JP Markets Broker Reviews and Full Information

What exactly is JP Markets?

JP Markets is a South African Forex brokerthat first began its operations in 2016 , based on an understanding of the foreign financial market. The primary JP Markets offering strives to be able to participate in long-term partnerships and the ability to trade that inspire local and international traders to achieve success in trading.

This can be done in a variety of ways, such as investing in the knowledge of traders, which JP Markets provides knowing that an effective trader is an experienced trader.

Who owns JP Markets?

Although the main JP Markets operations based throughout many countries across Africa its primary base is South Africa and the company that is responsible for it is has its headquarters in South Africa as well. It is the African center in Forex trading, the broker's proposition is constantly expanding even. In the JP Markets review we will look at its offerings in depth and then decide if it's an effective broker or not.

JP Markets Pros and Cons

JP market account opening is quick and smooth. It is it is a good way to access high-quality conditions for trading and copy trading, as well as educational tools.

However, there are a few disadvantages, and we also discovered certain negative comments and complaints about the broker too that could at one point misleading regarding the broker's professionalism. Therefore, we recommend investors check their information thoroughly before they opening an account with JP Markets.

10 Points Summary

| Headquarters | South Africa |

| Regulation and License | FSB |

| Platforms | MT4 |

| Instruments | Forex, Metals Indices, Shares and Futures built on CFDs |

| Costs | 1.7 pip |

| Demo Account | Available |

| Minimum deposit | 0$ |

| Base currencies | USD |

| Education | Webinars, Videos, and Analysis |

| Customer Support | 24/5 |

Awards

In addition to its dynamic trading reputation in the market as among the top brokerages within South Africa also through thousands of traders that they connect with There are many industry awards that acknowledge trading technology, services and terms brokers offer.

Are JP Markets safe or a fraud?

It's not true, JP Markets is not a fraud, but is an incorporated firm in South Africa also is a fully licensed broker with the Financial Services Board is known as FSB. Thus, JP Markets trading offering is able to be approved to provide an international service that is in compliance with safety standards and provides clients with clear conditions and minimal risk.

In what way South Africans are protected?

In the end, South Africa shows the substantial increase in the Forex sector, with more and companies are opening branches or companies within its authority. JP Markets, however has a solid history of incorporation with a focus on the operations of trading that are geared towards providing the most profitable trading opportunities.

Simply put, licensed and licensed and regulated by FSB compliance obligations, which are with a qualifying standard for how the broker provides trading terms as well as abides by various other security rules that are specifically targeted at money management and integration of markets. This means that there is protection against negative balances as well as segregation of the funds of traders and security at the highest quality, all of this is backed by the protection of the client's interests.

Does JP Markets license suspended?

There are a few news reports about JP Markets suspended license. It is actually true that JP Markets was licensed through FSB however in 2019, the regulator terminated a license with no prior notice because of alleged infractions against customers. But, it was an error as the broker doesn't operate anymore under the domain which was alleged to be in violation therefore, JP Market record remains clear.

Leverage

As JP Markets is a South Africa broker, local laws permit large leverage ratios to be used even for retail traders. This is, in the end, one of the main reasons for South Africa brokers, and JP Markets respectively, gaining greater recognition and increasing in popularity.

The maximum ratio that JP Markets can offer is JP Markets is

- 1:500 is used by professionals.

- Retail traders may access ratios like 1:100 or 1:200

However, levels of leverage and risk differ based on the specifications of the instrument as well as the specific asset you deal with, so be sure you check the trading conditions in addition.

Types of accounts

In JP Markets Review we discover two different types of accounts dependent on STP execution, with costs incorporated in spread-only or an ECN account that has commissions and spreads in raw form. Additionally, you can sign up for an account with Copy Trading in either Copy Trader as well as Copy Master might have additional authentication settings in order you can trade smoothly.

In addition to the JP Markets offering, it is one of the few brokers that offer an interest rate on accounts for trading that could have to be accompanied by a minimum qualifying balance.

What is the significance of JP Markets Fees?

JP market costs that will be charged to trade. The service is flexible terms and pricing options that are a mix of regular fees that are based on spreads and ECN account that has commission. Additionally, there are the appealing options included such as the ability to trade with high liquidity, and low Cryptocurrency and commodity fees.

| Fees | JP Markets Fees | FXTM Fees | AvaTrade Fees |

|---|---|---|---|

| Fee for deposit | No | No | No |

| Fee for Withdrawal | No | No | No |

| Fee for inactivity | Yes | Yes | Yes |

| Fee rating | Average | Average | Low |

Spreads

JP Markets Spreads are variable and dependent on market conditions. These are also competitive in comparison to other spreads on the market, and on average EUR/USD ranges from 2 to 2 pips on the STP account. We have already discussed that the ECN account comes with a commission of 10 dollars per lot, which is the best option for professionals but it is available to everyone as per the information.

There is no specific details about the spread conditions available on the website and we didn't get specific statistics about its spread.

Also, check out fees with another broker that is popular Valbury Capital.

| Asset/ Pair | JP Markets Spread | FXTM Spread | AvaTrade Spread |

|---|---|---|---|

| EUR USD Spread | 1.7 Pips | 1.5 pips | 1.3 Pips |

| Crude Oil WTI Spread | 5 pip | 9 pip | 3 pip |

| Gold Spread | 26 | 9 | 40 |

| BTC USD Spread | 26 | 20 | 0.75% |

Trading Instruments

JP Markets strives to bring trading conditions for international traders through its unique trading advantages and the ability to trade forex, Metals Indices, Futures and Shares based on CFDs.

Is JP Markets allow Capitec Bank?

Yes JP markets is highly recommended to Capitec Bank as a leading local brokerage firm for Forex, Bitcoin and Metal traders.

What is the process behind JP Markets work?

JP Markets operate on an STP basis that means it supplies traders with its trading platform , as well as linking your transactions to its market via quotes it receives from its liquidity suppliers.

How can I Deposit Funds to JP Markets?

The final point in the JP markets review is reviewing funding methods that permit you to deposit money to the account of your trader.

| Pros | Cons |

|---|---|

| No Minimum deposit | Redrawals can take a considerable amount of time. |

| A wide range of deposit options that are supported, including Bitcoin and E-wallets | |

| Free deposit and withdrawal |

Deposit Options

JP Markets differs from many brokers due to the fact that it is licensed and authorized to accept deposits from local clients and also. There are a variety of options for depositing, such as the ones below, which means there's no hassle to pay for the account for trading.

- Bank accounts are available with Absa, FNB, Standard Bank and Nedbank,

- and numerous payment gateways such as Skrill and Skrill, which also accept Bitcoin

In the end, JP markets issue and provided it on request. JPM Card which is operated as a MasterCardconnected with your trading account, ensuring that you can use it to enjoy all the advantages of Debit Card.

Minimum deposit

JP Markets does not have a minimum deposit requirement and therefore you can put in a sufficient amount which is excellent for all the parties. It is however, JP Markets recommend starting with R3,000 which is about $200, and also provides amazing education and training materials that are highly recommended for beginners to trading.

JP Markets minimum deposit in comparison to other brokers

| JP Markets | The majority of other brokers | |

| Minimum Deposit | $200 | $500 |

Withdrawals

JP Markets does not provide any fees for withdrawals or deposits However, banks or payment companies to JP Markets Withdrawal may waive some charges because of international rules therefore you must verify with the service provider regarding the fees it charges.

Trading Platforms

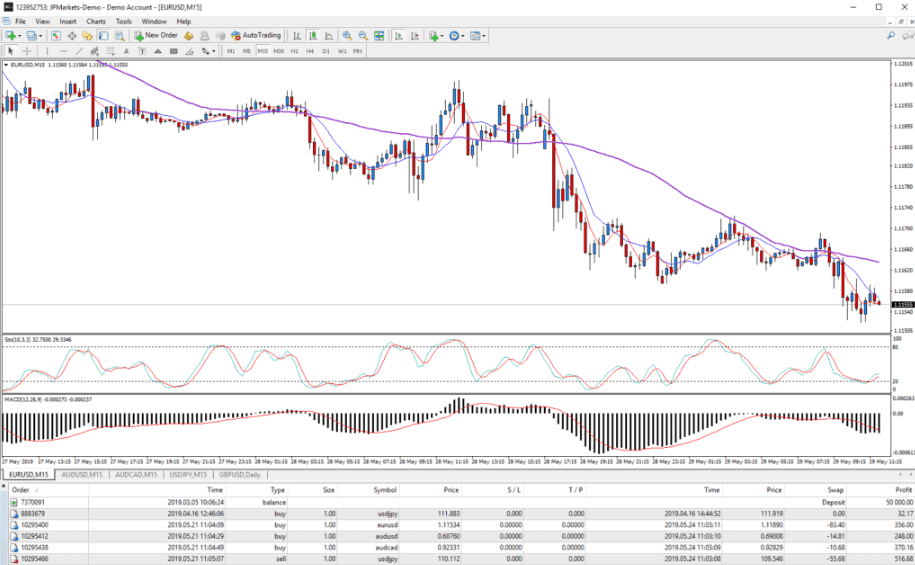

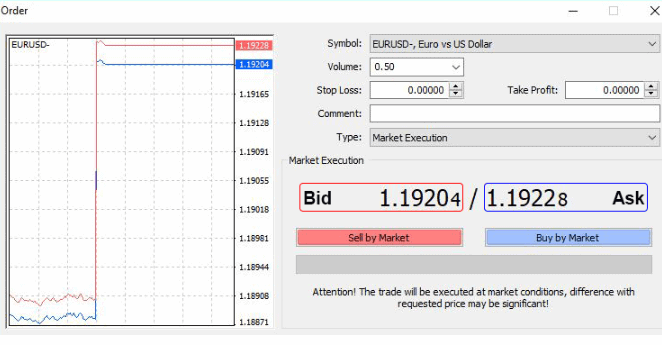

JP Markets pioneered the offering through the MT4 platform, which offers high-quality trading execution, with No Requotes, No Rejections or flexibility in trading terms. Its MetaTrader4 platform is the industry standard today well-known for its ingenuous and robust trading capabilities that are suitable either for investors in retail to buy and sell currency as well as for professionals.

| Pros | Cons |

|---|---|

| Design that is friendly to customers | No platform that is proprietary |

| The MT4 platform is a huge hit. | |

| A wide variety of tools | |

| Clear look |

Web Trading

JP Markets MT4 platform is able to support Web Trading of Futures, Indices, Equities and other CFD transactionsalong with advanced charting capabilities along with technical analysis tools along with automated trading. Of course it is true that the platform is accessible in a few versions, so traders can access the platform from any device that is mobile, which includes smartphones.

Mobile Platform

In addition, JP Market offers also its own app JPM Mobile App that is an extremely comfortable application that lets you take charge over the trading you make at any time.

Desktop Platform

Therefore, in addition to trading using a manual or automated method, you can also take part with Social Trading using copy Traders or Master accounts, which are accessible via the Desktop Platform. This means you can duplicate master accounts and benefit from trading without information or interruption through a simple copy of orders. For those who want to get more exposure to markets and manage larger capitals, become Master Trader.

How do I place an your order?

Customer Support

Regarding the Customer Support JP Markets establish Customer Support with the goal of providing traders with answers that are comparable and high-quality answers. Contact the support team at any time during the working hours by Live Chat, yet there are some comments from customers that have not received a an answer or were deemed to be false.

Education

In reality, JP Markets managed to keep its an unwavering consistency in their record and trading services by offering professional advice through dedicated online courses in trading as well as a vast array of educational material. They also provide research materials such as videos, online courses basic analysis, news feeds, and of course you are able to use all of the fantastic research available from MetaTrader available.

Conclusion

In general, JP Markets trading are well-equipped with education resources along withquite the most competitive conditions for trading. you have the option to trade using a manual method or copy trades to the Copy Accounts. Also, when you consider that JP Markets is a well-known brokerage in South Africa and is recognized by traders from around the world. and traders, which makes our vote favorable toward JP Markets. Furthermore the company is always expanding, growing and making trading opportunities more lucrative this is another advantage for long-term investments.

| Properties | Values |

|---|---|

|

Name

|

JP Markets |

|

Minimum Diposit

|

$ 1 |

|

Leverage

|

500:1 |

|

Regulation

|

FSCA (South Africa),, |

|

Headquarters

|

South Africa |

|

Established

|

2016 |

|

Address

|

Black River Office Park 2 Fir Street, Observatory, Cape Town Gatehouse, Building, 2nd Floor, South Africa |

|

Platform

|

MT4,, |

|

Payment Method

|

Visa,Mastercard,Skrill,Local bank transfer,, |

| Properties | Values |

|---|---|

|

Spreads

|

1.7 pips |

|

Min Position size

|

0.01 |

|

Broker Type

|

STP (Straight Through Processing),ECN (electronic communications networks),,,, |

|

Account Type

|

Cent account,Mini account,High Leverage,Standard,, |

|

Brokers by Country

|

UK Forex Brokers,, |

|

Techniques

|

Hedging Forex Brokers,Automated Trading Brokers,Mobile Trading Brokers,, |

|

Instruments

|

Forex Trading Brokers,Gold Trading Brokers,CFD Trading Brokers,Crypto Trading Brokers,Stock Trading Broke,Oil Trading Brokers,Commodity Forex Brokers,Metal Trading Brokers,, |

|

Account currency

|

USD,EUR,GBP,AUD,CAD,JPY,,USD, |

|

Tools

|

Charting Software,, |

|

Website Languages

|

en,, |

|

Support languages

|

en,, |

|

Bonus

|

Yes |

|

Reviews Rating

|

2.5 |

|

Withdrawal Fee

|

No |

|

Trading Signals

|

Yes |

|

Free Education

|

Yes |

|

Daily News

|

No |

|

Demo account

|

Yes |

|

Swapsr

|

Yes |

|

Pors

|

1. No Minimum deposit 2. A wide range of deposit options that are supported, including Bitcoin and E-wallets 3. Free deposit and withdrawal |

|

Cors

|

1. Redrawals can take a considerable amount of time. |

|

Display Analysis

|

Yes |

|

Serving country

|

ZA,SZ,, |

|

Not Serving country

|

US,, |

|

Contests

|

Yes |

|

Market analysis

|

Yes |

|

Copy Trading Brokers

|

No |

|

Bitcoin Forex Brokers

|

Yes |

|

Social trading

|

Yes |

|

Web trading

|

Yes |

|

Forex pairs

|

Yes |

|

CFDs

|

Yes |

|

Crypto

|

Yes |

|

Hedging

|

Yes |

|

PAMM

|

Zulu trade,Myfxbook Auto trade,Mql5 signals,, |

|

Mobile Trading

|

Yes |

|

Scalping

|

Yes |

|

Automated Trading

|

Yes |

|

Partnership Programs

|

Yes |

|

Free Phone

|

0878280576 |

|

Customer Support

|

24/5 |

Exness Broker reviews & comments (0)

Add a review

Your email address will not be published. Required fields are marked *