Pacific Financial Derivatives Broker Reviews and Full Information

What is Pacific Financial Derivatives?

Pacific Financial Derivatives is an New Zealand brokerage company, founded with Japanese technology and expertise. First the company was a licensed IB (Introducing Broker) as well as further enhancing its offerings to be an Authorized Futures Dealer as well as a certified financial service provider.

10 Points Summary

| Headquarters | New Zealand |

| Regulation and License | FMA |

| Instruments | FX, Spot Metals, Commodities, CFDs, Indices, Futures and Contracts |

| Platforms | MT4 |

| EUR/USD Spread | 0.5 Pips |

| Minimum deposit | 5$ |

| Demo Account | Provided |

| Base currencies | AUD, USD |

| Education | A wide range of educational support and customer support |

| Customer Support | 24/5 |

Are Pacific Financial Derivatives safe or a fraud?

It is vital to take care when choose a broker, as those that are regulated have to reduce risk managementand adhere to strict adherence of regulations and maintain specific capital. Thus, it is crucial to work using a legitimate state firm that is in compliance with the relevant registrations.

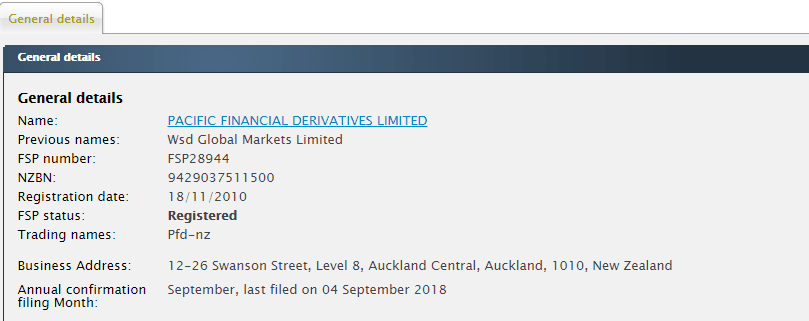

In the beginning of PFD time, the company was granted permission to operate by the Securities Commission as an Authorised IB in NZ Futures and Options Exchange. NZ Futures and Options Exchange. The firm then began to offer services and obtained a license to act as an the NZX's Futures and Options Participant Company.

Since 2011, the business has been recognized with the New Zealand authority FMA (Financial Markets Authority) to deal with Futures and four years later it obtained the license to be a Derivatives Issuer.

So, there's no doubts regarding PFD operational standards and the compliance as the supervision of FMA ensures a secure trading environment for investors. The fundamental requirements are in line with the most important laws, including anti-money laundering as well as fair dealing regulations.

In general it is the FMA is an agency that has the responsibility of regulating financial services and markets in the NZ , ensuring efficacy and the ability to provide transparency.

Instruments

Presently, PFD provides brokerage services via the NDD Straight to process model for trading with FX Spot Metals, Commodities, CFDs, Indices, Futures and Contracts to investors of every size and from all over the world.

Leverage

With PFD You'll be able to select a the right leverage for your specific trading needs, starting from 1:20 and all the way up to 1300 which is thought to be as high-leverage. Leverage tool is certainly powerful, however, you must be aware of how to use it in the most effectively, since leverage can work against you to the gains you make.

Yet, as the New Zealand broker PFD still offers the most leverage for retail traders, providing an the possibility of doubling the potential gains.

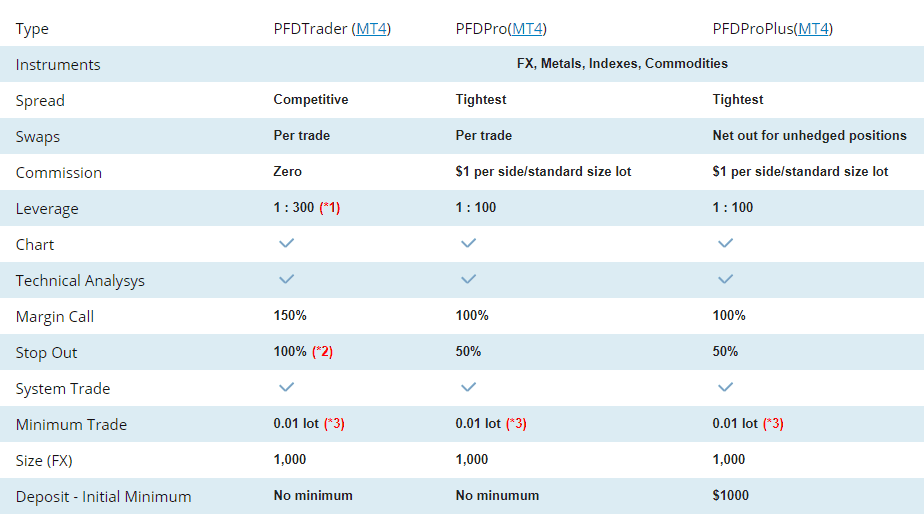

Types of accounts

PFD Broker created three types of accounts with access to the entire range of trading instruments with a wide range of trading conditions that are suitable. Also, trading terminals with monthly and daily statements as well as risk management using the positions of profit and loss and unbeatable support.

Additionally, there is the possibility of opening account Islamic accounts for clients who adheres to Sharia rules. This account comes with an account that does not rollover charges on overnight trades.

Fees

The accounts are created to cater to beginners who prefer to trade using all the costs included in an spread using the accounts like PFDTrader and, as they become more professional, you can move to PFDPro, which comes with the the tightest spread and a 1$ commission per transaction. It is also great that it has there is no deposit minimum required for either account, therefore you can trade with any amount.

Spreads

Pacific Financial Derivatives spreads are displayed according to the type of account that you trade with, as an example, see the table below to see the average spreads, which could be as low as the minuscule amount of pointsby trading on PFDProPlus. PFDProPlus account. Always take into consideration rolling over or the overnight fees as a charge that is added to open positions for overnight, as well as with 1% for short positions. You can also look at fees with another well-known brokerage FXCM.

| Asset/ Pair | PFDTrader Spread |

| EUR/USD | 0.5 |

| Crude Oil WTI | 17 |

| Gold | 20 |

Funding Methods

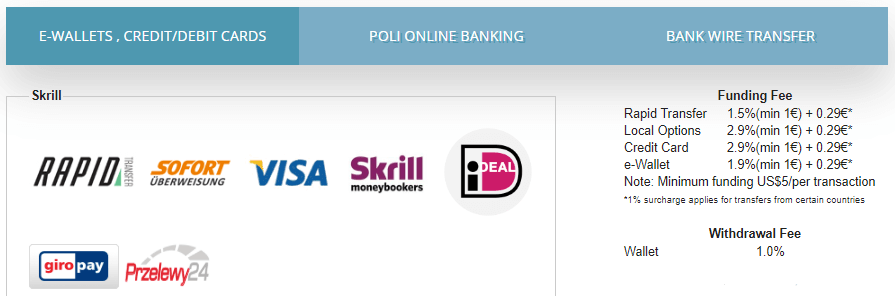

If you want to begin live trading it is necessary to top-up your account. Several choices to deposit or transfer funds are open to you. However, it is important to note that payment service providers can charge fees applicable to specific payment terms.

Deposit Options

Methods that include the those that are the most frequent payments with cards E-wallets, Bank Transfers, and Bank Transfers Neteller, Skrill, iDEAL, SoFort, etc or through POLi on-line banking.

Minimum Deposit

Pacific Financial Derivatives minimum investment is 5 dollars.

Pacific Financial Derivatives minimum deposit as compared to other brokers

| PFD | Most Other Brokers | |

| Minimum Deposit | $100 | $500 |

Withdrawal

The fees for funding or withdrawal fees vary between the various service providers, but were typically between 1.5-2.9 percent. There are, however, free withdrawals via Neteller or you'll get 1.0 percent in the event that you choose to pay with a card.

Trading Platforms

Like most brokerages, PFD provides the MT4 trading platform that is the most frequently utilized global platform that has a user-friendly interface and powerful features. PFD is a certified MetaQuotes partner that provides cutting-edge software for trading and allows trading of Forex, CFD and Futures Markets.

It is a platform is available through a web-based application, which simplifies the trading process, since the platform is accessible on any device and through any web browser with the only requirement is an internet connection. The mobile version is downloadable and the desktop Application are also available which allows users to remain connected and monitor trades with complete control as well as comfort and ease.

Furthermore, PFD's MT4 enhanced includes MetaTrader Market, a third-party robot and indicator vendor and the provider of numerous trading signals as well as a variety of tools at different levels. Through MultiTerminal traders can trade using the same interface for multiple accounts at once and Money Managers are highly regarded as well, and there is the option to get an Money Manager account.

Customer Support

Alongside the easy strategies and competitive pricing In addition, the broker offers traders with comprehensive educational assistance as well as customer service.

Support for customers is comprised of experts in trading who can assist you in every way they can that may be needed, including advice on analysis technical assistance, as well as in regard to operational matters in addition to the usual questions.

The client base of the business consists of retail traders from starting beginning to experienced veteran traders, along with institutional or corporate clients. The overall PFD ranking always gets the most praise from customers.

Conclusion

This Pacific Financial Derivatives review shows the existence of a New Zealand established brokerage companythat is operating and rely on the expertise in Japanese technologies. The long-standing process of STP gives direct access to efficient spreads and strong capabilities. In the end, the trading conditions are suitable for investors or traders in any amount as there are no requirement for deposits and a wide range of opportunities to participate, as well as the educational material and assistance from the company.

| Properties | Values |

|---|---|

|

Name

|

Pacific Financial Derivatives |

|

Minimum Diposit

|

$ 5 |

|

Leverage

|

1:300 |

|

Regulation

|

FMA (Austria),, |

|

Headquarters

|

New Zealand |

|

Established

|

1999 |

|

Address

|

Level 8, Swanson House,12- 26 Swanson St., Auckland Central 1010, New Zealand |

|

Platform

|

MT4,MT5,MT4 WebTerminal,MT5 WebTerminal,, |

|

Payment Method

|

Paypal,Visa,Mastercard,Credit Card,Wire,, |

| Properties | Values |

|---|---|

|

Spreads

|

0.5 pips |

|

Min Position size

|

0.01 |

|

Broker Type

|

STP (Straight Through Processing),NDD (Non Dealing Desk),Instant Execution,,,,, |

|

Account Type

|

Cent account,Mini account,Islamic account,Standard,, |

|

Brokers by Country

|

US Forex Brokers,, |

|

Techniques

|

Scalping Forex Brokers,Mobile Trading Brokers,, |

|

Instruments

|

Forex Trading Brokers,Gold Trading Brokers,Stock Trading Broke,Oil Trading Brokers,Metal Trading Brokers,,,,,,,,, |

|

Account currency

|

USD,EUR,GBP,CAD,JPY,NZD,CHF,,USD, |

|

Tools

|

Economic Calendar,Charting Software,, |

|

Website Languages

|

en,, |

|

Support languages

|

en,, |

|

Bonus

|

Yes |

|

Reviews Rating

|

3.8 |

|

Withdrawal Fee

|

Yes |

|

Trading Signals

|

No |

|

Free Education

|

Yes |

|

Daily News

|

No |

|

Demo account

|

Yes |

|

Swapsr

|

Yes |

|

Pors

|

1. Regulated brokerage 2. User friendly MT4 platform for multiple devices 3. FIX API 4. Variety of account funding methods |

|

Cors

|

1. No USA clients 2. No Cryptocurrencies for trading 3. Expiring demo accounts 4. No daily market analysis 5. No trader academy |

|

Display Analysis

|

Yes |

|

Serving country

|

NZ,, |

|

Not Serving country

|

US,, |

|

Contests

|

No |

|

Market analysis

|

No |

|

Copy Trading Brokers

|

No |

|

Bitcoin Forex Brokers

|

No |

|

Social trading

|

No |

|

Web trading

|

No |

|

Forex pairs

|

Yes |

|

CFDs

|

Yes |

|

Crypto

|

No |

|

Hedging

|

Yes |

|

PAMM

|

Yes,,,, |

|

Mobile Trading

|

Yes |

|

Scalping

|

Yes |

|

Automated Trading

|

Yes |

|

Partnership Programs

|

Yes |

|

Free Phone

|

+64 9 6320129/100/121 |

|

Customer Support

|

24/5 |

Exness Broker reviews & comments (0)

Add a review

Your email address will not be published. Required fields are marked *