Swissquote Broker Reviews and Full Information

What is Swissquote?

The beginning of the business began in the year 1990 with the creation of Marvel Communications SA, a company that specialized in web-based applications and financial software. Later on, the business model was changed to Swissquote with the launch of its first finance platform in 1996. It provided investors who are not a part of the financial system. It also offered real-time pricing all securities listed on the Swiss exchange in conjunction with the aim of open up banking to everyone.

Actually up to now, Swissquote is visited by 2 million times a month and is the largest financial site.

Swissquote Group Holding Ltd is the leading Swiss provider of online trading and financial services. The company is that is listed in the SIX Swiss Exchange and has its headquarters in Gland (VD) with offices in Zurich, Bern, Dubai, Malta, Hong Kong and London.

Are Swissquote a reliable broker?

For sure, the broker has a long name and a good reputation. Moreover, its trading terms as we'll discover inside Swissquote Review are quite competitive.

Through their milestones Swissquote acquisition of MIG Bank Ltd, one of the top Forex brokers in the world, also acts as an important strategic partner in conjunction with PostFinance as well as a variety of other major financial institutions, including Goldman Sachs, UBS, Commerzbank, Vontobel, etc.

Swissquote offers a variety of internet-based trading options however, the platform is user-friendly and offers options for eForex as well as ePrivate Bank as well as eMortgage and flexible savings accounts. Alongside a cost-effective service for private customers, Swissquote has also created specific services specifically for asset managers who are independent and corporate customers.

Swissquote Pros and Cons

Swissquote offers high-quality trading conditions, and is a authorized broker with worldwide acknowledgement and audit. There are many good platforms available in Swissquote offering, including MetaTrader without restrictions on strategies, prices are affordable and the learning materials are excellent for beginners. The options for funding are plentiful traders can take advantage of online banking with Swissquote Bank.

In contrast to the pros, the terms vary in every country and spreads may be higher for certain instruments, such as currency pairs.

10 Points Summary

| Headquarters | Switzerland |

| Regulation | FINMA, FCA, MFSA, SFC, DFSA |

| Platforms | MT4, MT5, eTrader Swiss DOTS |

| Instruments | Shares, Warrants and Derivatives, Options and Futures, Funds, ETFs, Indices, Forex, Commodities, Bonds and Cryptocurrencies |

| EUR/USD Spread | 1.7 pip |

| Demo Account | Available |

| Minimum deposit | 1,000 US$ |

| Base currencies | USD, EUR, GBP |

| Education | Research tools are provided. |

| Customer Support | 24/5 |

Awards

There are a variety of awards in the industry that acknowledge the hard work and achievements in Swissquote.

Additionally, the company actively participates in social service and provides support. Since the year 2015, Swissquote has been in an international relationship in a global partnership with Manchester United, one of the most well-known football teams around the world.

Is Swissquote secure or is it a scam?

Swissquote is regarded as a safe broker. The broker is monitored by a variety of top-of-the-line authorities like FCA in the UK, FINMA Switzerland, and so on.

Is Swissquote legit?

First, Swissquote Bank Ltd has a bank license granted by the supervisory authority , the Swiss Federal Financial Market Supervisory Authority (FINMA) and is an active affiliate of the Swiss Bankers Association.

Additionally, the world-wide branches are subsidiaries of Swissquote Bank and respectively authorized by the relevant national regulators.

So the trustworthy regulation from Switzerland as well as other authorities, establishing an unambiguous statement on the transparent and reliable operation Swissquote is able to perform.

| Swissquote entity | Regulation and License |

| Swissquote Group Holding Ltd | Authorized by FINMA (Switzerland) |

| Swissquote Ltd | Autorized through FCA (UK) to register number. 562170 |

| Swissquote MEA Ltd | Authorized by DFSA (Dubai) |

| Swissquote Asia Ltd | Authorized by SFC (Hong Kong) |

| Swissquote Financial Services (Malta) Ltd | Autorized through MFSA (Malta) the registration number. C 57936 |

How can you be protected?

In simple terms the strict supervision of the broker implies that every transaction that it performs is scrutinized and reported in detail. Additionally the bank and broker simultaneously are not just act in a fair manner towards clients as they could fine an entity in the event of breach, but they also are indemnifying and covering the risk of clients through various methods.

This is the primary reason each trader should think about only those who are licensed and regulated and not fall under offshore trading that isn't regulated by any guidance.

Leverage

Swissquote has on its website on its website a Standard Leverage rate at 1:100. But, as per the regulations for the specific entity, it falls within the requirements specific to it and therefore, the rates could alter, and the degree of professional trader or retail will always impact the rate, too.

- Thus, European clients entitled to use a maximum amount of 11:30 for the significant currency pairs and, in some cases, less for various instruments.

- Entities located in Dubai or Hong Kong may be eligible for a higher ratio of 1:200.

However, all traders should know how to leverage carefully, as higher rates can increase risk levels that could lead to losses of funds.

Types of accounts

It is possible to have Swissquote Four different types of trading account designed to meet the type of trader. They could be privately or business accounts. In this Swissquote review, we will discuss private or retail trading accounts for business account. You can find out more on their official site.

Also, for private accounts there are four trading accounts created for specific conditions or needs you may have. First is the Forex account. It provides a selection of multi-asset trading platforms like the MT4, MT5 and the advanced trader that allows you to trade CFDs and FX. The trading account offers the option to maximize your portfolio using stock trading, which includes more than 3 million products and more than 60 exchanges.

Account with Robo-Advisors can be described as an investment account that is revolutionary in its portfolio management, which Swissquote is famous for.

Finally, Crypto-Assets account can be used to exchange 12 cryptocurrency with very low costs. Naturally, the of the mentioned accounts are available in demo versions too, in order to learn and practice the software.

Trading Instruments

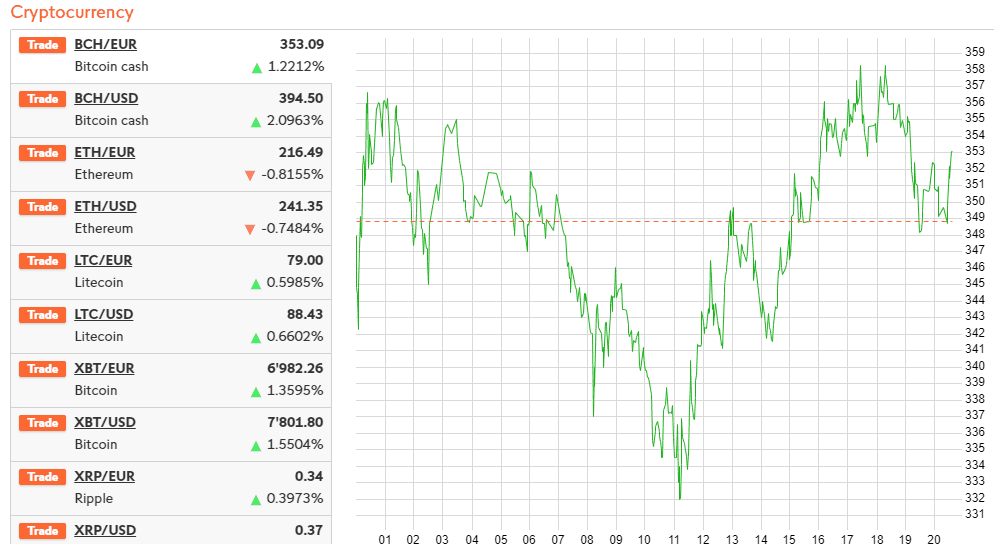

Beginning or experienced traders can find the best instruments to meet their optimal investment requirements, there are a variety of options to Shares as well as Warrants and Derivatives. Futures and Options funds, ETFs Indices Forex, Commodities, Bonds and Cryptocurrencies.

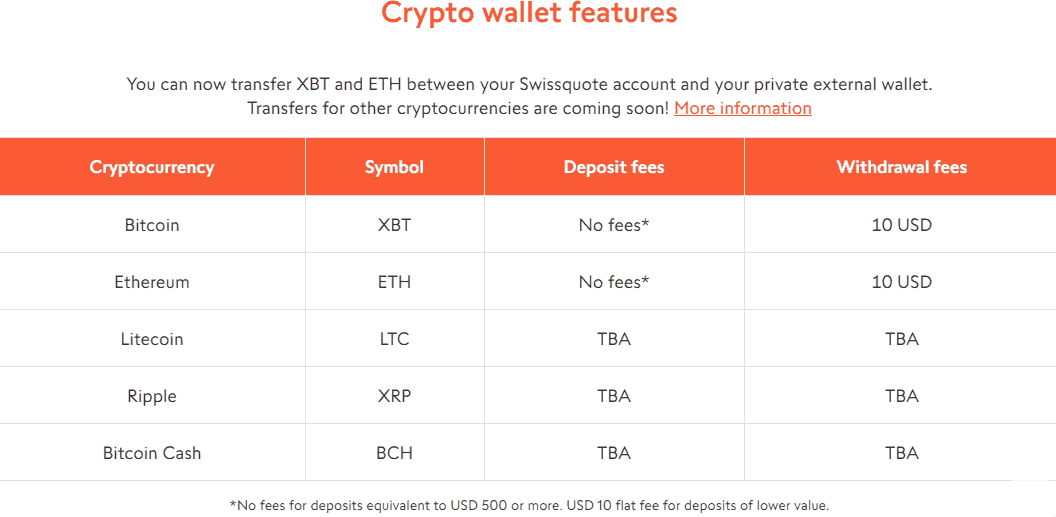

The attractive rates for ETFs, Funds, and Swiss DOTS begin at 9 pips, options and Futures starting at 1.5 CHF. The cryptocurrency market is quickly establishing its position as a market leading player that offers an infinite possibility to trade with five options available: Bitcoin, Ethereum, Litecoin, Ripple and Bitcoin Cash.

Fees

Swissquote fees for trading for every instrument varies based on the size of trading and trader's activity, but generally believed to be at the lower spread scale. The total swissquote fee is determined by spread, plus inactivity fees, funding fees , and swap fees. Look below for Swissquote fees comparison.

| Asset/ Pair | Swissquote Spread | CMC Markets Spread | Dukascopy Spread |

|---|---|---|---|

| EUR USD Spread | 1.7 pip | 0.7 pip | 0.2 pip |

| Crude Oil WTI Spread | 5 | 3 | 5 |

| Gold Spread | 28.6 | 3 | 30 pip |

| BTC/USD Spread | 1% | 0.75% | 60 |

Spreads

Spreads for Sqissquote are different for each account, and have their own fee structure, while costs can be built into an exchange-only basis, similar to when you trade Forex trading, or as an investment commission for stocks or investments.

E.g. when trading Cryptocurrencies in the amount equivalent to 5 - 10,000 CHF 1 fee are assessed in the event that the amount is greater than the limit of 0.75 percent fees, or just 0,5.

Below, you can see Swissquote typical trading charges for well-known instruments. In addition, you will see that the fees are actually averages for all brokers that are listed with each having its own distinct structure. It is also possible to examine the fees charged by Swissquote compared to an alternative Swiss brokerage Dukascopy.

| Fees | Swissquote charges | CMC Markets Fees | Dukascopy Fees |

|---|---|---|---|

| Deposit fee | No | No | No |

| Withdrawal fee | No | Yes | No |

| Inactivity Fee | Yes | Yes | Yes |

| Fee rating | Average | Low | Low |

Deposits and Withdrawals

Transfer of funds is a simple and fast procedure with Swissquote since the fund choices include the largest ones the Wire Transfer and Credit Card Deposits as well as China UnionPay. are now able to use recently introduced Crypto Wallets.

Minimum deposit

Swissquote the minimum amount of deposit is 1000 dollars for the Standard forex account. The amount can be higher based on the size of the trader, as well as the type of account that you make use of.

Swissquote minimal deposit in comparison to other brokers

| Swissquote | Most Other Brokers | |

| Minimum Deposit | $1000 | $500 |

Withdrawals

The withdrawals of Swissquote are processed by the unique Swissquote eBanking service which allow you to transfer or add funds, and manage accounts easily and efficiently. Being a Swiss bank, you can create your own Swissquote Card that comes with all the advantages to make payments and withdraw funds directly at the cash-machine.

The charges are based on the payment method used but generally speaking, Swissquote is not charged a a withdrawal or deposit fees or charge no account maintenance charges.

Trading Platforms

The Swissquote provides direct access to markets offered by the highly secure and robust platforms the company decided to offer. They are further separated into financial instruments on which the client trades on or the profile of an investor.

| Pros | Cons |

|---|---|

| Exclusive trading system Swiss DOTS user-friendly design and login | None |

| Price alerts | |

| The eTrader platform, the MT4 and and MT5 are also available | |

| Multilingual support | |

| Analysis of technical aspects | |

| Excellent mobile trading applications for trading |

Web-based trading

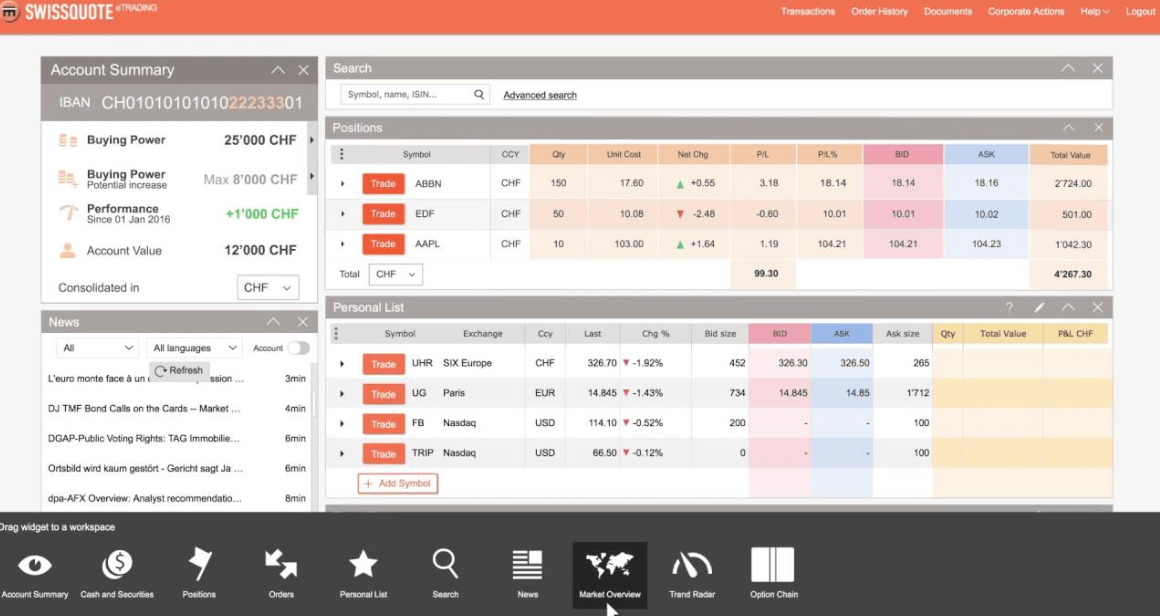

The choices are the eTrading platform, Swiss DOTS Themes Trading and mobile applications which means that you are capable of choosing and covering your specific requirements. The proposal is impressive. See below for general information and pick the most suitable option for you.

-- eTraderis an all-asset platform that is suitable for all traders. It allows to meet your goals using a simple and easy method. Widgets are available on the eTrading platform offer accounts overviews, ratings, and analysis as well as daily analysis using Trend Radar.

-- Swiss DOTS an exchange for derivatives that includes more than 90,000. OTC products. It offers competitive terms at 9.flat, with a variety of tools that are extensive

Desktop platform

In the download center, you can choose which platform that you require based on the settings on your device. Furthermore, Forex and CFDs trading are available through the platforms MT4 and MT5 too If you like the popular technology of Swissquote has you covered.

Mobile trading

Furthermore, free applications created for every device iPhone, Android, Smartwatch and even Apple TV, offering high-tech solutions. Different tools are connected to the platform exclusively for Swiss clients' access to trade via the virtual reality headset or by using MacOS TV or screensaver, and many more.

Robo trading

Another excellent Swissquote attribute is the autonomous investment process that requires a different glance. Without an emotional impression created and delivered by machines that provide exact results, increasing efficiency and time savings.

The robot-advisor acts as an online asset manager which creates an asset portfolio and monitors it round the all hours of the day.

The Robo-Advisors uses the same algorithm that was used to create the Swissquote Quant Fund, which won the Lipper Fund Award for the highest performance in three years in 2016.

Customer Support

Another great feature of our Swissquote review is the expert customer support that is available round all hours via live chat, telephone lines, or email. Customer service is defined by location, which includes hours of availability and hotlines it is a organized system that allows traders to be in contact.

Education

Through the Swissquote education center, you will have access to detailed and professionally designed educational materials that include important elements, analysis classes, webinars, and ebooks. Furthermore there is of course, Dem accounts are accessible with a powerful technical and analytical analysis that is built into the platforms along with price and news feed alerts.

Conclusion

In the end, Swissquote review sees a firm with a solid foundation in accordance with Switzerland the strict laws of finance. and also, the broker is not required to have licenses and adheres to strict rules in every global jurisdiction. If you are a trader who requires an all-asset option, Swissquote bank is a great choice, as it has access to many exchange-traded options. The technological solution offered by the firm is impressivetoo as well. In addition to that, traders of all kinds is able to benefit from top online bank solutions to meet your needs and needs. Alongside education materials as well as worldwide support offices and secure offers all worthy of consideration.

| Properties | Values |

|---|---|

|

Name

|

Swissquote |

|

Minimum Diposit

|

$ $1000 |

|

Leverage

|

1:100 | 1:30 |

|

Regulation

|

,,,DFSA (Denmark),FSA(SC) (Seychelles),FSCA (South Africa),DFSA (United Arab Emirates),FCA (United Kingdom),,,, |

|

Headquarters

|

Switzerland |

|

Established

|

1996 |

|

Address

|

Swissquote Bank SA Ch. de la Crétaux 33 P.O. Box 319, Gland, 1196, Switzerland |

|

Platform

|

MT4,MT5,MT4 WebTerminal,MT5 WebTerminal,, |

|

Payment Method

|

Visa,Mastercard,Wire,, |

| Properties | Values |

|---|---|

|

Spreads

|

1.7 pips |

|

Min Position size

|

0.01 |

|

Broker Type

|

MM ( Market Maker),,,,, |

|

Account Type

|

Cent account,Mini account,High Leverage,Islamic account,Standard,, |

|

Brokers by Country

|

Switzerland Forex Brokers,, |

|

Techniques

|

Hedging Forex Brokers,Carry Trade Brokers,Spread Betting Brokers,Automated Trading Brokers,Mobile Trading Brokers,, |

|

Instruments

|

Forex Trading Brokers,Futures Trading Brokers,Gold Trading Brokers,CFD Trading Brokers,Crypto Trading Brokers,Stock Trading Broke,Oil Trading Brokers,Commodity Forex Brokers,Metal Trading Brokers,Indexes Trading Brokers,, |

|

Account currency

|

USD,EUR,GBP,AUD,CAD,XAU,JPY,NZD,XAG,BTC,,USD, |

|

Tools

|

Economic Calendar,Charting Software,, |

|

Website Languages

|

en,, |

|

Support languages

|

en,, |

|

Bonus

|

Yes |

|

Reviews Rating

|

3.5 |

|

Withdrawal Fee

|

No |

|

Trading Signals

|

Yes |

|

Free Education

|

Yes |

|

Daily News

|

Yes |

|

Demo account

|

Yes |

|

Swapsr

|

Yes |

|

Pors

|

1. Proprietary trading platform Swiss DOTS User friendly design and login 2. Price alerts 3. eTrader, MT4, MT5 offered too 4. Supporting many languages 5. Technical analysis 6. Great mobile trading apps |

|

Cors

|

1. None |

|

Display Analysis

|

Yes |

|

Serving country

|

CN,HK,SG,CH,AE,GB,, |

|

Not Serving country

|

US,, |

|

Contests

|

Yes |

|

Market analysis

|

Yes |

|

Copy Trading Brokers

|

Yes |

|

Bitcoin Forex Brokers

|

Yes |

|

Social trading

|

Yes |

|

Web trading

|

Yes |

|

Forex pairs

|

Yes |

|

CFDs

|

Yes |

|

Crypto

|

Yes |

|

Hedging

|

Yes |

|

PAMM

|

MAMM,Myfxbook Auto trade,Mql5 signals,, |

|

Mobile Trading

|

Yes |

|

Scalping

|

Yes |

|

Automated Trading

|

Yes |

|

Partnership Programs

|

Yes |

|

Free Phone

|

+41 44 825 88 88 |

|

Customer Support

|

24/5 |

Exness Broker reviews & comments (0)

Add a review

Your email address will not be published. Required fields are marked *