USGFX Broker Reviews and Full Information

What is USGFX?

USGFX is an Australian brokerage firm based in Australia which operates with transparency and respect for their clients the principles and values. The broker offers Forex as well as CFD trading solutions for currencies, indices and commodities. In addition to the enhancements in customer services USGFX has an headquarters in Shanghai and an office satellite situated in Hong Kong.

When it comes to trading in itself, the company implements an automated execution process using the optical fiber connection to its servers which are situated within London in London and New York and thus provide Interbank connectivity at fastest speeds. As a result, there are many liquidity providers are able to access the most liquid pools, allowing the trading experience to be enjoyed at the cheapest costs or spreads.

10 Points Summary

| Headquarters | Australia |

| Regulation and License | ASIC |

| Instruments | Forex as well as CFD trading options to trade currencies, indices, and commodities |

| Platforms | MT4, MT5, WebTrader |

| EUR/USD Spread | 2.2 pip |

| Minimum deposit | 100$ |

| Base currencies | USD, AUD |

| Demo Account | Provided |

| Education | Risk management, market analysis and regular contests, seminars, and seminars |

| Customer Support | 24/5 |

Education

The broker also recognizes that a solid education and understanding of market procedures is the primary factor that determines successful trading. For that why USGFX has created its very own project TradersClub. The TradercClub offers a variety of education programs for traders of all levels and does not just provide materials, but also market analysis and risk management, as well as regular seminars, contestsand many more.

Awards

Over the course of the years of operating, the broker has earned not only the trust of global market, but also from the support for social gatherings, but also been awarded numerous awards which recognize them in the market for their professionalism.

Is Usgfx licensed?

Union Standard Group, which utilizes the trading name USGFX, is a licensed by the CFD and forex exchange regulators licensed through the Australian Securities and Investment Commission (ASIC) and is a holder of the Australian Financial Services Licence (AFSL).

We often say that the strict adherence to guidelines and a legitimate license is the first thing you should look for when choosing an agent. Simplyput, strict regulation calls for various ways to safeguard clients their funds, in addition to promote an environment that is healthy and a an open and transparent environment. This isn't the case for brokers that are not regulated.

In addition to the security offered according to the regulation, USGFX also implemented Negative Balance Protectionthat gives you assurance that the losses can't exceed the balance of the account.

Trading Platforms

Let's look at which trading and software USGFX utilizes, the broker selected the most reliable trade platforms MetaTrader4 and MetaTrader5 which are compatible with modern solutions and provides infinite possibilities.

Desktop trading

MT4 as well as MT5 are two different platforms that give you a powerful trading experience, with the distinct fact in that MT4 has the highest popularity and is the frequently used platform , while MT5 is a more advanced version with more advanced features. Both platforms can be used with a variety of devices and are accessible via WebTraderplatform that does not require download and provides multi-terminal.

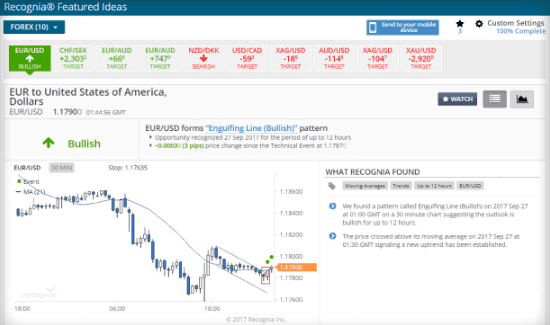

Research

Additionally, USGFX partners with Trading Centralthat is a prominent researcher that offers precise market analysis, technical analysis as well as insights built on years of collaboration with the most reputable institutions. You also have the ability to make use of the Recognia trading System that provides you with the best trading options through intra-day trades designed to suit your personal trading abilities.

Last but not the least possibility is the possibility of social Trading option, which lets traders who aren't able to keep at the forefront of markets just adhere to one of the expert trading strategies. They are offered at USGFX from two top social trading companies ZuluTrade as well as MyFXbook.

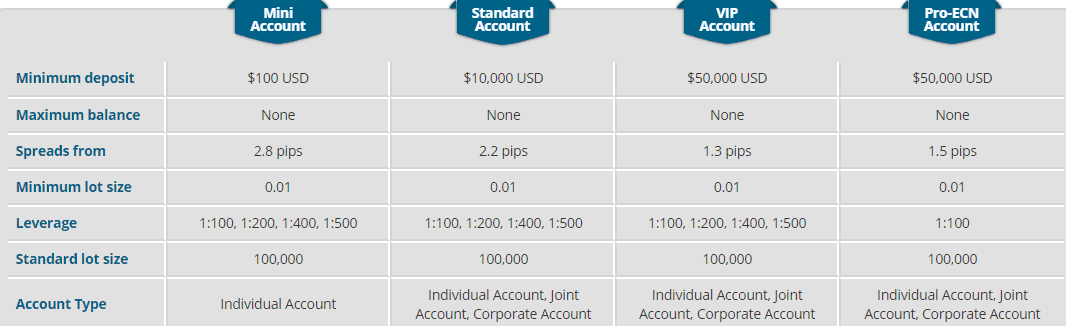

Accounts

The account types include four types of accounts developed by USGFX with each offering various requirements for traders, therefore you can select from Mini Account and Account with Standard Conditions and Pro-ECN accounts for professionals and VIP accounts.

A Demo account is included in the deal also offering 100k dollars virtual currency to test trading strategies. It is suggested as a first step.

Fees

USGFX spreads according to the type of account that you trade with, for an example, look at the table below to see an average spread. Always take into consideration rolling over or overnight fees as a charge that is charged on the overnight positions that are -0.8 for short, and 0.18 for a long-term position on the EUR/USD exchange. You can also examine fees against other Australian brokerage FP Markets.

| Asset/ Pair | USGFX Spread |

| EUR/USD | 2.2 |

| Gold | 5 |

| BTC/USD | 10Commission of $ |

Leverage

With USGFX gives you the ability to choose a leverage range from 1:20 to 1:500. This is thought of as the highest leverage. Leverage tool is indeed an effective tool, and is designed to increase the potential of your gains and allow you to trade larger amounts, however it is important to learn to utilize it effectively so that you don't get the reverse effect.

But, USGFX being an Australian ASIC accredited broker, adhere to the rules of the company and allows the use of high leverage for retail traders, which could be an important addition in your trading strategy.

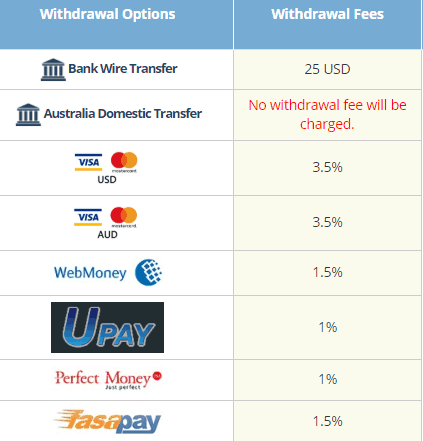

Deposits and Withdrawals

To withdraw or deposit funds from the trading account, you can choose from the various payment options available, which include

- Bank Wire Transfers,

- Visa or MasterCard payment,

- WebMoney,

- MoneyPolo,

- Perfect Money,

- fasapay,

- Skrill, Neteller

- Banking systems online are available for Thailand, Malaysia, Indonesia, Vietnam and MoneyNetint.

Withdrawal fee

Additionally, USGFX covers all costs associated with deposits and withdrawals could incur certain fees, for example credit cards can be eligible to pay 3.5 percent fee, or Skrillor Neteller. Neteller will add 1.5 percentage.

Minimum deposit

For your minimal deposit it is possible to begin trading with a simple 100$, which allows access to the trading account of the first grade , namely USGFX Mini Account. Higher rate accounts have different requirements to begin and can be viewed below.

Conclusion

In the end, the USGFX Review concludes the broker as a trusted partner to trade and invest. The technology-driven execution base offers an endless array of strategies for traders of all sizes. Furthermore the broker has developed an advanced account proposal that includes various options for trading conditions, sizes and conditions and starting capitals.

The spread, however, is simply too large. It is possible to trade with an ASIC approved Australian Forex broker FP Markets with much more favorable trading conditions.

Of course, we'd be delighted to hear your opinion on USGFX Share your experiences in the comment section below or contact us for more details.

| Properties | Values |

|---|---|

|

Name

|

USGFX |

|

Minimum Diposit

|

$ 100 |

|

Leverage

|

500:1 |

|

Regulation

|

ASIC (Australia),FCA (United Kingdom),, |

|

Headquarters

|

Australia |

|

Established

|

2005 |

|

Address

|

Govant Building PO BOX 1276 Port Vila, Saint Vincent And Grenadines |

|

Platform

|

MT4,MT5,, |

|

Payment Method

|

Visa,Mastercard,Wire,Skrill,Neteller,Perfect Money,Bitcoin,Fasa Pay,, |

| Properties | Values |

|---|---|

|

Spreads

|

2.2 pips |

|

Min Position size

|

0.01 |

|

Broker Type

|

STP (Straight Through Processing),Instant Execution,,,,, |

|

Account Type

|

Mini account,Scalping,High Leverage,Standard,, |

|

Brokers by Country

|

Australian Forex Brokers,UK Forex Brokers,, |

|

Techniques

|

Scalping Forex Brokers,Hedging Forex Brokers,Spread Betting Brokers,Automated Trading Brokers,Mobile Trading Brokers,Copy Trading Brokers,, |

|

Instruments

|

Forex Trading Brokers,Gold Trading Brokers,CFD Trading Brokers,Stock Trading Broke,Oil Trading Brokers,Commodity Forex Brokers,Copy Trading Brokers,Metal Trading Brokers,Indexes Trading Brokers,, |

|

Account currency

|

USD,AUD,CAD,,USD, |

|

Tools

|

Economic Calendar,Charting Software,Profit Calculator, |

|

Website Languages

|

en,, |

|

Support languages

|

en,, |

|

Bonus

|

Yes |

|

Reviews Rating

|

2.5 |

|

Withdrawal Fee

|

Yes |

|

Trading Signals

|

No |

|

Free Education

|

Yes |

|

Daily News

|

No |

|

Demo account

|

Yes |

|

Swapsr

|

Yes |

|

Pors

|

1. Regulated broker 2. Social trading powered by ZuluTrade & Myfxbook 3. Market news & technical analysis provided by ‘Trading Central’ 4. Structured & personalised trader education via TradersClub 5. MetaTrader platforms with trading tools |

|

Cors

|

1. Limited trading instruments 2. Demo account expires after 30 days 3. High withdrawal fees: up to $25 per withdrawal for every non-Australian bank transfer 4. Clients from USA & Japan are not accepted 5. Spreads & commission fees not the lowest 6. High minimum deposit requirements |

|

Display Analysis

|

Yes |

|

Serving country

|

AU,GB, |

|

Not Serving country

|

US, |

|

Contests

|

Yes |

|

Market analysis

|

Yes |

|

Copy Trading Brokers

|

Yes |

|

Bitcoin Forex Brokers

|

No |

|

Social trading

|

Yes |

|

Web trading

|

Yes |

|

Forex pairs

|

Yes |

|

CFDs

|

Yes |

|

Crypto

|

No |

|

Hedging

|

Yes |

|

PAMM

|

PAMM,MAMM,Myfxbook Auto trade,, |

|

Mobile Trading

|

Yes |

|

Scalping

|

Yes |

|

Automated Trading

|

Yes |

|

Partnership Programs

|

Yes |

|

Free Phone

|

+61291890223 |

|

Customer Support

|

Exness Broker reviews & comments (0)

Add a review

Your email address will not be published. Required fields are marked *