Price Markets Broker Reviews and Full Information

What is Price Markets?

Price Markets broker will match orders through its existing ECN system that supports greater than fifty FX, Indices and Commodities through their array of trading platforms, gateways and exchanges at the location of the client's choice. Price Markets is a UK well-established service provider of FX Prime infrastructure and brokerage services for the trading community that has been in operation since 2013.

The principle of a broker is to develop an broad array of technology-based solutionsand provide a competitive service for traders worldwide by utilizing established high-tech at the highest standard. In reality, Price Markets succeed in their efforts and has have received many awards and accolades for their achievements, with excellent reviews from the community of traders.

Price Markets Pros and Cons

Price Markets is a reputable legitimate broker with excellent trading conditions for technology used in trading. Opening accounts is simple and trading instruments are readily accessible and the costs for trading are included in commission charges.

On the flip side, price markets could be more suitable for traders who are more advanced, however there isn't a 24/7 customer support and education is also rather basic.

10 Points Summary

| Headquarters | UK |

| Regulation | FCA |

| Platforms | MT4 ECN, WebTrader, Currenex, liquidX, integral |

| Instruments | FX, Indices and Commodities |

| EUR/USD Spread | Zero pip +3.5$ commission |

| Demo Account | Available |

| Minimum deposit | 500 US$ |

| Base currencies | USD, EUR, GBP |

| Education | Education provided is limited. |

| Customer Support | 24/5 |

Are Price Markets safe or a fraud?

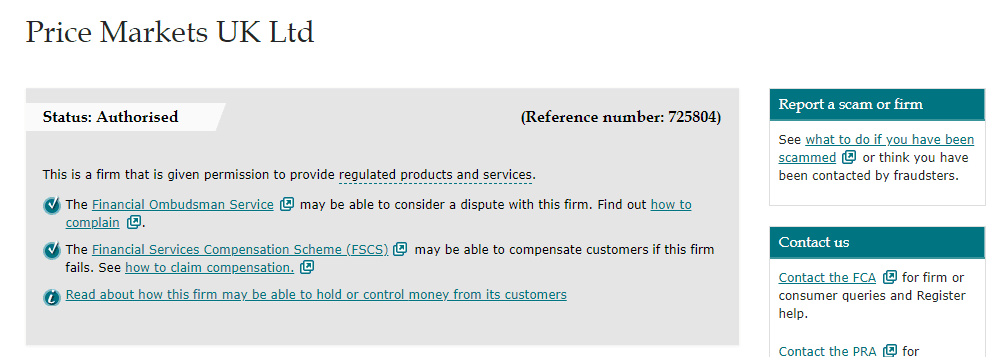

No Price Markets isn't an untruth. Price Markets UK Ltd is an organization that was incorporated by the UK and consequently legally authorized by FCA (Financial Conduct Authority)to operate within a robust regulatory framework, which is considered to be a low risk for a trading broker. In fact, regulation is the most crucial aspect because a legitimate license guarantees the proper monitoring, control and reporting of both counterparty and market risk to the authorities.

As an investor, it implies it is important that Price Markets keeps client's money in separate accounts with the large UK institutions, which ensure the security of funds. Additionally, there is the possibility of 50,000 pounds of FSCS protection Per Retail Client in the scenario it is discovered that Price Markets is no longer in a position to fulfill its obligations to its financial clients.

Leverage

Price Markets offer leverage as high as 1:30 for the most popular currency pair which allow you to utilize a greater trading sizes compared to the balance, which increases your the capabilities. However, this leverage also possible to reverse, so it is important to learn how to utilize it effectively.

In reality, the lower level is determined by the FCA regulations, as Price Markets is respectively authorized in the UK as well, and it is done with the intention to shield retailers from the misuse of leverage ratios with high levels.

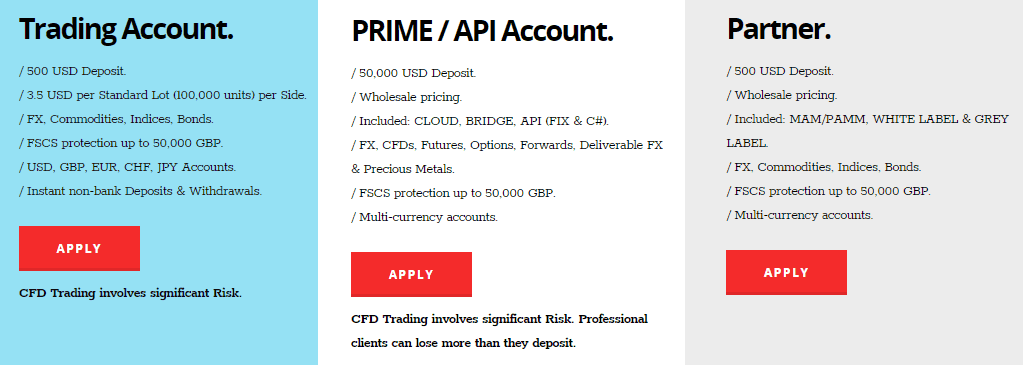

Types of accounts

Price Markets provides accounts that meet a variety of specifications specifically designed to meet specific requirements for trading. The minimum deal size can differ between different markets and could be as small as 1000 USD or 1 micro-lot. In reality, the retail type of account is just one option in the initial stage however, once the customer is able to answer the test, different terms could be offered based on the amount of experience, size and kind.

Fees

Price Markets transaction fees and pricing include the spread, commission and Swap fee or credit for each rollover , based on rates of the two currencies traded, with mark-ups and mark-downs starting at 1.5 percent.

| Fees | Price Markets Fees | Core Spreads Fees | InterTrader Fees |

|---|---|---|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity Fee | Yes | Yes | Yes |

| Fee position | Low | Low | Low |

Spreads

Usually, Price Markets Spreads Forex start at 0.0 pip, Gold from 12 cents, UK100 - 0.7 per cent in addition to GER30 0.3 points, and the costs are incorporated into the commission of 3.5dollars for the Standard account. Below are the spreads for Price Markets as well as the spreads from another broker that is popular Ikon Finance.

| Spread | Price Markets Spread | Core Spreads Fees | InterTrader Fees |

|---|---|---|---|

| EUR USD Spread | 0.3 pip | 0.6 pip | 0.6 Pips |

| Crude Oil WTI Spread | 1 Pips | 3 pip | 3 pip |

| Gold Spread | 1 | 4 | 1 |

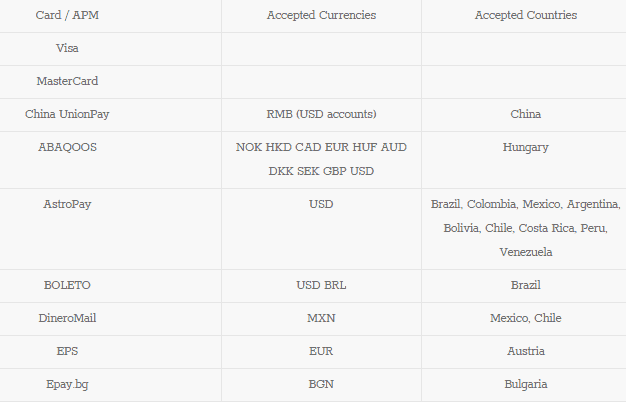

Methods of Payment

The withdrawals and deposits to and from your live account are processed by using a variety of choices, which allows you to pick the most choice for you based on the region you reside in or the your country of your residence. There are a variety of options available, including bank, Credit Card, Debit Card Local payment options as well as many online payment options like Giropay, Skrill, POLi, Sofort etc.

Minimum deposit

The minimum deposit required for Price Markets is 500$, which will allow you to sign up for either a trading Account and Partner accounts with the MAM and the PAMM option.

Price Markets minimum deposit, compared to other brokers

| Price Markets | Most Other Brokers | |

| Minimum Deposit | $500 | $500 |

Withdrawal

It is also great that Price Markets doesn't charge any fees to process withdrawal or deposits with accounts that are accessible in USD, EUR, GBP JPY, CHF and JPY currencies. This is certainly an amazing feature.

Trading Platforms

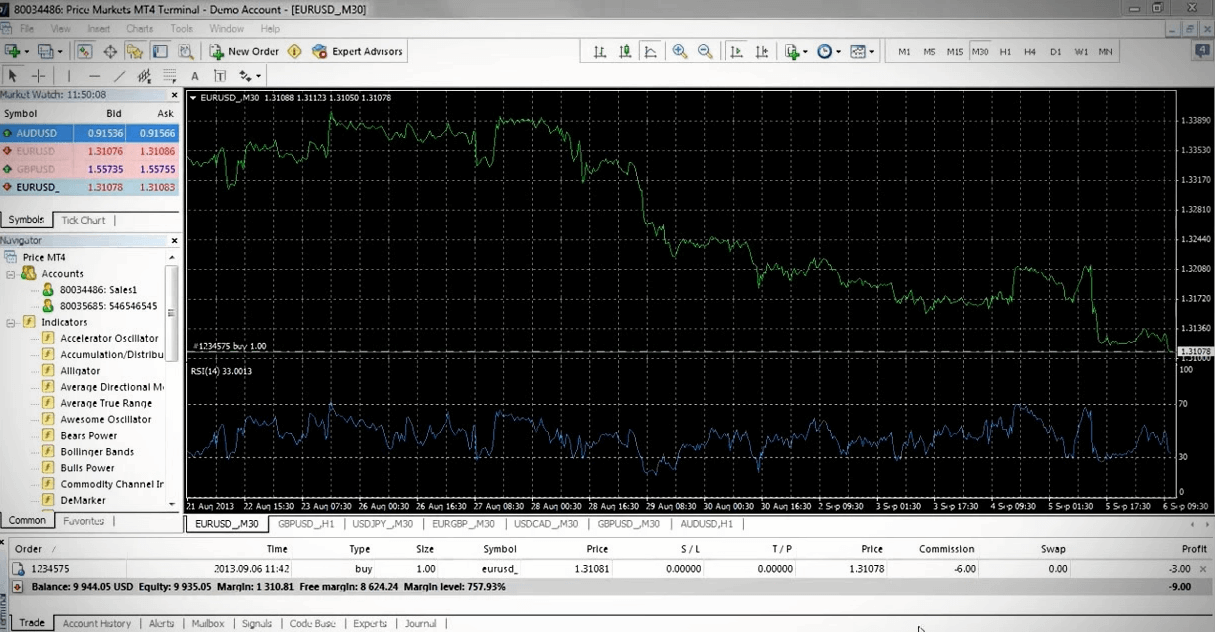

Price Markets uses a wide variety of solutions for platforms which provide the best-in class trading experience as well in the option of choosing from. All platforms are powered by a the low-latency cloud network of Price Markets located in LD in LD and NY.

Additionally, traders are able to select from a variety of trading options that include co-location, algorithmic trading bridge or aggregator deliveryable FX and PAMM for money managers IBs, white Labels. At an additional cost, there are a variety of machines offering VPS starting at 50$ per month. custom cloudservices, Research and Enterprise (Bare Metal Service) and more.

Its Price Markets platform's mainstay features its MetaTrader4 Terminal which can be used on desktop versions of the renowned platform that is further improved by priceCLOUD. There are other platforms available, including Currenex which provides an anonymous and seamless pricing experience, as well as liquidX, an integral offering DMA execution.

There are also a myriad of options to APIs or technical trading that depend according to specific conditions and order of the strategies you employ across multiple platforms.

In addition to the amazing features offered by the platform along with other features, trading applications let you review the performance in real-time of hundreds of signal providers or communities that is provides a wide array of options to select from.

Customer Support

The support for customers is provided by the broker at a an extremely high scale that provides exceptional care to customers. No matter what the type of customer, whether it is a corporate or retail trader, Price Markets supports by the information available in any way although educational materials are not always presented in the best way. Customer service is available in a variety of languages and accessible through chat on the internet or email, phone or other.

Conclusion

It was revealed that the Price Markets review made it clear that the broker treats customers fairly, in the sense of an affiliated principal broker, because Price Markets UK performs technology solution for trading which uses ECN connections. It is a variety of markets are traded through an CFD contract (Contract For Difference) which are protected from exposure to the markets for each instrument that you trade. Any trader of all sizes will be able to be able to begin trading on CFD contracts. Price Markets since there are numerous options for engaging in trading, but those who are novice to trading will not discover a wealth of instructional resources.

| Properties | Values |

|---|---|

|

Name

|

Price Markets |

|

Minimum Diposit

|

$ 500 |

|

Leverage

|

1:30 |

|

Regulation

|

FCA (United Kingdom), |

|

Headquarters

|

United Kingdom |

|

Established

|

2013 |

|

Address

|

30 St. Mary Axe 29th Floor, EC3A 8BF, United Kingdom |

|

Platform

|

MT4,MT4 WebTerminal,ActTrader,Currency.com,,,,, |

|

Payment Method

|

Visa,Mastercard,Wire,Skrill,Neteller,Union Pay,JCB, |

| Properties | Values |

|---|---|

|

Spreads

|

0 pip +3.5$ comissio |

|

Min Position size

|

0.01 |

|

Broker Type

|

ECN (electronic communications networks),NDD (Non Dealing Desk),,,, |

|

Account Type

|

Mini account,Scalping,High Leverage,Standard, |

|

Brokers by Country

|

UK Forex Brokers, |

|

Techniques

|

Scalping Forex Brokers,Hedging Forex Brokers,Carry Trade Brokers,Automated Trading Brokers,Mobile Trading Brokers,Copy Trading Brokers, |

|

Instruments

|

Forex Trading Brokers,Futures Trading Brokers,CFD Trading Brokers,Commodity Forex Brokers, |

|

Account currency

|

USD,EUR,GBP, |

|

Tools

|

Economic Calendar,Charting Software, |

|

Website Languages

|

en, |

|

Support languages

|

en, |

|

Bonus

|

Yes |

|

Reviews Rating

|

3.2 |

|

Withdrawal Fee

|

Yes |

|

Trading Signals

|

Yes |

|

Free Education

|

Yes |

|

Daily News

|

Yes |

|

Demo account

|

Yes |

|

Swapsr

|

Yes |

|

Pors

|

1. MT4 Trading platform Available. |

|

Cors

|

1. None |

|

Display Analysis

|

No |

|

Serving country

|

GB, |

|

Not Serving country

|

AF,AU,BY,BE,BI,CA,CF,CG,CD,DE,GN,GW,HT,IR,IQ,KP,LA,ML,MM,SO,SD,SY,UG,US,YE,ZW, |

|

Contests

|

Yes |

|

Market analysis

|

Yes |

|

Copy Trading Brokers

|

Yes |

|

Bitcoin Forex Brokers

|

No |

|

Social trading

|

Yes |

|

Web trading

|

Yes |

|

Forex pairs

|

Yes |

|

CFDs

|

Yes |

|

Crypto

|

No |

|

Hedging

|

Yes |

|

PAMM

|

PAMM,MAMM,Copy,Myfxbook Auto trade,Mql5 signals, |

|

Mobile Trading

|

Yes |

|

Scalping

|

Yes |

|

Automated Trading

|

Yes |

|

Partnership Programs

|

Yes |

|

Free Phone

|

+44232948230 |

|

Customer Support

|

Exness Broker reviews & comments (0)

Add a review

Your email address will not be published. Required fields are marked *