Trade Nation Broker Reviews and Full Information

What's Trade Nation?

Trade Nation was established in 2014 under the brand name Core Spreads. This was modified into Trade Nation in 2019 as a trading firm offering services and products for forex as well as CFD transactions. The broker has offices across South Africa, Australia and the UK, Australia, South Africa and the Bahamas.

The goal of the company has always been to make trading online easier, more enjoyable and profitable. This shows its international presence. And that's not all. What's more important is its strict regulation. However, the broker provides its services across the globe and also sends local companies in order to assist traders from countries like the UK, Australia, and other countries.

| Pros | Cons |

|---|---|

| Fully licensed broker | The terms and conditions for trading can differ in accordance with the regulations |

| Free withdrawal and deposit | Offshore entity |

| Fixed spreads | |

| MT4 | |

| Great tools for teaching |

10 Points Summary

| Headquarters | UK |

| Regulation | FCA, ASIC, FSCA, SCB |

| Platforms | CoreTrader2, MT4 |

| Instruments | FX, CFDS |

| Demo Account | Available |

| Minimum deposit | 0 US$ |

| Base currencies | There are a variety of currencies available |

| Education | It is provided on a no-cost basis. |

| Customer Support | 24/5 |

Are Trade Nation safe or a fraud?

In the case of trading on the internet security is the most important aspect to ensure that your money is secure and protected under the laws of the land.

| Pros | Cons |

|---|---|

| FCA and ASIC is a licensed broker for international trade. | International proposal is a part of offshore entities |

| Coverage across the globe and years of operation | |

| Protection against negative balance |

Is Trade Nation legal?

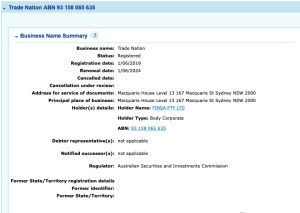

Trade Nation is regulated by the Financial Conduct Authority (FCA) in the UK as well as in Australia, the Australian Securities and Investments Commission (ASIC) as well as ASIC, and the Financial Sector Conduct Authority (FSCA) in South Africa. Trade Nation is a subsidiary of South Africa, the United Kingdom, Australia, South Africa and the Bahamas.

Additionally, Trade Nation serves an additional company that caters to clients around the world via its offshore branch located within the Bahamas. Naturally, we do not advise trading with offshore brokerages but, as Trade Nation also follows reputable licenses from ASIC and FCA which means that the broker is tightly controlled regarding its operations.

How can you be protected?

Trade Nation is heavily regulated in four jurisdictions, including ASIC and ASIC in Australia as well as the FCA of the UK. This regulatory status implies that Trade Nation are required to be fair to customers according to the strict guidelines of the regulators.

Additionally the broker is regularly audited and maintains the funds of clients in separate trust accounts, together with compensation plans in the event of bankruptcy to ensure the security of funds. All funds are managed by banks that are top of the line, like Barclay's within the UK and Westpac in Australia.

The broker also provides security against negative balances for every retail client's trading account.

Leverage

Another advantage of trading Forex is the possibility to leverage your investments which could potentially boost your profits. But, to limit risks as to minimize the risk of leverage, which can operate in both directions it is essential to know how to use leverage effectively.

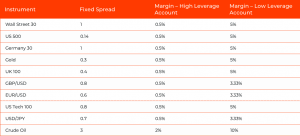

Trade Nation is offering leverage as high as 1:200, which can open the door to the forex market for retail traders who have an extremely low or minimal initial deposits to be able to cover the cost of margins. Leverage can boost gains, but keep in mind that losses may even exceed the initial deposit.

- 1:30 is permitted for UK as well as Australian traders

- 1:200 to be used for an international plan

Accounts

The broker provides Individual Accounts, Professional, and Corporate kinds.

Absolutely, brokers practices and learning accounts are available for customers to become accustomed to its platform and trading on its markets.

The broker offers its clients with a trading simulation that is essentially the equivalent of a demo account. It allows you to try out the strategies you are using without risking money using a practice account, or create an account that is live so you can access all of the features on the platform and begin trading in real time.

| Pros | Cons |

|---|---|

| Quick Account Opening, Fully digital | None |

| No minimum deposit |

Fees

Trade Nation offers low fixed spreads. The spreads are low and are fixed no matter if there are market changes. Contrary to variable spreads, which may be much larger when you close your investment Their spreads remain identical from beginning to end.

| Pros | Cons |

|---|---|

| No fee for inactivity | High foreign exchange fees |

| No deposit and no withdrawal fee | |

| Index and low stock CFD charges |

Overnight Fee

The traders trade on margin with Trade Nation, which means they can open a trade with just a small portion of the total amount. The broker basically provides traders with the full amount in order to execute the trade. In exchange, they are paid the broker a small amount each night while their account remains open. The amount is contingent on the market in which traders are trading in and the direction of trade.

Deposits and withdrawals

It is no minimum amount of deposit for brand new Trade Nation investors. Traders require only sufficient funds to meet the margin requirements for their business.

This broker takes debit and credit cards , and bank transfers. The broker can also take deposits using Skrill. Credit and debit card transactions is instant, whereas bank transfers can take a few days to process.

Trade Nation offers accounts in GBP USD, GBP, EUR, AUD , and ZAR. They also provide DKK, NOK, SEK.

The minimum amount you can withdraw will be fifty in the account currency that is on your bank account. As an instance 50 USD.

There's no minimum investment required for trading with Trade Nation and they do not charge any fees for withdrawals or deposits as well.

| Pros | Cons |

|---|---|

| No deposit fees | Conditions could differ based on the regulations |

| Free withdrawals | A few minor base currencies for account available |

| Variety of payment methods provided by an international institution |

Trading Platforms

Trade Nation users can Spread Trade on the Trade Nation platform CoreTrader2 and also trade CFDs using MetaTrader4. MetaTrader4 platform.

However, the company offers the its popular MetaTrader4 that is available in a variety of options for mobile, desktop web , and mobile as. The platform is equipped with the top indicators oscillators EA techniques and computerized desktop platforms that offer a variety of alternatives for intelligent trading and investment processes.

Of course, every platform has a an app for trading on mobile devices, so you can make use of mobile devices that provide complete liberty to make trades.

Customer Support

Another benefit of its customer-centric philosophy is the quality of its customer support service, which is available via a variety of methods, including Live Chat on the internet Email, Phone, etc. Broker's staff is always available and is able to support languages from around the world that are accessible through Live Chat or email. They also have telephone phones within Australia, UK and International in addition.

| Pros | Cons |

|---|---|

| Live chat | There isn't a 24/7 customer assistance |

| Telephone support |

Education

Trade Nation provides great research tools that provide a thorough analysis, ideal for traders who are just beginning their journey and helping with everyday trading, and features include reports and research, trading advice from professionals, beginner's guidebooks with videos of platform guides. Also, the broker provides signal center which provides FCA approved trading signals and the ability to build customized market watches.

| Pros | Cons |

|---|---|

| Demo account | None |

| Free Education | |

| FCA is a regulated source of trading signals | |

| Market news and analysis |

Conclusion

In the final Trade Nation Review we couldn't get any information about the trading conditions offered by the broker themselves The overall impression is that the company is to be a trustworthy brokerage company. It's not just controlled by one company, however, but across a number of global financial centers, which indicates an established foundation.

The positives are the an affordable deposit for beginning and current market information is an invaluable tool for anyone who is novice to trading. On the other hand, experts will be able to find a variety of solutions for their trading needs.

| Properties | Values |

|---|---|

|

Name

|

Trade Nation |

|

Minimum Diposit

|

$ 0 |

|

Leverage

|

1:30 | 1:200 |

|

Regulation

|

No Regulation,, |

|

Headquarters

|

United Kingdom |

|

Established

|

2014 |

|

Address

|

Longbow House, 20 Chiswell St, London EC1Y 4TW, United Kingdom |

|

Platform

|

MT4,cTrader,,,, |

|

Payment Method

|

Visa,Mastercard,Credit Card,Wire,Skrill,Neteller,, |

| Properties | Values |

|---|---|

|

Spreads

|

1-3 |

|

Min Position size

|

0.01 |

|

Broker Type

|

ECN (electronic communications networks),NDD (Non Dealing Desk),,,, |

|

Account Type

|

Mini account,RAW Spread,High Leverage,Islamic account,, |

|

Brokers by Country

|

UK Forex Brokers,, |

|

Techniques

|

Scalping Forex Brokers,Spread Betting Brokers,Automated Trading Brokers,Mobile Trading Brokers,, |

|

Instruments

|

Forex Trading Brokers,Gold Trading Brokers,CFD Trading Brokers,Metal Trading Brokers,, |

|

Account currency

|

USD,EUR,GBP,AUD,CAD,XAU,JPY,,USD, |

|

Tools

|

Charting Software,, |

|

Website Languages

|

en,, |

|

Support languages

|

en,, |

|

Bonus

|

Yes |

|

Reviews Rating

|

3.0 |

|

Withdrawal Fee

|

No |

|

Trading Signals

|

No |

|

Free Education

|

Yes |

|

Daily News

|

No |

|

Demo account

|

Yes |

|

Swapsr

|

Free/ Available |

|

Pors

|

1. Free deposit and withdrawal 2. Excellent research and education tools 3.Good customer support |

|

Cors

|

1. Slim product portfolio 2. No live chat 3. Desktop platform lacks safer login |

|

Display Analysis

|

No |

|

Serving country

|

GB,, |

|

Not Serving country

|

AF,, |

|

Contests

|

No |

|

Market analysis

|

No |

|

Copy Trading Brokers

|

No |

|

Bitcoin Forex Brokers

|

No |

|

Social trading

|

No |

|

Web trading

|

Yes |

|

Forex pairs

|

Yes |

|

CFDs

|

Yes |

|

Crypto

|

No |

|

Hedging

|

Yes |

|

PAMM

|

Myfxbook Auto trade,Mql5 signals,, |

|

Mobile Trading

|

Yes |

|

Scalping

|

No |

|

Automated Trading

|

Yes |

|

Partnership Programs

|

Yes |

|

Free Phone

|

+44 20 3180 5952 |

|

Customer Support

|

24/5 |

Exness Broker reviews & comments (0)

Add a review

Your email address will not be published. Required fields are marked *