approved canadian pharmacies online https://canadianpharmacypoint.com/ mail order drugs without a prescription

TradeATF Broker Reviews and Full Information

What exactly is TradeATF?

TradeATF has been a new participant in the Forex business, and is a company that was established in accordance with law of Cyprus that is based on the latest technology and strives to provide high-quality conditions and expertise to global traders.

In the end, TradeATF is a brand name owned by a popular firm called Hoch Ltd that also serves several other trading names, including iTrader and others. Therefore, its claims about a professionalism are also supported by the other experiences within the the Forex and the trading industry TradeATF is.

Although Trade ATF is rather a new broker, it currently has more than 10000 customers from all over the globe. This is a result of uniform trading conditions that brokers offer, while novice traders will benefit from simplified conditions and quick account opening. They also can benefit from the Forex training that Trade ATF provides.

Professionals will also find a number of the most innovative tools that are available, as well as acces to MT4 platform, and incredibly powerful trading tools with no restrictions. But, make sure to read the complete article to understand the TradeATF Review conditions better before you decide the broker you'd like to join.

TradeATF's Pros and Cons

TradeATF offers a brokerage offering simple account opening, great trading conditions, and a well-informed fee-based strategy.

On the negative side, there are complaints from traders, the instrument's range is restricted only to Forex and CFDs You can also check out some recent updates in the review.

10 Points Summary

| Headquarters | Cyprus |

| Regulation | CySEC, IFSC |

| Platforms | MT4 |

| Instruments | Stocks, Indices, Currencies cryptocurrency and commodities |

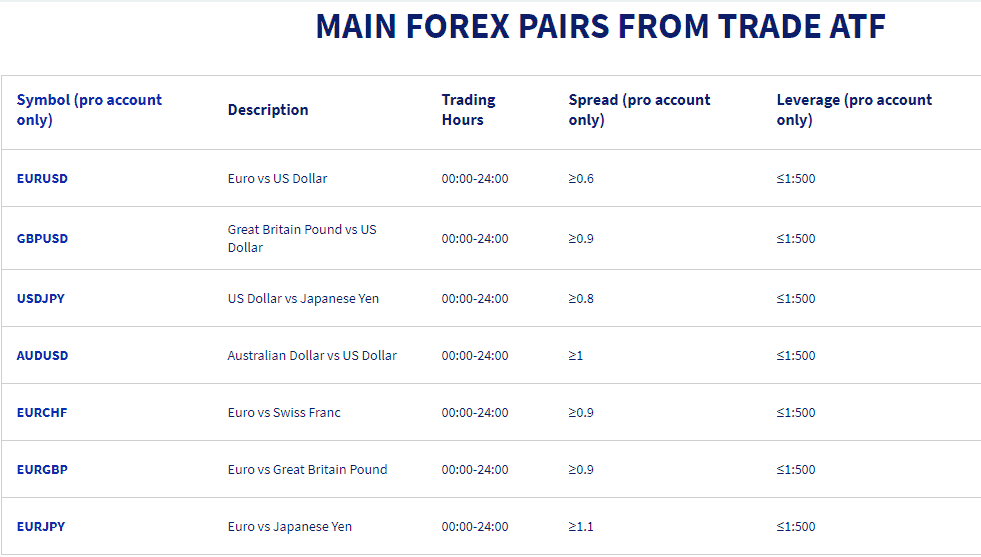

| Spread EUR/USD | 0.6 pip |

| Demo Account | Available |

| Minimum deposit | 100$ |

| Base currencies | Few currencies |

| Education | Education , including Webinars, Courses and Tools for research |

| Customer Support | 24/5 |

Is TradeATF an authentic and safe investment or a scam?

Yes, TradeATF is not a fraud, it has a CySEC license, and in the event of any rule breach, is punished and made publically aware. The primary thing to look for at this point is to determine the legitimacy of the broker the registration address, the address of its registration and the license that it operates under.

Is TradeATF real?

TradeATF has two separate entities which are one of them based in the offshore zone of Belize and the other is subject to European registrations and regulations that is in Cyprus. Eventually, TradeATF is a brand the trade name used for Hoch Capital Ltd which is regulated through the Cyprus Securities and Exchange Commission which sets the standards for the regulation and services in the financial sector throughout the EEA zone and beyond.

Additionally, as an European regulator, TradeATF is automatically in compliance with MiFID and ESMA regulations and the way that brokerage services clients and treat its customers as well as customers.

We don't suggest using offshore broker on their own and you must investigate before trading however, because TradeATF is controlled by European regulators, we suggest opening an account in accordance with the European regulation as one that is bound by international standards and safeguards your funds.

Leverage

Leverage is a efficient tool in trading, because it increases your capital investment in some number of ways giving you the opportunity to earn more money through trading smaller amount. However, leverage can also bring riskier ones and you must know how to use it in a safe manner, regardless of which instrument you want to use it, or on which instrument is not.

Risk Level

In recognition of its potential risks, the regulators across different jurisdictions have recently have been significantly lowering permitted levels or those which retail traders can employ. But, because TradeATF operates two entities, one of which is located in Europe, Cyprus another one accessible to international traders, and is based in Belize The two organizations will provide you with different leverage options.

- Cyprus entity leverage is up to 1:3 for major currency pairs and 1:10 for Commodities

- Internationalproposal has an leverage factor of one to 1:400.

- Professional traders have access to the highest leverage up to 1:400 or 1:500 after the status is confirmed.

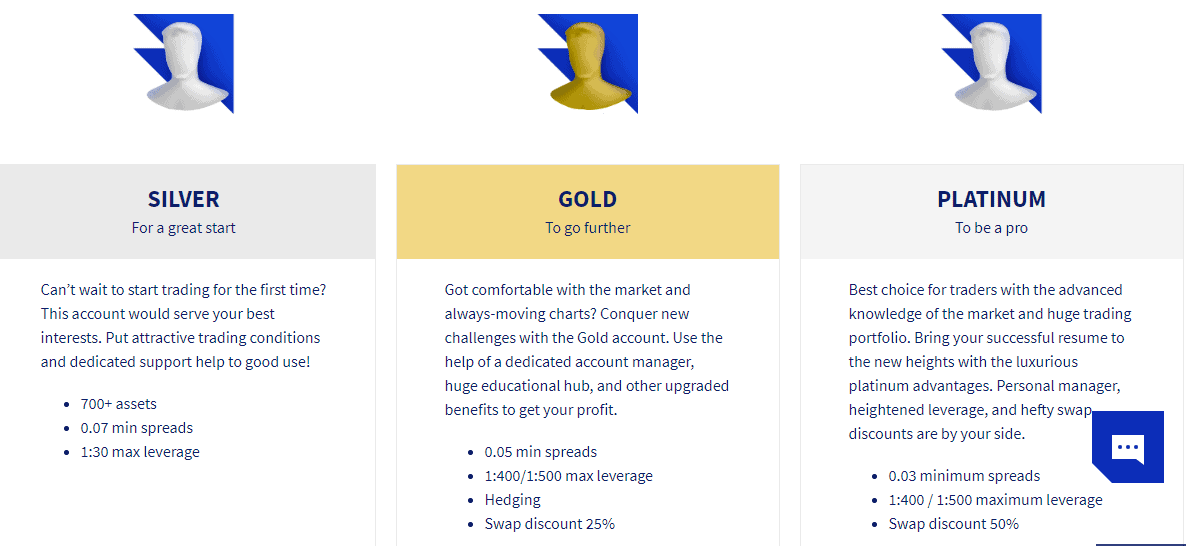

Types of accounts

TradeATF offers a variety of accounts that offer three types: Gold, Silver and Platinum designed specifically for traders just beginning their trading, or who are seeking to trade in the future with better conditions as the type of account increases. Through a variety of 700+ assets , each account type comes with a the most efficient fee structure, as well as discounts for Gold or Platinum holders on swaps and spread costs.

Additionally, TradeATF supports traders adhering to Sharia faith, making an the Islamic Account is available for all types of accounts with customized conditions in line with limitations.

How do you open an Account?

Trading Instruments

For the markets that are available, TradeATF provides trading on CFD basis, with access to over 350 assets which include the most popular Currency pair, Cryptocurrencies, Indexes, Energies, metals, Stocks and more. Its selection continues to expand. Although some traders might consider that a proposal made based on CFDs are rather restricted, there are many advantages to this type of trading.

Its main purpose is an easy way of trading, in which there is no need to fret about contract rollovers or connecting to an exchange. just by choosing from the range of trading instruments available on TradeATF platform, you can open the chart and start trading which is certainly a plus.

Fees

The cost of TradeATF is based on the type of account you choose to use in addition to the size of trading you manage. Silver accounts cost starting at minimum spreads of 0.07 and Gold accounts offers spreads as low as 0.05 with a rollover discount of 25% and Platinum offer spreads of 0.03 and swap discounts of 50 percent. Additional costs include the cost of funding, inactivity fee and swaps.

| Fee | Fees for TradeATF | Fees for ETFinance | OctaFX Fees |

|---|---|---|---|

| Deposit Fee | No | No | No |

| Fee for inactivity | Yes | Yes | Yes |

| Fee position | Average | Average | Low |

Spreads

TradeATF doesn't charge a commission, but bases its charges on a spread. That means that all you need to pay for trading services and capabilities is a spread or the difference between the buy and sell price that you pay for each trade that you open. Spread is also determined by the type of account you choose to use, so silver accounts have spreads that start at 0.07 pip, Gold owners get a discounted rate of 0.05 and Platinum customers are eligible for the the lowest rate at 0.03 pip.

Additionally, an additional in the form of a rollover or swap fee is charged for using a the swing strategy or hold positions for more than a day. But, Gold and Platinum traders can benefit from a swap discount of 25 and 50 percent, respectively. This is definitely a good deal. Look below for a table of comparison with the average TradeATF Spread. You can also examine the brokers against the other brokers that offer CFD with the same fees, commissions or an the inactivity fee. Additionally, to consider you can look up the FP Markets.

| Asset/ Pair | Fees for TradeATF | Fees for ETFinance | OctaFX Fees |

|---|---|---|---|

| EUR USD | 0.6 pip | 0.7 pip | 0.5 pip |

| Crude Oil WTI | 3 pip | 3 pip | 2 Pips |

| Gold | 36 | 37 | 20 |

A snapshot of TradeATF fees

Deposits and withdrawals

As a registered broker, TradeATF is automatically covered under rules for managing money that ensure client funds are secured and kept separate throughout the day. Additionally, the broker allows secure transactions, which means that you can transfer funds without restriction into or out of the trading account.

Option fees and Deposit fees

TradeATF provides the option to deposit funds using the most popular payment methods through the recourse to popular companies. It might seem at one moment like a limited selection in those who belong to the EU entity, however, these options are the most efficient and secure. Also, it is worth noting that if you have a bank account created by the International TradeATF entity you would have access to a greater variety of financial institutions, because the law allows. It is a good idea to inquire with the customer service on the subject of transfer policy.

- Bank Wire Transfer

- Credit Card Debit Card

- Skrill

Minimum deposit requirement

TradeATF's minimum deposit can be set at EUR100 which allows you to open a silver account, whereas a higher grade accounts will require larger sums of money. It is also beneficial that there are no charges for deposits and there isn't any commission. However, you must clarify the terms in conjunction with your financial institution or Bank itself since international laws could differ.

Minimum deposit for TradeATF in comparison to other brokers

| TradeATF | The majority of other brokers | |

| Minimum Deposit | $100 | $500 |

Withdrawal

TradeATF Money withdrawals are arranged in a an easy-to-use manner, since every transaction is demanded and handled via your online account.

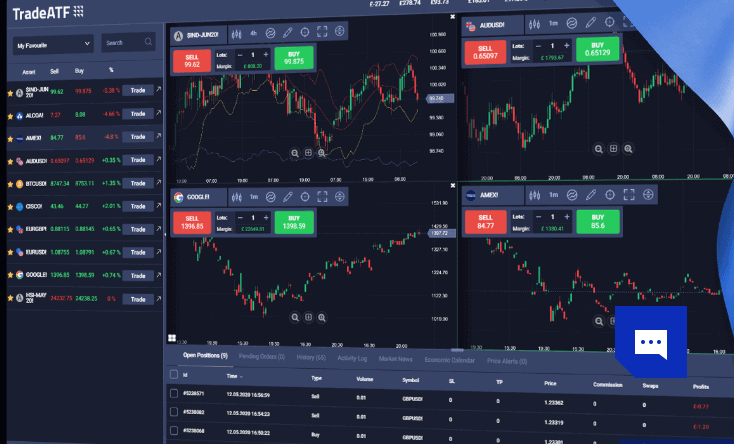

Trading Platforms

The platform you be using for the process of trading itself is an industry-leading well-known and well-respected MetaTrader4. We're not shocked that TradeATF picks this program and doesn't offer another platform. it is so versatile and loaded with amazing features that you will never need to look for anything different.

| Pros | Cons |

|---|---|

| Mainstay on MetaTrader4 | There is no alternative platform to be offered |

| Design that is user-friendly | |

| There are no limitations on strategies | |

| Cost Reports and Price Alerts Fee reports are available | |

| Multilingual support | |

| Web Mobile, Desktop and Web versions | |

| Social Capabilities for Trading |

Web Trading Platform

MetaTrader provided from TradeATF is actually it's a Web Version, while if you'd like, you can download the Desktop platform, too. All features are accessible and synchronized across every device as MT4 is an open-platform. Web Trading is certainly convenient as you don't require any special computer specifications and capabilities. just a browser and an internet connection. Once you connect, the it will be ready for trading immediately.

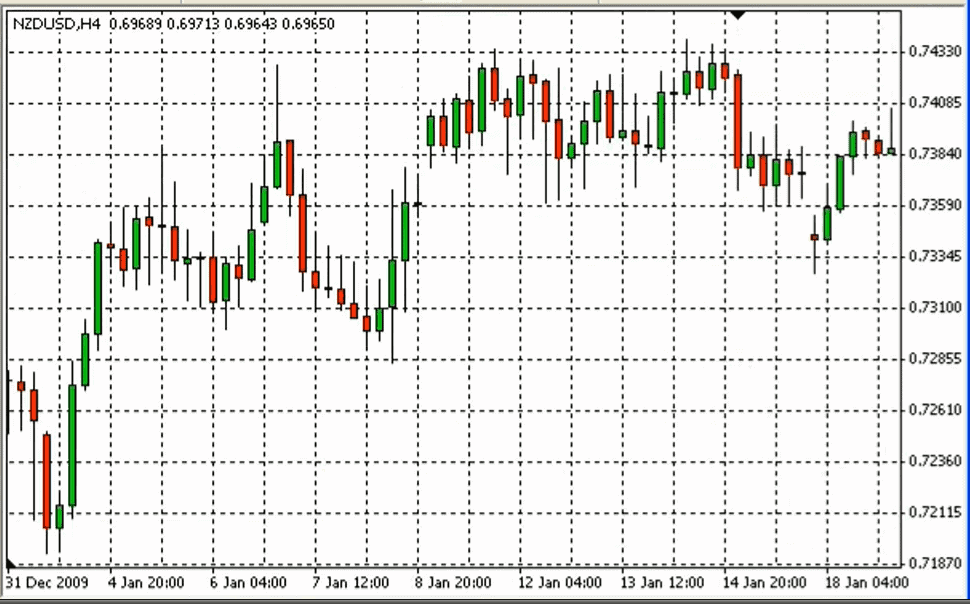

Feel and Look

MT4 is known and widely praised for its superior charting capabilities, user-friendly interface and user-friendly navigation. If you're not experienced with the platform, you can easily master it. Make sure you are able to master it through the educational materials TradeATF also provides.

Opening Position

On a platform, you'll have complete control over the opening and closing of positions. There are also a variety of options for orders, including limit losses, limits loss and many more. Additionally, MT4 is famous for its trading automation capabilities and using Robots also known for their EAs as well as the social-trade choices. TradeATF is a part of this package in addition, so that traders of different styles are able to join the trading activities effortlessly.

Mobile Trading Platform

The mobile application is accessible and is compatible with any mobile device that you utilize. With the help of custom features, you can also select between different types of charts as well as check your fee reports and enable one-click trading and more. All accessible on the go.

Customer Support

Another crucial aspect to consider when choosing the right broker is to look at the support offered by its customers, as you will need to find a reliable response and assistance in every issue you might encounter throughout the trading process. The good thing is that TradeATF support for customers is at an extremely sustainable level which means that you can speak to them via Live Chat, email or phone , if it's more suitable for you. However, make sure to get in touch with them within the working hours, since they provide the customer service is available 24 hours a day.

Education and Research

One of the advantages of TradeATF is the fact that it is a supportive model for all types of traders you might be. There are many organized educational and Forex training materials available, and the broker also offers classes that are based on the degree and the subject you're looking for. There are programs that are designed for beginner traders or for those who are looking to participate in trading socially.

A different great advantage is to Research Tools Trade ATF provides to almost every strategy and every aspect is included. TradeATF tools include more than 90+ tools to assist in the identification of trading, indicators as well as examples, signals, and more.

Conclusion

The latest warning, dated 28 May 2020 issued by the UK' FCA in regards to Hoch Capital and its trading names Trade ATF and iTrader as the broker was spotted doing something that is clearly detrimental to the interest of investors.

Although Hoch Capital is CySEC regulated broker, FCA considers its business practices and aggressive promotions in UKcontroversial in relation to their MiFID obligations. The brokers employed deceitful promotions and marketing methods that led to numerous complaints. Furthermore, the company did not conduct proper evaluations of the compatibility between the products it sells and its clients .

In this way, Hoch Capital and its trading names have been required to notify every account that is active and not offer any financial services to residents of the UK residents.

"Hoch Capital Ltd isn't authorized to provide financial services to citizens of the United Kingdom." - FCA states, more information is available through clicking the FCA's official link to warn.

| Properties | Values |

|---|---|

|

Name

|

TradeATF |

|

Minimum Diposit

|

$ 250 |

|

Leverage

|

500:1 |

|

Regulation

|

IFSC (Belize),CySEC (Cyprus),, |

|

Headquarters

|

United Kingdom |

|

Established

|

2013 |

|

Address

|

69 Brunswick Street Edinburgh, United Kingdom |

|

Platform

|

MT4,, |

|

Payment Method

|

Visa,Mastercard,Wire,Skrill,Neteller,, |

| Properties | Values |

|---|---|

|

Spreads

|

0.6 pip |

|

Min Position size

|

0.01 |

|

Broker Type

|

, |

|

Account Type

|

Mini account,High Leverage,Standard,, |

|

Brokers by Country

|

UK Forex Brokers,, |

|

Techniques

|

Hedging Forex Brokers,Automated Trading Brokers,Mobile Trading Brokers,Day Trading Brokers,, |

|

Instruments

|

Forex Trading Brokers,CFD Trading Brokers,Crypto Trading Brokers,Stock Trading Broke,Oil Trading Brokers,Commodity Forex Brokers,Metal Trading Brokers,Indexes Trading Brokers,, |

|

Account currency

|

USD,EUR,GBP,AUD,BSD,CAD,JPY,BTC,,USD, |

|

Tools

|

Charting Software,, |

|

Website Languages

|

en,, |

|

Support languages

|

en,, |

|

Bonus

|

Yes |

|

Reviews Rating

|

3.8 |

|

Withdrawal Fee

|

No |

|

Trading Signals

|

Yes |

|

Free Education

|

Yes |

|

Daily News

|

Yes |

|

Demo account

|

Yes |

|

Swapsr

|

Yes |

|

Pors

|

1. Mainstay on MetaTrader4 2. Design that is user-friendly 3. There are no limitations on strategies 4. Cost Reports and Price Alerts Fee reports are available 5. Multilingual support 6. Web Mobile, Desktop and Web versions |

|

Cors

|

1. There is no alternative platform to be offered. |

|

Display Analysis

|

Yes |

|

Serving country

|

BZ,CY,GB,, |

|

Not Serving country

|

CA,IT,GB,US,, |

|

Contests

|

Yes |

|

Market analysis

|

Yes |

|

Copy Trading Brokers

|

No |

|

Bitcoin Forex Brokers

|

Yes |

|

Social trading

|

No |

|

Web trading

|

Yes |

|

Forex pairs

|

Yes |

|

CFDs

|

Yes |

|

Crypto

|

Yes |

|

Hedging

|

Yes |

|

PAMM

|

Myfxbook Auto trade,, |

|

Mobile Trading

|

Yes |

|

Scalping

|

Yes |

|

Automated Trading

|

Yes |

|

Partnership Programs

|

Yes |

|

Free Phone

|

+27 108807911 |

|

Customer Support

|

24/5 |

Exness Broker reviews & comments (4)

Add a review

Your email address will not be published. Required fields are marked *