MEX Exchange Broker Reviews and Full Information

What exactly is MEX Exchange?

MEX Exchange is an established firm that specializes in online financial trading, which has been in operation from 2012 to Australia in Australia. It has has since become one of the top-rated companies in the industry. MEX Exchange offers its customers trading services through its sophisticated trading platforms that cover various instruments like the Forex market, Metals, CFDs, and stocks.

Additionally, MEX Exchange is part of the global organization, and a famous business MultiBankwith locations within Sydney, Los Angeles, Vienna, Frankfurt, Madrid, Cyprus, MEXFintech in Hong Kong, along with other locations MEX Group Worldwide offices in Hong Kong, MEX Asset Management (Austria) GmbH, Beijing, Tianjin, Hangzhou and Ho Chi Minh City, and more.

As we'll see more specifics regarding MEX Exchange services provided, the broker has become a huge as its services were are offered to over 280,000 customers, both institutional and retail across more than 90 countries.

MEX Exchange Pros and Cons

MEX Exchage is a reliable broker that has a good education and trading plans built on MT4 with a zerominimum deposit amount of $.

On the MEX Cons , the products are restricted only to Forex and CFDs as well as no support available 24/7.

10 Points Summary

| Headquarters | Australia |

| Regulation | ASIC |

| Platforms | MT4 |

| Instruments | CFDs are trading on Indices, Currencies, as well as commodities |

| Spread EUR/USD | 0.5 Pips |

| Demo Account | Available |

| Minimum deposit | 0$ |

| Base currencies | Various currencies |

| Education | Partnerships for Education and tools |

| Customer Support | 24/5 |

Awards

Thus, by offering its unrivalled knowledge of technologies, trading systems, and an approach that is professional towards FX trading and CFD, MEX exchange also delivers numerous trading options with a high-quality pricing and powerful conditions. In addition, there is a variety of tools including education material performed by the partnership with LepusProprietaryTrading a famous Forex educator, all accompanied by support on whatever question you may have.

Additionally, they have developed possibilities for Money Managers using the PAMM and MAM accounts, and numerous institutional programs that overall have recognized MEX Exchange as a great trading company, with a variety of business awards, honors, and other benefits. That's despite the large number of satisfied customers they support that acknowledge their achievements, too.

Does MEX Exchange safe or a fraud?

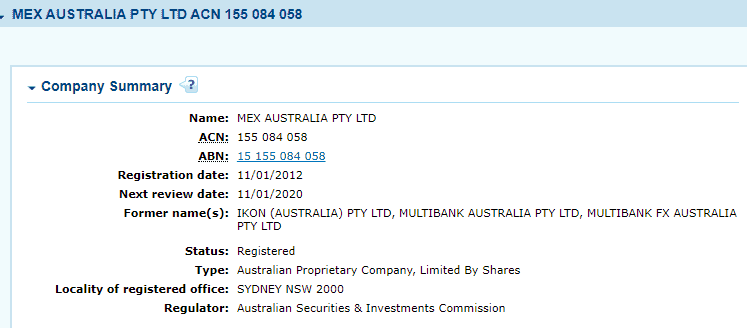

MEX Exchange is not an enigma, it's an Australian financial service company which abides by its regulations and laws, allowing trades with low risks. Australia being a highly regarded and trustworthy jurisdiction is strictly regulated by its financial companies and holds them to capitalization that is high as well as the protection of clients, ensuring that the integrity of markets and a healthy competition.

The responsibility of regulating financial institutions is performed through the authorities ASIC is a world-class regulator. Learn more regarding ASIC regulations via clicking here.

Is MEX Exchange legit?

It is indeed an authorized broker due to its registration and regulatory status in Australia. Additionally, it is evident it is that MEX Exchange is a part of the MultiBank Exchange Group that is an international financial investment company highly regulated by world respected authorities in respectable jurisdictions.

Traders protection

According to ASIC regulations, MEX Exchange follows ASIC guidelines, MEX Exchange maintains the accepted international guidelines for the administration of money and the operation of traders' accounts with the highest level of security. This entails segregation of the accounts of clients from corporate funds, making them impossible for the company to access it as well as implementing security for transactions.

Overall the rulebook will ensure your investment is protected by laws of the country safeguarding your interests while ensuring transparency throughout the trading processes.

Leverage

As an Australian financial investment company, MEX Exchange still permits high leverage ratios of up to 1:500 for traders who are retail. The leverage you earn is also based on the type of instrument you trade and also as determined by the degree of the trader. Therefore, professionals can are able to access higher levels when they confirm their status.

- Leverage for retail traders is 1:500 for the major currency pairs 1:100 for Commodities

But, it's essential to be aware of how to utilize leverage effectively since many world's regulators are already reducing drastically the amount of leverage allowed to protect customers. Furthermore there are defined margins that are required for trading certain instruments, which you need to examine and verify since margin calls happen in the event that there aren't enough funds to trade.

Types of accounts

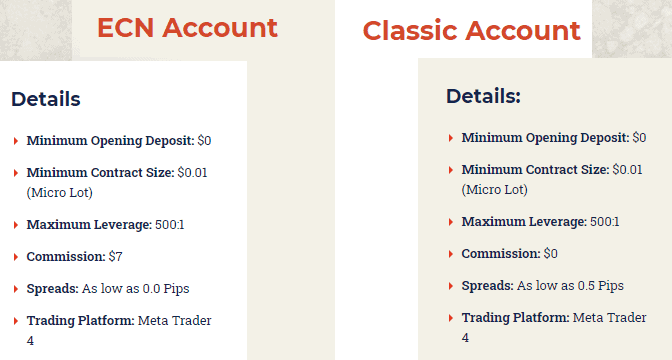

MEX Exchange offers two kinds of accounts designed to meet your preferences for trading. The options include a Standard account that operates on an open-ended basis as well as an ECN Account with a commission fee per trade. Both utilize powerful execution that is that is based in an STP bridges MEX Exchange group develops.

In fact the stability of performance is among the primary goals of MEX Exchange thus you'll probably appreciate its terms and conditions as well as the price models offered and also quotes from a variety of liquidity providers.

How to open an Account

Opening a digital account is an easy process and you must provide the necessary documents and information or make an order to make everything up perfectly. Follow the link to open your account and follow the subsequent steps.

- Follow the Open Account link

- Give your personal information and trading experience to verify your Live account.

- Verify your account using the link in your email. You will then gain the access you need to login into your account and Demo trading

- First deposit

- Markets and access to trading

What is MEX Exchange Fees?

The main thing for any trader is to think about a the course of fees or the amount you must pay the broker to use the trading service. While charge spreads are common which is the differences between buy and sell price, there's additional fees to consider, including fees for non-trading and inactivity charges, check out the the table below on fee rankings.

Additional charges

Other costs that could be added to your position include MEX Exchange swaps and overnight charges which will be charged when an account is open for more than one day. Swaps are calculated for each instrument, because each currency pair comes with each its own individual swap fee and can be checked directly on the platform.

Additionally, additional costs could include an inactivity fee or other fees which could be waived in exchange in the case of deposits or withdrawals So, it is best to think about all of the options like we did with the MEX Exchange Review.

| Fees | MEX Exchange Fees | OctaFX Fees | AvaTrade Fees |

|---|---|---|---|

| Fee for deposit | No | No | No |

| Fee for withdrawal | No | No | No |

| Fee for inactivity | Yes | Yes | Yes |

| Fee position | Low | Low | High |

Spreads

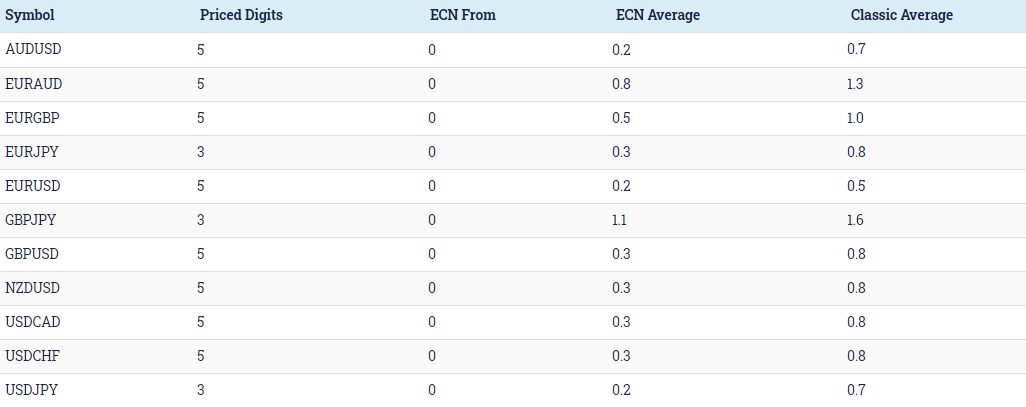

MEX Exchange spread as usually is determined by the type of account you manage. Thus, a the standard account that has all expenses included in spread, has spreads that start at 0.5 pip without additional costs that are a great choice for calculating easily taking positions.

If you choose to utilize MEX's ECN You will receive raw spreads beginning at 0.0 pip however, you will be charged a commission that is $7. You may see some examples of Forex spreads for the Classic account. We also found the MEX fees are competitive. You can compare their fees with AvaTrade.

| Asset/ Pair | MEX Exchange Spread | OctaFX Spread | Spread of AvaTrade |

|---|---|---|---|

| EUR USD Spread | 0.5 Pips | 0.5 pip | 1.3 Pips |

| Crude Oil WTI Spread | 2 pip | 2 Pips | 3 pip |

| Gold Spread | 15 | 20 | 40 |

Photograph of MEX Exchange fees

Instruments for Trading

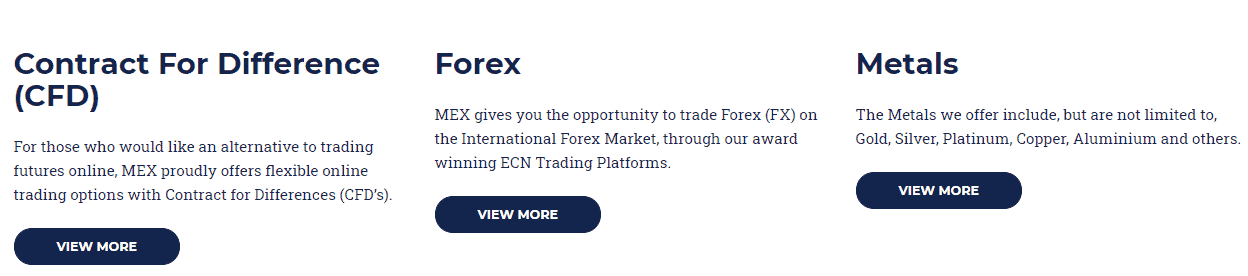

MEX Exchange builds its portfolio of instruments that are traded and offers trading in Forex, Metals and CFDs. Through CFDs trading, you can gain an access point to Cash Index trading, yet there are no exchange costs which are usually charged for trading directly in Indexes.

In addition to the most advanced ECN technology, MEX Exchange developed transforming it into a revolutionary stability platform for both beginners and professionals, which is an advantage even though the instrument selection is quite basic.

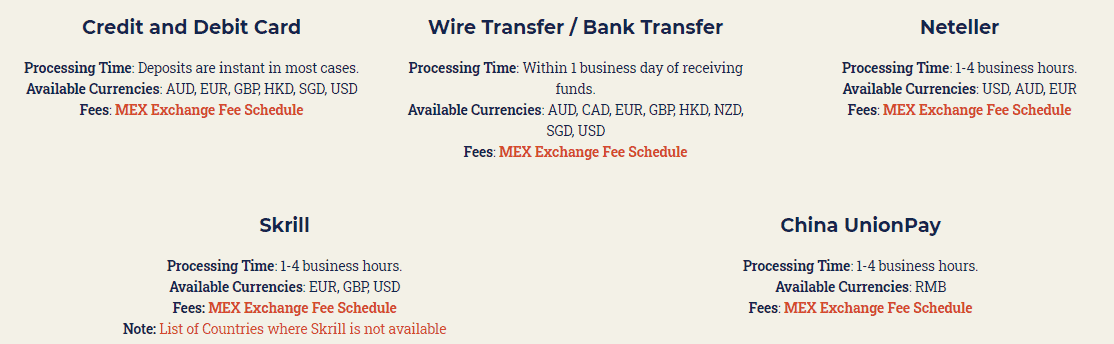

Deposits and withdrawals

MEX Exchange offers a selection of quick, easy and secure payment options for withdrawals and deposits, while all manipulations are made via the Client Portal. Additionally, you may choose your preferred base currency. This means that you don't have to pay any additional fees for conversion.

Option fees and Deposit fees

Typically, you will select a payment processor from

- Electronic-wallet Neteller, Skrill, China UnionPay,

- Transfers to banks or wires,

- Card payment

Is there a minimum amount of deposit required for MEX Exchange

MEX Exchange has no deposit requirements. Means, trader may decide the amount they wish starting with, since the minimum of zero dollarsfor Standard as well as ECN Accounts however, make sure to make sure you have all the required margins of the instrument you are trading.

MEX Exchange minimum deposit against other brokers

| MEX Exchange | The majority of other brokers | |

| Minimum Deposit | $0 | $500 |

Withdrawal

MEX Exchange withdrawal charges no fees at all internal costs. But according to the payment processor as well as the international law, certain fees could be relevant, so be sure to check these directly with the provider because they're not on your shoulders.

How long will it take to withdraw funds out of MEX Exchange?

Typically , brokers will confirm your request for withdrawal within one to two business days. However, be sure to add additional days because payment providers can take time to process your payment, which is dependent on the country you are from.

Trading Platforms

Mex Exchange offers you trading capabilities through a well-known option of MT4 technology which can also be enabled via an incomplete fill using bridge technology. Although the MetaTrader4 platform is a well-known platform among traders from all over the world, MEX Exchange enhanced software that includes an additional add-on, as well as many features that enhance its capability for a successful trading.

| Pros | Cons |

|---|---|

| Customer service that is of high quality | There is no 24/7 support |

| Live chat, phone lines | |

| Rapid response during working hours |

Web Trading

In the beginning, Web Trading allows you access to the trading area without any software required, simply by loading a web pages through your browser, you will be able to access your account and begin trading. It is extremely useful in all circumstances, but be aware that more advanced tools, as well as some additional options are only accessible on the desktop version of the software that is why, for trading with advanced features and features, you should install one.

Desktop platform

There are several variants of the program which are compatible for different devices, and they continuously evolving. This platform is marketed by the name MEX NexGenMT4, which is an online-based platform that includes all instruments as well as extensive analysis that MT4 is famous for.

Additionally, the platform accommodates APIs and Algos and Expert Advisors that are not restricted, and access via PAMM accounts that are available to managers So, all the features that are comprehensive along with a multitude of analytical and research tools are available.

Mobile Trading Platform

The mobile app is included in the package it is simple to use and includes a an array of tools. MT4 mobile has a range of features for charting, as well as customization. This is ideal for trading from mobile as well as full management for your accounts.

Customer Support

Through its international reach, the variety of its companies provide customers with a variety of support options in every case or concern. The 24-hour customer service is accessible in 10 languages through the help desk as well as on-boarding, configuration, and cash management is available via email, chat phones, chat lines etc.

Education

Beginners can count on education support via video and learning materials tutorials, seminars and other materialsdesigned in accordance with the degree of experience and appropriate to your needs. Indeed, education and good knowledge is a key to success in trading so here MEX Exchange is your good partner too, as long as the broker partnered with LepusProprietaryTrading some of well-recognized trading veteran company providing quality knowledge.

Additionally, in the process of trading, the broker also offers the most current online financial news in a variety of languages, which have been recognized as timely,where MEX Exchange has its own blog.

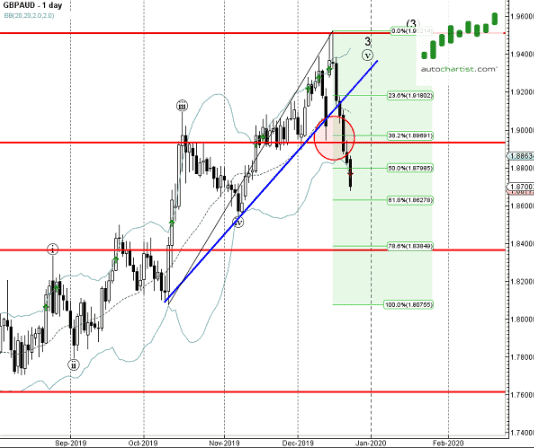

Tools for research and analysis are accessible through the platform. It also offers Autochartist as an excellent alternative to take advantage of DupliTrade sophisticated mirroring system for auto-execution that is recognized as the top signal provider to Forex, Indices and Commodities trading.

Conclusion

All in all, MEX Exchange might be an excellent option for both professional and beginner traders. MEX Exchange has strong background and a long history of trading success. They have as well as a robust technology that allows trading and also a more comprehensive offer with many assets that can be traded and a variety of various types of accounts to choose from, and educational materials. Thus, MEX Exchange might be a great choice for novice and experienced traders.

| Properties | Values |

|---|---|

|

Name

|

MEX Exchange |

|

Minimum Diposit

|

$ 0 |

|

Leverage

|

1:500 |

|

Regulation

|

ASIC (Australia),, |

|

Headquarters

|

Australia |

|

Established

|

2012 |

|

Address

|

Suite 61.03, Level 61, MLC Centre, 19-29 Martin Pl, Sydney NSW 2000, Australia |

|

Platform

|

MT4,, |

|

Payment Method

|

Visa,Mastercard,Credit Card,Wire,Skrill,Neteller,Union Pay,, |

| Properties | Values |

|---|---|

|

Spreads

|

0.5 pips |

|

Min Position size

|

0.01 |

|

Broker Type

|

MM ( Market Maker),STP (Straight Through Processing),DMA (Direct market access),, |

|

Account Type

|

Mini account,Fixed Spread,RAW Spread,Scalping,High Leverage,Islamic account,Standard,, |

|

Brokers by Country

|

Australian Forex Brokers,, |

|

Techniques

|

Scalping Forex Brokers,Hedging Forex Brokers,Automated Trading Brokers,Mobile Trading Brokers,, |

|

Instruments

|

Forex Trading Brokers,Gold Trading Brokers,CFD Trading Brokers,Commodity Forex Brokers,, |

|

Account currency

|

USD,,USD,,USD, |

|

Tools

|

Charting Software,, |

|

Website Languages

|

en,, |

|

Support languages

|

en,, |

|

Bonus

|

Yes |

|

Reviews Rating

|

3.2 |

|

Withdrawal Fee

|

No |

|

Trading Signals

|

No |

|

Free Education

|

Yes |

|

Daily News

|

No |

|

Demo account

|

Yes |

|

Swapsr

|

Yes |

|

Pors

|

1. MEX Exchage is a reliable broker with good education and trading proposal based on MT4 and 0$ minimum deposit requirement. 2. Quality customer support 3. Live chat, Phone lines 4. Quick response within working hours |

|

Cors

|

1. No 24/7 support |

|

Display Analysis

|

Yes |

|

Serving country

|

AU,, |

|

Not Serving country

|

GB,US,, |

|

Contests

|

Yes |

|

Market analysis

|

Yes |

|

Copy Trading Brokers

|

No |

|

Bitcoin Forex Brokers

|

No |

|

Social trading

|

No |

|

Web trading

|

Yes |

|

Forex pairs

|

Yes |

|

CFDs

|

Yes |

|

Crypto

|

No |

|

Hedging

|

Yes |

|

PAMM

|

Myfxbook Auto trade,Mql5 signals,, |

|

Mobile Trading

|

Yes |

|

Scalping

|

Yes |

|

Automated Trading

|

Yes |

|

Partnership Programs

|

Yes |

|

Free Phone

|

+61 2 9195 4000 |

|

Customer Support

|

24/5 |

Exness Broker reviews & comments (0)

Add a review

Your email address will not be published. Required fields are marked *