Trade.com Broker Reviews and Full Information

What is Trade.com?

TRADE.com is a trading name owned through Leadcapital Markets Ltd, which is located in Cyprus and, in turn, licensed and regulated under the Cyprus Securities and Exchange Commission.

When it was first established and to date, the goal of Trade.com is to offer the best service to trader that permit joining to cooperate at any level.

This is made possible by an extensive training to master techniques and strategies through accessible information and analysis of the factors that affect the world's markets. Together with the platform developed by Trade.com which provides the door to secure access to a broad variety of trading instruments and more than 2100 instruments to choose from on WebTrader.

Trade.com Pros and Cons

Trade.com is a trusted firm that has been in operation for years. it is safe, legitimate and regulated by top authorities like FCA. Opening an account is simple and the conditions are excellent and appropriate for regular or professional traders. Commissions and fees are minimal and the range of instruments is extensive.

The negatives is that the price will vary depending on the organization There is no 24-hour supportand no in-depth training materials that are essential for novices.

10 Point Summary

| Headquarters | Cyprus |

| Regulation | FCA, CySEC, FSCA |

| Instruments | Forex, Crypto, CFDs, Commodities, Bonds, Indices, and the Futures markets |

| Platforms | Proprietary Trade.com CFD WebTrader, IBKR Platform and TPs Online Platform |

| Demo Account | Available |

| Minimum deposit | 100 USD |

| Base currencies | EUR, USD, GBP |

| EUR/USD Spread | 1 Pips |

| Education | Not available. Tools for researching |

| Customer Support | 24/5 |

Is Trade.com secure or is it a scam?

There is no need to worry, Trade.com is not a fraud. It is a genuine broker that has high trust and a low risk trading experience.

Is Trade.com legitimate?

It is CySEC is the authority that supervises to supervise CIFs that are located in Cyprus is a member of ESMA (Committee of the European Securities Markets Authority). In order to ensure the highest level of protection to investors and conformity with the applicable regulations, the licence of the company is completely in accordance with the regulations that are set out in the European Parliament's Markets in Financial Instruments Directive (MiFID) which all are obligated to provide the highest level of trading and investment practice.

Additionally, Trade.com covers global trading needs through its subsidiary located in South Africa, which is controlled under the FSCA.

How can you be protected?

TRADE.com, due to its rules adheres to extremely strict guidelines for safeguard the funds of clients and ensures that they are held in trusted Tier 1 banks, and always separated away from company funds. In addition, TRADE.com offers a Compensation Fund that protects the investment, and also a top quality account management service to clarify all concerns related to trading and risk.

Leverage

In terms of leverage trading, which provides an excellent opportunity to trade larger relative to your initial balance, which can increase the gains. But you must be careful to study how to use this method, as leverage can be reversed.

It is the fact that internationally authorized brokers are in compliance with the regulations they adhere to Therefore, Trade.com is required to establish the maximum leverage according to European ESMA Regulation.

- ESMA together with CySEC The combination of CySEC and ESMA has reduced significantly the max leverage, which is mere 1:30 for major currency pairs 1:20 for smaller ones as well as 1:10 in the case of commodities. 1:1 for Cryptocurrencies.

- However, if you trade through an South Africa Trade.com entity, you'll get higher ratios of 1:200 or even 1 :300 in the case of Forex tools.

Types of accounts

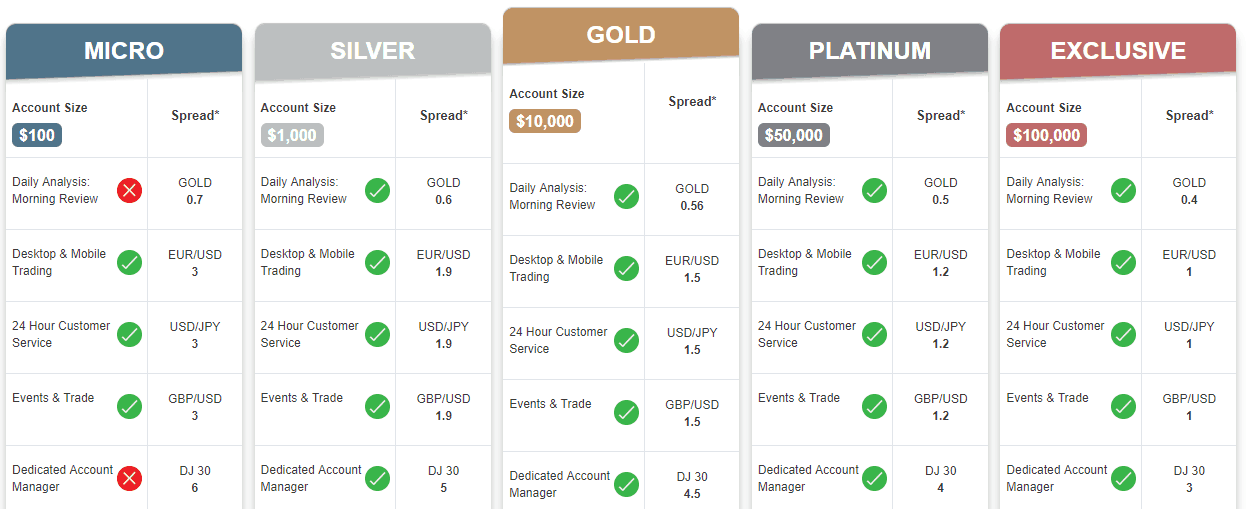

Trade.com providing services through five account types which are developed by Trade.com to meet demands of the traders as well as particular needs.

Every account is subscribed to the daily analysis provided by the company, and have the option of desktop and mobile trading, online tutorials as well as 24 hour customer service. They also have access to a variety of options and assets, such as Forex, CFDs, Commodities, Bonds, Indices and Stocks.

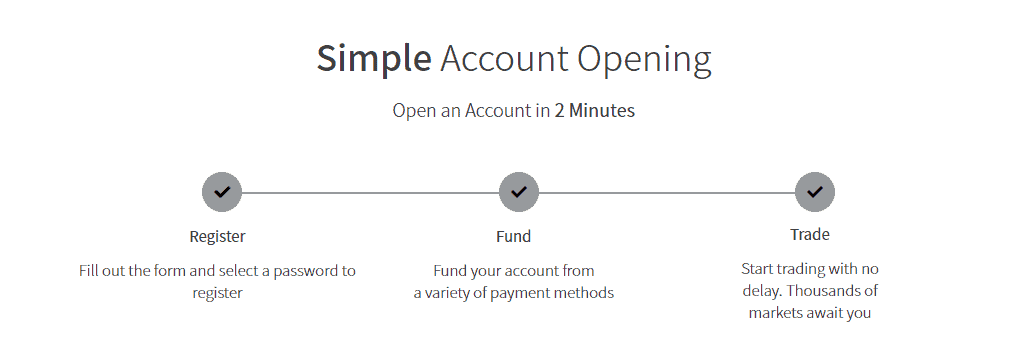

How do you open an account?

Fees

Trade.com trade costs are determined by what instrument is traded with, similar to CFDs trade and Futures or IPOs have various price models, with the first group is essentially traded using costs that are incorporated into the spread. However, Futures and Stocks trading would require a commission per trade.

Other costs such as inactivity fees and funding fees must be taken into consideration for a complete pricing and fee structure.

| Fees | Trade.com Fees | GO Markets Fees | XM Fees |

|---|---|---|---|

| Deposit fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity fee | Yes | Yes | Yes |

| Fee position | Low | Average | High |

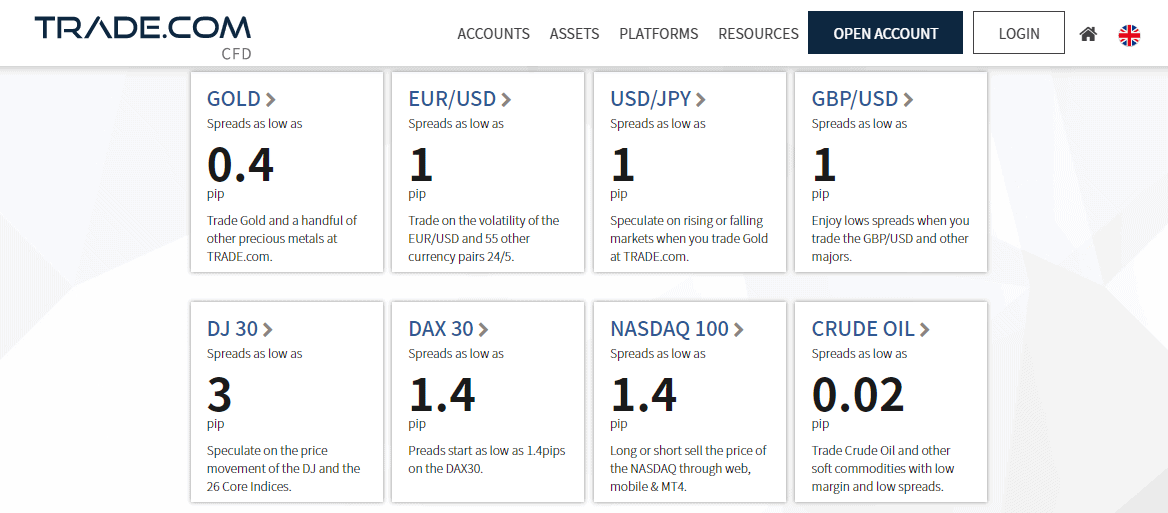

Spreads

Trade.com spreads offer one of the best competitive rates and comfortable conditions and the costs are all bundled into a compact spread when trading CFDs. A more compact spread means the market price won't need to be as close to your initial price, which means your trade will have a greater chance of becoming profitable. Additionally, better terms are offered as the size of your trade expands, which is great news for traders with advanced skills.

Check out the standard accounts Trade.com spreads to get more information Also, you can examine and compare fees with another broker that is popular forexCT.

Comparison of Trade.com charges and other brokers

| Asset/ Pair | Trade.com Spread | GO Markets Spread | XM Spread |

|---|---|---|---|

| EUR USD Spread | 1 pip | 1.2 Pips | 1.6 Pips |

| Crude Oil WTI Spread | 2 | 1.9 Pips | 5 |

| Gold Spread | 40 | 1.4 pip | 35 |

Our findings on Commission fees.

As we mentioned earlier during the Trade.com Review Futures, the IPO and stock trading are offered not just on distinct platforms such as IBKR and Trade.com, but also by providing various price models and trading terms. In this case, there is not a spread, however there is a charge per lot. This is also determined by the instrument that you trade. Also, make sure you verify all fees and commissions, since the futures contracts trade monthly and rollovers are available on certain dates.

Trading Instruments

Numerous products offer assets like Forex, Crypto, CFDs, Commodities, Bonds Indices, CFDs and Futures markets, along with the capability of applying single-click executions, stop-and- limit orders, and custom tools.

The cryptocurrency trade is available via Bitcoin, Dash, Ethereum as well as Litecoin with leverage ratio of 1:2 and spreads of 50.00 USD on the BCHUSD. Trade.com charges their customers only spreads that are added to the price. However, spreads remain in the competitive offerings of the markets.

Methods of Payment

Trade.com account can be financed through a variety of easy and secure options for quick transfer of funds into as well as from the account. Of course, the methods and conditions could differ depending on the local rules and regulations Be sure to check those.

Deposit Options

These options would permit you to transfer money into or from your trading account. This includes

- Credit Card using a secure online payment form via major debit and credit cards.

- Fast Bank Transfer with reduced cost of transfer and conversion.

- Skrill using just the email address of your choice and your password lets you to easily transfer money online and receive it,

- NETELLER using an prepaid card or the free money transfer service.

- Safecharge is an Electronic Money Institution authorized and controlled by the Central Bank of Cyprus

- You also have the option of using WebMoney, Qiwi or JSBfor the transactions.

How much is the deposit minimum required for Trade.com?

Trade.com minimum deposit amount will be 100dollars for a Micro account in the beginning the process. The minimum amount is based on the trading account you pick.

Trade.com minimum deposit is different from other brokers

| Trade.com | Most Other Brokers | |

| Minimum Deposit | $100 | $500 |

Withdrawals

Trade.com withdrawals offering favorable conditions for bank transfer and card withdrawals. There is a minimum amount to withdraw for all withdrawal methods (excluding wire transfers - 100$) which is set at $20. If the request is less, charges are waived. At present, you will not be charged any Withdrawal or Deposit fees because they are provided by Trade.com.

Trading Platforms

The Trade.com trading platforms include a wide range of the most user-friendly software. You have access to trading through download, online or tablet versions. We will also go over more in our Trade.com review of the platforms, but overall we have found excellent options for CFD traders or for those who focus on Futures trading or investing in stocks.

| Pros | Cons |

|---|---|

| Separate software specifically designed for CFD and Futures trading | None |

| Proprietary Trade.com CFD WebTrader | |

| IBKR Platform and TPs Online Platform | |

| Copy Trade and Technical Indicators | |

| No limitations regarding strategies | |

| Fast execution | |

| Available in many languages. |

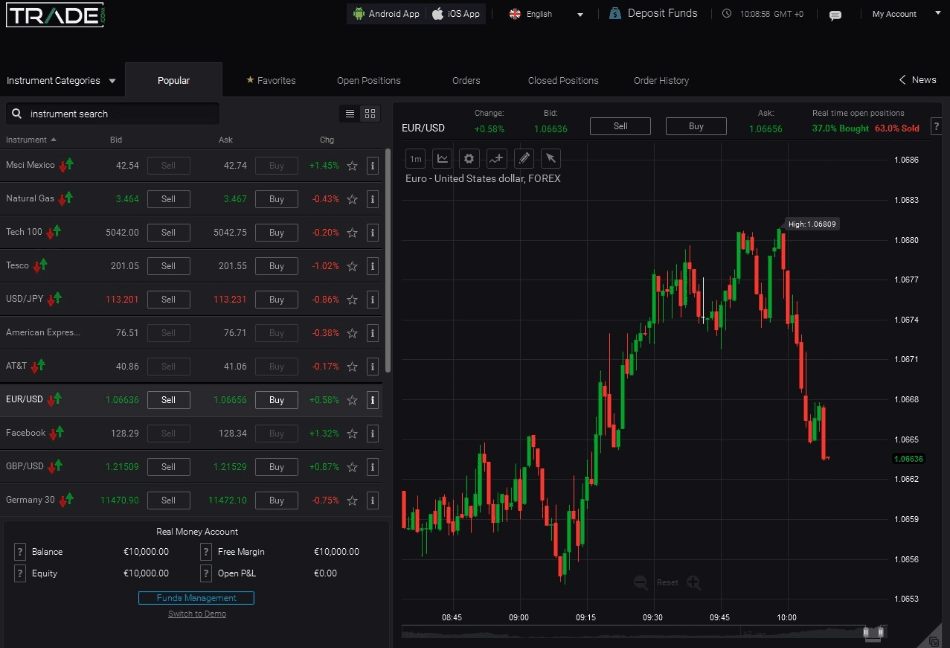

Web Platform

The revolutionary technology platform Trade.com WebTraderavailable to only Trade.com customers with an interface that is simple to navigate through the various trade propositions.

The platform has a multi-chart display and distinct functions, along the trading instruments, smart analysis and trading Central Event & Trade tool, and security-related management optimization.

DMA trading

Another, and extremely exciting possibility from Trade.com is to get involved in trading using the aid of a DMA or gain access to direct markets through a unique partnership with a renowned DMA supplier Interactive Brokers. So, active and professional traders can benefit from lucrative opportunities and the vast capabilities.

There is also the possibility of investing in a range of Stocks that are available for trading on the Thematic Online platform.

Desktop Platform

The platforms are accessible via mobile and desktop interfaces as well. It also provides a wide range of tools ranging from customization to the particular engagement. The full power of trading features are accessible through desktop versions.

Customer Support

Of of course it is possible to count on the ongoing assistance from the many international local languages and lines, e.g. Russia, France, Poland, Argentina, Chile, Germany, Norway, Peru and many more. Support is available via Live Chat telephone lines, or email.

Education

There's not a comprehensive educational center that you get at other top brokers, however Trade.com offers excellent research tools and other essentials. These include platforms that are already strong that come with built-in features, instruments for trading, sophisticated analyses, Trading Central along with Events & Trade tools.

Overall we'd like to note in the Trade.com report that this service offered by the broker could be better suited to professionals, advanced and not for novice traders. Particularly, considering the attractive professional options between platforms as well as its the overall capabilities of trading.

Conclusion

All in all, Trade.com offering provides the possibility to trade online for clients or trader who has nearly any needas we can see the following in the Trade.com Review. Trade.com offers a truly responsive assistance to their customers by way of a variety of call centers in the local area, but doesn't provide comprehensive training and analysis and research tools on its platforms that certainly emphasize their services.

| Properties | Values |

|---|---|

|

Name

|

Trade.com |

|

Minimum Diposit

|

$ 100 |

|

Leverage

|

1:30 |

|

Regulation

|

CySEC (Cyprus),FSCA (South Africa),FCA (United Kingdom), |

|

Headquarters

|

Cyprus |

|

Established

|

2013 |

|

Address

|

148 Strovolos Avenue, 1st floor, CY 2048, Nicosia, Cyprus |

|

Platform

|

MT4,MT4 WebTerminal,,,,, |

|

Payment Method

|

Visa,Mastercard,Wire,Skrill,Neteller,Paysafecard,Ideal,Giropay,SafeCharge,Sofort, |

| Properties | Values |

|---|---|

|

Spreads

|

1 pips |

|

Min Position size

|

0.01 |

|

Broker Type

|

NDD (Non Dealing Desk),Instant Execution, |

|

Account Type

|

Mini account,High Leverage,Standard, |

|

Brokers by Country

|

UK Forex Brokers,Cyprus Forex Brokers, |

|

Techniques

|

Scalping Forex Brokers,Hedging Forex Brokers,Mobile Trading Brokers, |

|

Instruments

|

Forex Trading Brokers,Futures Trading Brokers,Gold Trading Brokers,CFD Trading Brokers,Stock Trading Broke,Oil Trading Brokers,Commodity Forex Brokers, |

|

Account currency

|

USD,EUR,GBP, |

|

Tools

|

Economic Calendar,Charting Software, |

|

Website Languages

|

en, |

|

Support languages

|

en, |

|

Bonus

|

Yes |

|

Reviews Rating

|

3.5 |

|

Withdrawal Fee

|

No |

|

Trading Signals

|

No |

|

Free Education

|

Yes |

|

Daily News

|

No |

|

Demo account

|

Yes |

|

Swapsr

|

Yes |

|

Pors

|

1. FCA Regulated. 2. MT4 Platform available. |

|

Cors

|

1. Customer support 24/5. 2. No MT5 Trading platform. |

|

Display Analysis

|

Yes |

|

Serving country

|

CY,ZA,GB, |

|

Not Serving country

|

AU,BE,CA,CY,IR,JP,KP,SD,SY,US,YE, |

|

Contests

|

No |

|

Market analysis

|

Yes |

|

Copy Trading Brokers

|

No |

|

Bitcoin Forex Brokers

|

No |

|

Social trading

|

Yes |

|

Web trading

|

Yes |

|

Forex pairs

|

Yes |

|

CFDs

|

Yes |

|

Crypto

|

No |

|

Hedging

|

Yes |

|

PAMM

|

Myfxbook Auto trade,Mql5 signals, |

|

Mobile Trading

|

Yes |

|

Scalping

|

Yes |

|

Automated Trading

|

Yes |

|

Partnership Programs

|

Yes |

|

Free Phone

|

Unknown |

|

Customer Support

|

24/5 |

Exness Broker reviews & comments (0)

Add a review

Your email address will not be published. Required fields are marked *