JFD Bank Broker Reviews and Full Information

What exactly is JFD Brokers?

Formerly was known as JFD Brokers now broker is changed JFB Bank. JFB Bank.

JFD Group, founded in 2011 by professional traders who are committed to transparency in dealing and fairness being part of their main values. JFD Group has its headquarters is in Cyprus and has additional offices are located in Bulgaria as well as an affiliate located in Germany. In order to assist their customers, they offer local customer lines are available to customers across a variety of countries which include Russia, UK, Switzerland, Czech Republic and more.

Then, but not until JFD was able to establish itself as a modern and highly regarded company within the trade industry since the broker follows an agency-like structure with Direct Market Access which means that they can execute orders in a straight line using the client in mind, and without any confusion.

JFD Brokers : Pros and Cons

JFD is a reliable broker that has regulation and direct access to markets to provide an excellent trading service with a variety of trading platforms, and simple account opening. There are a variety of funding options available and traders can access the right information.

In the case of negative points, there's no support 24/7 and the conditions are subject to rules of the entity, which means that it could be more competitive in certain regions.

10 Points Summary

| Headquarters | Cyprus |

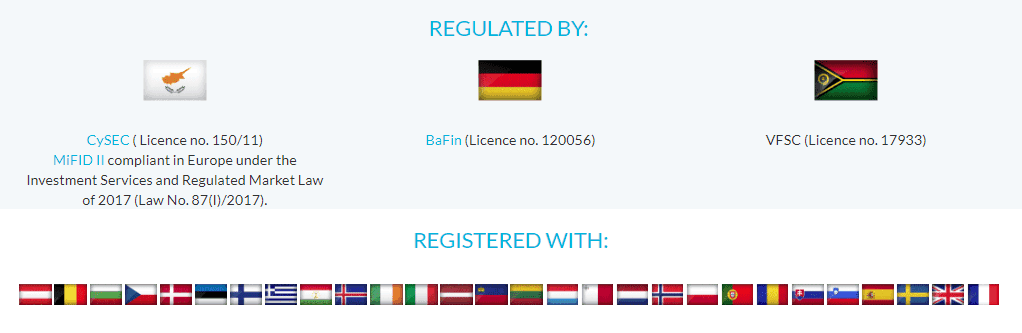

| Regulation | CySec, BaFIN, VFSC |

| Platforms | MT4, MT5, Guidance |

| Instruments | Foreign exchange, CFDs on Index, bonds, shares, commodities ETF and ETN Cryptocurrency |

| Spread EUR/USD | 0.01 + commission of 0.03$ |

| Demo Account | The Provider |

| Minimum deposit | 500$ |

| Base currencies | A variety of currencies are available |

| Education | Tools for education as well as daily analysis |

| Customer Support | 24/5 |

Is JFD Brokers reliable or scam?

JFD is licensed and registered broker. It is therefore not a fraud. It is an JFD group, which is subject to strict European rules that are governed through CySEC along with the MiFID as well as several registrations in the EEA zone such as FCA, CONSOB, BaFIN and ACPR. In addition to the CySEC licence, JFD is highly regulated to operate by German BaFIN recognized for their strict rules and oversight of the company. Although, JFD also serves an offshore company that is located in Vanuatu its overlapping regulations with ESMA doesn't raise doubts about their credibility and transparency.

The funds of clients are held apart from the company's funds, which are held at licensed financial institutions and assuring their security. Because JFD has been a part of the Investor Compensation Fund (ICF), all clients run under its protection in the event of bankruptcy. Additionally, the broker provides the protection of negative balances.

Instruments

The market offerings of JFD is a broad range of more than 1,000 trading instruments across eight asset classes which comprise Forex, CFDs on Index shares, commodities, bonds ETF as well as ETN, Cryptocurrency , and ETF and the JFD is also the only broker to offer physical Stocks on the MT5 platform.

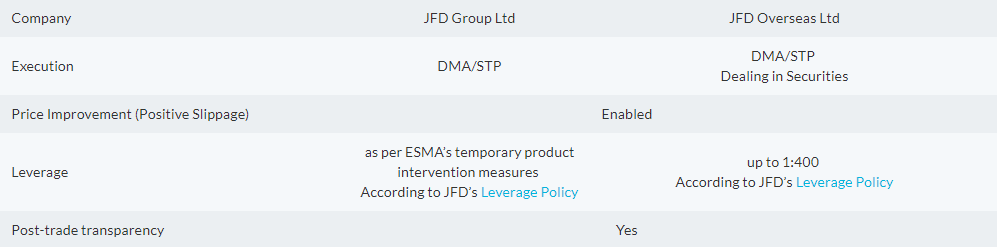

Leverage

In accordance with the restrictions of the regulator, JFD falls with specific rules for each state where it is allowed to manages as a business. In general, JFD uses lower leverage to lower the chance of losing money. Furthermore, European residents are permitted to utilize a maximum leverage of 1:3 for a trader, while a different trader working through JFD oversees could be eligible for leverage of up to 1:400 for Forex Instruments.

Types of accounts

JFD Bank offers only one type of account that comes with low spreads and quick execution to the market.

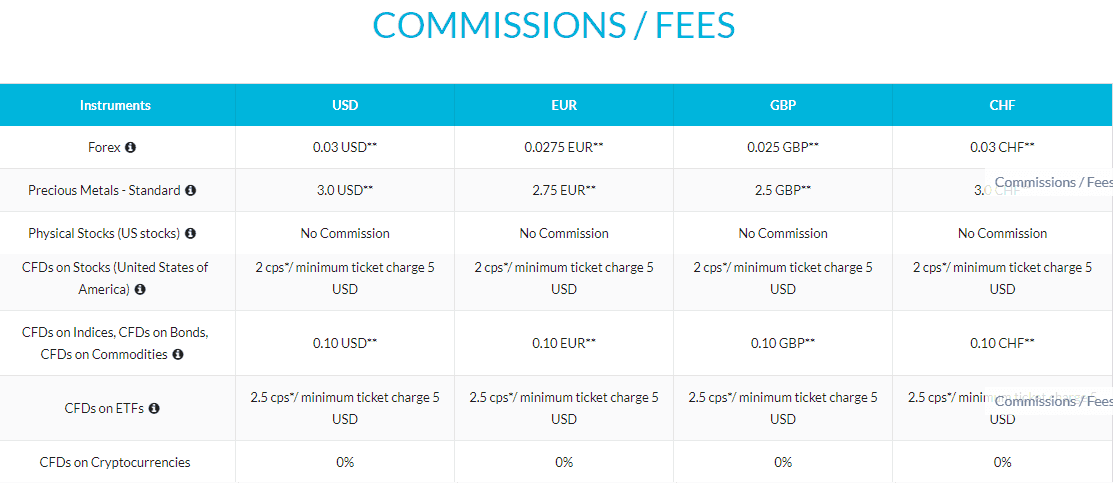

Fees

JFD Brokers' fees are reasonable they are usually incorporated into commission charges However, it is important to verify fees for funding, non-activity fees, and other charges as well. It is the Agency Model brings an absolutely zero rejection rate and there are no requotes. This is in addition to the inclusion of an unconditional and unrestricted access to the market for interbank transactions built on the "Fill or Fill" model that has positive and negative slippage.

| Fees | JFD Brokers Fees | AETOS Fees | Fees for ATC Brokers |

|---|---|---|---|

| Deposit Fee | No | No | No |

| Fee for Withdrawal | No | No | No |

| Inactivity Fee | Yes | Yes | Yes |

| Fee position | Low | Low | Average |

Spreads

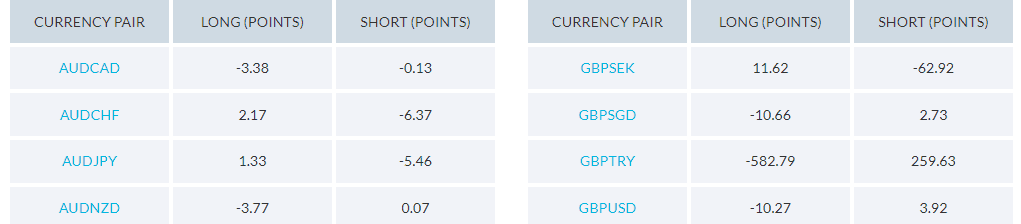

JFD spreads offer interbank spreads , which are generally 0.1 for the EUR/USD pair beginning at zero pip for all customers. CFD trading is available in DAX and DOW are offered at lower commissions on CFDs (0.1 per lot for each side) as well as risks managed with mini lots for CFD trading as well as the correct way to manage money.

Also, to take advantage of these fantastic quotes, the only obligation to pay an broker is a tiny commission, which is determined in the instruments you use however, it is actually extremely and low in comparison to the marketplace offering.

Find references below for spreads and fees and also look at what spreads are available for the XM.

Additionally, ov the night finance charges have been calculated in CFDs based on Stocks & cash Indices. They. They are 3.25 percent +/- Libor.

Deposits and withdrawals

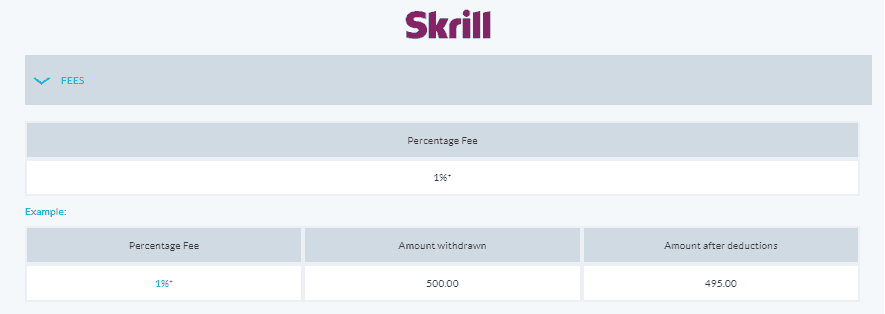

For live trading, select the appropriate payment method to either fund your account or transfer funds. There are a variety of options available, including transfer to banks, bank transfer using Sofort that will include 1.8 per cent deposit fees and online payments such as Skrillwith 2.9 percent charge, Safecharge with 1.95 percent fee, along with UnionPay without any charges. You should therefore carefully examine the payment method you select and review the the fees applicable to transfer of funds.

Withdrawal

To withdraw money, you may use the same method, and both are also eligible for fees. Therefore, Skrill and Safecharge will be charged 1% for the transaction.

Minimum deposit

JFD Bank minimum deposit amount is 500$ irrespective of the platform or trading account you select to trade.

JFD Bank minimum deposit in comparison to other brokers

| JFD Bank | The majority of other brokers | |

| Minimum Deposit | $500 | $500 |

Trading Platforms

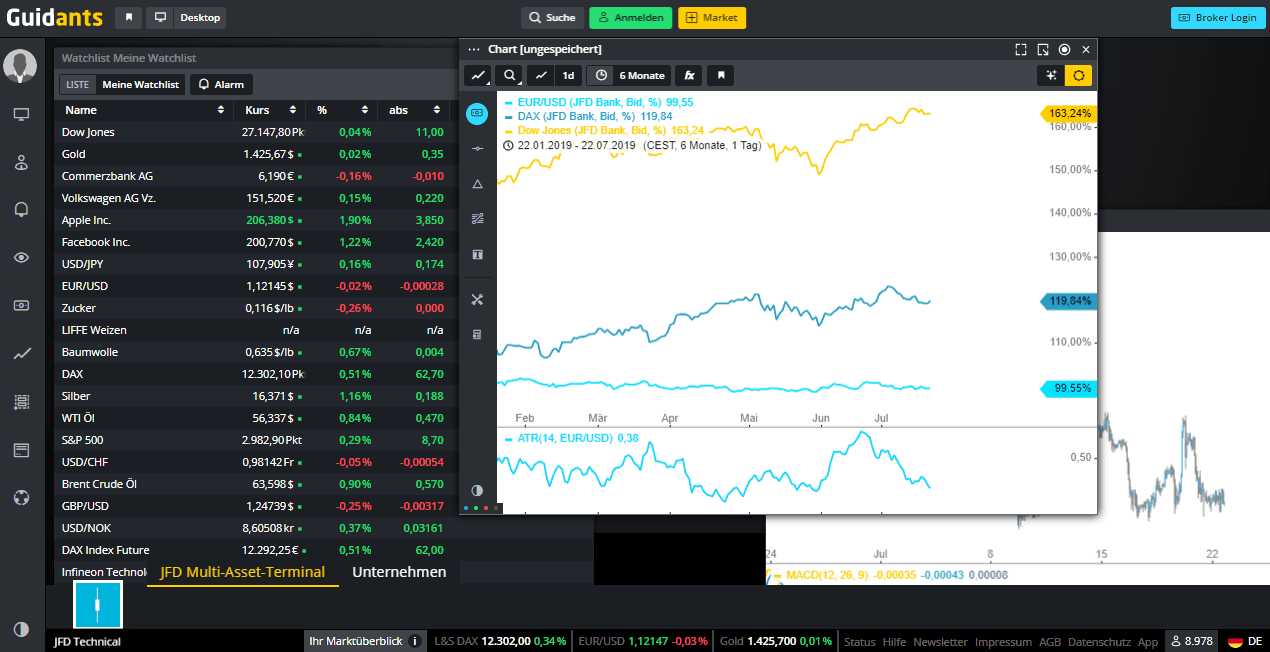

We will also get specifics of the technical optimization process and software that is offered by JFD. You can be assured that JFD has created the most efficient server infrastructure to guarantee trading success. Their servers are located at Equinix Data Centers located in London as well as New Yor, that are connected directly to the Liquidity Providers.

The technology can bring straight-through process high-capacity aggregation, intelligent order routing, and bridging up to a higher level. Additionally, traders remain connected in all conditions with the VPS (Virtual Private Server) for advanced trading strategiesand ongoing EA monitoring. The VPS service is offered by two providers , each with a discounted fee as an JFD client. Fozzy gives 50% off and MyTradeHost got 10% off per month.

For these trading systems, JFD selected the most reliable platforms due to their demonstrated capacity and performance. The prize-winning platforms are MT4 and M5 and can be found on the toolbar for traders to gain access to markets via an incredibly flexible and comprehensive trading platform as well as an strong Guidance platform that is available through its JFD exclusive offering that is available in German.

Social Trading

Overall, all platforms provide the highest quality of trading features with distinct features that can be used with different trading styles, still available as a choice to select among for a specific trader. Platforms are available on desktop, mobile and web applications, as well with the option to automate, carry out technical trading, or utilize trade on social networks capabilities.

Education

All in all, JFD brought a high-quality service to traders with different experiences and size that does not discriminate customers based on their style or amount of money invested. The award-winning research team offers daily market analysis and sophisticated educational tools that include state-of-the-art information and learning materials.

Despite the fact that the company is still a relatively new company but their growth and trust capability has been acknowledged by both industry publications and customers promptly.

Conclusion

In the end, JFD Bank shows one of the features shortlisted that provides all retail customers the same trading features. It doesn't really have any distinctions between customers , nor is it confusing as the markets are all accessible on different platforms, with only one price, one transaction, and one type of account model. The technical optimization of the broker and servers are on technological level that provide a powerful combination of trading for beginner or extremely advanced traders, with different designs, which is a good alternative to think about.

| Properties | Values |

|---|---|

|

Name

|

JFD Bank |

|

Minimum Diposit

|

$ 500 |

|

Leverage

|

1:400 |

|

Regulation

|

CySEC (Cyprus),BaFin (Germany),VFSC (Vanuatu), |

|

Headquarters

|

Cyprus |

|

Established

|

2011 |

|

Address

|

Kakos Premier Tower Kyrillou Loukareos 70, 4156 Limassol, Cyprus |

|

Platform

|

MT4,MT5, |

|

Payment Method

|

Wire,Skrill,Neteller,SafeCharge, |

| Properties | Values |

|---|---|

|

Spreads

|

1.0 |

|

Min Position size

|

0.01 |

|

Broker Type

|

STP (Straight Through Processing),DMA (Direct market access),ECN (electronic communications networks |

|

Account Type

|

Mini account,Scalping,Standard, |

|

Brokers by Country

|

Cyprus Forex Brokers, |

|

Techniques

|

Scalping Forex Brokers,Hedging Forex Brokers,Automated Trading Brokers,Mobile Trading Brokers, |

|

Instruments

|

Forex Trading Brokers,Gold Trading Brokers,CFD Trading Brokers,Crypto Trading Brokers,Stock Trading Broke,Oil Trading Brokers, |

|

Account currency

|

USD,EUR,GBP, |

|

Tools

|

Economic Calendar,Charting Software, |

|

Website Languages

|

en, |

|

Support languages

|

en, |

|

Bonus

|

Yes |

|

Reviews Rating

|

3.5 |

|

Withdrawal Fee

|

No |

|

Trading Signals

|

No |

|

Free Education

|

Yes |

|

Daily News

|

No |

|

Demo account

|

Yes |

|

Swapsr

|

Yes |

|

Pors

|

1. Free Education Available. 2. MT4, MT5 Terminal Available. 3. CySEC Regulated. |

|

Cors

|

1. Customer Support 24/5. |

|

Display Analysis

|

Yes |

|

Serving country

|

BG,CY,DE,VU, |

|

Not Serving country

|

BS,BW,KH,ET,GH,IR,KP,LV,PK,PA,PL,RU,LK,SY,TT,TN,US,YE, |

|

Contests

|

No |

|

Market analysis

|

Yes |

|

Copy Trading Brokers

|

No |

|

Bitcoin Forex Brokers

|

Yes |

|

Social trading

|

Yes |

|

Web trading

|

Yes |

|

Forex pairs

|

Yes |

|

CFDs

|

Yes |

|

Crypto

|

Yes |

|

Hedging

|

Yes |

|

PAMM

|

PAMM,MAMM,Myfxbook Auto trade,Mql5 signals, |

|

Mobile Trading

|

Yes |

|

Scalping

|

Yes |

|

Automated Trading

|

Yes |

|

Partnership Programs

|

Yes |

|

Free Phone

|

+49 (0) 69175374271 |

|

Customer Support

|

24/5 |

Exness Broker reviews & comments (0)

Add a review

Your email address will not be published. Required fields are marked *