MultiBank Exchange Group Broker Reviews and Full Information

What is MultiBank Exchange Group?

MultiBank was founded at the time of its establishment in California around 2005 and has since grown into an important financial institution offering clients direct access to exchanges and banks by using the latest trading platforms.

MultiBank Exchange Group is a MultiBank Exchange Group service is offered to more than 280,000 institutional and retail customers in over 90 countries. MultiBank has branches with offices in Sydney, Los Angeles, Vienna, Frankfurt, Madrid, Cyprus and UAE.

The group also has diverse branches that each have their own mission and purpose like MEXFintech is located at Hong Kong, while MEX Group Worldwide has locations located in Hong Kong, MEX Asset Management (Austria) GmbH, Beijing, Tianjin, Hangzhou and Ho Chi Minh City.

MultiBank Exchange Group Pros and Cons

MultiBank Exchange Group Globally recognized financial institution that has Sharp compliance to regulations It offers Forex as well as CFDs, with excellent Forex trade capabilities. It also offers a a variety of platforms, fast account opening and commission-free withdrawals and deposits.

If you have negative points, the Proposal are based on the organization and there is no 24/7 assistance.

10 Points Summary

| Headquarters | Australia, Germany, US, UAE, Hong King and Cyprus |

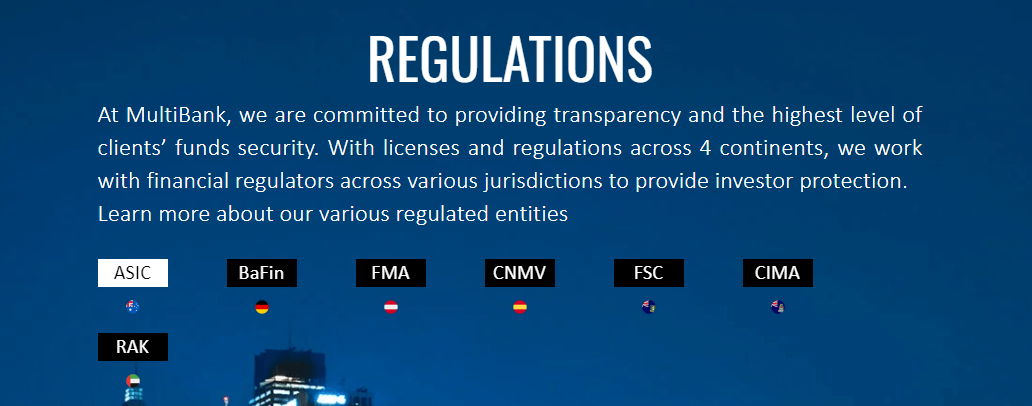

| Regulation | ASIC, BaFin, RAK |

| Platforms | MT5, Maximus, MultiBank Pro Platform, ECN PRO |

| Instruments | Currency, Forex, Indices and other commodities |

| EUR/USD Spread | 0.5 pip |

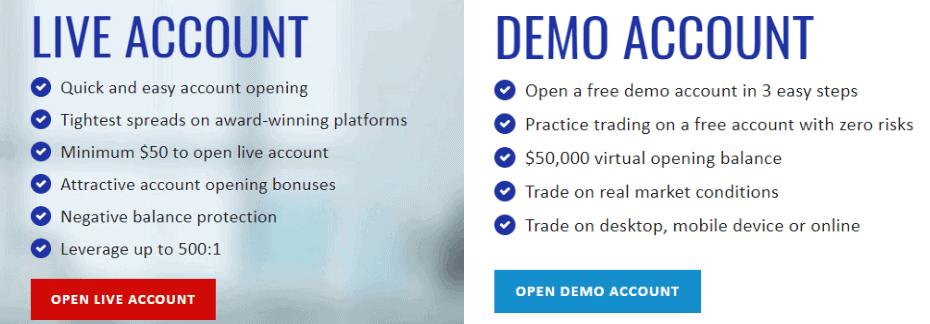

| Demo Account | Available |

| Minimum deposit | 0$ |

| Base currencies | Various currencies |

| Education | Tools for trading, research material and social trading |

| Customer Support | 24/5 |

Awards

MultiBank Exchange Group believes technology that is used to exchange is the most secure control over the financial markets, and that is why MultiBank Exchange Group delivers an award-winning trading system, as well as brokerage services and liquidity. In the end, the broker and its financial institution, which functions as an organization is a widely honored and recognized business that continuously develops its propositions and reaps significant rewards from it.

Does MultiBank Exchange Group safe or is it a fraud?

MultiBank Exchange Group is one of the well-known and respected financial institutions that follow best practices and are licensed and regulated in every country it serves which means it is not a fraud. MultiBank licenses include top-tier ASIC, BaFIN so is considered to be low risk Forex or CFD trading.

Are the MultiBank Exchange Group legit?

Yes there is a reason that MultiBank Exchange Group is legit. MultiBank Exchange Group is legit and highly regulated around the world. It includes world-renowned and respected authorizations - for instance, the Australian Securities and Investment Commission ("ASIC") and the Federal Financial Supervisory Authority ("BaFin") from Germany as well as European cross-boarding authorizations through CNMV, FMA.

Additionally, there is offshore registrations for offshore registration with Financial Services Commission ("FSC") of the British Virgin Islands, the Cayman Islands Monetary Authority ("CIMA") that in it's own doesn't provide the adequate security, and we suggest signing the agreement. However, in conjunction with many laws and regulations, MultiBank Exchange Group is considered to be a secure trader broker that you can invest in or deal with.

What are the best ways to protect traders?

At MultiBank because of its huge regulatory obligations, it operates in compliance with international standards that must be adhered to and provide the best protection and level of protection, you will be sure of its services.

Absolute security for funds is guaranteed by the regulated firms from MultiBank Exchange Group provided also all over the world and as much as 10 million dollars per bank account and segregated accounts at banks of first class. In addition the company also had the protection of negative balances that protects your account from losses, even though not all regulations requires this to the broker.

Leverage

Based on the specific organization within that particular entity of the MultiBank Exchange Group and its legal obligations The client will be provided with the opportunity the possibility of leverage tools that are powerful that can increase the results of trading.

In reality, regulations in a state or another have different laws regarding leverage and leverage, resulting in

- European institutions significantly reduce the permitted leverage up to 1:3 for the major currency pairs.

- Australian clients are still able to use the highest leverage ratios that can reach 1:500.

- International traders 1:500

- Dubai customers who are subject to RAK UAE regulation may use 1:200

- Professional clients entitled to 1:500

It is nevertheless recommended to be aware of how to utilize leverage effectively to avoid falling into unnecessary risk when trading.

Types of accounts

The specifications for trading accounts are can be divided into offering to retail clients or the institutional one this means it is an institutional account is determined by the type of investor and also offers Social Trading features.

Additionally, you'll have the option of choosing between platforms like Maximus MT4, MultiBank Pro MY4 or ECN Pro MT4, where the trading conditions and costs can differ from one the other.

How do you open an Account?

MultiBank Exchange Group review also shows steps on how to set up a digital bank account, which is a simple procedure. You must submit the required details and documents to prove your identity before proceeding to each step.

- Follow the Open Account link

- Enter your personal details and trade experiences to confirm your Live account.

- Verify your account by clicking the link you receive in your email. You will then gain the access you need to login into your account section and Demo trading

- First deposit

- Markets and access to trading

Fees

For the cost of trading, MultiBank Exchange Group mainstays on the costs that are included in the spread-only option that is available for accounts with a Standard account.

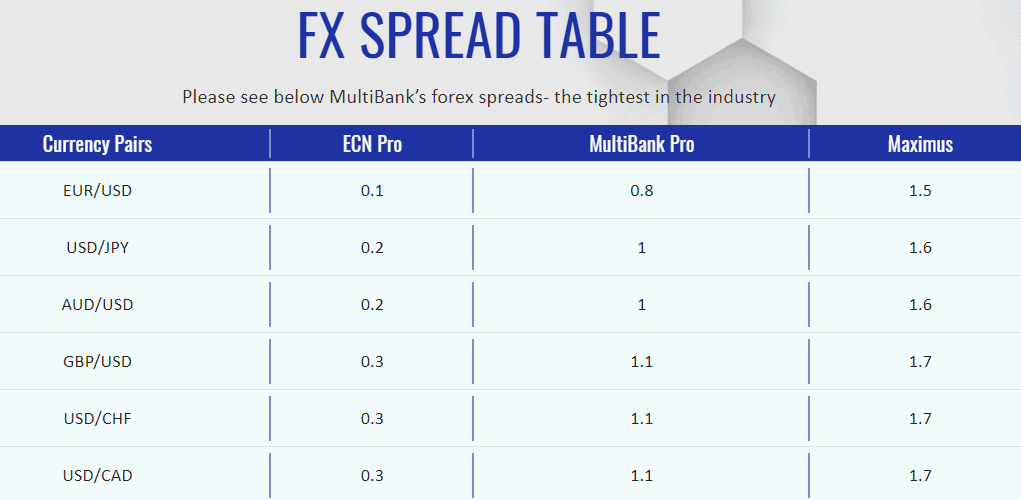

ECN ProMT4 - for a high-end account, with an active amount of 5,000$, it offers spreads as low as 0.1 pip, and a the commission is three dollars per lot and a trade total of 20.000$ and the commission is reduced into 2dollars per lot. This is a very competitive option and a good trading choice.

In general, MultiBank Exchange Group costs are in the range of low-cost trading with respect to the competition in the industry and you can also look at more cost examples below and on the picture to see the distinctions among the different platforms. Also, you can compare them to another brokers like Just2Trade.

Spreads

MultiBank trading conditions may differ depending on the trading account or platform you utilize at MultiBank for example, when you trade through Maximus MT4 then the spreads are typically approximately 1.4 percent. MultiBank Pro MultiBank Pro MT4 is designed specifically for those who have more experience and larger sizes due to the requirement of a 1,000dollars initial deposit. It is also cheaper generally 0.5 percent.

| Asset/ Pair | MultiBank Exchange Group Spread | OctaFX Spread | AvaTrade Spread |

|---|---|---|---|

| EUR USD Spread | 0.5 Pips | 0.5 pip | 1.3 pip |

| Crude Oil WTI Spread | 2 Pips | 2 pip | 3 pip |

| Gold Spread | 15 | 20 | 40 |

| Fees | MultiBank Exchange Group Fees | OctaFX Fees | AvaTrade Fees |

|---|---|---|---|

| Deposti Fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity Fee | Yes | Yes | Yes |

| Fee position | Low | Low | High |

Photo of MultiBank Exchange Group fees

Trading Instruments

MultiBank's trading account gives you an unbeatable liquidity in a strictly controlled framework to ensure your funds are secure, as well as the possibility of trading various instruments, including currency exchanges, metals and CFDs that have a strict pricing.

It is a sign that the exchange technology provides you with complete transparency, with quotes from 20 of the top banks, 12 exchanges and 6 ECNs and with the growth of technology based on blockchain and crypto currencies, MultiBank has included this asset in its CFD trading service.

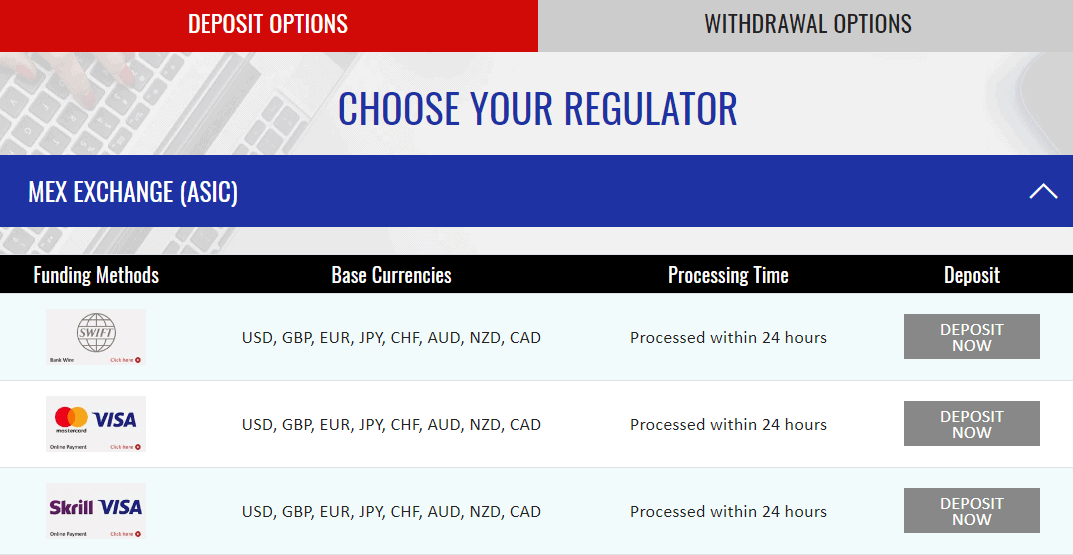

What payment options does MultiBank Exchange Group offer?

MultiBank offers a range of fast, simple and secure payment methods for withdrawals and deposits that is available to select the most suitable one however, they are subject to regulatory restrictions that are imposed by another. Thus, the traders that have been issued with different Group organizations may have variations in the method of payment and charges, if applicable..

Deposit Options

One of the advantages is the ability to select the currency of your account as your base currency, so that you not be charged unnecessary fees for exchange. The supported currencies include USD GBP, EUR, USD JPY, CHF, NZD, AUD as well as general options for funding, including the following options however, make sure you use the you have the option available in the country you are from.

- Bank Wire transfers,

- Credit Card,

- Neteller, Skrill, fasapay and online-payments

Minimum deposit

MultiBank's Minimum deposit is 50$ which can be a fantastic opportunity for traders regardless of its size or the strategy. But, be sure to examine the applicable margins for the instrument you plan to trade to ensure you can meet certain conditions. Also, the various platforms for technology, which may require larger deposit amounts.

HYCM minimal deposit is different from other brokers

| HYCM | Most Other Brokers | |

| Minimum Deposit | $100 | $500 |

Withdrawal

In general, MultiBank Exchange Group does not charge commissions for withdrawals or deposits on its behalf however, the different regions have their own legal rules for payment service providers and international laws may result in certain charges. You should confirm any charges with the provider directly and the customer support of the broker.

How can I withdraw funds to MultiBank Exchange Group?

To take the money out of the account, you must submit the request online . In addition, the funds will be transferred via the method you choose.

What is the time frame to withdraw funds out of MultiBank Exchange Group?

Typically , brokers will confirm your request for withdrawal within 1-2 business days however, this can vary based on the terms of the company.

Trading Platforms

MultiBank platform provides the latest technology that is based on MetaTrader's strong capabilities, incorporated into the MT4 and MT5 platforms which allow partial filling using bridge technology, without slippage or requotes. Utilizing the MT4 engine, these platforms operate an ECN connections that are customized to suit the capacities of trading options that allow advanced, yet user-friendly fit for any trading strategy.

| Pros | Cons |

|---|---|

| A wide range of platforms, such as MetaTrader5, Maximus, ECN Pro, and the MultiBank Pro, a proprietary MultiBank Pro platform | None |

| Trade with ease for the user | |

| Alerts on price and notifications via push | |

| Different languages are supported and there are different trading styles | |

| Web versions, Mobile and Desktop versions | |

| Social trading, trading ideas, trading APIs and Expert Advisors PAMM and MAM trading |

Web Platform

In particular, MultiBank platforms including an array of platforms like Maximus Platform, ECN PRO Platfrom and MultiBank Pro Platfrom, and each one is suited to the requirements of the customers they serve and offer a great options for any type of trader you're.

Therefore, if you're a an algorithmic, scalper or automated trader, or making use of the advanced offerings for money managers with MAM, PAMM as well as MAM, everything is readily available and accessible through MultiBank Exchange Group platforms.

Desktop trading platform

All platforms are available in desktop versions too as a place to find the essential tools needed to manage your positions as well as advanced analytics features. There are also a variety of options for maximizing your strategies and also allowing you to manage the risk of your money.

The majority of the platforms are all run on MT4 software, and are vary by type of account, which includes and can be tailored to your accounts' pricing and options. However it is the MT5 platform includes all the different features of the MT4 with the addition of additional editions, like enhanced trading capabilities as well as enhanced scripting tools for customized indicators and experts to assist you.

Mobile Platform

Absolutely mobile apps are included and each platform comes with an app that is easy to use, and comes with a an array of tools.

In addition to everything else, in addition to the award-winning platform capabilities that MultiBank is well-known for it's diverse portfolio of services includes the ability to use a free VPS and APIs, and also with no restrictions on EAs. Furthermore, there's an possibility to be a part of an online Demo Contest and win significant prizes, with no financial risk, and that is an excellent opportunity.

Customer Support

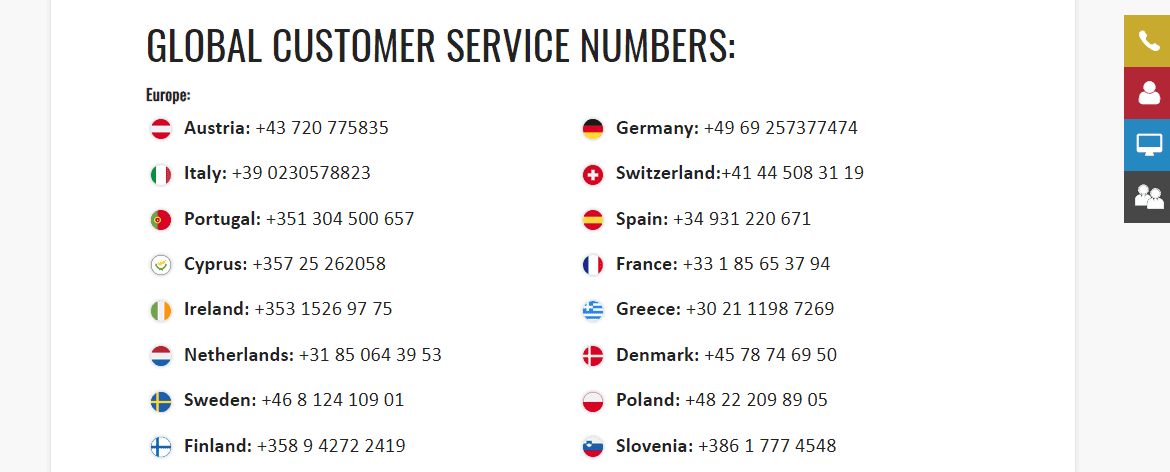

Furthermore, the diversity of the firms provides their clients with a variety of support options at any time and with any questions. The 24h customer support is available in 10plus languages and the help desk along with on-boarding, configuration, and cash management capabilities.

Additionally, Customer Service reachable easily and can provide high-quality answers being available via Email, Live Chat or or the contact form and even an a staggering number of international telephone lines which truly span the world.

Research

For beginners, you can count on education support with instructional materials, videos tutorials and seminars, as well as up-to-date, organized financial news online in a variety of languages to help you make better choices and gain knowledge.

In the end, MultiBank Education was timely acknowledged, and there is an efficient learning center that is well-organized and also various research tools and resources. You will have access expert advisors Signals providers and social trading tools which will help you learn to replicate trades and trades and much other.

Conclusion

Overall The MultiBank Exchange Group review presents an organization with a wide variety of offices with established locations and expanded trading portfolios across the various nations, regulations, and products. In general the case, the MultiBank Exchange Group broker is an option that is reliable for nearly all traders from almost everywhere because of their worldwide coverage, comprehensive trading plan and the excellent support they provide. There are a variety of accounts ideal for new traders or investors with experience, in addition to the competitive conditions for trading through their STP process of transactions.

| Properties | Values |

|---|---|

|

Name

|

MultiBank Exchange Group |

|

Minimum Diposit

|

$ 50 |

|

Leverage

|

1:30 | 1:500 |

|

Regulation

|

ASIC (Australia),BaFin (Germany), |

|

Headquarters

|

Australia, USA, Germany |

|

Established

|

2005 |

|

Address

|

MEX Group Worldwide Limited. 200 Gloucester Road, Wan Chai, Hong Kong |

|

Platform

|

MT4,MT5, |

|

Payment Method

|

Visa,Mastercard,Credit Card,Wire,Skrill,Neteller, |

| Properties | Values |

|---|---|

|

Spreads

|

0.5 pips |

|

Min Position size

|

0.01 |

|

Broker Type

|

MM ( Market Maker),ECN (electronic communications networks),,,, |

|

Account Type

|

Mini account,High Leverage,Standard, |

|

Brokers by Country

|

Australian Forex Brokers,US Forex Brokers, |

|

Techniques

|

Scalping Forex Brokers,Hedging Forex Brokers,Automated Trading Brokers,Mobile Trading Brokers,Day Trading Brokers, |

|

Instruments

|

Forex Trading Brokers,Futures Trading Brokers,CFD Trading Brokers,Commodity Forex Brokers, |

|

Account currency

|

USD,EUR,GBP,AUD,CAD, |

|

Tools

|

Economic Calendar,Charting Software, |

|

Website Languages

|

en, |

|

Support languages

|

en, |

|

Bonus

|

Yes |

|

Reviews Rating

|

3.2 |

|

Withdrawal Fee

|

No |

|

Trading Signals

|

No |

|

Free Education

|

Yes |

|

Daily News

|

No |

|

Demo account

|

Yes |

|

Swapsr

|

Yes |

|

Pors

|

1. ASIC, BaFin Regulated Broker. 2. MT4, MT5 Trading Platform Available. |

|

Cors

|

1. None |

|

Display Analysis

|

Yes |

|

Serving country

|

AU,CY,DE,HK,AE,US, |

|

Not Serving country

|

GB, |

|

Contests

|

Yes |

|

Market analysis

|

Yes |

|

Copy Trading Brokers

|

No |

|

Bitcoin Forex Brokers

|

No |

|

Social trading

|

Yes |

|

Web trading

|

Yes |

|

Forex pairs

|

Yes |

|

CFDs

|

Yes |

|

Crypto

|

No |

|

Hedging

|

Yes |

|

PAMM

|

Myfxbook Auto trade,Mql5 signals, |

|

Mobile Trading

|

Yes |

|

Scalping

|

Yes |

|

Automated Trading

|

Yes |

|

Partnership Programs

|

Yes |

|

Free Phone

|

+1 646-568-9702 |

|

Customer Support

|

24/5 |

Exness Broker reviews & comments (0)

Add a review

Your email address will not be published. Required fields are marked *