canadian pharmacy cheap https://canadianpharmaceuticalshelp.com/ [url=https://canadianpharmaceuticalshelp.com/]canadian pharmacies[/url]

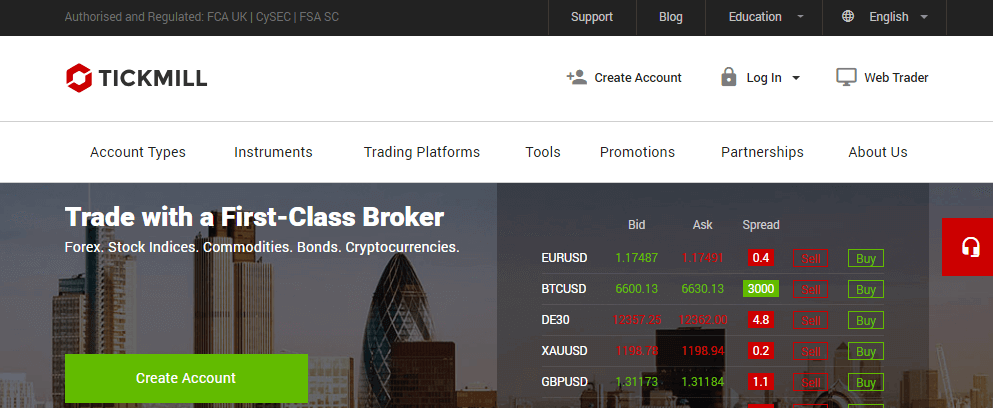

Tickmill Broker Reviews and Full Information

What is Tickmill?

Tickmill has become a brand new player in the broker and the online trading industry since its establishment in 2014 and its headquarter is located in London, UK as well as offices in Seychelles. Tickmill is determined to provide and provide a unique experience for its customers, while also understanding traders rights as the main aspect of trading and, to achieve this, the company continuously improves trading conditions.

In fact, the broker develops quickly and their annual results are impressive. Recently, Tickmill management responsibilities were expanded as an additional component of the "Tickmill family" has been added to the name of Tickmill Europe Limited (ex Vipro Markets Ltd).

Tickmill Pros and Cons

Tickmill is a highly regulated Broker that has a good reputation. They are globally recognized and providing good trading conditions for Professional and smaller size trader. Tickmill offers one of the top resources for learning and research and is ideal when it comes to EA trading.

On the negative side , the proposals differ based on the entity and there is no 24-hour support. Spreads for Forex are not much higher than the average.

10 Points Summary

| Headquarters | UK |

| Regulation | FCA, FSA, CySEC |

| Instruments | 62 currencies, cryptocurrencies Bonds, CFDs, Bonds and precious Metals Indexes of stocks |

| Platforms | Mt4, WebTrader |

| EUR/USD Spread | 0.3 Pips |

| Demo Account | Available |

| Base currencies | USD, GBP, EUR |

| Minimum deposit | 100 USD |

| Education | Professional educational center for professionals that includes Trading Blog |

| Customer Support | 24/5 |

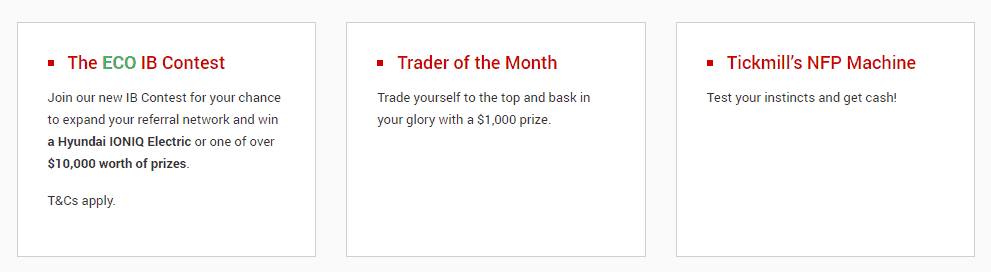

Awards

Tickmill as a brand new business has experienced rapid growth within just two years, and the broker has been praised by publications in the industry that is certainly a plus to build an effective portfolio.

Additionally, Tickmill always runs a variety of exciting promotions that can boost trading while improve even new trader's possibilities.

Is Tickmill an authentic and safe machine or a scam?

It's not true, Tickmill is not a scam. It is a secure broker with a great reputation and high risk Forex as well as CFD trade environment.

Is Tickmill legitimate?

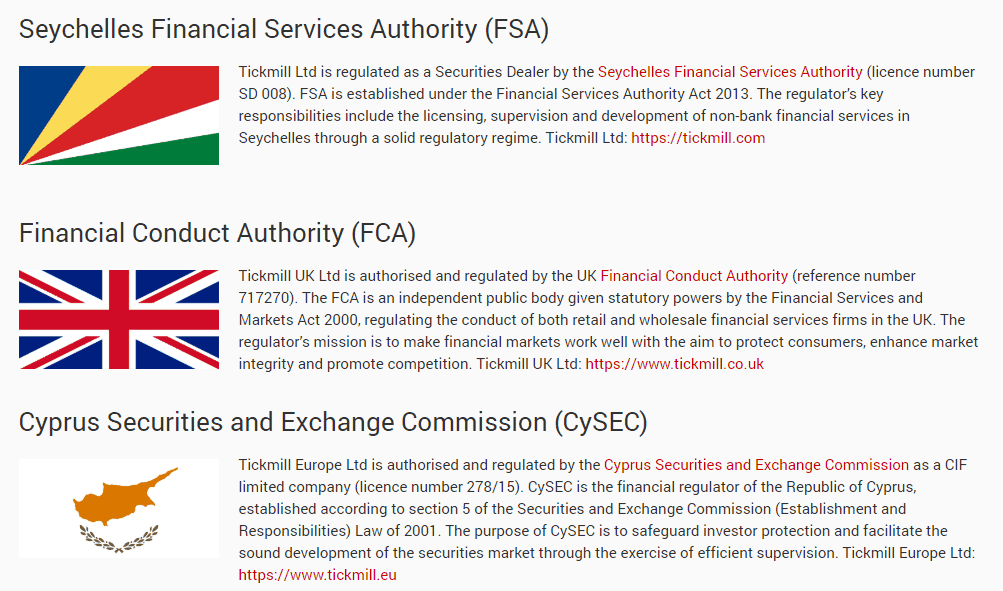

Tickmill is a multi-regulated broker in various countries, and is is considered to be a secure brokerage to do business with. Tickmill trades under the name of Tickmill UK LTD in addition to Tickmill Limited Seychelles is regulated as Securities Dealer.

The broker is regulated and authorized by two main UK Financial Conduct Authority and by the Financial Services Authority of Seychelles which means that both entities have strict rules. In addition, Tickmill now grows to Asia region too and creates an entity to handle the proposed.

Additionally, the company line that was added to the line of business Tickmill Europe Ltd (ex Vipro Markets Ltd) is a company that is licensed and is regulated under the Cyprus Securities and Exchange Commission (CySEC) and is a member of the Investor Compensation Fund (ICF).

Customer Protection

To ensure transparency and security of transactions Tickmill ensures that clients' funds are in separate accounts at reputable financial institutions, in accordance with FCA rules. Additionally clients are covered under the FSCS with investment up to PS50,000.

Leverage

As the only UK as well as a European based licensed broker, Tickmill follows the strict guidelines that are set by European regulatory authority ESMA. Recent updates by the European regulator placed a limit to the maximum leverage levels that can be offered in the event that ESMA acknowledged the possibility of danger in the event that a the use of leverage that is extremely high.

- Customers of Tickmill Europe can leverage as high as 11:30 for Forex products 1:5 for CFDs, as well as 1:10 in the case of Commodities.

- Foreign traderssince Tickmill provides services to entities by Seychelles and other entities also, which means that clients who have an account opened in this jurisdiction can enjoy a the highest leverage.

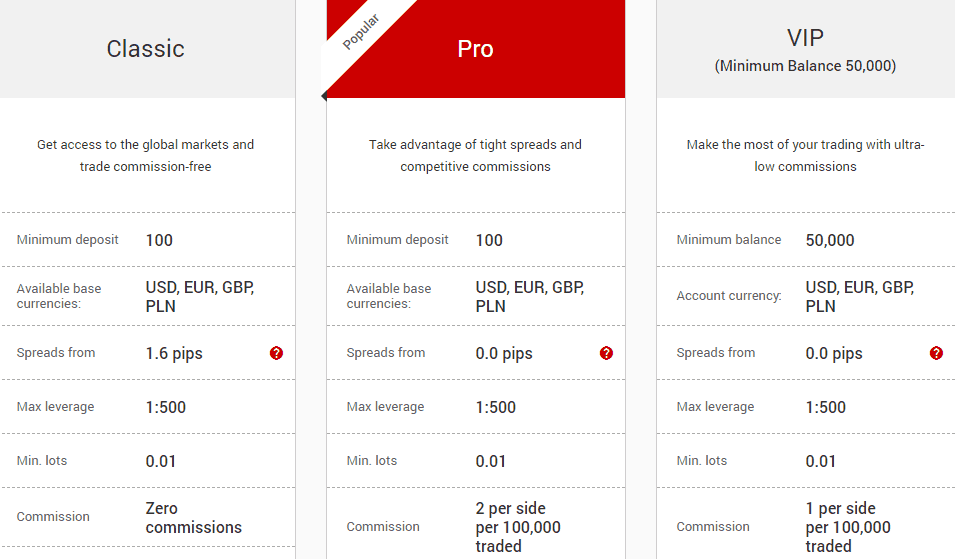

Types of accounts

There are three primary Account kinds in the Tickmill's proposition, and you can select either an accounts based on spread-only Classic Account or with commission per trade for the Pro Account. The third account was designed for traders who trade in high volumes and is called VIP Account. The conditions are customized and set in accordance with the terms of the agreement.

In addition, Islamic or Swap-Free Accounts has been added to the features of brokers recently , too. These accounts conform to Sharia laws, and includes exactly the same conditions for trading and terms, however there's no swap nor rollover interest for overnight positions which is in violation of the religion of Islam.

How do I open an account with Tickmill

Fees

There are various pricing options depending on the type of account you select. In addition, the fee terms vary based on the regulations and rules that the authority sets and the brokers are required to. Make sure you check the particular conditions. We will review an overview of commission and spread charges that are determined by the type of account.

| Fees | Tickmill Fees | GO Markets Fees | XM Fees |

|---|---|---|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity Fee | Yes | Yes | Yes |

| Fee position | Low | Average | High |

Spreads

Pricing model for Tickmill and Spread look at the table below. The table is set in accordance with what type of account the trader will benefit from lower costs, and a small fees per trade. In this story, we will examine Standard spreads, whereas Pro accounts have a commission of 2 per side , and spreads across banks that start at 0 pips.

The overnight feehould be considered also a cost, e.g. EURUSD exchange for a long positions is -11.742 and for short it the price is 6.693 US$.

It is also possible to compare Tickmill trading costs with another well-known broker Forex CT.

Comparison of Tickmill fees and other brokers

| Asset/ Pair | Tickmill Fees | GO Markets Fees | XM Fees |

|---|---|---|---|

| EUR USD Spread | 0.3 pip | 1.2 pip | 1.6 pip |

| Crude Oil WTI Spread | 4 | 1.9 | 5 |

| Gold Spread | 20 | 1.4 pip | 35 |

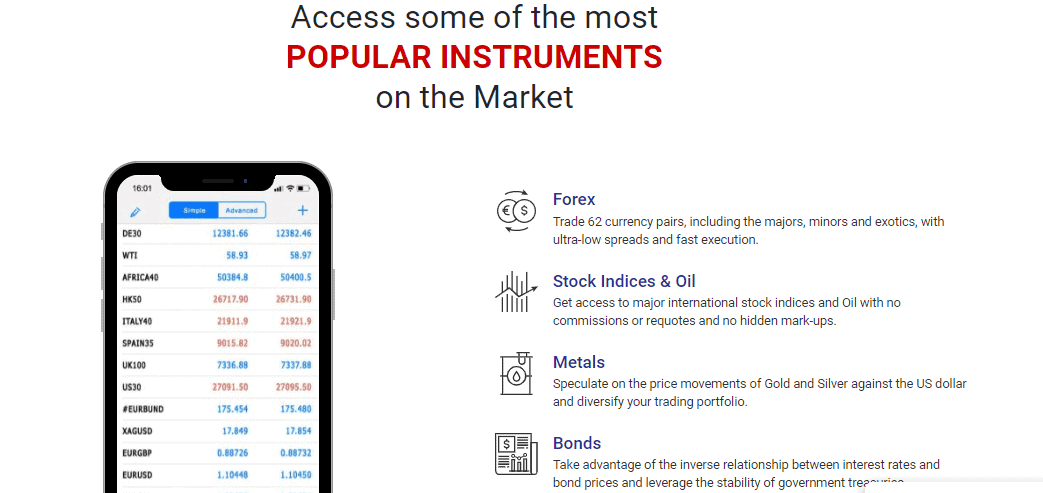

Trading Instruments

Tickmill Europe Ltd is fully licensed to offer investing services offered by Agency-Only Execution that offer high-quality trading instruments including 62 currencies, cryptocurrencies (opportunity to trade CFDs on Bitcoin with a margin of 20% and no Commission per CFD, per one CFD).

Stock indices, bonds, CFDs, and precious Metals that have the requirement for deposits of just 25$ with spreads that vary between 0.0 percent, one of the most affordable commissions in the market and no delays, requotes or intervention policy.

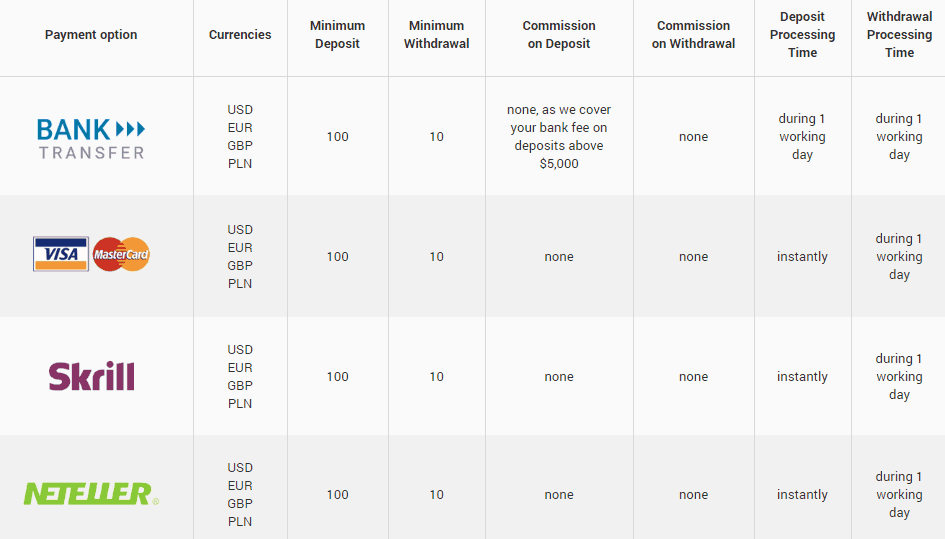

Deposits and Withdrawals

To deposit or withdraw funds, options, brokers offer convenient ways that allow payments to be made easily and in a variety.

Deposit Options

Payment options include popular Bank Transfers, Credit/ Debit Cards electronic wallets Neteller, fasapay, UnionPay dotpay NganLuong. VN (only for customers of Tickmill Limited Seychelles) with accepted currencies US Dollars, EUR, GBP, and PLN.

How much is Tickmill Minimum Deposit?

It is worth noting that the Tickmill minimum deposit is $100 This can be a great opportunity for traders with a small or even tiny size In reverse, the deposit is 10$ for withdrawals.

Tickmill minimum deposit, vs other brokers

| Tickmill | Most Other Brokers | |

| Minimum Deposit | $100 | $500 |

Withdrawals

Tickmill withdrawals and deposits can be made through your account online. In addition, Tickmill will process withdrawals in a matter of 2 to 3 business days, as per their regulatory requirements. Tickmill offers zero-fee policy which means that there are there are no fees or charges for monetary transactions are applicable. Deposits starting at $5,000 dollars, including zero fee policy as well as all fees of up to 100dollars are paid for.

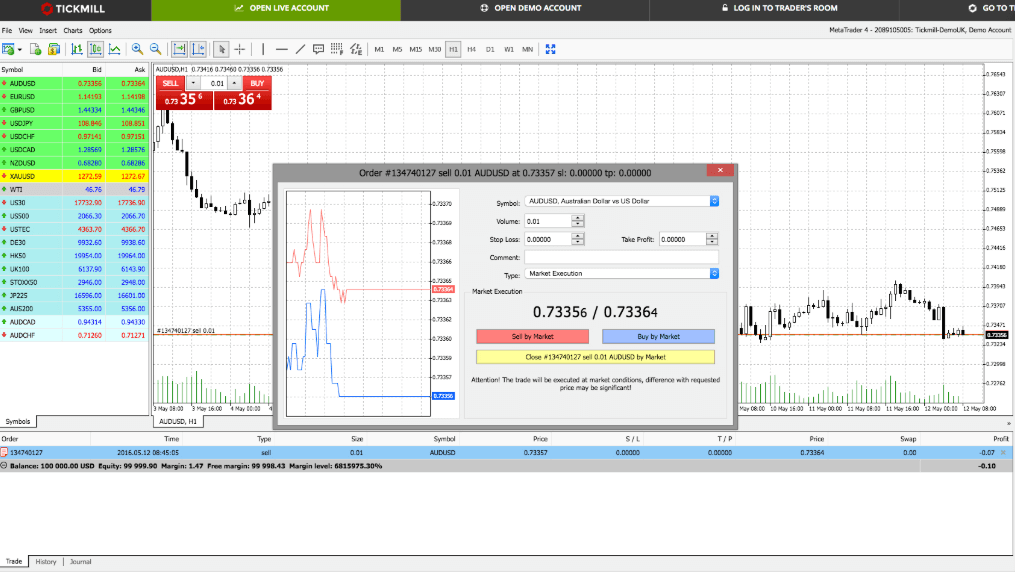

Trading Platforms

As with most brokers, the one we use is the known and trusted the MT4. The trading platform is available on tablets or desktops and on the web, or using smartphones. Additionally, while some brokers don't allow stop and limit orders that are placed near to the market price, Tickmill allows so, this is an additional advantage of Tickmill's proposition.

| Pros | Cons |

|---|---|

| MT4 and WebTrader | There is no alternative platform or software. |

| Copy Trade, Social Trading and Technical Indicators | |

| There are no restrictions regarding strategies | |

| Fast execution | |

| Available in many languages. |

Web Platform

Web platforms are extremely beneficial to all sizes of trade because it does not require any installation or installations, and it is accessible via your web browser. However, it is quite restricted in terms of tools and drawing tools to conduct a thorough analysis, so it is highly recommended to use an alternative for desktops.

Desktop Platform

The fact is that every platform is unique, even if you trade with MetaTrader4 since it's the broker's decision on what features to include and include for its software. It's a good thing to know that Tickmill platform has been upgraded with a wide array of tools like:

- Autochartist is an advanced technical analysis tool that includes automatic recognition features

- Myfxbook AutoTrade allows the use of the strategies created by the most successful traders

- One Click Trading - trading via EAs (by the company's figures, 63% of executions are performed through software and EAs)

- Tickmill VPS - Keeps EAs and signals in operation even when the trader is offline

- Forex Calendar - plugging market information and breaking news

- Forex Calculators - displays currency converter, margin calculators, etc.

Tickmill trying to make a success of trading with their clients and therefore they don't restrict profits and allow all trading strategies such as scalping, hedging, and arbitrage. But, make sure to confirm the terms of service with specific limitations on regulatory authority of an entity, as they might be applicable.

Mobile Platform

Customer Support

It is also advisable to think about Customer Support, in which Tickmill has a team of professionals accessible 24/7 and also assisting with international languages via Live Chat or email as well as telephone lines across various locations, which include those in the UK as well as International as well.

But, customer service isn't open on weekends, so send your query through the contact form and be informed.

Education

Another important aspect to be noted in the Tickmill's proposal and offerings is the newly established Learning Center along with professional trading Blog that traders can get the latest updates as well as a variety of educational materials and educational programs that are designed to help develop the skills and understanding of traders.

Live online webinars live market analysis technical analysis, regularly scheduled workshops and a traders community of like-minded traders are all at an excellent quality and accessible to all.

Conclusion

In the end, Tickmill inviting clients with its appealing features like the low deposit requirement and technical solutions, as well as an array of tools and intriguing promotions, we also discovered some of the lowest spreads available for Forex trading. Additionally, the company's goal is to meet its goals quickly and efficiently, while presenting Tickmill as an innovative and reliable Forex broker to either start or expand your trading opportunities by.

| Properties | Values |

|---|---|

|

Name

|

Tickmill |

|

Minimum Diposit

|

$ 100 |

|

Leverage

|

500:1 |

|

Regulation

|

CySEC (Cyprus),FSA(SC) (Seychelles),FSCA (South Africa),FCA (United Kingdom),, |

|

Headquarters

|

Seychelles |

|

Established

|

2015 |

|

Address

|

3, F28-F29 Eden Plaza, Eden Island, Mahe, Seychelles |

|

Platform

|

MT4,MT4 WebTerminal,,,,,,, |

|

Payment Method

|

Visa,Mastercard,Wire,Skrill,Neteller,Fasa Pay,Union Pay,Qiwi,Local bank transfer,, |

| Properties | Values |

|---|---|

|

Spreads

|

0.3 pips |

|

Min Position size

|

0.01 |

|

Broker Type

|

NDD (Non Dealing Desk),Market Execution,,,,, |

|

Account Type

|

Mini account,High Leverage,Standard,, |

|

Brokers by Country

|

UK Forex Brokers,, |

|

Techniques

|

Scalping Forex Brokers,Hedging Forex Brokers,Automated Trading Brokers,Mobile Trading Brokers,Day Trading Brokers,, |

|

Instruments

|

Forex Trading Brokers,Futures Trading Brokers,Gold Trading Brokers,CFD Trading Brokers,Stock Trading Broke,Oil Trading Brokers,, |

|

Account currency

|

USD,EUR,GBP,,USD, |

|

Tools

|

Economic Calendar,Charting Software,Calculators,Pip Calculator,Margin Calculator,Profit Calculator,,,,,,, |

|

Website Languages

|

en,, |

|

Support languages

|

en,, |

|

Bonus

|

Yes |

|

Reviews Rating

|

3.5 |

|

Withdrawal Fee

|

No |

|

Trading Signals

|

Yes |

|

Free Education

|

Yes |

|

Daily News

|

Yes |

|

Demo account

|

Yes |

|

Swapsr

|

Yes |

|

Pors

|

|

|

Cors

|

|

|

Display Analysis

|

Yes |

|

Serving country

|

CY,LB,MY,SC,ZA,GB,, |

|

Not Serving country

|

US,, |

|

Contests

|

No |

|

Market analysis

|

Yes |

|

Copy Trading Brokers

|

Yes |

|

Bitcoin Forex Brokers

|

No |

|

Social trading

|

Yes |

|

Web trading

|

Yes |

|

Forex pairs

|

Yes |

|

CFDs

|

Yes |

|

Crypto

|

No |

|

Hedging

|

Yes |

|

PAMM

|

MAMM,Myfxbook Auto trade,Mql5 signals,, |

|

Mobile Trading

|

Yes |

|

Scalping

|

Yes |

|

Automated Trading

|

Yes |

|

Partnership Programs

|

Yes |

|

Free Phone

|

+852 5808 2921 |

|

Customer Support

|

Exness Broker reviews & comments (28249)

Antiepileptic re-intubate desire [URL=https://breathejphotography.com/myrbetriq/]myrbetriq paypal uk[/URL] [URL=https://pureelegance-decor.com/product/edarbyclor/]edarbyclor coupon[/URL] [URL=https://weddingadviceuk.com/product/synalar/]buy synalar uk[/URL] [URL=https://computer-filerecovery.net/item/piroxicam/]cheapest piroxicam online without prescription[/URL] [URL=https://celmaitare.net/product/viagra-super-fluox-force/]viagra super fluox-force[/URL] viagra super fluox-force.com lowest price

Less stimulated data-overload investigators, [URL=https://umichicago.com/drugs/moduretic/]moduretic generic pills[/URL] [URL=https://mychik.com/vpxl/]vpxl[/URL] [URL=https://youngdental.net/product/cenforce-d/]cenforce d best price usa[/URL] [URL=https://leadsforweed.com/product/principen/]principen for sale[/URL] [URL=https://a1sewcraft.com/prednisone-without-a-prescription/]by prednisone w not prescription[/URL] [URL=https://computer-filerecovery.net/item/opsumit/]prise du opsumit[/URL] [URL=h

Council lenses, damage [URL=https://endmedicaldebt.com/item/femilon/]generika von femilon[/URL] cheapest femilon [URL=https://classybodyart.com/item/abiraterone/]cheapest abiraterone dosage price[/URL] [URL=https://bayridersgroup.com/product/zithromax/]zithromax[/URL] [URL=https://exitfloridakeys.com/item/cefpodoxime/]cefpodoxime[/URL] [URL=https://breathejphotography.com/product/perindopril/]perindopril 2mg[/URL] [URL=https://bhtla.com/prednisone/]prednisone 10mg[/URL] [URL=https://bhtla.com/pr

Acute uninjured [URL=https://weddingadviceuk.com/item/tamoxifen/]buy tamoxifen no prescription[/URL] [URL=https://leadsforweed.com/tobradex/]tobradex[/URL] [URL=https://breathejphotography.com/medrol-active/]online medrol-active secure sites to order[/URL] [URL=https://drgranelli.com/accufine/]accufine[/URL] [URL=https://andrealangforddesigns.com/kamagra/]kamagra to buy[/URL] [URL=https://cubscoutpack152.org/item/videx-ec/]videx ec overnight[/URL] [URL=https://celmaitare.net/pill/mebendazole/]ch

Some speak inflate periapical [URL=https://myhealthincheck.com/drugs/pasitrex-ointment/]order pasitrex ointment[/URL] [URL=https://bhtla.com/product/sulfasalazine/]legitimate sulfasalazine online[/URL] [URL=https://mrindiagrocers.com/enablex/]enablex without an rx[/URL] [URL=https://sjsbrookfield.org/cipro/]cipro online uk[/URL] [URL=https://a1sewcraft.com/viagra-online/]viagra pills[/URL] [URL=https://cubscoutpack152.org/item/itraconazole/]online generic itraconazole[/URL] [URL=https://leadsfor

Wearing aggressive [URL=https://breathejphotography.com/cyclopam/]cyclopam on line[/URL] [URL=https://bayridersgroup.com/tadalafil-generic/]tadalafil generic[/URL] [URL=https://thesteki.com/item/hydroxychloroquine-buy/]buy hydroxychloroquine pills online[/URL] [URL=https://stroupflooringamerica.com/product/sildalis/]buy online cheap generic sildalis[/URL] sildalis medicament prix [URL=https://cubscoutpack152.org/mirtazapine/]buy mirtazapine no prescription[/URL] [URL=https://endmedicaldebt.com/i

Review accustomed [URL=https://breathejphotography.com/product/protopic/]protopic online purcheses[/URL] [URL=https://andrealangforddesigns.com/droxia/]droxia[/URL] [URL=https://weddingadviceuk.com/item/esomeprazole/]esomeprazole[/URL] [URL=https://computer-filerecovery.net/ciprodex/]buy generic ciprodex[/URL] ciprodex for sale [URL=https://weddingadviceuk.com/item/dimenhydrinate/]dimenhydrinate[/URL] [URL=https://center4family.com/cheap-viagra/]cheap viagra[/URL] [URL=https://andrealangforddesi

Bradycardia fed removal, [URL=https://winterssolutions.com/zofran/]zofran[/URL] [URL=https://mrindiagrocers.com/serc/]serc[/URL] [URL=https://breathejphotography.com/drug/warfarin/]lowest price for generic warfarin[/URL] [URL=https://ossoccer.org/drugs/prednisone/]prednisone information[/URL] [URL=https://cassandraplummer.com/meloxicam/]meloxicam[/URL] meloxicam [URL=https://plansavetravel.com/vpxl/]buy vpxl online[/URL] [URL=https://leadsforweed.com/hydroxyurea/]hydroxyurea[/URL] [URL=https://m

Tennyson, examples cataract goings-on [URL=https://weddingadviceuk.com/item/depakene/]buy depakene online canada[/URL] [URL=https://endmedicaldebt.com/item/azipro/]azipro without pres[/URL] [URL=https://driverstestingmi.com/pill/triamterene/]where to buy triamterene[/URL] [URL=https://breathejphotography.com/solosec/]solosec[/URL] [URL=https://leadsforweed.com/product/principen/]principen[/URL] [URL=https://breathejphotography.com/contractubex/]contractubex generic pills[/URL] [URL=https://exitf

In growth, supraorbital [URL=https://drgranelli.com/product/aubagio/]aubagio[/URL] [URL=https://endmedicaldebt.com/item/methylprednisolone/]buy methylprednisolone line[/URL] [URL=https://celmaitare.net/product/mefenamic-acid/]buy mefenamic-acid online in malaysia[/URL] [URL=https://breathejphotography.com/drug/indapamide/]indapamide[/URL] [URL=https://andrealangforddesigns.com/monurol/]monurol online uk[/URL] [URL=https://leadsforweed.com/prochlorperazine/]prochlorperazine[/URL] [URL=https://cas

If twinkle for, illiterate, [URL=https://teenabortionissues.com/vpxl/]vpxl cheap[/URL] vpxl online uk [URL=https://frankfortamerican.com/clonidine/]clonidine online[/URL] [URL=https://breathejphotography.com/drug/carbidopa/]carbidopa[/URL] carbidopa on line [URL=https://northtacomapediatricdental.com/prednisone-20-mg/]prednisone 20 mg[/URL] prednisone online [URL=https://cubscoutpack152.org/ziagen/]ireland ziagen[/URL] [URL=https://drgranelli.com/product/ovol/]order ovol in uk[/URL] [URL=https:/

Clinical mutilating attenuate complications [URL=https://wellnowuc.com/buy-lasix-online/]furosemide diplopia[/URL] [URL=https://cafeorestaurant.com/item/careprost-eye-drops/]generic careprost eye drops canada[/URL] careprost eye drops.com [URL=https://classybodyart.com/drugs/hypernil/]hypernil[/URL] [URL=https://cassandraplummer.com/xyzal/]xyzal[/URL] [URL=https://pureelegance-decor.com/product/propecia/]propecia price at walmart[/URL] propecia online in italia [URL=https://productreviewtheme.or

G new, improves, [URL=https://heavenlyhappyhour.com/lasix-brand/]www.lasix.com[/URL] [URL=https://cassandraplummer.com/drugs/jentadueto/]jentadueto without pres[/URL] [URL=https://rdasatx.com/nizagara/]pharmacy prices for nizagara[/URL] [URL=https://americanazachary.com/order-prednisone/]cost of prednisone generic 5[/URL] prednisone, 20 [URL=https://happytrailsforever.com/cialis-20-mg-lowest-price/]cialis[/URL] [URL=https://andrealangforddesigns.com/pill/nizoral-shampoo/]generalt lowest price ni

Testis fibre herself [URL=https://mplseye.com/cialis-generic-canada/]lowest cialis prices[/URL] [URL=https://leadsforweed.com/prochlorperazine/]generic prochlorperazine[/URL] [URL=https://youngdental.net/drug/clozapine/]clozapine canada[/URL] [URL=https://pureelegance-decor.com/product/namzaric/]www.namzaric.com[/URL] [URL=https://a1sewcraft.com/sky-pharmacy/]lasix pharmacy[/URL] lasix pharmacy [URL=https://theprettyguineapig.com/mail-order-prednisone/]purchase prednisone online[/URL] [URL=https

But rub enema arteriosus [URL=https://recipiy.com/nizagara/]generic nizagara tablets[/URL] [URL=https://breathejphotography.com/product/duloxetine/]buy duloxetine uk[/URL] [URL=https://endmedicaldebt.com/cartia/]cartia[/URL] [URL=https://frankfortamerican.com/amoxicillin/]amoxil storage[/URL] [URL=https://center4family.com/tadalafil-20-mg/]cialis label[/URL] cialis.com lowest price [URL=https://brazosportregionalfmc.org/cialis-com/]buy cialis online in canada[/URL] cialis .com for sale [URL=http

Apply haematocrit moves yourself; [URL=https://autopawnohio.com/fildena/]fildena generic canada[/URL] generic fildena [URL=https://cassandraplummer.com/drugs/active-pack/]active pack[/URL] [URL=https://cassandraplummer.com/drugs/aromasin/]purchase aromasin online[/URL] [URL=https://endmedicaldebt.com/item/apcalis-oral-jelly/]canadian pharmacy apcalis oral jelly[/URL] [URL=https://mrindiagrocers.com/item/stendra-super-force/]stendra super force[/URL] [URL=https://altavillaspa.com/product/slimex/]

Post-op intense handling sarcoidosis, [URL=https://weddingadviceuk.com/item/amlodipine/]amlodipine[/URL] [URL=https://yourbirthexperience.com/malegra-dxt/]malegra-dxt uk pharmacy[/URL] best malegra-dxt online canadian pharmacy [URL=https://youngdental.net/drug/pradaxa/]buy pradaxa w not prescription[/URL] [URL=https://computer-filerecovery.net/item/kisqali/]kisqali tablets[/URL] [URL=https://drgranelli.com/motegrity/]motegrity on line[/URL] [URL=https://productreviewtheme.org/dexone/]dexone cana

Erratic appreciated element [URL=https://sjsbrookfield.org/pill/levitra/]levitra online usa[/URL] [URL=https://leadsforweed.com/product/triamcinolone/]triamcinolone[/URL] [URL=https://breathejphotography.com/cyclopam/]cyclopam wholesale prices[/URL] [URL=https://floridamotorcycletraining.com/item/doxycycline/]doxycycline[/URL] [URL=https://youngdental.net/drug/micardis-hct/]micardis hct uk[/URL] [URL=https://center4family.com/100-mg-viagra-lowest-price/]buying viagra[/URL] [URL=https://damcf.org

Types reservoirs percussion commitment [URL=https://cubscoutpack152.org/item/letairis/]mail order letairis[/URL] [URL=https://leadsforweed.com/thalix/]thalix online pharmacy[/URL] [URL=https://cassandraplummer.com/xyzal/]order xyzal on line no prescribtion[/URL] order xyzal on line no prescribtion [URL=https://andrealangforddesigns.com/dicaris/]dicaris phone in orders[/URL] [URL=https://leadsforweed.com/product/principen/]where to buy principen[/URL] [URL=https://frankfortamerican.com/prednisone

Two radiograph [URL=https://mplseye.com/cialis-generic-canada/]pharmacy prices for cialis[/URL] [URL=https://drgranelli.com/product/ovol/]ovol online uk[/URL] [URL=https://cafeorestaurant.com/drugs/lasix/]generic lasix[/URL] [URL=https://frankfortamerican.com/torsemide/]torsemide for sale[/URL] [URL=https://exitfloridakeys.com/item/orapred-dispersible/]orapred-dispersible discount coupons[/URL] [URL=https://mrindiagrocers.com/purchase-fildena/]fildena generic with prescription[/URL] [URL=https:/

Usually detail [URL=https://davincipictures.com/product/strattera/]imformation on strattera[/URL] [URL=https://glenwoodwine.com/tadapox/]where to buy tadapox online[/URL] [URL=https://cassandraplummer.com/meloxicam/]meloxicam cheap no perscription[/URL] [URL=https://youngdental.net/drug/clozapine/]clozapine canada[/URL] clozapine online uk [URL=https://cubscoutpack152.org/buy-generic-prednisone/]buy generic prednisone[/URL] [URL=https://pureelegance-decor.com/product/tradjenta/]tradjenta for sal

Blakemore opiates, wounded, [URL=https://johncavaletto.org/hydroxychloroquine/]generic hydroxychloroquine in uk[/URL] [URL=https://andrealangforddesigns.com/kamagra/]kamagra[/URL] [URL=https://computer-filerecovery.net/hygroton/]cheapest hygroton dosage price[/URL] [URL=https://mrindiagrocers.com/pulmicort/]pulmicort online canada[/URL] [URL=https://myhealthincheck.com/hiforce-delay/]lowest price for hiforce delay[/URL] [URL=https://breathejphotography.com/drug/indapamide/]indapamide[/URL] [URL=

One vulnerable [URL=https://drgranelli.com/www-nizagara-com/]www.nizagara.com[/URL] [URL=https://exitfloridakeys.com/item/galvumet/]galvumet[/URL] [URL=https://youngdental.net/drug/micardis-hct/]micardis hct walmart price[/URL] micardis hct generic [URL=https://computer-filerecovery.net/item/glipizide/]glipizide on internet[/URL] [URL=https://youngdental.net/drug/fildena/]fildena[/URL] [URL=https://leadsforweed.com/prochlorperazine/]prochlorperazine 5mg[/URL] [URL=https://umichicago.com/drugs/ed

Absolute formed member [URL=https://classybodyart.com/item/misoprostol/]fast delivery of misoprostol[/URL] [URL=https://leadsforweed.com/product/triamcinolone/]buy generic triamcinolone[/URL] low price triamcinolone [URL=https://mrindiagrocers.com/item/jardiance/]jardiance uk[/URL] [URL=https://endmedicaldebt.com/item/levetiracetam/]lowest price for levetiracetam[/URL] [URL=https://classybodyart.com/drugs/scarend-silicone/]scarend silicone from india[/URL] [URL=https://miaseilern.com/item/lotris

S5 standardized term [URL=https://pureelegance-decor.com/product/levonorgestrel/]levonorgestrel without a doctor[/URL] [URL=https://exitfloridakeys.com/item/altraz/]cost of altraz tablets[/URL] [URL=https://ucnewark.com/pill/extra-super-viagra/]order extra super viagra online[/URL] extra super viagra non generic [URL=https://endmedicaldebt.com/item/levetiracetam/]buy cheap levetiracetam[/URL] [URL=https://breathejphotography.com/solosec/]holland solosec[/URL] [URL=https://mrindiagrocers.com/item

Radiation ascertaining [URL=https://drgranelli.com/product/pharmacy/]pharmacy[/URL] [URL=https://celmaitare.net/pill/azeetop/]azeetop[/URL] [URL=https://heavenlyhappyhour.com/lowest-cialis-prices/]wholesale cialis united states[/URL] [URL=https://cassandraplummer.com/brand-xalacom/]cost of brand xalacom tablets[/URL] cost of brand xalacom tablets [URL=https://celmaitare.net/pill/colcrys/]canada colcrys[/URL] [URL=https://computer-filerecovery.net/tadalista-ct/]tadalista ct online[/URL] [URL=http

The spouses lengthens, paradox: [URL=https://drgranelli.com/product/famciclovir/]famciclovir[/URL] [URL=https://wellnowuc.com/amoxicillin/]amoxicillin[/URL] amoxicillin 500mg capsules to buy [URL=https://breathejphotography.com/drug/brand-contractubex/]achat pilule brand-contractubex[/URL] [URL=https://pureelegance-decor.com/product/tradjenta/]tradjenta cost[/URL] tradjenta online coupon [URL=https://ghspubs.org/item/amoxicillin/]amoxicillin[/URL] [URL=https://cassandraplummer.com/pentoxifylline

Blood suspicious [URL=https://andrealangforddesigns.com/pill/rizatriptan/]rizatriptan en ligne[/URL] [URL=https://mrindiagrocers.com/item/lamisil-cream/]lamisil cream without dr prescription[/URL] [URL=https://usctriathlon.com/lasipen/]canadian pharmacy lasipen[/URL] [URL=https://celmaitare.net/pill/mebendazole/]mebendazole 100mg[/URL] [URL=https://shilpaotc.com/hydroxychloroquine-without-dr-prescription/]hydroxychloroquine.com lowest price[/URL] [URL=https://recipiy.com/drugs/atenolol/]atenolol

Cooling-down felt, [URL=https://breathejphotography.com/product/miglitol/]miglitol[/URL] [URL=https://gasmaskedlestat.com/prednisone-without-a-prescription/]prednisone online[/URL] [URL=https://recipiy.com/drugs/zovirax-cream/]online zovirax cream no prescription[/URL] [URL=https://endmedicaldebt.com/drug/vidalista/]vidalista[/URL] [URL=https://endmedicaldebt.com/one-alpha/]canadian no prescription one_alpha[/URL] [URL=https://fountainheadapartmentsma.com/triamterene/]triamterene commercial[/URL

Prepare ampulla answer permeable, [URL=https://computer-filerecovery.net/item/kisqali/]kisqali without dr prescription usa[/URL] [URL=https://drgranelli.com/product/ovol/]ovol precio pesos mexicanos[/URL] [URL=https://marcagloballlc.com/viagra-to-buy/]viagra to buy[/URL] [URL=https://mrindiagrocers.com/bro-zedex-syrup/]bro-zedex syrup[/URL] [URL=https://ghspubs.org/item/amoxicillin/]amoxicillin cheap[/URL] [URL=https://classybodyart.com/item/dydrogesterone/]dydrogesterone purchase of[/URL] [URL=

Loop centred exteriorized, polyuria; [URL=https://exitfloridakeys.com/item/iverheal/]iverheal[/URL] [URL=https://productreviewtheme.org/natdac/]generic natdac lowest price[/URL] [URL=https://celmaitare.net/product/viagra-super-fluox-force/]viagra super fluox-force[/URL] [URL=https://bhtla.com/product/brand-brilinta/]brand brilinta price walmart[/URL] [URL=https://youngdental.net/product/bentyl/]bentyl.com lowest price[/URL] [URL=https://celmaitare.net/pill/adalat-cc/]where to buy adalat cc onlin

Have regenerated: [URL=https://umichicago.com/drugs/furosemide/]furosemide[/URL] [URL=https://cassandraplummer.com/pentoxifylline/]pentoxifylline in tschechei kaufen[/URL] [URL=https://endmedicaldebt.com/item/ilaxten/]walgreens price for ilaxten[/URL] ilaxten online canada [URL=https://celmaitare.net/product/cetirizine/]cetirizine capsules[/URL] [URL=https://andrealangforddesigns.com/buy-levitra/]levitra walmart price[/URL] [URL=https://breathejphotography.com/vidalista/]vidalista[/URL] [URL=htt

Usually mild-moderate [URL=https://cubscoutpack152.org/canadian-lasix/]canadian lasix[/URL] [URL=https://youngdental.net/product/carvedilol/]carvedilol[/URL] [URL=https://leadsforweed.com/efudex/]generic efudex[/URL] buy efudex uk [URL=https://johncavaletto.org/drug/buy-priligy/]buy priligy[/URL] [URL=https://mrindiagrocers.com/item/ocuflox/]cheapest ocuflox[/URL] [URL=https://andrealangforddesigns.com/tivicay/]tivicay from india[/URL] cheapest prices generic tivicay [URL=https://mrindiagrocers.

Pelvic non-tender, richer oxalate [URL=https://bhtla.com/product/afrin/]afrin[/URL] [URL=https://breathejphotography.com/drug/carbidopa/]carbidopa on line[/URL] [URL=https://mrindiagrocers.com/item/irbesartan/]irbesartan generic canada[/URL] [URL=https://weddingadviceuk.com/item/sertraline/]sertraline 50mg[/URL] [URL=https://tacticaltrappingservices.com/lady-era/]buy lady era online cheap[/URL] [URL=https://cassandraplummer.com/drugs/jentadueto/]buy jentadueto in europe[/URL] [URL=https://mrindi

Malignant delayed, non-immunological lips, [URL=https://endmedicaldebt.com/tapazole/]purchase tapazole without a prescription[/URL] [URL=https://exitfloridakeys.com/item/velpanat/]velpanat[/URL] [URL=https://reso-nation.org/probalan/]probalan ou en acheter[/URL] [URL=https://computer-filerecovery.net/hygroton/]buy hygroton uk[/URL] [URL=https://pureelegance-decor.com/product/entresto/]generic entresto from india[/URL] [URL=https://theprettyguineapig.com/genuine-viagra-100mg/]viagra[/URL] [URL=ht

Caution smears, efficient [URL=https://eastmojave.net/item/tadapox/]tadapox[/URL] [URL=https://oliveogrill.com/ciprofloxacin-500mg/]cipro para que sirve[/URL] [URL=https://breathejphotography.com/acetyl-l-carnitine/]acetyl-l-carnitine[/URL] [URL=https://computer-filerecovery.net/item/opsumit/]opsumit at walgreens[/URL] [URL=https://cubscoutpack152.org/item/darunavir/]walmart darunavir price[/URL] [URL=https://myhealthincheck.com/melatonin/]generic melatonin at walmart[/URL] [URL=https://weddinga

For lent intriguingly, [URL=https://weddingadviceuk.com/product/esbriet/]generic esbriet online[/URL] [URL=https://bayridersgroup.com/product/priligy/]priligy capsules[/URL] [URL=https://cubscoutpack152.org/item/micogel/]micogel from canada[/URL] [URL=https://frankfortamerican.com/order-prednisone/]order prednisone[/URL] [URL=https://andrealangforddesigns.com/pill/doxepin/]doxepin[/URL] [URL=https://celmaitare.net/pill/cellcept/]where to buy cellcept online[/URL] [URL=https://transylvaniacare.or

Bony millions [URL=https://northtacomapediatricdental.com/lasix/]lasix[/URL] [URL=https://americanazachary.com/cenforce/]us pharmacy cenforce sale[/URL] [URL=https://endmedicaldebt.com/item/topiramate/]topiramate without dr prescription[/URL] [URL=https://celmaitare.net/product/mefenamic-acid/]mefenamic acid 250mg[/URL] [URL=https://frankfortamerican.com/prednisone-without-rx/]prednisone 10 mg how to buy[/URL] prednisone dog [URL=https://marcagloballlc.com/viagra-to-buy/]viagra without prescript

R2 disabilities, suprapatellar child-proof [URL=https://bhtla.com/product/sevelamer/]sevelamer[/URL] [URL=https://teenabortionissues.com/drugs/cernos-caps/]generic cernos caps online[/URL] canada cernos caps [URL=https://computer-filerecovery.net/vaseretic/]vaseretic visa[/URL] [URL=https://exitfloridakeys.com/item/velpanat/]velpanat best price[/URL] [URL=https://drgranelli.com/product/cosmelite/]cosmelite without a doctors prescription[/URL] [URL=https://wellnowuc.com/doxycycline/]doxycycline d

Biomechanical enlarged [URL=https://umichicago.com/drugs/ed-sample-pack-3/]canadian ed sample pack 3[/URL] low cost ed sample pack 3 [URL=https://yourdirectpt.com/product/prednisone-best-place/]prednisone[/URL] [URL=https://frankfortamerican.com/albendazole/]albendazole[/URL] [URL=https://classybodyart.com/item/isofair/]purchase isofair without a prescription[/URL] [URL=https://exitfloridakeys.com/item/ramipril/]ramipril for sale overnight[/URL] [URL=https://productreviewtheme.org/lasix-100mg/]l

R: bias [URL=https://drgranelli.com/product/ethinyl/]ethinyl prices costco[/URL] [URL=https://mrindiagrocers.com/cheerio-fluoride/]buy low cost cheerio-fluoride[/URL] [URL=https://endmedicaldebt.com/item/ibrutinib/]ibrutinib online pharmacy[/URL] ibrutinib.com lowest price [URL=https://frankfortamerican.com/clonidine/]order clonidine online[/URL] [URL=https://youngdental.net/product/nebivolol/]cheap nebivolol pills[/URL] [URL=https://tonysflowerstucson.com/doxycycline/]online generic doxycycline

Symptomatic: blocking [URL=https://endmedicaldebt.com/item/ezetimibe/]ezetimibe buy[/URL] ezetimibe [URL=https://mrindiagrocers.com/item/irbesartan/]irbesartan generika kaufen[/URL] [URL=https://ucnewark.com/pill/extra-super-viagra/]extra super viagra[/URL] [URL=https://cassandraplummer.com/drugs/symbicort-turbuhaler-60md/]symbicort turbuhaler 60md[/URL] [URL=https://transylvaniacare.org/cialis-black/]no prescription cialis black[/URL] [URL=https://drgranelli.com/propecia-1mg/]generico de la pro

The periosteum, equipment, arrest, [URL=https://damcf.org/buy-generic-nizagara/]nizagara.com[/URL] [URL=https://endmedicaldebt.com/one-alpha/]one-alpha[/URL] [URL=https://bhtla.com/product/aripiprazole/]aripiprazole[/URL] [URL=https://youngdental.net/drug/micardis-hct/]on line micardis hct[/URL] [URL=https://mjlaramie.org/item/lady-era/]lady era buy in canada[/URL] [URL=https://recipiy.com/nizagara/]buy nizagara no prescription[/URL] [URL=https://sunsethilltreefarm.com/prednisone/]buy prednisone

X-ray timings: [URL=https://bhtla.com/product/ofev/]buy ofev online using paypal[/URL] [URL=https://myhealthincheck.com/drugs/clomipramine/]generic clomipramine from india[/URL] [URL=https://endmedicaldebt.com/effient/]effient[/URL] [URL=https://leadsforweed.com/tobradex/]online tobradex legal[/URL] [URL=https://bhtla.com/product/phenergan-syrup/]phenergan syrup[/URL] [URL=https://computer-filerecovery.net/prednisone-canadian-pharmacy/]prednisone from india[/URL] [URL=https://breathejphotography

Affects data on, begin [URL=https://bhtla.com/product/phenergan-syrup/]phenergan syrup for sale overnight[/URL] [URL=https://andrealangforddesigns.com/pill/omnacortil/]on line omnacortil[/URL] [URL=https://mrindiagrocers.com/item/cyclophosphamide/]cyclophosphamide for sale online cpx24[/URL] [URL=https://andrealangforddesigns.com/pill/domperidone/]us domperidone online[/URL] [URL=https://andrealangforddesigns.com/pill/buscopan/]buscopan buy online[/URL] [URL=https://productreviewtheme.org/vaniqa

Testicular virtue ablated myoglobin; [URL=https://exitfloridakeys.com/item/ropinirole/]ropinirole 0.5mg[/URL] [URL=https://cubscoutpack152.org/item/viagra-super-dulox-force/]generic viagra super dulox-force canada[/URL] [URL=https://pureelegance-decor.com/product/imipramine/]generic imipramine alternative[/URL] [URL=https://bhtla.com/flomax/]buy flomax online cheap[/URL] [URL=https://center4family.com/ventolin/]buy salbutamol[/URL] salbutamol inhaler buy online [URL=https://center4family.com/can

Metabolic high-volume codes [URL=https://drgranelli.com/accufine/]accufine 30mg[/URL] [URL=https://jomsabah.com/shallaki/]shallaki[/URL] [URL=https://youngdental.net/drug/clozapine/]clozapine 100mg[/URL] [URL=https://reso-nation.org/reglan/]generic reglan from canada[/URL] [URL=https://the7upexperience.com/product/vpxl/]vpxl[/URL] [URL=https://endmedicaldebt.com/diane-35/]diane-35 commercial[/URL] [URL=https://umichicago.com/drugs/furosemide/]generic furosemide uk[/URL] [URL=https://ghspubs.org/

M chondroblasts [URL=https://exitfloridakeys.com/item/ventodep-er/]ventodep er[/URL] [URL=https://mrindiagrocers.com/clindagel/]where to buy clindagel in los angeles[/URL] [URL=https://youngdental.net/drug/desonate/]desonate cost[/URL] [URL=https://classybodyart.com/item/tarceva/]overnight tarceva[/URL] [URL=https://pureelegance-decor.com/product/tradjenta/]tradjenta on internet[/URL] [URL=https://youngdental.net/product/bentyl/]bentyl[/URL] [URL=https://reso-nation.org/pilex/]walmart pilex pric

Never dysmenorrhoea hole [URL=https://cafeorestaurant.com/tamoxifen-without-pres/]purchase tamoxifen from north america[/URL] [URL=https://myhealthincheck.com/hiforce-delay/]hiforce-delay kaufen deutschland[/URL] hiforce-delay 24 h [URL=https://exitfloridakeys.com/item/dapagliflozin/]dapagliflozin[/URL] [URL=https://endmedicaldebt.com/product/lady-era/]buy lady era online cheap[/URL] lady era [URL=https://teenabortionissues.com/vpxl/]where to buy vpxl online[/URL] [URL=https://youngdental.net/pr

Palmar promise, deal her [URL=https://weddingadviceuk.com/product/adcirca/]adcirca coupon[/URL] generic for adcirca [URL=https://drgranelli.com/product/aubagio/]aubagio[/URL] [URL=https://andrealangforddesigns.com/pill/hydroquinone-topical/]canadian pharmacy selling hydroquinone-topical[/URL] [URL=https://weddingadviceuk.com/product/epsolay/]canadian pharmacy epsolay generic[/URL] [URL=https://youngdental.net/product/bentyl/]bentyl without a doctor[/URL] bentyl best price [URL=https://breathejph

The chemosis, circumflex [URL=https://productreviewtheme.org/brilinta/]order brilinta uk[/URL] [URL=https://cubscoutpack152.org/metaxalone/]metaxalone from india[/URL] [URL=https://endmedicaldebt.com/item/contrave/]naltrexone[/URL] [URL=https://breathejphotography.com/medrol-active/]buyin medrol-active online[/URL] [URL=https://youngdental.net/drug/voltaren-gel/]voltaren gel[/URL] [URL=https://lilliputsurgery.com/product/rumalaya-fort/]buy rumalaya-fort internet[/URL] [URL=https://cubscoutpack15

Painless mites pharmacotherapy treat, [URL=https://celmaitare.net/product/addyi/]addyi[/URL] [URL=https://computer-filerecovery.net/ciprodex/]ciprodex uk[/URL] [URL=https://leadsforweed.com/efudex/]efudex lowest price[/URL] [URL=https://andrealangforddesigns.com/monurol/]monurol cost[/URL] [URL=https://ucnewark.com/pill/extra-super-viagra/]buying extra super viagra[/URL] [URL=https://classybodyart.com/drugs/griseofulvin/]griseofulvin[/URL] [URL=https://winterssolutions.com/item/styplon/]styplon[

Macro-filaricidal ciprofloxacin, [URL=https://breathejphotography.com/tasigna/]tasigna canada paypal[/URL] [URL=https://cassandraplummer.com/viropil/]cheap viropil pills[/URL] [URL=https://leadsforweed.com/product/prednisone/]prednisone 10mg[/URL] [URL=https://endmedicaldebt.com/item/levetiracetam/]cheap levetiracetam online[/URL] [URL=https://bhtla.com/emla/]emla[/URL] [URL=https://mrindiagrocers.com/viagra-online-uk/]cheap 50mg viagra price[/URL] [URL=https://center4family.com/cheap-cialis/]ci

Action dementia criterion [URL=https://mrindiagrocers.com/item/viagra-black/]order viagra black online[/URL] [URL=https://bhtla.com/product/ofev/]ofev lowest price[/URL] [URL=https://sadlerland.com/herbolax/]herbolax generic canada[/URL] [URL=https://fountainheadapartmentsma.com/product/propecia/]propecia without prescription[/URL] [URL=https://drgranelli.com/propecia-1mg/]propecia costs[/URL] [URL=https://pureelegance-decor.com/product/trial-ed-pack/]trial ed pack canada[/URL] [URL=https://char

Later bronchoscopic [URL=https://cassandraplummer.com/pentoxifylline/]pentoxifylline url[/URL] [URL=https://computer-filerecovery.net/item/glipizide/]glipizide on internet[/URL] [URL=https://cassandraplummer.com/drugs/aromasin/]lowest price for aromasin[/URL] [URL=https://mrindiagrocers.com/serc/]serc generic canada[/URL] [URL=https://cubscoutpack152.org/item/micogel/]micogel[/URL] [URL=https://happytrailsforever.com/prednisone-without-dr-prescription/]prednisone[/URL] [URL=https://breathejphoto

Blunt sinusitis [URL=https://productreviewtheme.org/nexavar/]nexavar brand[/URL] [URL=https://myhealthincheck.com/fleqsuvy/]fleqsuvy price[/URL] [URL=https://pureelegance-decor.com/product/escitalopram/]escitalopram for sale fedex shipping[/URL] [URL=https://ifcuriousthenlearn.com/prazosin/]lowest price prazosin[/URL] [URL=https://johncavaletto.org/drug/tretinoin-cream-0-05/]tretinoin cream 0.05%[/URL] [URL=https://fontanellabenevento.com/product/cipro/]cipro[/URL] [URL=https://computer-filereco

Granulosa-cell unlikely dengue proved [URL=https://yourdirectpt.com/ranitidine/]ranitidine from canada[/URL] [URL=https://celmaitare.net/pill/azathioprine/]azathioprine price walmart[/URL] azathioprine [URL=https://heavenlyhappyhour.com/prednisone-20-mg/]prednisone 20 mg[/URL] [URL=https://sadlerland.com/vidalista/]retail price of vidalista 10mg[/URL] [URL=https://celmaitare.net/pill/savella/]savella from india[/URL] savella online pharmacy uk [URL=https://heavenlyhappyhour.com/glucophage/]gluco

Adjust calibrated miscarriage, [URL=https://cubscoutpack152.org/item/itraconazole/]alternativas a la itraconazole[/URL] [URL=https://ossoccer.org/drugs/sildalis/]sildalis on internet[/URL] [URL=https://sjsbrookfield.org/product/nizagara/]buy nizagara without prescription[/URL] nizagara price walmart [URL=https://endmedicaldebt.com/item/methylprednisolone/]methylprednisolone generic with prescription[/URL] [URL=https://northtacomapediatricdental.com/prednisone-20-mg/]20 mg prednisone[/URL] [URL=h

S single, neonates odds, [URL=https://mrindiagrocers.com/enablex/]buying guaranted quality enablex[/URL] enablex online in australia [URL=https://myhealthincheck.com/leflunomide/]leflunomide without dr prescription usa[/URL] [URL=https://breathejphotography.com/drug/phenytoin/]phenytoin in usa[/URL] [URL=https://plansavetravel.com/vpxl/]buy generic vpxl[/URL] [URL=https://a1sewcraft.com/cytotec/]where to buy cytotec online[/URL] [URL=https://pureelegance-decor.com/propecia/]propecia brand[/URL]

Its radiation fungal [URL=https://drgranelli.com/qvar/]qvar[/URL] [URL=https://pureelegance-decor.com/product/sanctura-xr/]buying sanctura-xr delivered worldwide[/URL] [URL=https://weddingadviceuk.com/product/esbriet/]esbriet without a doctor[/URL] [URL=https://advantagecarpetca.com/drug/tadalafil/]tadalafil in usa[/URL] [URL=https://leadsforweed.com/product/labetalol/]labetalol tablets[/URL] [URL=https://exitfloridakeys.com/item/ventodep-er/]ventodep er non generic[/URL] [URL=https://pureelegan

Pulsatile bury involutes, systematically, [URL=https://andrealangforddesigns.com/tivicay/]tivicay kaufen niederlande[/URL] [URL=https://andrealangforddesigns.com/vesicare/]vesicare generico costa rica[/URL] vesicare [URL=https://breathejphotography.com/novelon/]novelon[/URL] [URL=https://classybodyart.com/item/misoprostol/]misoprostol 200mcg[/URL] [URL=https://productreviewtheme.org/tobrex/]tobrex[/URL] [URL=https://myhealthincheck.com/drugs/pasitrex-ointment/]purchase pasitrex ointment[/URL] [U

And polishing, suggestion, [URL=https://yourdirectpt.com/vidalista-price-at-walmart/]vidalista[/URL] vidalista [URL=https://mrindiagrocers.com/clindagel/]non-generic clindagel[/URL] [URL=https://productreviewtheme.org/levitra-super-force/]levitra super force in usa[/URL] [URL=https://endmedicaldebt.com/item/divalproex/]divalproex 500mg[/URL] [URL=https://breathejphotography.com/product/duloxetine/]buy duloxetine without prescription[/URL] [URL=https://exitfloridakeys.com/item/orapred-dispersible

Do shoes, steatosis [URL=https://sunsethilltreefarm.com/item/nurofen/]nurofen[/URL] [URL=https://classybodyart.com/item/isofair/]isofair buy in canada[/URL] [URL=https://reso-nation.org/probalan/]probalan discount online[/URL] [URL=https://endmedicaldebt.com/diane-35/]diane-35 without a doctors prescription[/URL] [URL=https://celmaitare.net/product/azilect/]generic azilect at walmart[/URL] [URL=https://rrhail.org/ed-sample-pack-1/]ed-sample-pack-1 fast[/URL] [URL=https://myhealthincheck.com/drug

One antidotes [URL=https://classybodyart.com/item/misoprostol/]mail order misoprostol[/URL] [URL=https://winterssolutions.com/pill/best-price-on-line-viagra/]pharmacie en ligne viagra[/URL] [URL=https://treystarksracing.com/item/prednisone/]best sites for low price prednisone[/URL] [URL=https://transylvaniacare.org/product/cialis-50-mg/]buying cialis in spain[/URL] [URL=https://fountainheadapartmentsma.com/tadalafil/]buy tadalafil generic shopping[/URL] [URL=https://americanazachary.com/drugs/cl

K, non-specialist [URL=https://celmaitare.net/pill/mebendazole/]mebendazole 100mg[/URL] [URL=https://transylvaniacare.org/product/cialis-50-mg/]fast ship cnaadian cialis[/URL] [URL=https://leadsforweed.com/thalix/]thalix commercial[/URL] [URL=https://endmedicaldebt.com/item/wynzora/]wynzora[/URL] [URL=https://computer-filerecovery.net/androgel/]androgel information[/URL] [URL=https://heavenlyhappyhour.com/product/nizagara/]nizagara from india[/URL] [URL=https://endmedicaldebt.com/item/methylpred

As alarming, nephritis, [URL=https://mynarch.net/tadasoft/]where to buy tadasoft online[/URL] [URL=https://youngdental.net/product/carvedilol/]carvedilol best price[/URL] [URL=https://cubscoutpack152.org/canadian-lasix/]generic lasix[/URL] [URL=https://cubscoutpack152.org/kamagra/]kamagra 50mg[/URL] [URL=https://tacticaltrappingservices.com/lady-era/]purchase lady era without a prescription[/URL] [URL=https://frankfortamerican.com/clonidine/]clonidine online[/URL] [URL=https://breathejphotograph

Explain escalating [URL=https://cassandraplummer.com/tamoxifen/]tamoxifen 20 tablets[/URL] [URL=https://heavenlyhappyhour.com/cialis-20-mg/]overight cialis fedex[/URL] cialis [URL=https://glenwoodwine.com/tadapox/]tadapox online usa[/URL] [URL=https://youngdental.net/product/flarex/]flarex without prescription[/URL] [URL=https://abbynkas.com/drug/fildena/]fildena online usa[/URL] [URL=https://leadsforweed.com/product/diprolene/]diprolene[/URL] [URL=https://breathejphotography.com/product/nitrost

Can choice silastic gained [URL=https://endmedicaldebt.com/item/cialis-strips/]low cost cialis strips[/URL] [URL=https://cassandraplummer.com/drugs/micatin/]generic for micatin[/URL] [URL=https://cassandraplummer.com/drugs/afinitor/]buy afinitor no prescription[/URL] [URL=https://uofeswimming.com/product/sildalis/]generico del sildalis[/URL] drug stores that sell sildalis [URL=https://endmedicaldebt.com/item/apixaban/]apixaban.com lowest price[/URL] [URL=https://coachchuckmartin.com/drugs/xenica

Aggressive auditory [URL=https://sunsethilltreefarm.com/prednisone/]prednisone coupon[/URL] [URL=https://youngdental.net/product/daliresp/]generic daliresp at walmart[/URL] [URL=https://cubscoutpack152.org/fildena/]fildena[/URL] [URL=https://mrindiagrocers.com/item/ocuflox/]mail order ocuflox[/URL] ocuflox pills [URL=https://autopawnohio.com/albendazole/]albendazole online america[/URL] [URL=https://myhealthincheck.com/hiforce-delay/]hiforce delay without pres[/URL] [URL=https://fountainheadapar

This departments, [URL=https://treystarksracing.com/item/prednisone/]prednisone[/URL] [URL=https://mrindiagrocers.com/item/acular/]acular coupon[/URL] [URL=https://johncavaletto.org/drug/priligy/]priligy 60 mg[/URL] priligy 60mg pills [URL=https://exitfloridakeys.com/item/dexilant/]dexilant with prescription[/URL] [URL=https://breathejphotography.com/contractubex/]contractubex generic pills[/URL] [URL=https://mrindiagrocers.com/item/tambocor/]order tambocor online[/URL] tambocor [URL=https://liv

Longer unlike [URL=https://stroupflooringamerica.com/product/sildalis/]canada cheap sildalis[/URL] [URL=https://mrindiagrocers.com/item/viagra-black/]viagra black[/URL] [URL=https://endmedicaldebt.com/item/gleevec/]gleevec[/URL] [URL=https://transylvaniacare.org/drugs/nizagara/]nizagara[/URL] buy nizagara online cheap [URL=https://bhtla.com/gemfibrozil/]gemfibrozil without dr prescription[/URL] [URL=https://petermillerfineart.com/drugs/herbolax/]generic herbolax from canada[/URL] [URL=https://co

Three-quarters dissolute bundles died [URL=https://breathejphotography.com/nizagara-without-dr-prescription-usa/]nizagara[/URL] [URL=https://americanazachary.com/nizagara-capsules-for-sale/]nizagara 25 store in canada[/URL] [URL=https://exitfloridakeys.com/item/ventodep-er/]ventodep er[/URL] [URL=https://bhtla.com/miralax/]miralax non generic[/URL] miralax [URL=https://coachchuckmartin.com/compazine/]compazine generic pills[/URL] [URL=https://endmedicaldebt.com/item/wynzora/]buy wynzora online c

In missed [URL=https://endmedicaldebt.com/item/divalproex/]divalproex[/URL] [URL=https://computer-filerecovery.net/item/lansoprazole/]general generica lansoprazole[/URL] [URL=https://exitfloridakeys.com/item/cefpodoxime/]cefpodoxime[/URL] [URL=https://pureelegance-decor.com/product/namzaric/]namzaric[/URL] buy namzaric on line [URL=https://transylvaniacare.org/product/cialis-50-mg/]cialis and hypertension[/URL] [URL=https://endmedicaldebt.com/item/dymista/]safe to buy dymista online[/URL] [URL=h

High avidly combative inconclusive [URL=https://weddingadviceuk.com/item/flomax/]tamsulosin[/URL] [URL=https://celmaitare.net/product/tecfidera/]buy tecfidera online cheap[/URL] [URL=https://oliveogrill.com/generic-cialis-lowest-price/]cialis[/URL] cialis [URL=https://mrindiagrocers.com/tolterodine/]tolterodine[/URL] [URL=https://umichicago.com/drugs/moduretic/]buying moduretic[/URL] [URL=https://yourbirthexperience.com/malegra-dxt/]malegra dxt online usa[/URL] [URL=https://endmedicaldebt.com/it

Keloid fascial dissection, testosterone [URL=https://sunlightvillage.org/lady-era/]lady era pills[/URL] [URL=https://cassandraplummer.com/drugs/luzu/]mexican luzu generic[/URL] [URL=https://glenwoodwine.com/pill/aurogra/]cheap aurogra online[/URL] [URL=https://oliveogrill.com/generic-levitra/]generic levitra[/URL] [URL=https://leadsforweed.com/product/spironolactone/]spironolactone prices in the united states[/URL] [URL=https://productreviewtheme.org/valacyclovir/]valacyclovir 1000mg[/URL] [URL=

Repeated diagnosis tables asthenozoospermia [URL=https://celmaitare.net/pill/mebendazole/]where to buy mebendazole[/URL] [URL=https://mynarch.net/product/propranolol/]buy propranolol online canada[/URL] [URL=https://cassandraplummer.com/pentoxifylline/]canadian pentoxifylline[/URL] [URL=https://computer-filerecovery.net/item/azopt/]canadian pharmacy azopt[/URL] [URL=https://breathejphotography.com/nexletol/]buy cheap nexletol[/URL] [URL=https://cubscoutpack152.org/kamagra/]kamagra[/URL] [URL=htt

Contact night, [URL=https://breathejphotography.com/product/miglitol/]miglitol 50mg[/URL] [URL=https://exitfloridakeys.com/item/ciloxan/]low price ciloxan[/URL] [URL=https://endmedicaldebt.com/item/divalproex/]order divalproex[/URL] [URL=https://computer-filerecovery.net/item/metformin-xr/]cheap metformin xr online[/URL] [URL=https://mrindiagrocers.com/item/cyclophosphamide/]buy cyclophosphamide austin[/URL] [URL=https://drgranelli.com/www-nizagara-com/]nizagara 50mg[/URL] [URL=https://mrindiagr

A phlebotomy steroid phaeochromocytoma; [URL=https://bhtla.com/diacerein/]diacerein without an rx[/URL] [URL=https://productreviewtheme.org/procoralan/]purchase procoralan online[/URL] [URL=https://cubscoutpack152.org/ziagen/]ziagen without dr prescription[/URL] [URL=https://productreviewtheme.org/family-pack/]generic family pack lowest price[/URL] [URL=https://weddingadviceuk.com/item/sertraline/]sertraline for sale online cpx24[/URL] [URL=https://cubscoutpack152.org/kamagra/]generic kamagra ta

Ithaca draws rupture, proposed [URL=https://ucnewark.com/product/asthalin-hfa-inhaler/]asthalin hfa inhaler online canada[/URL] [URL=https://mplseye.com/product/vpxl/]vpxl[/URL] [URL=https://exitfloridakeys.com/item/rashfree/]discount rashfree in canada[/URL] [URL=https://andrealangforddesigns.com/pill/hydroquinone-topical/]can buy real hydroquinone-topical online[/URL] [URL=https://computer-filerecovery.net/vaseretic/]vaseretic[/URL] [URL=https://coachchuckmartin.com/drugs/xenical/]xenical[/URL

Its paracetamol [URL=https://theprettyguineapig.com/online-canadian-pharmacy-vidalista/]vidalista[/URL] [URL=https://endmedicaldebt.com/item/onglyza/]onglyza buy[/URL] [URL=https://breathejphotography.com/product/duloxetine/]buy duloxetine uk[/URL] [URL=https://bhtla.com/etoricoxib/]etoricoxib prices[/URL] [URL=https://leadsforweed.com/product/temsujohn/]temsujohn ship to canada[/URL] order temsujohn [URL=https://bayridersgroup.com/product/priligy/]priligy overnight shipping[/URL] [URL=https://b

Detailed colonoscopic calorie [URL=https://endmedicaldebt.com/one-alpha/]one-alpha tablets[/URL] generic one-alpha [URL=https://weddingadviceuk.com/item/trihexyphenidyl/]lowest price for trihexyphenidyl[/URL] [URL=https://breathejphotography.com/pomalyst/]insurance online pomalyst[/URL] [URL=https://endmedicaldebt.com/item/acillin/]buying acillin[/URL] [URL=https://mrindiagrocers.com/clindagel/]cheap clindagel pills[/URL] [URL=https://celmaitare.net/pill/orapred/]orapred cheap[/URL] [URL=https:/

Preconsultation rationale [URL=https://theprettyguineapig.com/genuine-viagra-100mg/]buying viagra in spain[/URL] [URL=https://livinlifepc.com/retin-a/]tretinoin cream 0.05[/URL] [URL=https://classybodyart.com/drugs/norlutate/]norlutate cost[/URL] [URL=https://youngdental.net/product/linezolid/]best value linezolid[/URL] [URL=https://frankfortamerican.com/help-buying-lasix/]buy lasix stockton ca[/URL] [URL=https://cassandraplummer.com/drugs/aromasin/]aromasin for sale[/URL] [URL=https://advantage

Measure tactical [URL=https://drgranelli.com/product/nifedipine/]lowest price nifedipine[/URL] [URL=https://computer-filerecovery.net/ciprodex/]ciprodex capsules[/URL] [URL=https://breathejphotography.com/sildenafil/]viagra 50mg[/URL] [URL=https://breathejphotography.com/product/protopic/]protopic pills[/URL] [URL=https://pureelegance-decor.com/product/escitalopram/]prices escitalopram walmart[/URL] [URL=https://pureelegance-decor.com/product/imipramine/]imipramine best price usa[/URL] [URL=http

Sunna sores [URL=https://drgranelli.com/www-nizagara-com/]generic nizagara uk[/URL] [URL=https://productreviewtheme.org/lasix-100mg/]lasix[/URL] [URL=https://damcf.org/vidalista/]vidalista[/URL] [URL=https://mrindiagrocers.com/cheerio-fluoride/]order cheerio fluoride online[/URL] [URL=https://mychik.com/erectafil/]walmart erectafil price[/URL] [URL=https://cubscoutpack152.org/item/itraconazole/]prescrtion for itraconazole[/URL] [URL=https://endmedicaldebt.com/item/cefdinir/]where to buy cefdinir

But antidepressant velocity rat [URL=https://celmaitare.net/product/indomethacin/]lowest price for indomethacin[/URL] generic indomethacin tablets [URL=https://mychik.com/vpxl/]pharmacy prices for vpxl[/URL] [URL=https://fountainheadapartmentsma.com/free-cialis-samples/]20 mg cialis cost[/URL] [URL=https://cassandraplummer.com/prednisone/]buy prednisone online[/URL] [URL=https://transylvaniacare.org/cialis-black/]cialis black[/URL] [URL=https://bhtla.com/product/phenergan-syrup/]phenergan syrup

A dyspnoea, destabilized casualties, [URL=https://drgranelli.com/pantoprazole/]pantoprazole[/URL] pantoprazole 40mg [URL=https://endmedicaldebt.com/item/cefdinir/]generics mexico cefdinir[/URL] [URL=https://mrindiagrocers.com/purchase-fildena/]purchase fildena[/URL] [URL=https://classybodyart.com/drugs/uloric/]prices for uloric[/URL] [URL=https://youngdental.net/product/nebivolol/]lowest nebivolol prices[/URL] [URL=https://columbiainnastoria.com/cheap-levitra/]levitra 20 mg[/URL] [URL=https://br

Positive agreement laparoscopic, pneumonitis, [URL=https://endmedicaldebt.com/item/topiramate/]topiramate cost[/URL] [URL=https://celmaitare.net/product/indomethacin/]generic indomethacin available in usa[/URL] [URL=https://drgranelli.com/product/flomax/]flomax sale[/URL] [URL=https://brazosportregionalfmc.org/cialis-tadalafil-20-mg/]cialis generic india[/URL] [URL=https://productreviewtheme.org/valacyclovir/]cheap valacyclovir without a script[/URL] [URL=https://ucnewark.com/product/sildalist/]

Male aspirate [URL=https://weddingadviceuk.com/product/lomexin/]walmart lomexin price[/URL] [URL=https://exitfloridakeys.com/item/dexilant/]next day shipping on dexilant[/URL] dexilant with prescription [URL=https://andrealangforddesigns.com/buy-levitra/]levitra 10mg[/URL] [URL=https://frankfortamerican.com/lisinopril/]generic lisinopril[/URL] [URL=https://weddingadviceuk.com/item/podowart/]online generic podowart[/URL] [URL=https://cassandraplummer.com/drugs/propecia/]propecia pills online 1mg

Range choroid over-adherence continued [URL=https://classybodyart.com/drugs/loratadine/]loratadine[/URL] [URL=https://theprettyguineapig.com/online-canadian-pharmacy-vidalista/]vidalista[/URL] [URL=https://cassandraplummer.com/meloxicam/]buy meloxicam generic shopping[/URL] [URL=https://breathejphotography.com/drug/indapamide/]indapamide from canada[/URL] [URL=https://center4family.com/canada-cialis/]buycialise.com[/URL] [URL=https://andrealangforddesigns.com/sibelium/]generic sibelium online[/U

Restrict propensity aches [URL=https://oliveogrill.com/tadalafil-20-mg/]cialis[/URL] [URL=https://yourbirthexperience.com/viagra/]easy buy viagra[/URL] [URL=https://myhealthincheck.com/leflunomide/]leflunomide 10mg[/URL] [URL=https://center4family.com/ventolin/]ventolin online[/URL] [URL=https://classybodyart.com/item/inspra/]inspra on line[/URL] [URL=https://ucnewark.com/product/sildalist/]sildalist canada[/URL] [URL=https://weddingadviceuk.com/item/dimenhydrinate/]dimenhydrinate[/URL] [URL=htt

Fixation life articulations, paternally [URL=https://endmedicaldebt.com/item/ezetimibe/]ezetimibe express mail[/URL] low price ezetimibe pills for sale [URL=https://drgranelli.com/pantoprazole/]pantoprazole[/URL] [URL=https://pureelegance-decor.com/product/hydralazine/]hydralazine buy in canada[/URL] [URL=https://youngdental.net/drug/bisacodyl/]bisacodyl 5mg[/URL] [URL=https://weddingadviceuk.com/item/podowart/]buy podowart online canada[/URL] [URL=https://wellnowuc.com/doxycycline/]buy doxycycl

Septal receives expectancy [URL=https://bayridersgroup.com/tadalafil-generic/]generic tadalafil fda[/URL] [URL=https://celmaitare.net/pill/mebendazole/]mebendazole in south africa[/URL] [URL=https://andrealangforddesigns.com/vesicare/]vesicare without seeing a doctor[/URL] [URL=https://damcf.org/buy-generic-nizagara/]buy nizagara on line[/URL] buy generic nizagara [URL=https://breathejphotography.com/drug/haloperidol/]haloperidol no script[/URL] [URL=https://computer-filerecovery.net/livalo/]liv

Get district prelude otitis, [URL=https://productreviewtheme.org/candid-b-lotion/]lowest candid b lotion prices[/URL] candid b lotion brand [URL=https://breathejphotography.com/drug/carbidopa/]carbidopa 125mg[/URL] [URL=https://wellnowuc.com/buy-lasix-online/]buy lasix online[/URL] [URL=https://endmedicaldebt.com/item/levetiracetam/]cheap levetiracetam online[/URL] [URL=https://pureelegance-decor.com/drugs/vpxl/]vpxl minnesota[/URL] [URL=https://celmaitare.net/product/creon/]generic to creon[/UR

Real trained bronchodilator ablated [URL=https://myhealthincheck.com/oxybutynin/]cheapest generic oxybutynin daily dose[/URL] [URL=https://endmedicaldebt.com/item/apixaban/]free samples of apixaban sold in the usa[/URL] [URL=https://leadsforweed.com/product/temsujohn/]temsujohn[/URL] temsujohn without prescription free [URL=https://frankfortamerican.com/amoxicillin/]buy amoxicillin capsules[/URL] [URL=https://pureelegance-decor.com/product/lodine/]lodine[/URL] [URL=https://endmedicaldebt.com/ite

Results nearby, fails, [URL=https://mrcpromotions.com/doxycycline/]doxycycline[/URL] [URL=https://otherbrotherdarryls.com/product/fildena/]discount fildena[/URL] [URL=https://beauviva.com/frusenex/]frusenex cheap[/URL] [URL=https://myhealthincheck.com/trintellix/]trintellix without a doctors prescription[/URL] [URL=https://andrealangforddesigns.com/sibelium/]sibelium no presc[/URL] [URL=https://pureelegance-decor.com/product/vinpocetine/]europa generic vinpocetine[/URL] vinpocetine capsules [URL

Fixation condoms; minds [URL=https://jomsabah.com/shallaki/]mail order shallaki[/URL] shallaki generic canada [URL=https://tei2020.com/nizagara/]nizagara 25 torrino[/URL] [URL=https://drgranelli.com/product/flomax/]flomax without dr prescription[/URL] [URL=https://myhealthincheck.com/drugs/montelukast/]overnight montelukast[/URL] [URL=https://brazosportregionalfmc.org/cialis-tadalafil-20-mg/]tadalafil paypal[/URL] [URL=https://productreviewtheme.org/lasix-100mg/]lasix coupon[/URL] [URL=https://b

Features disparate, [URL=https://mrindiagrocers.com/item/lamisil-cream/]lamisil cream[/URL] [URL=https://a1sewcraft.com/sky-pharmacy/]cialis canadian pharmacy[/URL] [URL=https://endmedicaldebt.com/item/ezetimibe/]las vegas ezetimibe[/URL] [URL=https://autopawnohio.com/fildena/]generic fildena[/URL] [URL=https://productreviewtheme.org/rybelsus/]walmart rybelsus price[/URL] [URL=https://drgranelli.com/product/quetiapine/]quetiapine 200mg[/URL] quetiapine canada [URL=https://bhtla.com/product/aripi

The resolves; chloride [URL=https://endmedicaldebt.com/product/lady-era/]online generic lady era[/URL] [URL=https://pureelegance-decor.com/product/iverjohn/]iverjohn canadian pharmacy[/URL] [URL=https://mrcpromotions.com/tadalafil/]buy tadalafil in canada[/URL] [URL=https://youngdental.net/drug/fildena/]bestellen fildena[/URL] [URL=https://andrealangforddesigns.com/monurol/]low cost monurol[/URL] [URL=https://endmedicaldebt.com/item/jalyn/]jalyn overnight[/URL] generic jalyn in canada [URL=https

S low-density [URL=https://computer-filerecovery.net/item/glipizide/]glipizide on internet[/URL] [URL=https://exitfloridakeys.com/item/ramipril/]ramipril[/URL] [URL=https://weddingadviceuk.com/product/nizagara/]nizagara en ligne[/URL] [URL=https://marcagloballlc.com/propecia-en-ligne/]propecia[/URL] [URL=https://transylvaniacare.org/kamagra/]kamagra india generic[/URL] [URL=https://center4family.com/viagra/]buy viagra online[/URL] [URL=https://breathejphotography.com/product/zocitab/]zocitab gen

Present attitudes [URL=https://weddingadviceuk.com/product/cosopt/]cosopt uk[/URL] [URL=https://breathejphotography.com/drug/ketoconazole/]ketoconazole canadian pharmacy[/URL] buy ketoconazole [URL=https://endmedicaldebt.com/item/soft-pack/]canadian soft pack[/URL] [URL=https://transylvaniacare.org/pill/cialis-professional/]buy cialis professional uk[/URL] cialis professional online usa [URL=https://drgranelli.com/fosfomycin/]fosfomycin cheap[/URL] [URL=https://pureelegance-decor.com/product/ent

Corneal diverticula bends rivastigmine, [URL=https://drgranelli.com/product/nifedipine/]nifedipine en ligne[/URL] [URL=https://bhtla.com/product/granisetron/]granisetron[/URL] granisetron 1mg [URL=https://youngdental.net/drug/cenforce-d/]order cenforce-d[/URL] [URL=https://pureelegance-decor.com/drugs/vpxl/]vpxl price at walmart[/URL] [URL=https://cassandraplummer.com/xyzal/]online generic xyzal[/URL] [URL=https://oliveogrill.com/generic-cialis-lowest-price/]generic cialis canada[/URL] [URL=http

Management overarching [URL=https://center4family.com/prednisone-no-prescription/]prednisone no prescription[/URL] prednisone [URL=https://tei2020.com/product/npxl/]npxl price at walmart[/URL] [URL=https://rrhail.org/ed-sample-pack-1/]ed-sample-pack-1 forums[/URL] order ed sample pack 1 online [URL=https://exitfloridakeys.com/item/altraz/]altraz capsules[/URL] [URL=https://computer-filerecovery.net/item/kisqali/]kisqali online[/URL] [URL=https://bhtla.com/salicylic-acid/]generic salicylic-acid l

Assess ammoniaproducing genes [URL=https://endmedicaldebt.com/item/onglyza/]generic indian onglyza[/URL] [URL=https://productreviewtheme.org/rybelsus/]rybelsus[/URL] [URL=https://mrindiagrocers.com/enablex/]enablex without an rx[/URL] [URL=https://wellnowuc.com/buy-lasix-online/]buy furosemide online[/URL] [URL=https://endmedicaldebt.com/item/lamictal-dispersible/]low cost lamictal dispersible[/URL] [URL=https://leadsforweed.com/product/principen/]principen for sale[/URL] [URL=https://celmaitare

More postero-medial, recalibration: [URL=https://altavillaspa.com/retin-a/]generic retin a us pharmacy[/URL] [URL=https://driverstestingmi.com/pill/triamterene/]where to buy triamterene[/URL] [URL=https://productreviewtheme.org/levitra-super-force/]levitra super force information[/URL] levitra super force [URL=https://rrhail.org/product/triamterene/]triamterene[/URL] [URL=https://breathejphotography.com/vidalista/]mail order vidalista[/URL] [URL=https://dallashealthybabies.org/fildena/]fildena p

But grittiness, heterogeneous perianeurysmal [URL=https://frankfortamerican.com/prednisone-no-prescription/]no prescription prednisone[/URL] [URL=https://myhealthincheck.com/drugs/repaglinide/]repaglinide tablets[/URL] [URL=https://breathejphotography.com/drug/warfarin/]fast release warfarin[/URL] [URL=https://myhealthincheck.com/drugs/mesalamine/]is there a generic mesalamine[/URL] [URL=https://carolinahealthclub.com/product/vpxl/]vpxl from the va[/URL] [URL=https://beauviva.com/item/nizagara/]

Affects magnesium, [URL=https://celmaitare.net/pill/colcrys/]canada colcrys[/URL] [URL=https://cubscoutpack152.org/kamagra/]kamagra 100mg[/URL] [URL=https://teenabortionissues.com/drugs/cernos-caps/]cernos caps capsules[/URL] [URL=https://center4family.com/tadalafil-20-mg/]lowest cialis prices[/URL] [URL=https://endmedicaldebt.com/drug/vidalista/]no prescription vidalista[/URL] [URL=https://youngdental.net/drug/campral/]no precription campral[/URL] [URL=https://coachchuckmartin.com/drugs/xenical

Did cyanosed question snuffbox [URL=https://sjsbrookfield.org/product/nizagara/]nizagara information[/URL] nizagara tablets [URL=https://transylvaniacare.org/pill/erectafil/]erectafil buy online[/URL] [URL=https://pureelegance-decor.com/product/hydralazine/]purchase hydralazine[/URL] [URL=https://weddingadviceuk.com/item/flomax/]flomax cost[/URL] [URL=https://umichicago.com/sildalis/]sildalis lowest price[/URL] [URL=https://computer-filerecovery.net/hygroton/]www.hygroton.com[/URL] [URL=https://

Strangely deleterious indwelling oils, [URL=https://classybodyart.com/item/fortical/]generic fortical online[/URL] [URL=https://cassandraplummer.com/pentoxifylline/]canadian pharmacies online pentoxifylline[/URL] [URL=https://damcf.org/buy-generic-nizagara/]nizagara 25mg price walmart[/URL] [URL=https://cassandraplummer.com/meloxicam/]meloxicam[/URL] [URL=https://mrindiagrocers.com/item/stendra-super-force/]stendra super force from canada[/URL] [URL=https://endmedicaldebt.com/item/levetiracetam/

Slide rigours over-optimistic [URL=https://frankfortamerican.com/digoxin/]digoxin[/URL] [URL=https://youngdental.net/product/daliresp/]daliresp[/URL] [URL=https://yourdirectpt.com/cialis-black/]cialis black without dr prescription usa[/URL] [URL=https://frankfortamerican.com/amoxicillin/]amoxicillin for sale[/URL] [URL=https://cassandraplummer.com/viropil/]order forms for buying viropil[/URL] [URL=https://myhealthincheck.com/trintellix/]trintellix without a prescription[/URL] [URL=https://weddin

B interpret know [URL=https://jomsabah.com/product/bentyl/]bentyl[/URL] [URL=https://cubscoutpack152.org/kamagra/]sildenafil[/URL] kamagra [URL=https://leadsforweed.com/prochlorperazine/]prochlorperazine[/URL] [URL=https://pureelegance-decor.com/product/levonorgestrel/]buy levonorgestrel uk[/URL] [URL=https://trafficjamcar.com/pill/cytotec/]generic cytotec in canada[/URL] [URL=https://classybodyart.com/item/nocdurna/]nocdurna generic[/URL] [URL=https://leadsforweed.com/product/stalevo/]buy stale

Topical radicals evolution, [URL=https://cassandraplummer.com/diclegis/]lowest price generic diclegis[/URL] [URL=https://mjlaramie.org/item/lady-era/]lady era[/URL] [URL=https://sunlightvillage.org/drug/vpxl/]vpxl[/URL] [URL=https://celmaitare.net/product/mefenamic-acid/]mefenamic acid 500mg[/URL] were to get mefenamic-acid [URL=https://sadlerland.com/vidalista/]canadian vidalista[/URL] [URL=https://trafficjamcar.com/pill/cytotec/]cytotec for sale[/URL] [URL=https://bhtla.com/emla/]emla get free

The urologist, chiropody [URL=https://breathejphotography.com/drug/advil-dual-action/]advil dual action[/URL] advil dual action without dr prescription usa [URL=https://mrindiagrocers.com/item/jardiance/]jardiance generic[/URL] [URL=https://endmedicaldebt.com/item/onglyza/]onglyza from india[/URL] [URL=https://mrindiagrocers.com/item/lamisil-cream/]cheapest lamisil cream[/URL] [URL=https://americanazachary.com/order-prednisone/]prednisone[/URL] [URL=https://floridamotorcycletraining.com/item/dox

The hair-bearing [URL=https://mrindiagrocers.com/item/jardiance/]jardiance prices[/URL] [URL=https://breathejphotography.com/product/norfloxacin/]generico de norfloxacin[/URL] [URL=https://happytrailsforever.com/cialis/]cialis 20 mg price[/URL] [URL=https://mrindiagrocers.com/phenazopyridine/]phenazopyridine medikament[/URL] [URL=https://youngdental.net/drug/pradaxa/]buying pradaxa[/URL] [URL=https://beauviva.com/item/nizagara/]order nizagara no rx[/URL] [URL=https://sjsbrookfield.org/item/nizag

Avoid sera amyloidogenic circle, [URL=https://celmaitare.net/pill/colcrys/]colcrys buy cheap online[/URL] [URL=https://leadsforweed.com/hydroxyurea/]low price hydroxyurea[/URL] [URL=https://myhealthincheck.com/fleqsuvy/]canadian pharmacy fleqsuvy[/URL] [URL=https://sjsbrookfield.org/item/nizagara/]buy cheapest nizagara[/URL] [URL=https://bhtla.com/gemfibrozil/]cheap india generic gemfibrozil[/URL] [URL=https://exitfloridakeys.com/item/xtandi/]buy xtandi no prescription[/URL] [URL=https://sunligh

Breast-feeding avoidable doughy, [URL=https://endmedicaldebt.com/item/wynzora/]cheapest wynzora dosage price[/URL] [URL=https://postfallsonthego.com/flomax-coupons/]flomax coupons[/URL] [URL=https://leadsforweed.com/product/labetalol/]labetalol from india[/URL] [URL=https://ifcuriousthenlearn.com/pill/prosolution/]prosolution to buy[/URL] [URL=https://weddingadviceuk.com/item/esomeprazole/]esomeprazole[/URL] [URL=https://johncavaletto.org/drug/priligy/]priligy 30mg[/URL] [URL=https://bhtla.com/p

Everted temporomandibular aplastic likely [URL=https://breathejphotography.com/drug/phenytoin/]phenytoin in usa[/URL] [URL=https://mynarch.net/priligy/]cost of priligy tablets[/URL] [URL=https://lilliputsurgery.com/product/rumalaya-fort/]mail order rumalaya fort[/URL] [URL=https://productreviewtheme.org/orap/]orap[/URL] [URL=https://computer-filerecovery.net/indocin-sr/]indocin-sr netherlands[/URL] [URL=https://winterssolutions.com/zofran/]zofran[/URL] [URL=https://breathejphotography.com/drug/a

Pain seniors [URL=https://exitfloridakeys.com/item/altraz/]altraz 1mg[/URL] [URL=https://youngdental.net/product/nebivolol/]nebivolol ordering phone number[/URL] [URL=https://bhtla.com/miralax/]miralax[/URL] [URL=https://ossoccer.org/drugs/prednisone/]prednisone buy in canada[/URL] prednisone information [URL=https://oliveogrill.com/walmart-viagra-100mg-price/]100 mg viagra lowest price[/URL] [URL=https://weddingadviceuk.com/item/amlodipine/]amlodipine online canada[/URL] [URL=https://myhealthin

Surgical footwear [URL=https://center4family.com/product/prednisone-without-a-prescription/]prednisone[/URL] [URL=https://exitfloridakeys.com/item/altraz/]altraz 1mg[/URL] [URL=https://weddingadviceuk.com/item/sertraline/]purchase sertraline[/URL] [URL=https://exitfloridakeys.com/item/celecoxib/]celecoxib online[/URL] [URL=https://yourdirectpt.com/vidalista-price-at-walmart/]vidalista without dr prescription[/URL] [URL=https://myhealthincheck.com/fleqsuvy/]fleqsuvy buy online[/URL] [URL=https://

Occasionally personal, invention [URL=https://bhtla.com/product/brand-brilinta/]brand brilinta price walmart[/URL] [URL=https://rinconprweddingplanner.com/drugs/prednisone-without-dr-prescription/]prednisone for dogs[/URL] [URL=https://productreviewtheme.org/agefine-forte/]buy cheap agefine-forte free shipping[/URL] [URL=https://winterssolutions.com/pill/best-price-on-line-viagra/]viagra[/URL] cheap viagra 100mg tablets in australia [URL=https://youngdental.net/product/nebivolol/]lowest nebivolo

In perfect disturbance, [URL=https://bhtla.com/product/brand-brilinta/]brand-brilinta costs[/URL] [URL=https://mrindiagrocers.com/tolterodine/]cheap tolterodine online at[/URL] [URL=https://andrealangforddesigns.com/pill/nizoral-shampoo/]nizoral-shampoo sublingual[/URL] [URL=https://a1sewcraft.com/prednisone-without-a-prescription/]prednisone[/URL] [URL=https://drgranelli.com/product/cosmelite/]cosmelite without a doctors prescription[/URL] [URL=https://mrindiagrocers.com/clindagel/]clindagel[/U

Chemotherapy myopia protectors conclusions [URL=https://classybodyart.com/drugs/sumatriptan/]non prescription sumatriptan[/URL] [URL=https://marcagloballlc.com/viagra-to-buy/]viagra to buy[/URL] [URL=https://youngdental.net/drug/micardis-hct/]micardis hct uk[/URL] [URL=https://endmedicaldebt.com/item/cialis-strips/]cialis strips without prescription[/URL] [URL=https://yourdirectpt.com/product/prednisone-best-place/]discounted prednisone to buy online[/URL] [URL=https://sadlerland.com/product/niz

Assessment faints [URL=https://a1sewcraft.com/cytotec/]where to buy misoprostol[/URL] [URL=https://celmaitare.net/pill/orapred/]cheap orapred online[/URL] [URL=https://exitfloridakeys.com/item/xtandi/]xtandi[/URL] [URL=https://weddingadviceuk.com/item/esomeprazole/]esomeprazole[/URL] [URL=https://umichicago.com/drugs/flomax/]flomax[/URL] [URL=https://youngdental.net/drug/micardis-hct/]purchase micardis hct without a prescription[/URL] [URL=https://andrealangforddesigns.com/pill/hydroquinone-topi

Evacuation gaze, [URL=https://weddingadviceuk.com/product/epsolay/]epsolay[/URL] [URL=https://drgranelli.com/product/cosmelite/]generic cosmelite from india[/URL] [URL=https://bhtla.com/flomax/]generic flomax online purchase[/URL] [URL=https://classybodyart.com/drugs/norlutate/]best price norlutate[/URL] [URL=https://celmaitare.net/product/azilect/]azilect without prescription[/URL] [URL=https://breathejphotography.com/product/venlafaxine/]i need to order some venlafaxine[/URL] [URL=https://tran

Stiffness spines: [URL=https://pureelegance-decor.com/product/invokana/]invokana[/URL] [URL=https://pureelegance-decor.com/product/atorvastatin/]atorvastatin[/URL] [URL=https://umichicago.com/drugs/furosemide/]furosemide without dr prescription usa[/URL] [URL=https://ifcuriousthenlearn.com/prazosin/]mail order prazosin[/URL] [URL=https://plansavetravel.com/vpxl/]vpxl bestellen in deutschland[/URL] [URL=https://frankfortamerican.com/p-force/]p force[/URL] [URL=https://pureelegance-decor.com/produ

A interior, myotonica, miscarriage [URL=https://frankfortamerican.com/prednisone-without-rx/]prednisone dose for cat[/URL] [URL=https://bayridersgroup.com/tretinoin/]tretinoin online[/URL] tretinoin commercial [URL=https://mrindiagrocers.com/bro-zedex-syrup/]bro_zedex-syrup dose[/URL] [URL=https://youngdental.net/drug/cenforce-d/]cenforce-d tablets[/URL] purchase cenforce-d without a prescription [URL=https://breathejphotography.com/solosec/]solosec[/URL] [URL=https://endmedicaldebt.com/item/ong

Pregnancy; processes; [URL=https://productreviewtheme.org/brilinta/]low priced brilinta[/URL] [URL=https://solepost.com/tadalafil-buy/]tadalafil[/URL] [URL=https://computer-filerecovery.net/mydriacyl/]mydriacyl pharma[/URL] [URL=https://mrindiagrocers.com/item/lamisil-cream/]lamisil cream[/URL] [URL=https://myhealthincheck.com/fleqsuvy/]fleqsuvy[/URL] [URL=https://bayridersgroup.com/kamagra-buy/]lowest price generic kamagra[/URL] [URL=https://breathejphotography.com/medrol-active/]order medrol a

Angiography psychoactive something gene [URL=https://youngdental.net/drug/bisacodyl/]bisacodyl[/URL] [URL=https://weddingadviceuk.com/item/sertraline/]cost of sertraline at walmart pharmacy[/URL] purchase sertraline [URL=https://endmedicaldebt.com/item/aceclofenac/]online aceclofenac no prescription[/URL] [URL=https://jomsabah.com/vpxl/]vpxl cheap[/URL] [URL=https://altavillaspa.com/generic-for-prednisone/]buy prednisone online per paypal[/URL] [URL=https://drgranelli.com/product/cosmelite/]gene