Scandinavian Capital Markets Broker Reviews and Full Information

What exactly is Scandinavian Capital Markets?

Scandinavian Capital Markets is an pure ECN brokerage that utilizes the STP for execution and offers a secure trade environment for the Swedish market, thanks to its headquarters at Stockholm and further.

The broker has been operating since the year 2011 and has been rated a Premier Broker with customized price feeds for liquidity, customised pricing, and general flexibility in trades. Scandinavian Capital Markets offers access to Forex exchange and more than 50 currency pairs, all connected via Equinix NY4 Center resulting in its robust global infrastructure.

Scandinavian Capital Markets Pros and Cons

Scandinavian Capital Markets account opening is straightforward trading conditions are based on high-tech equipment, while spreads are standard.

From a negative perspective On the negative side, there's no great instrument range and education could be restricted.

10 Points Summary

| Headquarters | Sweden |

| Regulation | Swedish FSA |

| Instruments | Gain access to Forex exchange and more than 50 currency pairs |

| Platforms | Currenex, cTrader, MT4 |

| Minimum deposit | 10,000 US$ |

| Spread EUR/USD | 1.7 pip |

| Base currencies | USD GBP, EUR, SEK |

| Demo Account | Available |

| Education | Daily news and regular webinars |

| Customer Support | 24/5 |

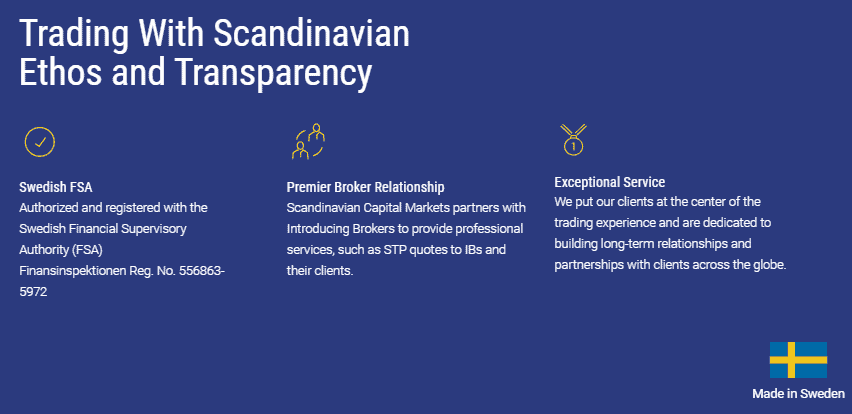

Are Scandinavian Capital Markets safe or an enigma

It's not true, Scandinavian Capital Markets is not a fraud but a licensed broker that has low risk.

As an Sweden financial investment company , they operate from Stockholm will also follow all required legal procedures to ensure safe trading conditions. The body that supervises and regulates trading companies within Sweden is called the Swedish Financial Supervisory Authority or Finansinspektionen. Thus, Scandinavian Capital Markets is also as per the above conditionsand is fully conforming with European ESMA regulation as well as MiFID directive.

Thus, when investing or trading in Scandinavian Capital Markets there are implemented guarantees of transparency in transactions in which no conflicts of interest arise due to their technological base. Alongside the fact that it is authorized and its authorization, there are various rules that govern the treatment of the customer as well as how his funds are managed and stored and managed, which is not the case with an offshore business .

In addition, European regulation , it also grants cross-boarding legal status and permits brokers to join into a compensation plan in the event of insolvency.

Leverage

As being a European Broker Scandinavian Capital markets therefore must adhere to the regulations that have recently decreased the leverage limits due to the risk involved. Although retail traders are able to access an maximum of 1:30 leverage on major currency pair and lower on other currencies, professionals, when their status is confirmed can use the leverage ratio of 1:100.

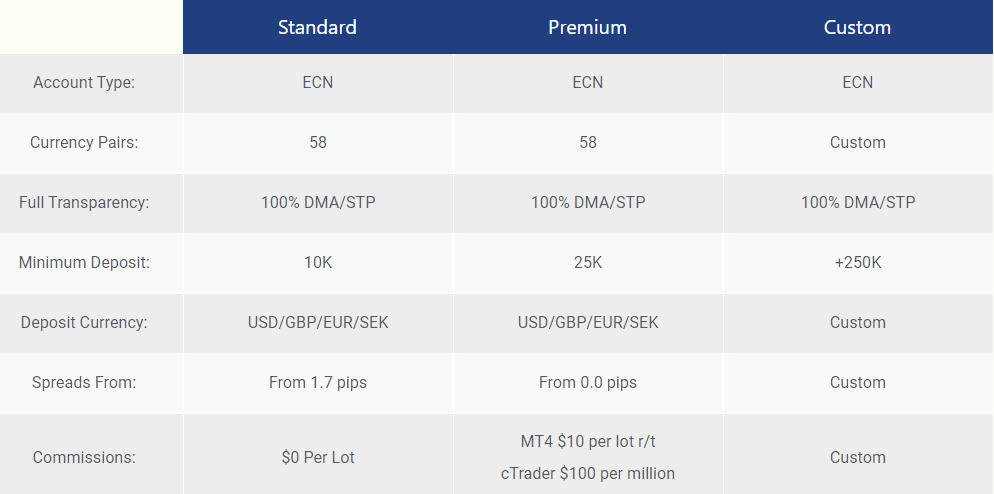

Accounts

Scandinavian Capital Markets provides traders with a selection of top account options that are defined by the size of trading that is operated which, in turn, provides better conditions for high-end traders. There are three types of accounts that are featuring a very affordable price that are based on raw spread as well as commissions. However, the Standard account gives the best conditions and all charges included in a spread.

Additionally, the Custom account option for large or institutional traders will provide the conditions to be 100% customized for traders who maintain more than 250 dollars as a starting amount. Additionally, you can look at fees with another well-known broker RoboForex to ensure that the terms are more clear based on the specific requirements of your.

It is actually at the start, or a skilled professional can find the correct conditions to submit for Scandinavian Markets, along with Islamic traders who have the ability to open a accounts with no swaps also known as Islamic account.

Fees

Fees are determined according to the type of account you'd like to use and can be determined by the spread or commission charges. You should also consider additional fees, check out the fee tables below.

| Fees | Scandinavian Capital Markets Fees | Goldwell Capital Fee | Lirunex Spread |

|---|---|---|---|

| Deposit Fee | No | No | No |

| Fees for withdrawal | No | No | No |

| Inactivity Fee | Yes | Yes | Yes |

| Fee rating | Average | Average | Average |

Spreads

Scandinavian Capital Markets spreads obviously depend on the type of account you are using. Standard spreads start at 1.7 pip, while Premium account is built on an interbank spread, with the commission rate of 10dollars per lot on MT4 platforms or 100$/million of trades using the cTrader.

| Asset | Scandinavian Capital Markets Spread | Goldwell Capital | Spread of Lirunex |

|---|---|---|---|

| EUR USD Spread | 1.7 pip | 1.8 pip | 1.5 pips |

| Crude Oil WTI Spread | 4 | 4 | 4 |

| Gold Spread | 50 cents | 50 cents | 50 cents |

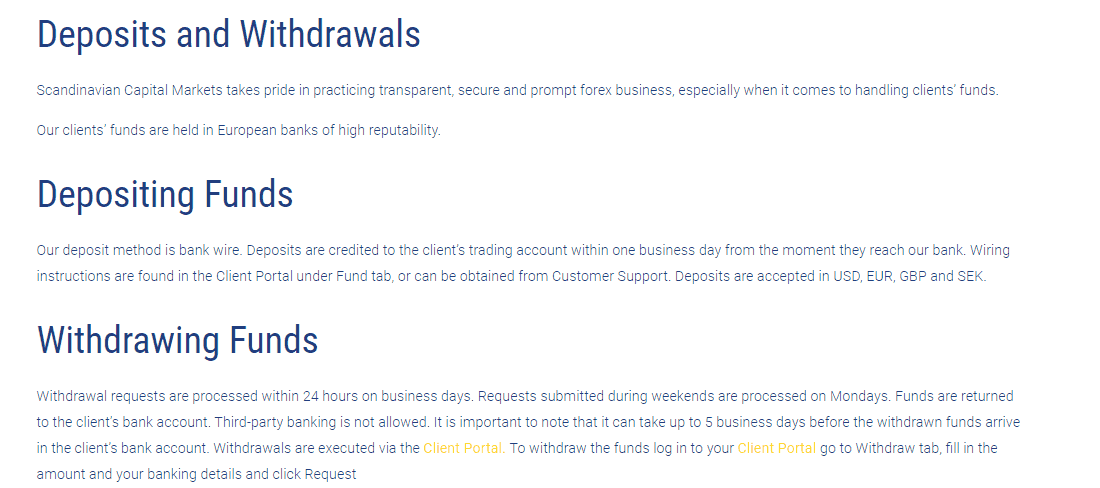

Deposits and withdrawals

The final point in this review Scandinavian Capital Markets Review is the methods of funding or how you can transfer money from or to the account you use for trading. In the end, Scandinavian Capital Markets utilizes only deposits through Bank wirewhich might appear to be a restriction, but it is the most sensible and secure method of sending money.

Scandinavian Capital Markets minimum deposit

Scandinavian Capital Markets minimum deposit is 10k$ however, higher grade accounts will require larger amounts. In reality, this amount could be prohibitive for beginners however, when you consider Scandinavian Capital Markets trading offering and its professional character, the broker is still an ideal choice for active traders.

Scandinavian Capital Markets minimum deposit in comparison to other brokers

| Scandinavian Capital Markets | Many Other Brokers | |

| Minimum Deposit | $10,000 | $500 |

Scandinavian Capital Markets withdrawal

Scandinavian Capital Markets withdrawal process requires quick processing and doesn't waive any additional commissions on withdrawals or deposits. Yet, your bank or specific conditions for your particular jurisdiction could charge fees to your bank, but these fees remain yours for the taking.

Trading Platforms

Scandinavian Capital Markets trading technology delivers unparalleled performance and is and is complemented by a wide range of exchange platforms. The technology platform provides custom liquidity for institutional, retail or professional trades, and the capability to customize an option and define its ability to adapt.

In terms of trading platforms itself you can choose between reputable software such as cTrader, Currenex and an industry standard the MT4.

Each platform uses advanced trading technologies and is an all-inclusive software that includes trading activities, risk management and complete settlement options.

Therefore, it's purely dependent on your preferences and your personal preference what platform you would like to use without restrictions or the ability to hedge. It is also important to remember that Scandinavian Capital Markets gives access to automated trading and API connectivity to the Myfxbook tool that allows for seamless replication of positions.

Another significant aspect that is a significant part of Scandinavian Capital Markets offering is the solution to money managers using the MAM account and offering that is specifically designed for traders who are institutional.

Education

While we'll discuss Scandinavian Capital Markets trading conditions and software in greater detail and also, the broker offers the information needed for successful trading. They provide the latest news and events, weekly webinars, and extremely flexible customer service that Scandinavian Markets is quite regarded as having.

Conclusion

In the end, Scandinavian Capital Markets is completely in compliance with all regulations and laws. Conditions for trading may be an ideal choice for traders who are experienced or active traders due to a large minimum deposit. Furthermore, the broker's trading software provides advanced platforms and tools which are also essential and appropriate for high-end professional trading for institutional or fund managers. However, with its training material provided by Scandinavian Capital Markets you may enroll to continue the development of the strategy you use.

| Properties | Values |

|---|---|

|

Name

|

Scandinavian Capital Markets |

|

Minimum Diposit

|

$ 10,000 |

|

Leverage

|

100:1 |

|

Regulation

|

FSA (Sweden),,, |

|

Headquarters

|

Sweden |

|

Established

|

2011 |

|

Address

|

Kistagangen 16 164 40 Kista Stockholm, Sweden |

|

Platform

|

MT4,cTrader,,, |

|

Payment Method

|

Wire,,, |

| Properties | Values |

|---|---|

|

Spreads

|

1.7 pips |

|

Min Position size

|

0.01 |

|

Broker Type

|

ECN (electronic communications networks),, |

|

Account Type

|

Mini account,Scalping,Islamic account,Standard,,, |

|

Brokers by Country

|

European Union Brokers,,, |

|

Techniques

|

Scalping Forex Brokers,Hedging Forex Brokers,Automated Trading Brokers,Mobile Trading Brokers,,, |

|

Instruments

|

Forex Trading Brokers,Gold Trading Brokers,CFD Trading Brokers,Metal Trading Brokers,,, |

|

Account currency

|

USD,EUR,GBP,AUD,CAD,JPY,XAG,,USD,,USD, |

|

Tools

|

Charting Software,,, |

|

Website Languages

|

en,,, |

|

Support languages

|

en,,, |

|

Bonus

|

Yes |

|

Reviews Rating

|

3.5 |

|

Withdrawal Fee

|

Yes |

|

Trading Signals

|

Yes |

|

Free Education

|

Yes |

|

Daily News

|

Yes |

|

Demo account

|

Yes |

|

Swapsr

|

Yes |

|

Pors

|

1. Scandinavian Capital Markets account opening is straightforward trading conditions are based on high-tech equipment, while spreads are standard. |

|

Cors

|

1. No Mt5 |

|

Display Analysis

|

Yes |

|

Serving country

|

SE,,, |

|

Not Serving country

|

CU,IR,KP,SY,US,YE,,, |

|

Contests

|

Yes |

|

Market analysis

|

Yes |

|

Copy Trading Brokers

|

No |

|

Bitcoin Forex Brokers

|

No |

|

Social trading

|

No |

|

Web trading

|

Yes |

|

Forex pairs

|

Yes |

|

CFDs

|

Yes |

|

Crypto

|

No |

|

Hedging

|

Yes |

|

PAMM

|

PAMM,MAMM,Zulu trade,Myfxbook Auto trade,,, |

|

Mobile Trading

|

No |

|

Scalping

|

Yes |

|

Automated Trading

|

Yes |

|

Partnership Programs

|

Yes |

|

Free Phone

|

+ 46 8 559 26 151 |

|

Customer Support

|

24/5 |

Exness Broker reviews & comments (0)

Add a review

Your email address will not be published. Required fields are marked *