Saxo Bank Broker Reviews and Full Information

What is Saxo Bank?

The Saxo Group spans the globe with a solid unified global web of relationshipsthrough the local and regional sales local organizations, the company to service customers in around 180 different countries.

It is the Saxo Group is a multi-asset financial and trading organization with more than 25 years of Fintech innovation and is an fully licensed and regulated European banking institution under the supervision of the Danish FSA. The head office is in Copenhagen as well as an entity that operates in various financial centers across the world , including London, Paris, Zurich, Dubai, Singapore, Shanghai, Sydney, Hong Kong and Tokyo.

Firstly Bank was introduced as Midas in the beginning, but later changed its name to Saxo Bank A/S when the European Union Directive has been accepted (back in 1996). Additionally, Saxo Bank became the first broker in Denmark that was approved in accordance with this directive.

Does Saxo Bank a market maker?

Saxo services are created to serve both institutional and private clients to provide a range of investments and trading solutions. Saxo banks is one of the huge in its field having greater than 15 million dollars in AUM, more than 1 million daily transactions , and is a trusted partner for 300+ brokers, banks and financial service providers that offer an extensive range of types and kinds of instruments. As an official Market Maker Saxo Bank establishes an extensive presence in the world of finance in addition to acting as a liquidity service.

Saxo Bank Pros and Cons

Saxo Bank is considered very solid and reliable because of its regulatory status and bank license in Europe and additional transparency. The trading conditions are excellent and the variety of instruments offered is vast that includes options, Futures, Bond, Forex and CFD instruments. These instruments are available through well-designed trading platforms and software. Spreads and costs are low and reasonable as well as account opening quick and easy and supported by a high-quality customer service.

However, if the it is possible that the minimum deposit could not be appropriate for new traders, as well the deposit fee could be applicable according to your bank.

10 Points Summary

| Headquarters | Copenhagen |

| Regulation | Danish FSA, ASIC, JFSA, MAS, FCA, FSC |

| Minimum deposit | 10,000$ |

| Platforms | Proprietary Web-based trading platform SaxoTraderGO and desktop SaxoTraderPRO |

| Instruments | CFDs, stocks, FX ETFs, Futures Mutual funds, Options and Bonds |

| Demo Account | 20 Day Free Demo account |

| Base currencies | Various currencies supported |

| EUR/USD Spread | 0.8 Pips |

| Education | No education courses |

| Customer Support | 24/5 |

Awards

All in all, the company profile has positive reviews along with operational score in addition to the many clients they service and gained an excellent reputation over the years. Although the company always displays the most impressive outcomes in its work, along with international recognition.

Are Saxo Bank safe or a fraud?

Absolutely, Saxo Bank is secure. It is a multi-regulated broker that operates under bank license. It is regarded as low risk trader. Forex and CFDs in conjunction with Saxo Bank.

Are Saxo Bank legit?

Saxo Bank A/S is definitely an established broker, since it is incorporated into Denmark company and it is a a fully authorized European bank (license number. 1149). The company also operates its services under supervision and control of the Danish Financial Supervisory Authority (FSA).

Thus, Saxo Bank operations are carried out as an EU-regulated investment and banking firm which is subject to the supervision of the EU and has all the laws, regulations, and guidelines to ensure complete compliance and protection of customers.

In addition to the main authorization, Saxo bank is subject to operate under a variety of global institutions due to its global presence that includes Singapore, Dubai, Hong Kong and more.

How can you be protected?

Additionally, Saxo Bank A/S is subject to strict financial reporting requirements as per EU directives and guidelines regarding handling of client accounts. In this regard, Saxo Bank is a respected member of the Danish Guarantee Fund for Depositors and Investors that will guarantee clients deposit accounts the amount of EUR 100,000 money in case of bankruptcy.

| Saxo Bank entity | Regulation and License |

| Saxo Bank A/S | Autorized through Danish FSA License number. 1149 |

| Saxo Capital Markets UK Limited | The Authorized Financial Conduct Authority (United Kingdom) registration no. 551422 |

| Saxo Capital Markets Pte. Ltd. Singapore | Autorized through the MAS (Singapore) registration number. 200601141M |

| Saxo Bank A/S - DIFC Representative Office | Authorized by the U.A.E. Central Bank registration no. 2017/995/13 |

| Autorized through DFSA (Dubai) registration number. CL2637 | |

| Saxo Bank FX K.K. | Anuthorized through FSA (Japan) registration number. 239 |

| Saxo Capital Markets Hong Kong Ltd | Autorized to be registered by SFC (Hong Hong)registration no. 1395901 |

| Saxo Capital Markets (Australia) Pty. Ltd | Autorized to be registered by ASIC (Australia)registration number. 126 373 859 |

Leverage

Alongside investments There are also instruments that allow leverage trading. However, the maximum permitted leverage is set by the regulators of each geographical region, in addition to the established levels set by the trader themselves.

In the end, Saxo Bank leverage comes at a maximum of 1:100 for Forex instruments in various locations, as the bank doesn't accept high risk trade strategies for traders that are good. The truth is that high leverage can increase the risk so the leverage levels are set at reasonable levels.

The headquarters is Saxo Bank which deploys regulated brokerage activities recently revised the limits to leverage, so make sure to confirm the terms in accordance with the company and the location of your residence.

- European clients can benefit from 30:1 leverage for Forex instrument,

- Dubai as well as UAE traders can claim the maximum amount of 1:200

- Australian clients subject to ASIC regulation could still be subject to leverage of 400:1.

Types of accounts

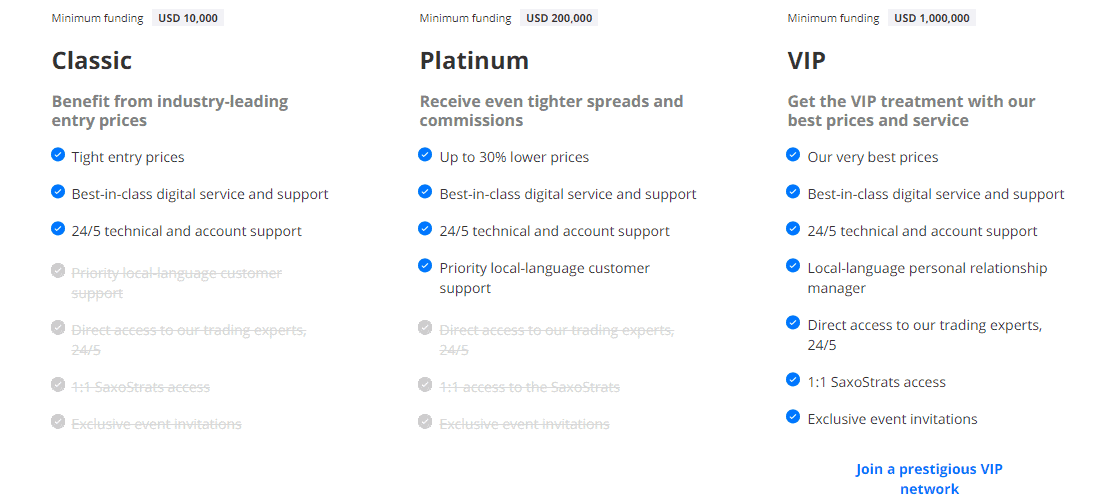

Saxo Bank offers three accounts that are available regardless of how much trade the client makes each one of which has the same capabilities in terms of technology and support for companies.

The differences between them differ in the pricing options and the level of customer support provided by the business, such as extensive research and news capabilities as well as preferential customer support. Furthermore the bonus provided from the institution is incorporated in the interest rates, and is a component of the services offered to Premium clients and over.

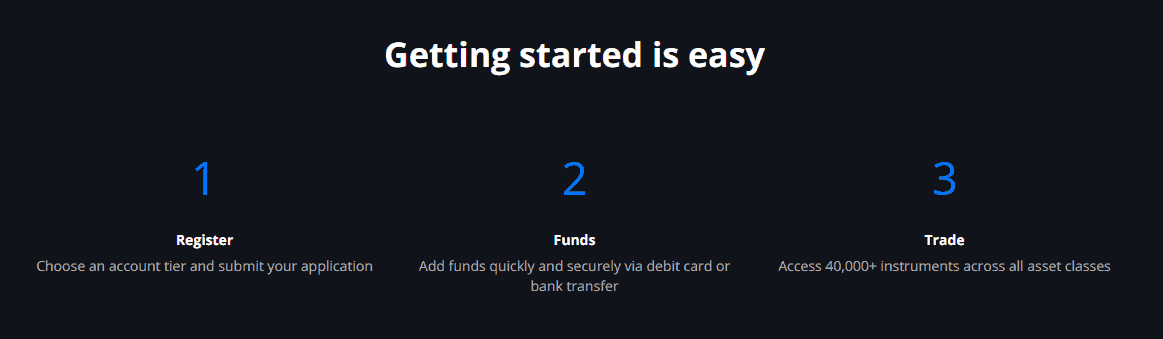

The novice traders will profit of Saxo Bank's offer to new traders. Saxo Bank offer to try out different strategies in the market and get yourself with their platform prior to trading in real time. In addition, the free 20-day demonstration of their platform with an account that is simulated to 100,000$ to test your skills is open to everyone.

How do you open your account?

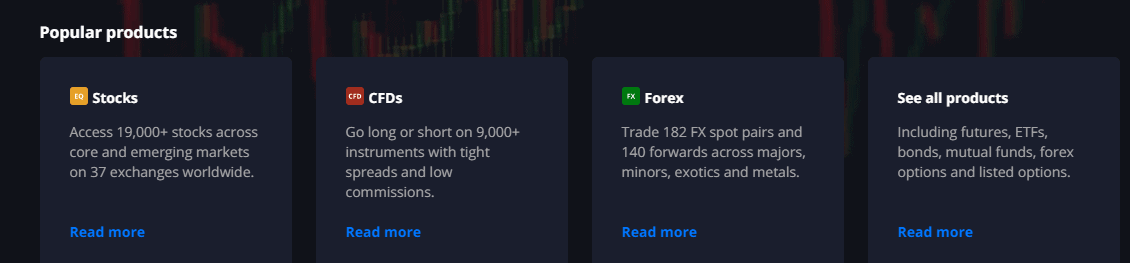

Instruments

The products offered by the Saxo Bank include a truly vast array of markets that you can trade, including CFDs, FXs ETFs, Stocks and Options, Futures, Mutual fund as well as bonds. This is a wonderful and huge proposal for every size trader who wants to get the instrument you'd like to trade with competitive prices.

Fees

A deeper look at the Saxo Bank pricing on its many more than 40'000plus instruments in its portfolio . These are all accessible through the multi-currency account that is one single cross-margin based on the instrument that you choose to trade. We rate Saxo fees as being low and average, but also think of the fact that they charge less than full fees, including financing and other fees in comparison with competitors.

| Fees | Saxo Bank Fees | BDSwiss Fees | AvaTrade Fees |

|---|---|---|---|

| Deposit Fee | Yes | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity Fee | Yes | Yes | Yes |

| Fee rating | Low | Average | Average |

Spreads

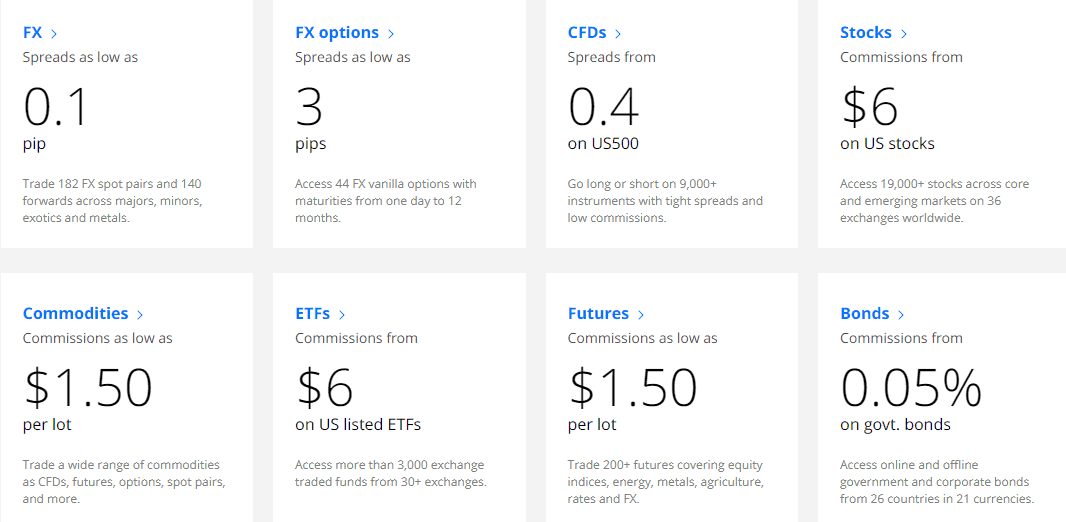

Saxo Bank traders can benefit from the tight spreads and low commissions by obtaining real-time quotes for currency pairs as well as various other assets, e.g. USD/EUR at 0.1 pip, US 500 at 0.4 points and US Stocks starting from 6USD.

In addition to extremely affordable prices that we discovered through the Saxo Bank Review because the broker is among the largest liquidity providers, which means that they can offer quick and low quotes. the larger account displays spreads that start at 0 pips.

It is also possible to compare Saxo Bank trading fees to another well-known broker known as Rakuten Securities in addition, look at the comparison below.

Commission

It is specified by the instrument that price model is used, alike trading of Commodities, Options, Mutual Funds ETFs Futures and Bonds are charged commissions. So for detailed terms, make sure to check on the website of Saxo Bank, which has complete pricing is provided and defined in accordance with the type of account that you sign up for. However, commissions are very pleasant in Saxo Bank as well, as are the similar listed US ETFs are priced at 3$ 3$, Futures 1.25dollars per lot and Bonds are available for 0.05 percent the govt.

Trading Fees of Saxo Bank vs Similar Brokers

| Asset/ Pair | Saxo Bank Spread | BDSwiss Spread | AvaTrade Spread |

|---|---|---|---|

| EURUSD Spread | 0.8 Pips | 1.5 pips | 1.3 pip |

| Crude Oil WTI Spread | 5 | 6 | 3 |

| Gold Spread | 27 | 25 | 40 |

Deposits and Withdrawals

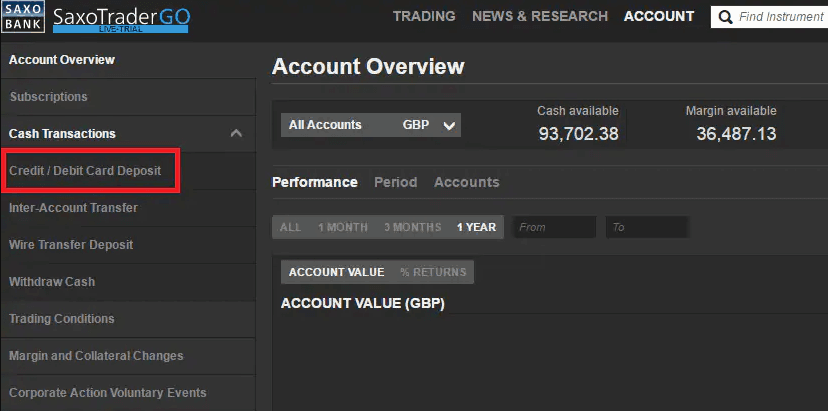

The withdrawals or deposits of Saxo Bank only accept money that comes from the bank account or an account by a licensed financial institution. Saxo Bank does not accept third Party Payouts or Bankers Drafts. Check cash deposits or remittances through Exchange houses.

Deposits

Additionally, Debit & Credit card transactions can be subjected to the deposit fee paid by the operator of the card (Visa MasterCard) that can range between 0.50 percent to 2.83 percent, based on the currency used for transaction.

Is there a minimum amount of deposit for Saxo Bank?

Saxo Bank minimum deposits and the smallest amount is 10,000dollars for a Classic Account in addition to the above, there are additional restrictions on transactions with funds that could be enforced due to the conditions of the payment provider.

Higher types of accounts will need more funds at the beginning and 200k$ for Platinum accounts and 1 million dollars for VIP accounts This leaves Saxo Bank as truly broker that is suited to professionals and larger size traders.

Saxo Bank minimum deposit in comparison to other brokers

| Saxo Bank | Most Other Brokers | |

| Minimum Deposit | $10,000 | $500 |

Withdrawal

Saxo's options for bank withdrawals are well-organized, they are by far the most frequently used. Bank Wire is available, and also card payment. In the case of withdrawals, you will find no charges to be paid for withdrawals made through the online cash withdrawal Module.

Trading Platforms

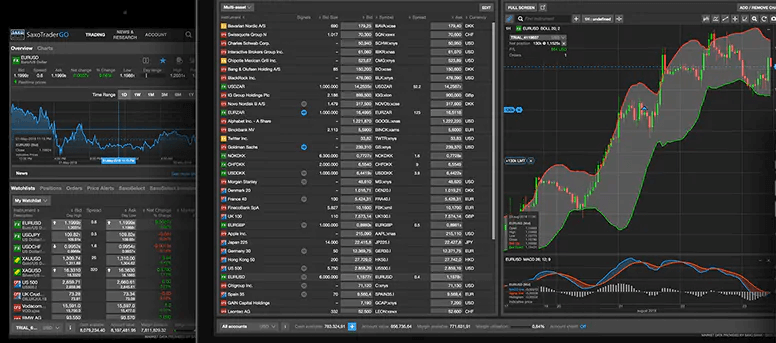

Saxo Bank trading platforms are Saxo Bank trading platforms are specifically designed with a thorough appreciation of the significance in the combination of a simple interface and the ability to perform powerful tasks.

If the client is a seasoned trader seeking speed and flexibility or an investor that requires an easy platform to use on the move, Saxo Bank can provide this solution in two forms of its software: SaxoTraderGo as well as SaxoTraderPRO.

| Pros | Cons |

|---|---|

| Proprietary Web-based trading platform SaxoTraderGO and desktop SaxoTraderPRO | No MT4 or another industry-wide software |

| Design and layout that is user-friendly, as well as login | |

| Price alerts | |

| A wide range of advanced tools and trading strategies | |

| Multilingual support |

Web Platform

SaxoTraderGO is the preferred choice for most investors and traders and is an easy to use yet powerful platform that is awarded for its efficiency. Reliable, fast and accessible across all gadgets, SaxoTraderGO is a web-based platform that works with all types of assets and products. A broad range of tools and features for managing risk lets you execute trades swiftly and efficiently.

Desktop Platform

SaxoTraderPRO can be described as the best choice of an online, fully-customized professional-grade platform that is designed specifically for traders with advanced skills. SaxoTraderPRO offers an easy multi-screen interface for Windows as well as Mac as well as have access to tablets and mobile apps.

The platform offers customizable workflows and workstations, customized trade settings, and a several advanced functions such as upgraded the trade ticket and depth trading sales and time, algorithmsic orders, charting program and option chain that supports the vanilla option and for touch.

Mobile App

There is also an application for mobiles which lets keep track of trading trends, market movements and updates from your smartphone.

Customer Support

Also, as a respected European Bank there is well established support across over 180 nations through offices located in important financial centers. Customer support is offered throughout Europe, Asia Pacific and Middle East regions also in several languages, ensuring that customers can be assured of needed assistance.

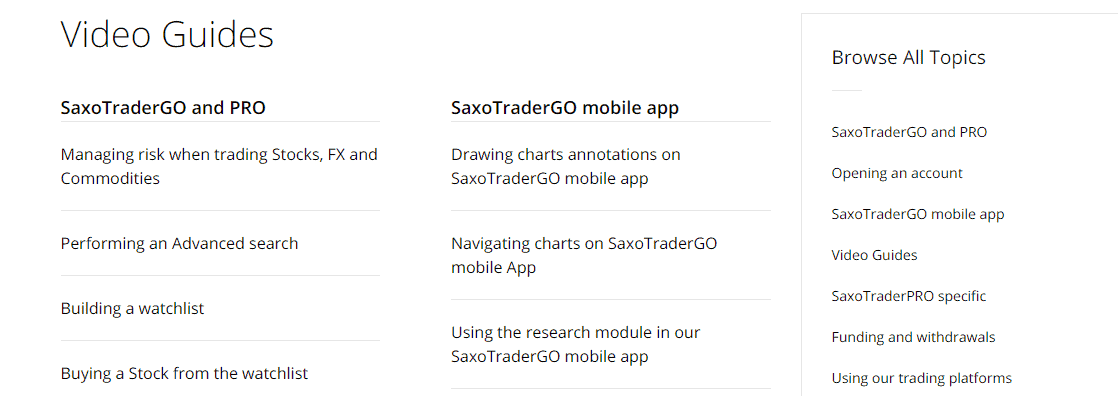

Education

Because Saxo Bank offering mainly proposals for traders who have years of experience and larger sizes, Saxo Bank might be not a good choice for beginner traders due to absence of educational courses in other brokers' offers also. There is an analysis of technical aspects, News feed and Video guides to aid in the learning of the platform's proprietary features, but this is it.

But, traders and professionals who decide to use Saxo will certainly benefit from an array of amazing instruments for research and tools for strategy building accessible directly on the platform.

Conclusion

To conclude, Saxo Bank is a reliable broker. It was first introduced to the market in 1992. Saxowas a fintech firm long time before the term ever invented. It has grown into among the top reliable names for investing and trading online. As a licensed and licensed and Danish bank as well as a regulated Danish bank, Saxo Bank is a trusted name in the market. Saxo Bank Group brings a solid and reliable product to trade in any phase of the economy, and also to cover the risk of hedges. If you're a retail trader, Saxo Bank will provide the same benefits and access that an institution or a business. So, overall Saxo Bank is a excellent choice for traders with larger sizes because the first deposit is greater.

| Properties | Values |

|---|---|

|

Name

|

Saxo Bank |

|

Minimum Diposit

|

$ 2000 |

|

Leverage

|

1:30 |

|

Regulation

|

ASIC (Australia),CNB (Czech Republic),DFSA (Denmark),SFC (Hong Kong),CONSOB (Italy),AFM (Netherlands),MAS (Singapore),FINMA (Switzerland),U.A.E (United Arab Emirates),FCA (United Kingdom),, |

|

Headquarters

|

Copenhagen, Denmark |

|

Established

|

1992 |

|

Address

|

Philip Heymans Alle 15, Hellerup, 2900, Denmark |

|

Platform

|

Advanced Trader 1,, |

|

Payment Method

|

Visa,Mastercard,Credit Card,Wire,Local bank transfer,, |

| Properties | Values |

|---|---|

|

Spreads

|

0.4 |

|

Min Position size

|

0.01 |

|

Broker Type

|

MM ( Market Maker),DMA (Direct market access),Instant Execution,,,,, |

|

Account Type

|

Mini account,Guaranteed SL,Islamic account,Standard,, |

|

Brokers by Country

|

European Union Brokers,, |

|

Techniques

|

Scalping Forex Brokers,Hedging Forex Brokers,Spread Betting Brokers,Automated Trading Brokers,Mobile Trading Brokers,, |

|

Instruments

|

Forex Trading Brokers,Gold Trading Brokers,CFD Trading Brokers,Stock Trading Broke,Oil Trading Brokers,Commodity Forex Brokers,Metal Trading Brokers,Indexes Trading Brokers,, |

|

Account currency

|

USD,EUR,GBP,DZD,AUD,BSD,CAD,XAU,JMD,JPY,NZD,XAG,,USD, |

|

Tools

|

Economic Calendar,Charting Software, |

|

Website Languages

|

en,, |

|

Support languages

|

en,, |

|

Bonus

|

Yes |

|

Reviews Rating

|

3.5 |

|

Withdrawal Fee

|

No |

|

Trading Signals

|

Yes |

|

Free Education

|

Yes |

|

Daily News

|

Yes |

|

Demo account

|

Yes |

|

Swapsr

|

Yes |

|

Pors

|

1. Great trading platform 2. Outstanding research 3. Broad product portfolio |

|

Cors

|

1. High bond, options and futures fees 2. High minimum deposit 3. Lacks live chat and 24/7 availabilit |

|

Display Analysis

|

Yes |

|

Serving country

|

AU,CZ,DK,FR,HK,IT,JP,NL,SG,CH,AE,GB,, |

|

Not Serving country

|

US,, |

|

Contests

|

Yes |

|

Market analysis

|

Yes |

|

Copy Trading Brokers

|

No |

|

Bitcoin Forex Brokers

|

No |

|

Social trading

|

Yes |

|

Web trading

|

Yes |

|

Forex pairs

|

Yes |

|

CFDs

|

Yes |

|

Crypto

|

No |

|

Hedging

|

Yes |

|

PAMM

|

Myfxbook Auto trade,Mql5 signals,, |

|

Mobile Trading

|

Yes |

|

Scalping

|

Yes |

|

Automated Trading

|

Yes |

|

Partnership Programs

|

Yes |

|

Free Phone

|

+48 222 755 570 |

|

Customer Support

|

Exness Broker reviews & comments (0)

Add a review

Your email address will not be published. Required fields are marked *