InterTrader Broker Reviews and Full Information

What exactly is InterTrader?

The InterTrader brokerage company was founded in 2012, with the goal of providing an open, fair and non-market-neutral trading. Trading execution is carried out through mirroring to the market that is the underlying market each position the client makes, while the company takes care of its risk therefore you trade in a transparent manner.

Contrary to the traditional market-maker model that has the client and broker aren't on opposite side as in the market-neutral execution. However, the broker loses when the client wins so, which is why InterTrader is interested in clients' gains as well.

InterTrader Pros and Cons

InterTrader is a safe broker that offers simple account opening as well as flexibility in trading conditions. We are able to offer good technological solutions, as well as the availability of social trading and spreads that are low.

On the other hand There isn't any 24/7 assistance or good training Also, trading instruments are not available.

10 Points Summary

| Headquarters | UK |

| Regulation | FCA |

| Platforms | InterTrader, MT4, Sigma Trading |

| Instruments | Major trading instruments, Forex, Indices, Cryptocurrencies CFDs |

| Spread EUR/USD | 0.6 1 pips |

| Demo Account | Available |

| Minimum deposit | 0 US$ |

| Base currencies | Several currencies available |

| Education | It is a service that is offered |

| Customer Support | 24/5 |

What kind brokers are there? InterTrader?

The trader's orders are completely anonymous therefore you can are able to interact with the market through placing orders within market spreads. market spread. Therefore with InterTrader your trading costs are incorporated into a spread , while prices are obtained from the interbank are combined into a liquidity pool that allows access to the most liquid liquidity.

Also, when trading forex CFDs via MT4 at the market cost, a small additional commission will be charged per trade. For the platform that is web-based as well as to spread betting and non-forex CFDs on the MT4 platform, this fee can be added on to market price, which is called the spread.

Awards

Is InterTrader an authentic company or is it a scam?

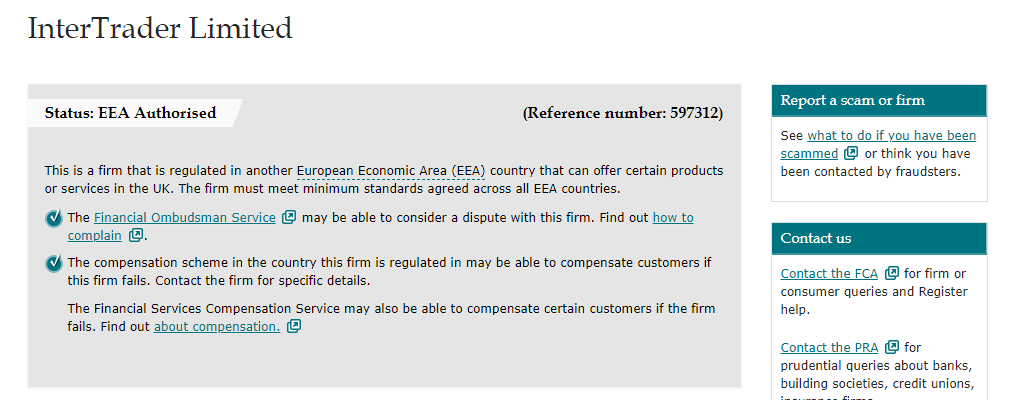

There is no need to worry, InterTeader is not a scam, it's a licensed broker with top-tier FCA that offers risk-free trading.

InterTrader is an trading name for InterTrader Limited that is owned and managed by GVC Holdings PLC. While GVC are among the largest listed international sports betting and gaming businesses that are listed in the London Stock Exchange, its subsidiary InterTrader Limited authorized and regulated by the Gibraltar Financial Services Commission.

Additionally it is also true that it is also important to note that the broker itself is licensed and operates its services under the Financial Conduct Authority in the UK. Through this arrangement the business is held to high standards and a degree of flexibility suitable to any country.

The safety of funds transferred by clients is essential for any client that is why all transactions are managed in a responsible and secure manner. The funds of clients that transfer to InterTrader is securely held in a separate account in compliance with regulatory money rules. Additionally, each customer is protected under The Gibraltar Investor Compensation Scheme (GICS) which is up to EUR20,000 per customer plus an added parental assurance through bwin.party Holdings Ltd.

Leverage

The InterTrader broker provides its services by following the strict regulations of the FCA the leverage permitted amounts will vary based on the particular information the regulation provides. The main company of InterTrade can provide the maximum leverage of 11:30 in the case of Forex instruments 1:20 for non-major currency pairs 1:5 for stocks, etc.

The current levels were established because of the fact that FCA along with European regulation drastically reduce the leverage propositions due to the recognition of potential high risk when the use of leverage with high ratios. So, make sure to learn how to utilize leverage effectively and implement it in the most efficient way in you trading strategy.

Types of accounts

The trading accounts are InterTrader are classified by the platform, which is why it offers Web and MT4 types of accounts. Both accounts run using the NDD models with small spreads and are available to Spread betting.

Fees

InterTrader trading costs and prices are usually incorporated into a spread. The broker strives to keep spreads across all markets at a low level as well as providing favorable rates for fees for withdrawals as well as other fees that are not related to trading.

The market offering offered by InterTrader includes the most important trading instruments and you can purchase or sell CFDs in cryptocurrencies such as Bitcoin, Ether, Bitcoin Cash, Litecoin and Ripple using the MT4 platform.

| Fees | Fees for InterTraders | Core Spreads Fees | AvaTrade Fees |

|---|---|---|---|

| Deposit Fee | No | No | No |

| Fee for Withdrawal | No | No | No |

| Fee for Inactivity | Yes | Yes | Yes |

| Fee position | Low | Low | Average |

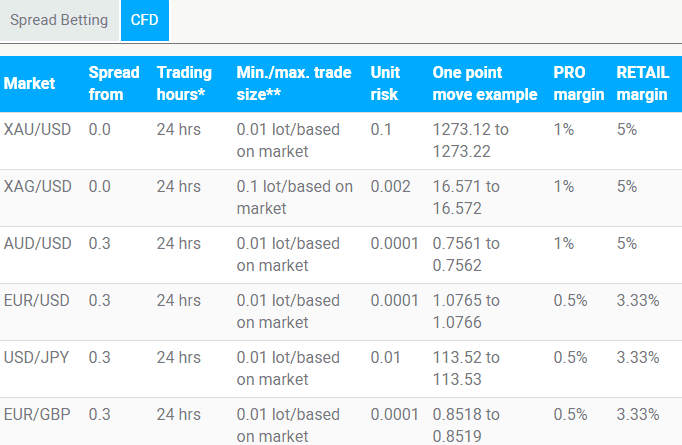

Spreads

InterTrader spreads provide the most value-for-money services since spreads are calculated by interbank market. Spreads between EUR and USD are usually 0.6 per cent as well UK 100 shares 0.1 percent per share.

Additionally, trading with InterTrade you can reduce your costs further thanks to the reward for loyalty TradeBack. If your trader is able to pay a total spread expense during the month of more than PS500 no matter how much they have earned from their positions, they get a rebate automatically.

Check out the typical spread below for popular instruments. Also, check out and compare fees to AvaTrade.

| Spread | InterTrader Spread | Core Spreads Spread | AvaTrade Spread |

|---|---|---|---|

| EUR USD Spread | 0.6 Pips | 0.6 pip | 1.3 pip |

| Crude Oil WTI Spread | 3 pip | 3 pip | 3 pip |

| Gold Spread | 4 | 4 | 4 |

| Spread BTC/USD | 0.60% | 0.70% | 0.75% |

Overnight charges

Another option is a financing adjustment referred to as an the overnight cost or swap that is applied to forex and indices. It is an interest expense for keeping your position open for a period of time. When it comes to forex this rate can be calculated using the central bank's interest rate, plus 1percent(* for positions that are long) and less than the 1%* rate on short position. For indices , the rate will be calculated as ++/2.5%. 2.5 percent.

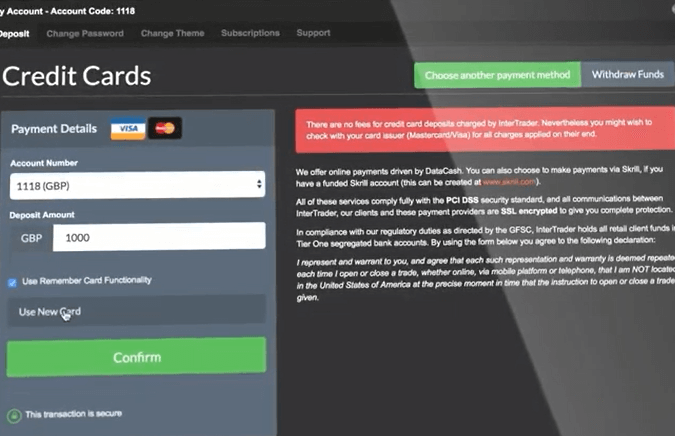

Deposits and withdrawals

Customers of InterTrader can make deposits and withdraw funds through three simple payment options. Transfer to bank or via InterTrader's platform, deposit using the debit or credit debit cardor through an online payment service that is secure Skrill.

Minimum deposit

No minimum deposit requirement to open an InterTrader account However, any new trade on the account requires deposit based on the what instrument you intend to trade which is known as margin.

InterTrader minimum deposit is different from other brokers

| InterTrader | Many Other Brokers | |

| Minimum Deposit | $0 | $500 |

Withdrawal

InterTrader withdrawals are credit Cards or Bank Wire and Bank Wire. There are zero fees of $ for all transactions. Thus, you are able to deposit and withdraw whatever amount is appropriate for you as the broker does not charge any additional charges for the transactions. However, you should check with your the payment service provider to see if there are any fees that might be charged by the payment service provider.

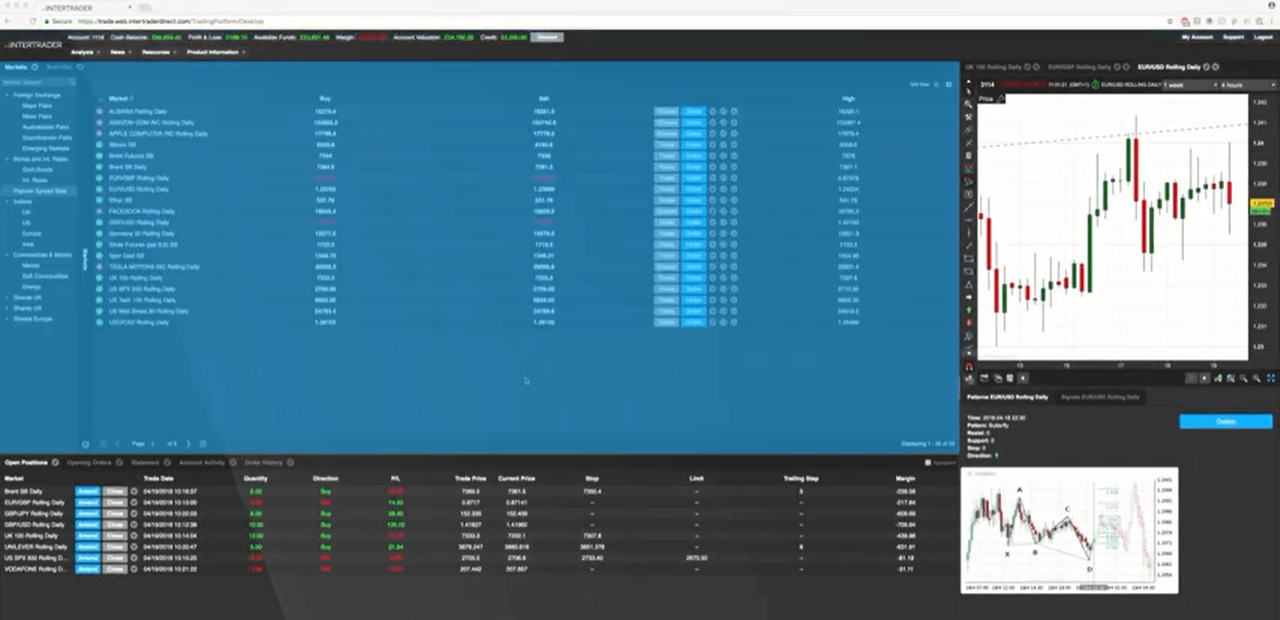

Trading Platforms

With InterTrader you have the option of a proprietary website-based platforms that comes with free trading tools. There are also robust mobile trading applications that cover a variety of tablets and smartphones and the well-known desktop or mobile MT4 platform.

Although, InterTrader is an easy platform that can be accessed from any web browser, and also mobile App it allows spread betting as well as CFD trading that are fully customizable layouts, flexible layouts and numerous watchlists. The prices are enhanced by technology, and the platform is equipped with sophisticated integrated trading tools, as well as news and chart software.

Social trading

But, if, for whatever reason, you prefer using the the well-known MetaTrader4 which comes with analysis and testing of strategies, as well as the capability of running EAs to automate trading you're welcome. Additionally, the platform permits the use of Fix API which allows you to connect your their own platform to the broker's server in addition to the AutoTrade Myfxbook to use forex trading systems that have proven results.

Last and not least, is the option of social trading via ZuluTrade, which is an automatic, major social trading platform which has over 100,000 users and lets you use their trading signals free. It's a fantastic tool for beginners which allows you to sign up and grow as well as become a leading trader as others are taking your signals and copying them.

Conclusion

In conclusion, operating in the global market, InterTrader broker has proven to be a reliable service. InterTrader broker offers dependable on-line trading service that are safe and secure. There isn't any doubt about their credibility because the broker operates within the strict regulations of FCA. Based on the the No Dealing Desk business model the traders of InterTrader get the highest possible rates for their transactions. Technology solutions are on the top of the line as they offer various trading platform and instruments.

| Properties | Values |

|---|---|

|

Name

|

InterTrader |

|

Minimum Diposit

|

$ 1 |

|

Leverage

|

1:30 |

|

Regulation

|

FCA (United Kingdom),, |

|

Headquarters

|

United Kingdom |

|

Established

|

2012 |

|

Address

|

City Tower, 40 Basinghall St, London EC2V 5DE, United Kingdom |

|

Platform

|

MT4,,,,, |

|

Payment Method

|

Visa,Mastercard,Credit Card,Wire,Skrill,Neteller,, |

| Properties | Values |

|---|---|

|

Spreads

|

0.6 pips |

|

Min Position size

|

0.01 |

|

Broker Type

|

NDD (Non Dealing Desk),Market Execution,,,, |

|

Account Type

|

Mini account,RAW Spread,Scalping,High Leverage,Standard,, |

|

Brokers by Country

|

UK Forex Brokers,, |

|

Techniques

|

Scalping Forex Brokers,Hedging Forex Brokers,Automated Trading Brokers,Mobile Trading Brokers,, |

|

Instruments

|

Forex Trading Brokers,Futures Trading Brokers,CFD Trading Brokers,Commodity Forex Brokers,, |

|

Account currency

|

USD,EUR,GBP,AUD,,USD, |

|

Tools

|

Charting Software,, |

|

Website Languages

|

en,, |

|

Support languages

|

en,, |

|

Bonus

|

Yes |

|

Reviews Rating

|

3.5 |

|

Withdrawal Fee

|

Yes |

|

Trading Signals

|

No |

|

Free Education

|

Yes |

|

Daily News

|

Yes |

|

Demo account

|

Yes |

|

Swapsr

|

Yes |

|

Pors

|

1. Segregates client funds 2. Established in 2009 3. Regulated by Financial Conduct Authority 4. Min. deposit from $1 |

|

Cors

|

1. Not FCA Regulated |

|

Display Analysis

|

Yes |

|

Serving country

|

GB,, |

|

Not Serving country

|

US,, |

|

Contests

|

Yes |

|

Market analysis

|

Yes |

|

Copy Trading Brokers

|

No |

|

Bitcoin Forex Brokers

|

No |

|

Social trading

|

Yes |

|

Web trading

|

Yes |

|

Forex pairs

|

Yes |

|

CFDs

|

Yes |

|

Crypto

|

No |

|

Hedging

|

Yes |

|

PAMM

|

Myfxbook Auto trade,Mql5 signals,, |

|

Mobile Trading

|

Yes |

|

Scalping

|

Yes |

|

Automated Trading

|

Yes |

|

Partnership Programs

|

Yes |

|

Free Phone

|

+44 20 3364 5189 |

|

Customer Support

|

24/5 |

Exness Broker reviews & comments (0)

Add a review

Your email address will not be published. Required fields are marked *