Rakuten Securities Broker Reviews and Full Information

What exactly is Rakuten?

Rakuten trading name that is a well popular broker, is a part that is part of Rakuten Inc. one of the most reputable internet service businesses that deal in travel, e-commerce, banking and securities marketing, e-moneyand many more.

Rakuten Group is expanding globally and currently is operating across Asia, Europe, the Americas and Oceania.

The headquarters of the company are is located is in Tokyo, Japan while branching out to Hong Kong, Malaysia and Australia. As for the financial services, Rakuten Securities launched in 1999 and has since expanded into a major brokerage company that offers a broad array of trading opportunities as well as accessible assets.

Is Rakuten a trustworthy broker?

From the beginning and up to now, Rakuten is one of the biggest brokerages online throughout Japan in addition to across Asia providing services to more than 2.6 million customers. The company also continuously expands its structure to include many more options to provide and more options for investors that is always a plus. So, in 2016 the broker entered into a partnership with FXCM and later acquired FXCM Asia ltd.

Rakuten Pros and Cons

Rakuten has a long history operating and an excellent reputation. It is a globally recognized and awarded broker. They offer platforms MT4 and its own Rakuten FX with outstanding assistance, training and research tools. Suitable for both professionals and beginners.

For Cons, Terms and Conditions and trading offerings themselves may differ depending on the regulations and the entity.

10 Points Summary

| Headquarters | Tokyo |

| Regulation | ASIC, SFC |

| Instruments | Commodities, bonds, Equities ETFs, investment trusts and CFDs, FX |

| Platforms | MT4, Rakuten FX, ZuluTrade |

| Spread EUR/USD | 0.5 Pips |

| Demo Account | The Provider |

| Base currencies | EUR GBP, AUD USD, GBP, EUR |

| Minimum deposit | 50$ |

| Education | Commodities, bonds, Equities ETFs, investment trusts and CFDs, FX |

| Customer Support | 24/5 |

Awards

Rakuten is now a global broker with an international reputation, many accomplishments and awards and is also acknowledged for its social and sponsorship programs , as an official company that is involved with Sports and Entertainment. Similar to this, you can find Rakuten logo on the t-shirts of world-renowned FC Barcelona as Rakuten is an acknowledged main partner of the club.

Is Rakuten secure or is it a scam?

Rakuten is tightly controlled by different authorities of the highest level such as ASIC, SFC, JFSA broker, for its branches and its global offices. It is a low-risk way to trade Forex and CFDs through Rakuten because of its rules.

Is Rakuten legit?

It is true that Rakuten has been proven to be legit and is regulated, and has been authorized to operate every business it operates and operates around the world.

The headquarters of Rakuten Securities responsible for trading activities and proposals is located in Japan and is regulated by authorities in the country's Financial Services Agency (FSA Japan) as well as being an participant in the Financial Futures Association and the Commodity Futures Association.

Hong Kong branch RSHK authorized and is regulated through SFC as well as Australian entity RSA is was regulated by the highly respected ASIC. Additionally the Malaysian branch is regulated from The Securities Commission Malaysia and holds Capital Markets Services License (CMSL).

How can you be protected?

The above mentioned range of laws and authorizations assures the reliability of brokers and ensures that operations are carried out in accordance with the standards of regulation. This is a guarantee of a reliable investment service, and clients are safeguarded in a variety of ways by money segregation regulations and other controls which are inspected by authorities to ensure that you are receiving transparent and accurate information about the conditions.

| Rakuten entity | Regulation and Licence |

| Rakuten Securities Japan | Autorized to FSA (Japan) |

| Rakuten Securities Australia Pty Ltd | Autorized through ASIC (Australia) Registration number. AFSL No. 418036 |

| Rakuten Securities Hong Kong Limited | The authorization was granted to be registered by SFC (Hong Kong)registration number. AIM232 |

| Rakuten Trade | Accredited By CMSL (Malaysia) |

Leverage

A global broker that operates in multiple organizations and is controlled by local authorities, the various branches of Rakuten can offer various degrees of leverage.

- Although Japanese and Australian organizations of Rakuten continue to offer a large leverage levels of up to 1:500 for Forex,

- The other branches around the world could limit 1:100 for Forex significant pairs.

Of course, leverage can be the opportunity for great benefits but, be sure to understand leverage and how to utilize it in a smart way, since an increased or leveraged trading volume could play significant dividends in earnings or losses.

Types of accounts

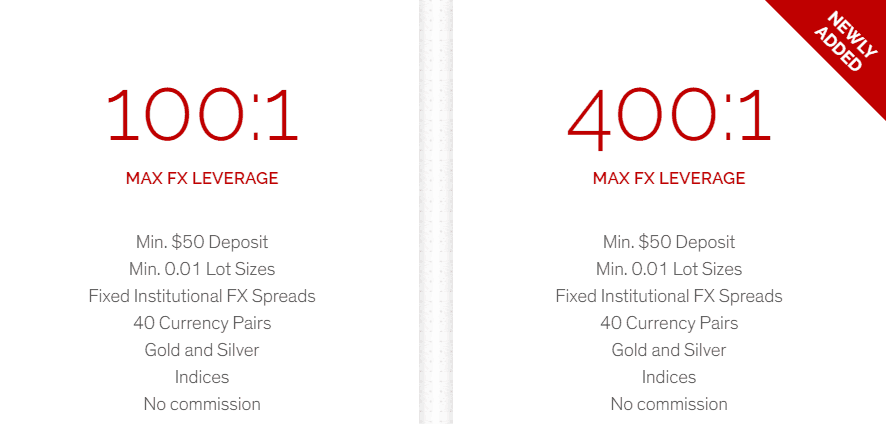

We will use this as a reference to Rakuten Review the Australian offer, in which two types of accounts are offered with the Standard Account as well as High Leverage Account. The conditions are identical, however there is a difference in terms of the maximum leverage allowed spread, maximum allowable quantities.

To ensure that you don't mix up the types of accounts available, check over the relevant entity that the type of account is handled by as the terms and terms may differ from one rule to the next.

Instruments

The range of products is as we see through Rakuten Review. Rakuten Review including equities commodities bonds Investment trusts, CFDs, ETFs, and FX..

Fees

Rakuten utilizes pricing technology that is directly derived via its Tokyo platform as this lets them leverage the bigger orders and offer more competitive prices to global markets. It also offers spread basis charges. Other charges can be found in the table of fees below.

| Fees | Rakuten Fees | CMC Markets Fees | XM Fees |

|---|---|---|---|

| Fee for deposit | No | No | No |

| Fee for Withdrawal | No | No | No |

| Fee for inactivity | Yes | Yes | Yes |

| Fee position | Low | Low | High |

Spreads

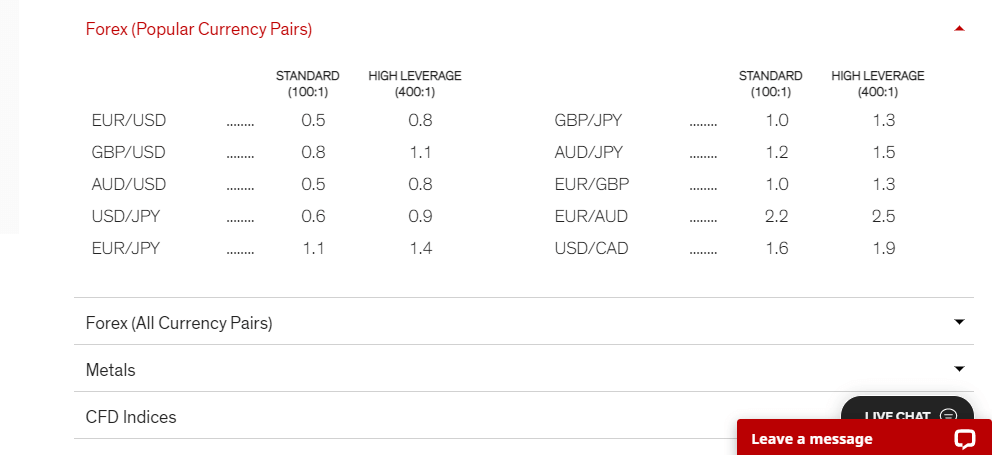

Rakuten doesn't charge commissions for spreads however the spread of 95 percent can be determined during operating times and the remaining five percent may differ because of the reason of low liquidity.

Additionally, as we learned in our Australian proposal, there are two accounts that have the standard EUR USD 0.5 Pips and Conditions of high leverage EUR USD 0.8 pip, and the account with the highest leverage will have the possibility of a slight increase in spread but will still be in the same league as other market offerings.

The comparison of the typical Rakuten spreads is shown below. Also, you can see the difference among Standard as well as High Leverage spreads. Likewise, you can review the fees offered by another broker that is well-known Plus500.

| Asset/ Pair | Rakuten Spread | CMC Markets Spread | XM Spread |

|---|---|---|---|

| EUR USD Spread | 0.5 Pips | 0.7 pip | 1.6 Pips |

| Gold Spread | 1.5 | 3 | 35 |

Payment Methods

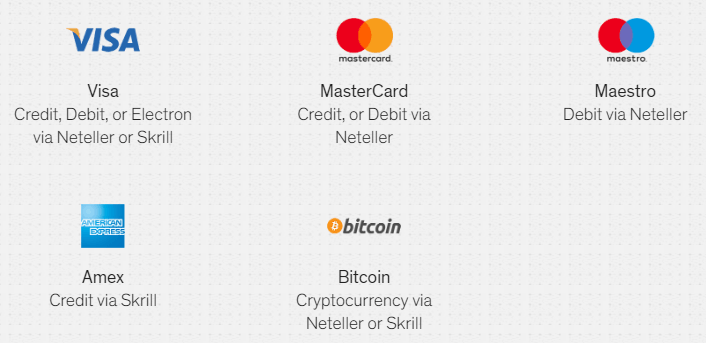

As as a Rakuten customer, you have the ability to make a choice to fund your trading account in a variety of currencies, mainly USD, AUD USD, EUR and GBP and you can choose which base currency you wish you want to use, and even set up several accounts.

Options for Deposits

There are many widely-supported ways and options for payment which may differ depending on regions too, however, they typically contain

- International and domestic bank wire transfers,

- E-wallets options Neteller, Skrill, ChinaUnion Pay,

- Credit or debit cards, Amex,

- as well as Bitcoin using electronic-wallets.

How much is the minimal amount of deposit required by Rakuten

The minimum deposit for Rakuten is 50dollars and therefore traders of any size can be enticed in trading with Rakuten with ease. However, you must consult with the broker to secure all margins based on the instrument you trade with.

The bank charges no fees associated with deposits made via domestic transfer However, banks could charge foreign transaction fees for alternative payment options.

Rakuten Minimum deposit is different from other brokers

| Rakuten | The majority of other brokers | |

| Minimum Deposit | $50 | $500 |

Withdrawals

Rakuten withdrawals are processed with the same processes as deposits, which include popular banks Wire and Cards, while the fees for withdrawal will differ from one method to the next, e.g. Neteller or Skrill will add an additional 2% cost. However, make sure to verify the payment method with your Rakuten company, as different locations may have somewhat different rules for payment.

Trading Platforms

The branching nature of Rakuten offers a variety of platforms to their customers. These could result in some variations between the two entities too.

| Pros | Cons |

|---|---|

| A proprietary trading platform Rakuten FX | Each entity has a different platform options |

| Design and layout that is user-friendly, as well as login | |

| Price alerts | |

| Many languages are supported, as well as technical analysis and strong features | |

| There is MT4 as an alternative | |

| Standard and Advanced versions |

Desktop Platform

The Australia Rakuten provides the trading platforms well-known MetaTrader4 platform which, in addition to its impressive capability, allows you to analyze the market with a variety of charts, tools for technical analysis and a user-friendly interface with a modular design.

Another option for platforms includes Rakuten FX, which is the Rakuten FX trading platform, which provides services to Hong Kong entities is an user-friendly software that has robust capabilities and its AS streaming trading feature provides fast order execution and lower costs for trading due to the strict set spread and with no extra costs.

Web Trading

The investment is defined according to pre-determined preferred size of trading lot and auto copy notification. real-time account report reports are also accessible via desktop mobile, web and desktop platforms which means that it is compatible with all devices.

The Malaysian offering also provides access to the market platform through iSPEED.my app or the web-based trading screen that offers an efficient method to control trading activities using an online account.

Mobile Platform

Mobile platform supports Android Support for iOS and a complete set of Trading Orders Analysis and technical indicators.

Customer Support

The support for customers is available around all hours, and also able to support live chat, telephone lines, and also via numerous sources like WhatsApp providing easy communication. Additionally, Rakuten gained a good rating among other brokers due to the quality of its customer service, which is a further benefit to the service it offers.

Education

The beginner traders or even the more experienced traders are also assisted by education resources and tools that include powerful analysis of technical aspects help with the coverage of key topics through the education courses as well as regularly scheduled Webinars and videosalso made in different languages, which makes learning easier.

To practice trading on a demo account that is risk-free, you can sign up for a free account anytime and try your strategies and Rakuten conditions.

Conclusion

Our final thoughts on Rakuten Review are good, the broker provides expert services and is constantly making improvements to their services. The overall offer to traders and investors is complete due to the wide range of types of accounts as well as floating or fixed spreads, floating spreads as well as trading platforms and the availability of new tools. Overall, we recommend Rakuten is a trustworthy and highly appealing trading broker. The only thing you need to be mindful of is to verify the relevant details pertaining to the home country and which branch the customer is trading in, since the terms may be different.

| Properties | Values |

|---|---|

|

Name

|

Rakuten Securities |

|

Minimum Diposit

|

$ 50 |

|

Leverage

|

1:400 |

|

Regulation

|

ASIC (Australia),SFC (Hong Kong), |

|

Headquarters

|

Australia |

|

Established

|

1999 |

|

Address

|

Suite 25.03, Level 25, Governor Macquarie Tower, 1 Farrer Place Sydney, NSW 2000, Australia |

|

Platform

|

MT4,MT4 WebTerminal, |

|

Payment Method

|

Visa,Mastercard,Wire,Skrill,Neteller,Bitcoin,Maestro,Union Pay,AMEX, |

| Properties | Values |

|---|---|

|

Spreads

|

0.5 pips |

|

Min Position size

|

0.01 |

|

Broker Type

|

MM ( Market Maker),Market Execution,,,,, |

|

Account Type

|

Mini account,Standard, |

|

Brokers by Country

|

Australian Forex Brokers, |

|

Techniques

|

Carry Trade Brokers,Spread Betting Brokers,Automated Trading Brokers,Mobile Trading Brokers,Copy Trading Brokers, |

|

Instruments

|

Forex Trading Brokers,Gold Trading Brokers,Stock Trading Broke,Commodity Forex Brokers,Indexes Trading Brokers, |

|

Account currency

|

USD,EUR,GBP, |

|

Tools

|

Economic Calendar,Charting Software, |

|

Website Languages

|

en, |

|

Support languages

|

en, |

|

Bonus

|

Yes |

|

Reviews Rating

|

3.5 |

|

Withdrawal Fee

|

Yes |

|

Trading Signals

|

No |

|

Free Education

|

Yes |

|

Daily News

|

No |

|

Demo account

|

Yes |

|

Swapsr

|

Yes |

|

Pors

|

1. ASIC Regulated. 2. MT4 Trading Platform Available. |

|

Cors

|

1. Customer Support 24/5. 2. MT5 Not Available . |

|

Display Analysis

|

Yes |

|

Serving country

|

AU, |

|

Not Serving country

|

AF,AW,BE,CA,CF,CN,CG,CD,CZ,ER,GW,IR,IQ,IL,JP,KP,LB,LR,MM,NZ,RU,ST,SO,SD,SY,TW,TR,UA,US,VE,YE,ZW, |

|

Contests

|

Yes |

|

Market analysis

|

Yes |

|

Copy Trading Brokers

|

Yes |

|

Bitcoin Forex Brokers

|

No |

|

Social trading

|

Yes |

|

Web trading

|

Yes |

|

Forex pairs

|

Yes |

|

CFDs

|

Yes |

|

Crypto

|

No |

|

Hedging

|

Yes |

|

PAMM

|

Copy,Myfxbook Auto trade,Mql5 signals, |

|

Mobile Trading

|

Yes |

|

Scalping

|

Yes |

|

Automated Trading

|

Yes |

|

Partnership Programs

|

Yes |

|

Free Phone

|

+612 9247 2483 |

|

Customer Support

|

24/5 |

Exness Broker reviews & comments (0)

Add a review

Your email address will not be published. Required fields are marked *