Ikon Finance Broker Reviews and Full Information

What exactly is Ikon Finance?

Ikon Finance is a brokerage company that is a part of the online trading sector, while also providing access to speculate in markets in Futures and FX Futures market. At the beginning of its operations it was able to provide access to New York as a Futures Commission Merchant and further located its office in the UK as one of its subsidiaries which provides online trading solutions to institutional customers.

Although Ikon Finance is not a large business or trading service provider, the broker constantly is developing its strategies and products it offers by partnering with market-leading vendors. It also develops in-house technology and offers liquidity for clients of institutions.

Of course the company offers an attractive offer for retail customers too via its affiliate Ikon Finance Limited operating in accordance with the changing regulations.

10 Points Summary

| Headquarters | UK |

| Regulation and License | FCA |

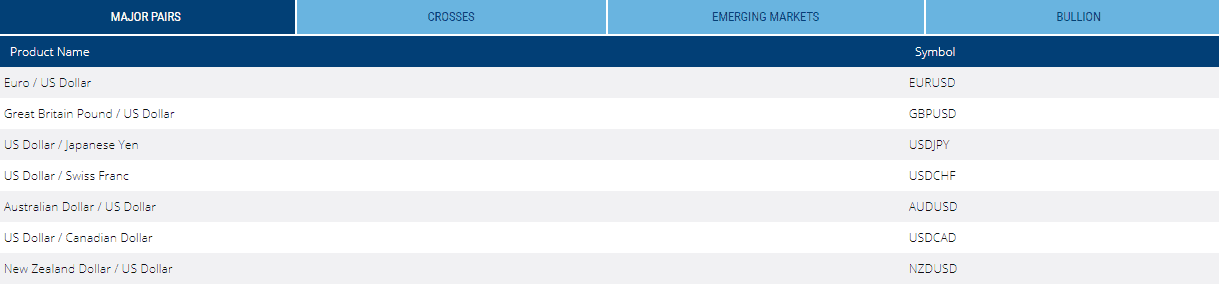

| Instruments | Forex, Futures |

| Platforms | MT4, Ikon Prodigy |

| Costs | 1.3 pip |

| Demo Account | The Provider |

| Base currencies | USD, GBP, EUR, |

| Minimum deposit | 100$ |

| Education | Materials for learning and education |

| Customer Support | 24/5 |

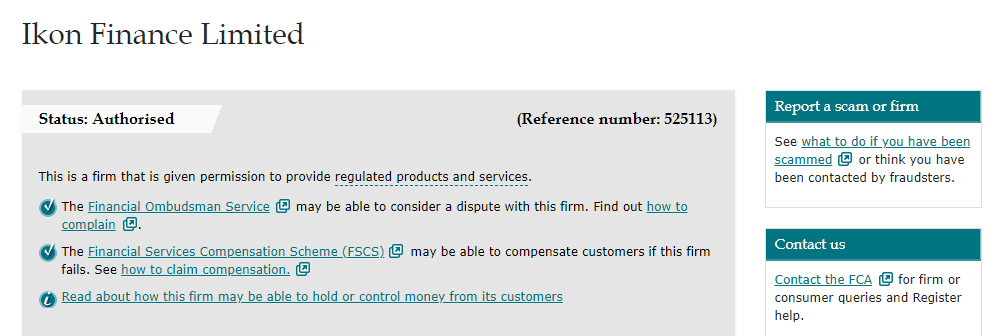

Are Ikon Finance safe or a fraud?

Ikon Finance Limited is licensed and controlled through the Financial Conduct Authority because the company is located within London, UK and according to the law , requires an official license from FCA for legal operation.

So, the broker completely adheres to a variety of FCA rules, which is in fact one of the most stringent operational guidelines as well as its numerous cross-registrations and regulations throughout all of the EEA zone. This is why is the regulation crucial, as the client is treated fairly and the funds of trader's are segregated. This is accounts in which the traders' assets are kept separately from the assets of the broker always.

Alongside that rule providing security and money security, each Ikon Finance client is covered by the Investor Compensation Fund in the unlikely scenario.

In addition, Ikon Finance continuously monitors its operations and provides complete security for all transactions online or manipulations using the array of platforms offered.

Leverage

The marginal trading is a well-known Forex lucrative opportunity allows retail traders to work with an increased amount of their deposit at the beginning and to operate bigger positions. This is a huge benefit as it boosts your chances of earning profits, but it is important to be aware of how to utilize leverage effectively and gain a thorough understanding of the potential risks as well.

But, it was acknowledged by authorities around the world as a risky instrument and, as such, it was recommended that the UK and European regulators lowered the allowed amounts of leverage.

- Particularly, you can make use of the only limit of 1:30 for Major Currency pairs as well as a lower rate of 1:20 for minor currencies and is suitable for all UK licensed brokers, and Ikon Finance as well.

Types of accounts

Ikon offers four different types of accounts which comprise Ikon Classic Icon Plus MT4 Account Icon Plus, MT4 Prodigy Classic and Ikon Pro Accounts.

Each account type offers an individual solution for traders, whether they prefer low costs, a particular method, or platform, or the need to trade using spreads only or on commission basis.

In terms of trading cost, the basic package includes all expenses to Ikon Finance Spread. Ikon Financial Spread however, other accounts with higher grades will have better rates and a spread starting at 0.3 pip and a range of trading lot requirements based on the kind of account.

Furthermore, those who require the use of a exchange-free or Islamic account, with specific terms and requirements are welcome to create accounts at Ikon Finance too.

Fees

Below is a standard account spread and also look up and examine Ikon Finance fees to another well-known broker the XTB.

| Asset/ Pair | Ikon Finance Spread |

| EUR/USD | 1.3 |

| Crude Oil WTI | 4 |

| Gold | 30 cents |

Deposits and withdrawals

The payments made by the client and the transactions that go to and from trading accounts can be carried out in a variety of ways, and include the most reliable and efficient alternatives like card payments, bank Transfers, and use of the online platform Skrill.

Minimum deposit

Ikon Finance minimum balance is 200dollars. It is considered to be a decent and appealing offer, since the price is reasonable for traders of various levels.

Ikon Finance M minimum deposit in comparison to other brokers

| Ikon Finance | Many Other Brokers | |

| Minimum Deposit | $200 | $500 |

Withdrawals

There are a variety of withdrawal options available on Ikon Finance including Bank Transfers or cards, as well as electronic wallets. To cover the transaction cost there are additional charges that could be incurred and they are always the on the trader's shoulders because the service provider is charged a fee for the execution of the transaction. But, consult the broker's Ikon Finance in order to check the fees which may be charged when you transfer the funds from or to your trading account, since some options are carried out using zero cost.

Trading Platforms

Ikon Finance is the Ikon Finance mainstays at the top of the line MetaTrader4 platform, which supports expert Advisors (EAs) which allows users to incorporate trade algorithmic or signaling into their trading platform, and execute trades with a variety of options, such as robots and manual trading.

Desktop platform

However, there is a possibility to make use of the specialized Ikon Prodigy platform that is able to take into account the numerous inputs coming from an array of retail and institutional customers across the globe, and offers sophisticated trading tools and features that offer high-speed and stability.

Therefore, the decision is entirely yours to make, whether you choose to use the MT4 that has more than 50 indicators and tools that do not just assist in predicting trends but also identify the right exit and entry points and to test Ikon Prodigy. Ikon Prodigy.

Mobile trading

Ikon is also compatible with various mobile devices to ensure that the trader can keep up-to-date with the latest market details and also manage trades no matter the place of residence.

A short overview of the options is made available to all live and demo account holders so that you'll be able to observe the minor differences between the programs and pick the best one according to your trading needs and preferences towards the strategy you choose to use.

Education

But, Ikon Finance professional basis is not a nightmare for traders who are new, since beginners can get familiar themselves with the most important trading aspects and re-test the practice with the risk-free Demo account as well as the learning and education materialfrom the firm. Support is available throughout the day with a variety of options and options that are accessible to customers anytime.

Conclusion

In general, Ikon Finance is a trustworthy FCA licensed company located within the UK that provides a variety of portfolios and lets different types of traders or investors to participate in trading across different platforms and markets. Broker's provided trading conditions and the execution model allows for advanced feature trading that can be adapted to traders with different types and styles of. Beginning traders will also benefit from the instructional resources and support offered as well as the support offered, and the more experienced clients will have access to the most powerful trading tools that can help improve the trading capability.

| Properties | Values |

|---|---|

|

Name

|

Ikon Finance |

|

Minimum Diposit

|

$ 200 |

|

Leverage

|

1:30 |

|

Regulation

|

FCA (United Kingdom),, |

|

Headquarters

|

United Kingdom |

|

Established

|

1999 |

|

Address

|

6th, 106 Leadenhall St, London EC3A 4AA, United Kingdom |

|

Platform

|

MT4,, |

|

Payment Method

|

Visa,Mastercard,Wire,Skrill,Neteller,, |

| Properties | Values |

|---|---|

|

Spreads

|

1.3 pips |

|

Min Position size

|

0.01 |

|

Broker Type

|

STP (Straight Through Processing),ECN (electronic communications networks),Instant Execution,, |

|

Account Type

|

Mini account,Fixed Spread,Scalping,High Leverage,Standard,, |

|

Brokers by Country

|

UK Forex Brokers,, |

|

Techniques

|

Scalping Forex Brokers,Hedging Forex Brokers,Mobile Trading Brokers,Day Trading Brokers,, |

|

Instruments

|

Forex Trading Brokers,Futures Trading Brokers,, |

|

Account currency

|

USD,EUR,GBP,,USD, |

|

Tools

|

Charting Software,, |

|

Website Languages

|

en,, |

|

Support languages

|

en,, |

|

Bonus

|

Yes |

|

Reviews Rating

|

3.5 |

|

Withdrawal Fee

|

Yes |

|

Trading Signals

|

No |

|

Free Education

|

Yes |

|

Daily News

|

Yes |

|

Demo account

|

Yes |

|

Swapsr

|

Yes |

|

Pors

|

N/A |

|

Cors

|

N/A |

|

Display Analysis

|

Yes |

|

Serving country

|

GB,, |

|

Not Serving country

|

US,, |

|

Contests

|

No |

|

Market analysis

|

Yes |

|

Copy Trading Brokers

|

No |

|

Bitcoin Forex Brokers

|

No |

|

Social trading

|

No |

|

Web trading

|

Yes |

|

Forex pairs

|

Yes |

|

CFDs

|

Yes |

|

Crypto

|

Yes |

|

Hedging

|

Yes |

|

PAMM

|

Zulu trade,Myfxbook Auto trade,, |

|

Mobile Trading

|

Yes |

|

Scalping

|

Yes |

|

Automated Trading

|

Yes |

|

Partnership Programs

|

Yes |

|

Free Phone

|

+44 20 3384 0750 |

|

Customer Support

|

24/5 |

Exness Broker reviews & comments (0)

Add a review

Your email address will not be published. Required fields are marked *