

| Minimum deposit | 10,000$ |

| Base currencies | USD GBP, EUR, USD |

| Demo Account | It is a service that is offered |

| Education | News and Opinion section |

| Customer Support | 24/5 |

Are you sure? Valbury Capital safe or a fraud?

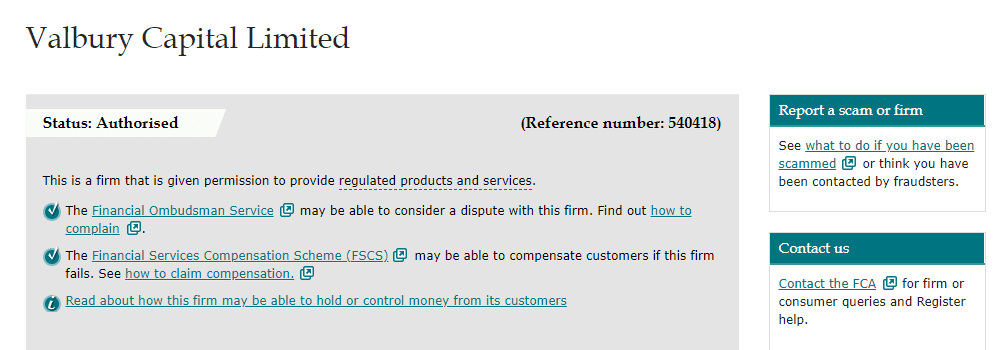

There is no need to worry, Valbury Capital is not a fraud.

Valbury Capital, as based in the UK company, is approved through the Financial Conduct Authority. In the end, all businesses that are in the financial market in the UK must be licensed and monitored by the FCA and its purpose is to ensure uniformity in offering and honesty. Thus, Valbury Capital clients are received with respect and dignity by offering transparent trading terms.

One of the major aims of the regulations is to offer a secure investment option to institutions, professional, or retail and is the the right of a trusted jurisdiction. That's that you should pick only brokers that are regulatedin order to be certain that they are able to provide a safe trading environment as well as the security of your investment.

As part of the structure, clients' money is held in separate accounts that are fully protected with the FSCS compensation fund in the event bankruptcy of brokers and controlled with the interests of the client first.

What exactly is Valbury Capital Leverage?

Another topic that is important to discuss within this Valbury Capital review is leverage levels that can give greater exposure to markets and increase your profit.

- Authorities have recently imposed restrictions on using high leverage by retail traders, so if you trade through the UK broker, you can leverage as high as 1:20 for Forex instruments one-to-20 for currency pairs that are minor,, and as high as 1:10 on Commodities.

But, since Valbury Capital mainly offers a business and professional trading solution, the professional can access greater ratios, up to 1:100.

Trading Instruments

One of the most impressive offerings Valbury Capital offers, in an vast array of strong trading platforms that give direct access to Markets via an NDD execution that is transparent by utilizing multi-source liquidity.

In terms of the variety of instruments available, you can find a multi-asset portfolio that is geared to international exchanges, and encompassing more than 170 forex pairs CFDs Options, Futures as well as Options Commodities, Equities, Fixed Incomes as well as ETFs.

Furthermore, you can benefit from the news, support and opinion sections provided through Valbury Capital and supporting your everyday choices.

Types of accounts

Since Valbury Capital tailors its solution in accordance with the needs of traders, the account types can only be defined by the kind of investor you are.

Fees

Valbury Capital fees are based on a spread, plus an fees for inactivity, funding fees and other fees that could be incurred. Instruments are available via its top technologies and connections, as well with voice execution, can be traded on global exchanges. The broker works with various liquidity providers. Therefore its ECN system will select the most suitable quote available and then executes your order with that price.

| Fees | Valbury Capital Fees | City Index Fees | CIX Markets Fees |

|---|---|---|---|

| Deposit Fee | No | No | No |

| Fee for Withdrawal | No | No | No |

| Tailored charges | Yes | Yes | Yes |

| Fee position | Low | Low | Low |

Spreads

Valbury Capital offers tight spreads however as mentions on its website, there isn't a same as another trader so its spreads and terms are determined by the balance of your account you have, the instrument you trade, and the volume you trade. So, Valbury Capital will provide a completely customized solution that is based on high spreads and competitive commissions. Also, you can compare fees with another broker that is popular the LCG.

How do I deposit funds into Valbury Capital?

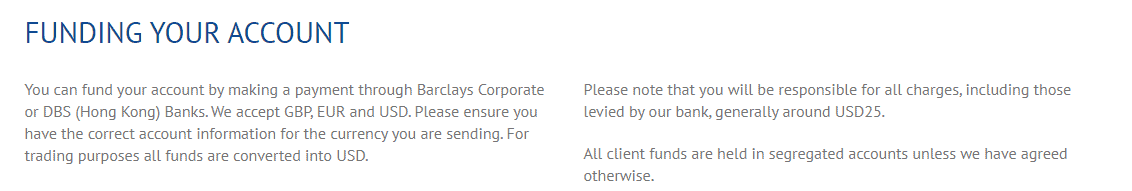

Valbury Capital funding methods that permit you to transfer funds into accounts for trading. Valbury Capital maintains only Bank Wire Transfer as a method of payment because of its proven reliability and convenience.

Minimum deposit

The minimum deposit at Valbury Capital is 10,000$. Even though the amount is quite large for new traders, Valbury Capital indeed is focused and rely more on the professional and experienced traders with high volumes.

Valbury Capital minimum deposit in comparison to other brokers

| Valbury Capital | The majority of other brokers | |

| Minimum Deposit | $10,000 | $500 |

Fee for withdrawal

Valbury Capital withdrawal options are only Bank Wire. Additionally, the broker states that the customer is accountable for all costs incurred during the transfer, which are typically $25.

Trading Platforms

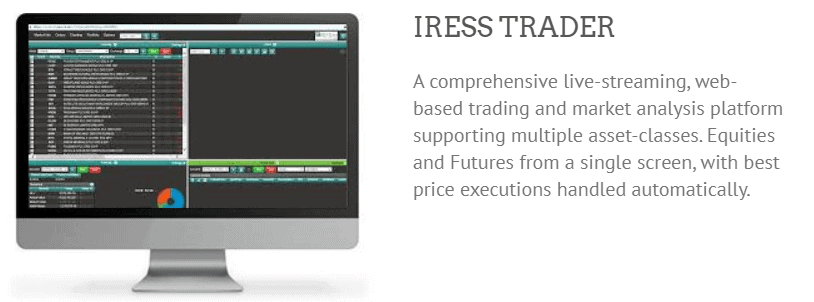

Another positive aspect of Valbury Capital Review is brokers have platform technology and there's no obligation to a specific provider, rather there are a variety of reliable gateways. The software available includes market-leading platforms such as PATS J-Trader, CQG Trader, IRESS, etc all ensured by transparent and competitive pricing.

This is a fantastic idea, and each platform lets you to pick the most option for your trading strategy you employ. Although the MT4 platform doesn't require an introduction, it is the standard in the market and the most widely used platform with its powerful capabilities and an easy to use interface.

Additionally, Valbury Capital includes Trading Technologies with a simultaneous capability to trade in across multiple markets, and TraderToolsas an open supplier of liquidity aggregate using the Unique Liquidity Network.

Pats J-Trader and Pro-Markis one of the top platforms designed for professionals who trade futures. Additionally, CQG QTrader CQG Trader or CQG Integrated gives you the highest-performance trading capability across multiple classes of assets. Finally, IRESS Pro or IRESS the Trader is an incredibly flexible application that gathers complete price and trade information together.

Indeed, Valbury Capital truly brings you a fantastic and more options of the latest technology and programs to utilize in reverse, enhancing the possibilities and capabilities of dealing.

Conclusion

The final opinions on Valbury Capital are good, but the broker is best suited for traders of larger size professional or corporate clients. Because of its large minimum deposit requirement, Valbury could be difficult to access for novices and it's recommended to begin small when taking the beginning of your journey into Forex. For the general offering, Valbury Capital proposes some of the most effective platform for the industry, accompanied by excellent execution and a variety of liquidity providers that they use to provide the best rates. Additionally, their customized and one-to-one approach to each customer is another thing to take into consideration and think about when making a decision.

| Properties | Values |

|---|---|

|

Name

|

Valbury Capital |

|

Minimum Diposit

|

$ 10000 |

|

Leverage

|

1:30 |

|

Regulation

|

FCA (United Kingdom),, |

|

Headquarters

|

United Kingdom |

|

Established

|

2008 |

|

Address

|

30 Crown Pl, London EC2A 4EB, United Kingdom |

|

Platform

|

MT4,, |

|

Payment Method

|

Wire,, |

| Properties | Values |

|---|---|

|

Spreads

|

Custom Tight spread |

|

Min Position size

|

0.01 |

|

Broker Type

|

ECN (electronic communications networks),NDD (Non Dealing Desk),,,, |

|

Account Type

|

Cent account,Mini account,High Leverage,Islamic account,Standard,, |

|

Brokers by Country

|

UK Forex Brokers,, |

|

Techniques

|

Scalping Forex Brokers,Hedging Forex Brokers,Spread Betting Brokers,Automated Trading Brokers,Mobile Trading Brokers,, |

|

Instruments

|

Forex Trading Brokers,Gold Trading Brokers,Oil Trading Brokers,Commodity Forex Brokers,, |

|

Account currency

|

,USD,,USD,,USD,,USD,,USD,,USD, |

|

Tools

|

Charting Software,, |

|

Website Languages

|

en,, |

|

Support languages

|

en,, |

|

Bonus

|

Yes |

|

Reviews Rating

|

3.5 |

|

Withdrawal Fee

|

No |

|

Trading Signals

|

Yes |

|

Free Education

|

Yes |

|

Daily News

|

Yes |

|

Demo account

|

Yes |

|

Swapsr

|

Yes |

|

Pors

|

1. Valbury Capital is a reliable broker with top-tier license. 2. the account opening is fully digital and trading environment is good. 3. There are tailored solution to spreads, platforms and conditions good for investors. |

|

Cors

|

1. There is no 24/7 support and proposal might be more suitable for advanced traders. |

|

Display Analysis

|

Yes |

|

Serving country

|

GB,, |

|

Not Serving country

|

US,, |

|

Contests

|

No |

|

Market analysis

|

Yes |

|

Copy Trading Brokers

|

No |

|

Bitcoin Forex Brokers

|

No |

|

Social trading

|

No |

|

Web trading

|

Yes |

|

Forex pairs

|

Yes |

|

CFDs

|

Yes |

|

Crypto

|

Yes |

|

Hedging

|

Yes |

|

PAMM

|

PAMM,MAMM,Myfxbook Auto trade,Mql5 signals,, |

|

Mobile Trading

|

Yes |

|

Scalping

|

Yes |

|

Automated Trading

|

Yes |

|

Partnership Programs

|

Yes |

|

Free Phone

|

+44 800 122 3150 |

|

Customer Support

|

24/5 |

Exness Broker reviews & comments (0)

Add a review

Your email address will not be published. Required fields are marked *