Royal Financial Trading Broker Reviews and Full Information

What is Royal Financial Trading?

Royal Financial Trading is a group of professionals in trading who created the brokerage business in 2006 in order to offer the best trading conditions, custom-made services, and assistance.

The initial headquarters of the broker was located in Lebanon was the first location, however because of the rapid growth across the globe the company opened offices in major financial world centers The company established offices in major financial centers Cyprus as well as Australia as well as completely complying with the applicable laws.

The broker will offer the actual execution of trades on the market based on the execution of NDD, and the gains of clients could be multiplied using an leverage that is up to 1:500 with Forex Financial instruments.

You can also choose a trading strategy to be a day trader, automated trading, follow the best practices by using the Social Trading capabilities or perhaps invest using the MAM system.

Royal Financial Trading Pros and Cons

Royal Financial Trading is among the most reputable Brokers, with simple online account opening, excellent platform tools and education research. Additionally, there are a variety of options for depositing or withdrawing funds.

On the other hand, the fees for trading in Stock CFDs are more expensive, and there isn't 24/7 assistance.

10 Points Summary

| Headquarters | Australia |

| Regulation and License | ASIC, CySEC, CMA, FSA, VFSC |

| Instruments | Spot FX , commodities CFDs for Indices Stocks, Spot FX, and Bonds |

| Platforms | MT4, MubasherTrade Pro, RJO, Trading Central |

| EUR/USD Spread | 1.4 Pips |

| Minimum deposit | 50 US$ |

| Demo Account | Provided |

| Base currencies | USD, EUR, AUD, GBP, CAD, HKD, NZD, SGD, CHF, PLN, LBP |

| Education | Live News, Economic Calendar, Traders Dashboard, Market Levels and the Trading Central |

| Customer Support | 24/5 |

Awards

Overall, we'll get more information regarding the Royal group of companies in the Rotal Financial Trading Review. Through its market-leading trading conditions, the company was awarded a number of honors from credible financial expositions, and continues to grow.

Are Royal Financial Trading safe or fraud?

Yes, ROYAL is not a fraud, it's a multi-licensed broker with top-tier ASIC and additional regulations issued by CySEC in addition to CMA Lebanon. Royal Financial trading is considered as low risk for Forex as well as CFDs.

Is Royal Financial Trading legit?

Royal Financial Trading is approved through the Australian Securities and Investments Commission (ASIC), and also by the Cyprus Securities and Exchange Commission (CYSEC) and the Lebanese Capital Markets Authority (CMA) and Central Bank of Lebanon.

Additionally, there are international companies that have been authorized through FSA and VFSC that permit traders from different nations to create accounts.

Are you protected?

In the simplest terms, being regulated by the top authority, Royal perform its transparent operation in full compliance with established rules. The rules are always are able to provide clients the most effective capabilities under the complete supervision of the rules within their respective areas of operation.

In addition, the transparency that is provided in the framework's requirements is intended to reducing systematic risk as well as protect investors from unlawful practices, and organize professional operations or clearing settlement services in clear specificity. Additionally, the funds of clients are always secured and not only through segregation within the world's top banks however, but also through risk management mechanisms, internal controls and scheme compensation in the event of bankruptcy.

Leverage

For the Leverage ratios that are offered from Royal Financial Trading it does depend on which restrictions and regulations your account has been created with. So, Australian traders may benefit from the highest levels of leverage as high as 1:500 for Forex instruments, as long as the ASIC authority permits this.

- In the reverse , Cyprus regulatory restrictions as well as European legislation requires a lower leverage limit of 1:30 for the most important currency pairs , and even 1:10 for Commodities.

Trading with a Lebanese entity can grant different leverage levels as well, therefore make sure you know the regulation you'll be a part of and which levels apply to your residence status.

Accounts

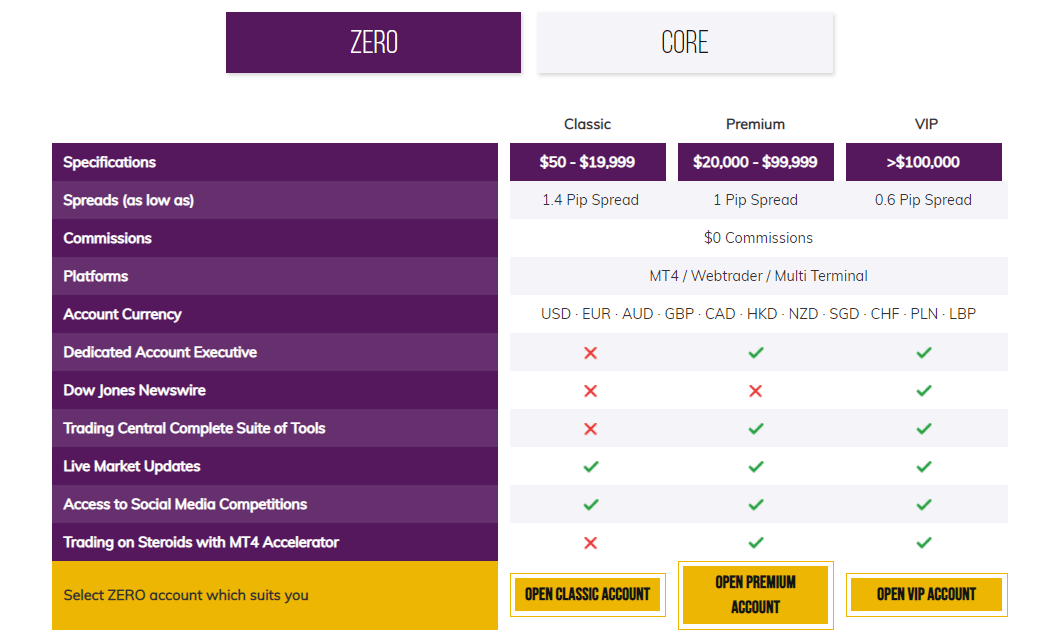

There's an selection of two principal types of accounts: the first on a spread-only basis or commission-based which is known as Core and Zero account. Additionally depending on your first investment broker, they can provide you with higher trading conditions as well as less expensive costs.

The perfect solution is comprised of all six types of accounts for traders of larger to smaller size. It includes Classic Premium, Vip, Zero and Core accounts as well.

In addition, there is an option to open either Individual Join, Corporate, or Trust Accounts and the MAM to manage multiple accounts through one interface. It also has an Islamic accountsfor Muslim traders that is free of charges for swap, interest and rollover fees.

Instruments

There are a variety of investment options that are available in the Royal as well as trading access is provided by the executed NDD model through the selection among financial instruments Spot FX as well as commodities CFDs for Indices, Bonds and Stocks.

Fees

The wide variety of account types allows for a wide range of options for investment strategies and activities. using an account with Royal Financial Trading account allows you to gain access to the most rigorous data on narrow spreads as well as low-cost and fast execution.

| Fees | Royal Financial Trading Fees | AvaTrade Fees | BDSwiss Fees |

|---|---|---|---|

| Deposit fee | No | No | No |

| Withdrawal fee | No | No | No |

| Inactivity fee | Yes | Yes | Yes |

| Fee rating | Low | Low | Average |

Spreads

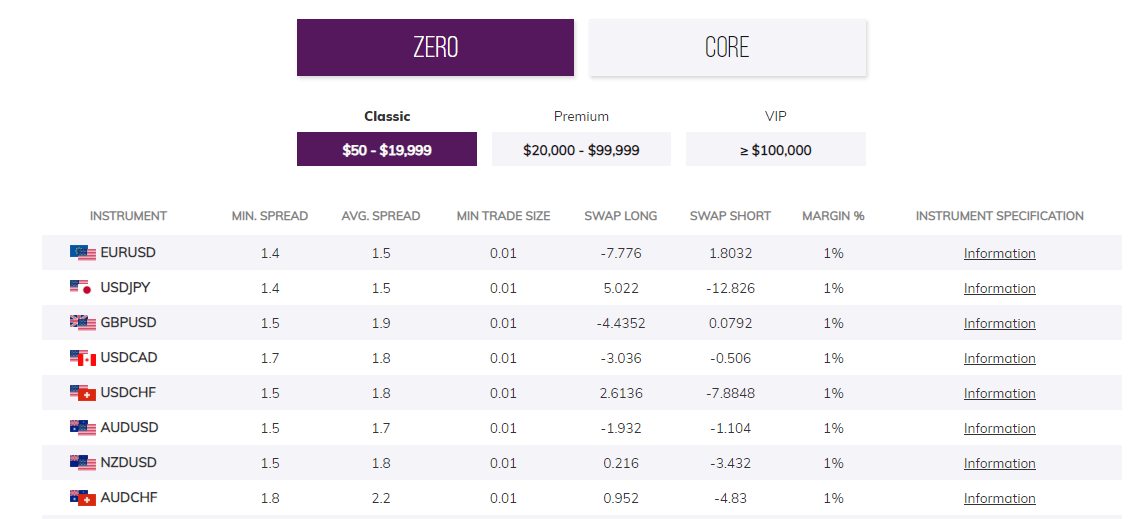

Royal Financial Trading spreads created in accordance with the type of account, as the larger your account, you have, the best spread is offered.

If you choose an account with zero balance, the total cost is built into an adjustable spread, that you can see on the following table. If you'd like to work on commission-based The Core Account group can be the best choice which has spreads that start from 0.01 pips. You can also add 7$ commission for a traditional account $5 for Premium, and 3.5$ for VIP.

Also, look at or Compare spreads across various accounts for the most well-known pairs in the images below. Always think about the rollover fee or overnight fees as a fee for positions that are held for more than a day. Also, you can look up fees applicable to another well-known broker that is STO.

| Asset/ Pair | Royal Financial Trading Fees | AvaTrade Fees | BDSwiss Fees |

|---|---|---|---|

| EUR USD | 1.4 pip | 1.3 pip | 1.5 pips |

| Crude Oil WTI | 4 | 3 | 6 |

| Gold | 17 | 40 | 25 |

| BTC/USD | 50.5 | 0.75% | 2000 |

A snapshot of Royal Financial Trading spreads

Deposits and Withdrawals

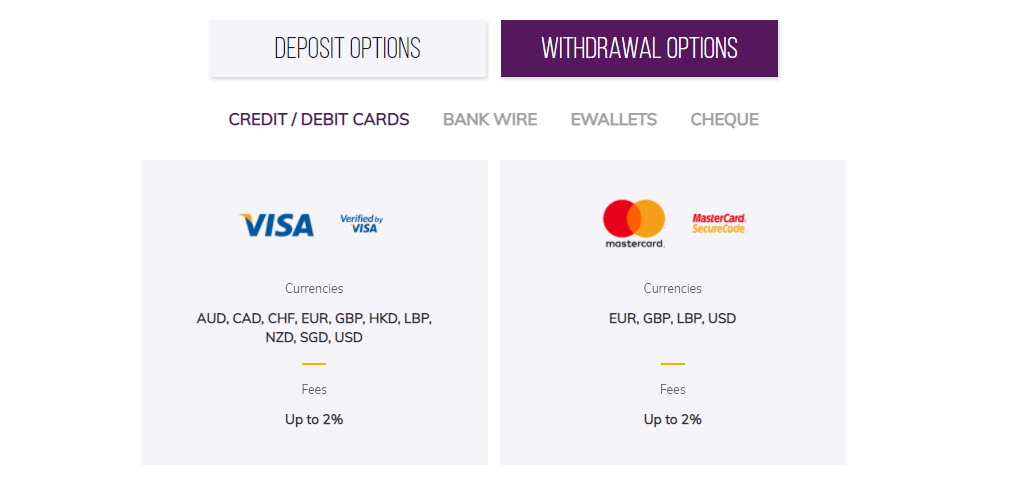

The process of depositing and withdrawing money is a further important aspect of Royal Financail Trading Review, and we discovered that the broker offers 13 payment options as well as providing 11 base currencies for accounts that all support the smooth transfer of money.

Deposit methods

The payment options include a wide variety of payment options, however they could differ based on the laws of your country and the place you reside therefore it is advisable to confirm this information with the help center also.

- Credit cards

- Transfers to banks

- Money Transfer, Pape Cheque

- Electronic payments Skrill, Neteller, iDEal, giropay , and many more

It is important to note that there some differences in methods of payment and commissions applicable in accordance with your Royal Financial Trading entity you are trading with, since different jurisdictions have different rules.

Minimum deposit

Royal Financial Trading minimum deposit of 50dollars to create an account. Classic live account with higher types requiring greater deposits. Check out the above section.

Royal Financial Trading minimum deposit vs . other brokers

| Royal Financial Trading | Most Other Brokers | |

| Minimum Deposit | $50 | $500 |

How can I withdraw cash?

Royal Financial Trading withdrawal charges can vary depending on the location and payment method you select. However, there are fees on withdrawal methods that are card-based or bank wire transfer transfers up to 2 percent.

Trading Platforms

The technology used for trading at Royal provides traders with the trading platform that provides rapid access to the market and provides abundant details. It is MetaTrader4 is among the most well-known online trading platforms in the world that blends the simplicity of the interface with powerful tools . It's also a Royal Financial mainstay.

| Pros | Cons |

|---|---|

| Mainstay on MT4 | None |

| Web-based trading platform | |

| Login and design that is user friendly and user-friendly | |

| Price alerts | |

| Professional platform MetaFX | |

| Multilingual support |

Web Trading

There are a variety of variations of the platform that satisfy the requirements, such as the desktop, WebTrader and Mobile application in addition to the option of simultaneous trading options via MT4 MultiTerminal in addition to MAM account for Money Managers.

Desktop Platform

The platforms all have nearly the same functions however, there are differences in the features traders might need. Desktop versions typically complete with all features available therefore you are able to use the strategy that you like best.

Furthermore, there's an accessible MetaFX platform that allows you to manage multiple accounts , or appropriate for professionals too.

Mobile Platform

The mobile platform is included part of the package, allowing you to keep up-to-date in any circumstances from your mobile phone iOS or Android and to further create the trading platform and provide a precise analysis of technical aspects.

What is Social Trading?

Royal Financial Trading provides daily reports with the most current trends as well as a host of tools to improve trading. They include the MT4 Accelerator, VPS Hosting options, Trading Central analysis and Social Trading capabilities.

Social trading is a fantastic option that lets traders trade on the top platforms myFXbook, ForexSignals.com and ZuluTrade. Social trading is currently an industry-leading analytical platform which allows you for comparing and copying trades made by professionals. It can be beneficial for beginners as well as experienced traders.

Customer Support

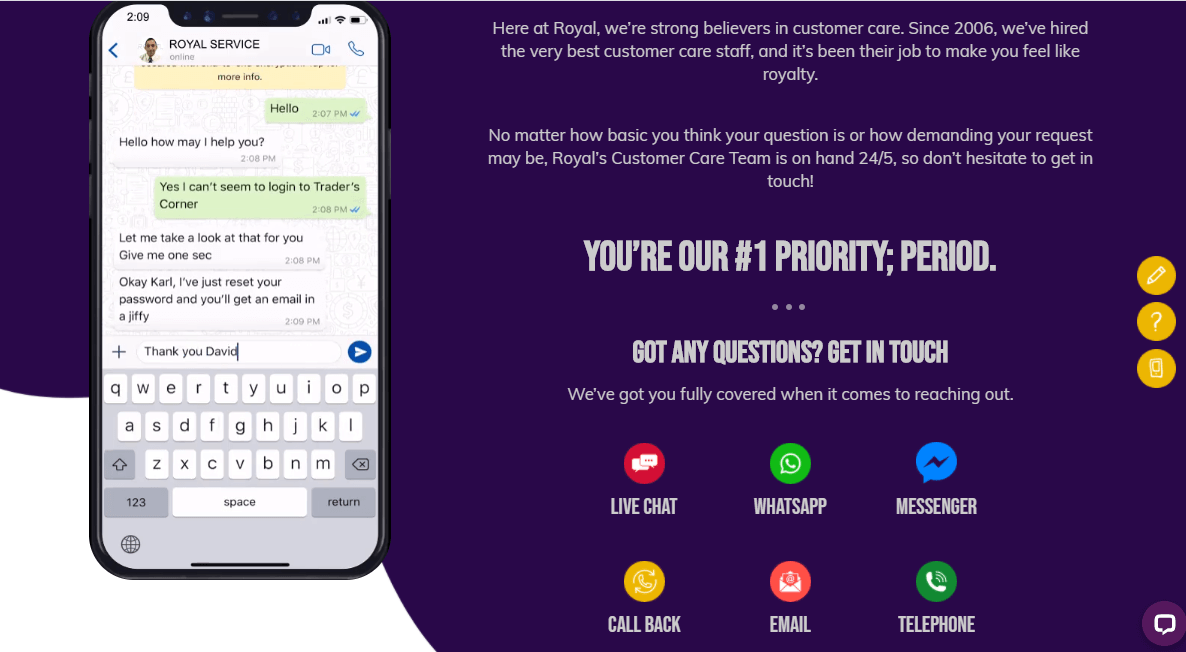

One of the key elements that make up this review Royal Financial Trading review a proposal that has a high degree of customer support and service that meets the needs of traders, with the possibility of contacting the broker through phone lines, email and also via call-back options, Live chat support, WhatsApp and Messenger support and more.

Education

Additionally is a team of experienced specialists and relationship managers are always ready to assist its customers. Furthermore, daily reports and analysis tools together with educational material ensure that traders are in the right direction with well-established resources like Live News, Economic Calendar and Traders Dashboard. Market Levels and the Trading Central.

Conclusion

Our final opinion regarding Royal Financial Trading cleared an established, global brokerage firm that offers the benefit of a efficient trading system as well as a wide range of possibilities. A reliable direct connection, seamless process of trading and various technologies with low prices for trading are an ideal combination. Traders of various sizes or different strategies, with social trading can connect and select the most suitable choice, as well as a broad variety of trading platforms and services available.

| Properties | Values |

|---|---|

|

Name

|

Royal Financial Trading |

|

Minimum Diposit

|

$ 50 |

|

Leverage

|

1:500 |

|

Regulation

|

ASIC (Australia),CySEC (Cyprus),CMA (Kenya),FSA (Saint Vincent and the Grenadines),VFSC (Vanuatu),,, |

|

Headquarters

|

Australia |

|

Established

|

2006 |

|

Address

|

Level 7, 1 York Street, Sydney NSW 2000, Australia, Australia |

|

Platform

|

MT4,MT4 WebTerminal,Alternative Non-MT4,Copy Trading,ZuluTrade,Myfxbook,Advanced Trader 1,,, |

|

Payment Method

|

Visa,Mastercard,Wire,Skrill,Neteller,Perfect Money,Bitcoin,Tether USDT,Fasa Pay,Poli,,, |

| Properties | Values |

|---|---|

|

Spreads

|

1.4 pips |

|

Min Position size

|

0.01 |

|

Broker Type

|

ECN (electronic communications networks),NDD (Non Dealing Desk),,,,,, |

|

Account Type

|

Mini account,Fixed Spread,Scalping,High Leverage,Standard,,, |

|

Brokers by Country

|

Australian Forex Brokers,,, |

|

Techniques

|

Scalping Forex Brokers,Hedging Forex Brokers,Spread Betting Brokers,Automated Trading Brokers,Mobile Trading Brokers,Copy Trading Brokers,,, |

|

Instruments

|

Forex Trading Brokers,Futures Trading Brokers,Gold Trading Brokers,CFD Trading Brokers,Crypto Trading Brokers,Stock Trading Broke,Oil Trading Brokers,Metal Trading Brokers,Indexes Trading Brokers,,, |

|

Account currency

|

USD,EUR,GBP,AUD,CAD,HKD,LBP,NZD,SGD,CHF,,USD,,USD, |

|

Tools

|

Economic Calendar,Charting Software,Pip Calculator,Margin Calculator,Profit Calculator,, |

|

Website Languages

|

en,,, |

|

Support languages

|

en,,, |

|

Bonus

|

Yes |

|

Reviews Rating

|

4.0 |

|

Withdrawal Fee

|

Yes |

|

Trading Signals

|

Yes |

|

Free Education

|

Yes |

|

Daily News

|

Yes |

|

Demo account

|

Yes |

|

Swapsr

|

Yes |

|

Pors

|

1. Commission-free trading available. 2. 165+ markets to trade on. 3. 24/5 quality customer support. 4. Enhanced version of MT4: MT4 Accelerator |

|

Cors

|

1. Off-shore regulation. 2. Lebanese Capital Markets Authority is not a major financial regulator. |

|

Display Analysis

|

Yes |

|

Serving country

|

AU,CY,LB,VC,US,VU,, |

|

Not Serving country

|

IR,JP,KP,US,, |

|

Contests

|

Yes |

|

Market analysis

|

Yes |

|

Copy Trading Brokers

|

Yes |

|

Bitcoin Forex Brokers

|

Yes |

|

Social trading

|

Yes |

|

Web trading

|

Yes |

|

Forex pairs

|

Yes |

|

CFDs

|

Yes |

|

Crypto

|

Yes |

|

Hedging

|

Yes |

|

PAMM

|

PAMM,MAMM,Copy,Zulu trade,Myfxbook Auto trade,Mql5 signals,,, |

|

Mobile Trading

|

Yes |

|

Scalping

|

Yes |

|

Automated Trading

|

Yes |

|

Partnership Programs

|

Yes |

|

Free Phone

|

+1 (888) 705-9006 |

|

Customer Support

|

24/5 |

Exness Broker reviews & comments (0)

Add a review

Your email address will not be published. Required fields are marked *