IFGM Broker Reviews and Full Information

What is IFGM?

IFGM (or, previously known as IFM Trade was a incorporated Australian firm which, along with its headquarters and its main operation has established global support offices that provide online trading services with prices that are institutional-grade.

10 Points Summary

| Headquarters | Australia |

| Regulation | ASIC |

| Platforms | MT4, IFGM WebTrader |

| Instruments | Forex, Global Equity CFDs, Gold and Commodities in all 40+ instruments. |

| EUR/USD Spread | 1.1 pip |

| Demo Account | Provided |

| Minimum deposit | 200 US$ |

| Base currencies | AUD, USD |

| Education | Advanced learning materials for beginners and beginning learners |

| Customer Support | 24/5 |

Instruments

The competitive conditions reflect the capability to trade Forex, Global Equity CFDs, Gold and Commodities in more than 40 instruments.

To integrate into the current technology of online trading The company offers low latency environments which is paired with an an extensive price feed and a an extremely tight spread.

Additionally in addition, the IFGM broker does not just serve clients who are retail customers, but also provides the possibility for corporate members or money managers, to join with the partnership. The accounts of the PAMM and MAMare accessible to managers who use an MT4 platform, with all EAs are accepted.

Education

A fascinating aspect is the advance IFGM Client Portal that brings an array of essential information, as well as assistance from a personal account manager, who can provide assistance in a variety of languages. For educational materials, the trader of any level , from beginner to advanced will be able to find relevant information via educational material that will help them gain a better understanding of markets.

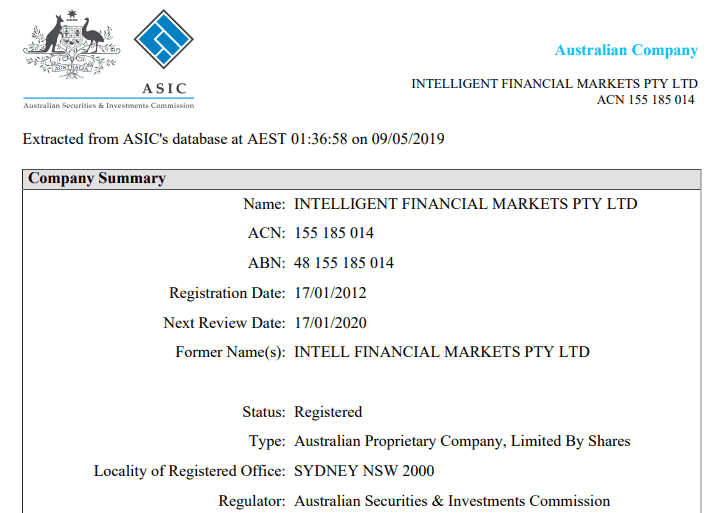

Is IFGM an actual scam or safe?

The answer to these important questions is yes, IFGM is a safe broker. Actually, IFGM features one of the most trusted and experienced brokers using MT4 services as of 2012, while providing its services under the strict guidelines that are enforced by ASIC (Australian Securities and Investment Commission).

IFGM created a variety of methods to safeguard their customers using any method they can including but not only Trader's Funds segregation in the largest institution, the Commonwealth Bank. Participation in schemes as well as transaction encryption, as well as the compliance with internal processes like audits, risk management, and audits.

The truth is that approval of the reliable authority of a popular investment locations reduces the chance to be considered scams to a minimum. But, all traders should be sure to verify the legitimacy of status of the company and identify those that might, in reality, be false with the details of their incorporation.

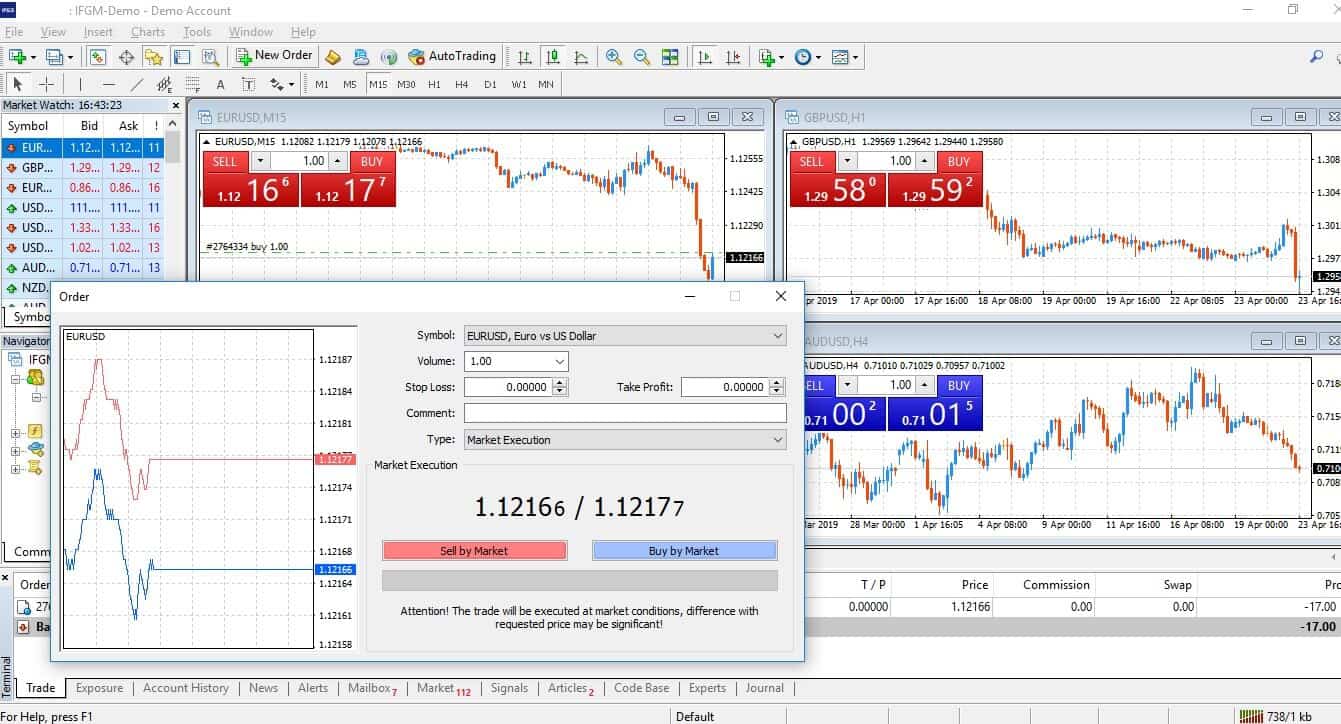

Trading Platforms

The platform used by IFGM is well-known MetaTrader4 which was created through mobile and desktop versions, and IFGM created its WebTrader which allows traders to trade directly through the web browser. The platforms can be used on any operating systems and devices , while using trading instruments that are available under unbeatable conditions.

The platforms have nearly the same capabilities that can be used with any strategy by Expert Advisors or Hedging or one click trading. However, even in the event that the platform is efficient, it must be armed with tools for trading.

The technology is always evolving which is why the broker at IFGM working providing the most current tools that improve trading capabilities. Different chart types offer unlimited possibilities for analysis, as well as analytical tools for technical analysis that come with a myriad of indicators.

In addition, in conjunction with the possibilities of MAM and PAMM, the broker also made the possibility to participate in Futures and Options trading along with Automated Futures. Futures trading systems are supplied by a US third party and fully automated, executing orders at high speed by the algorithms.

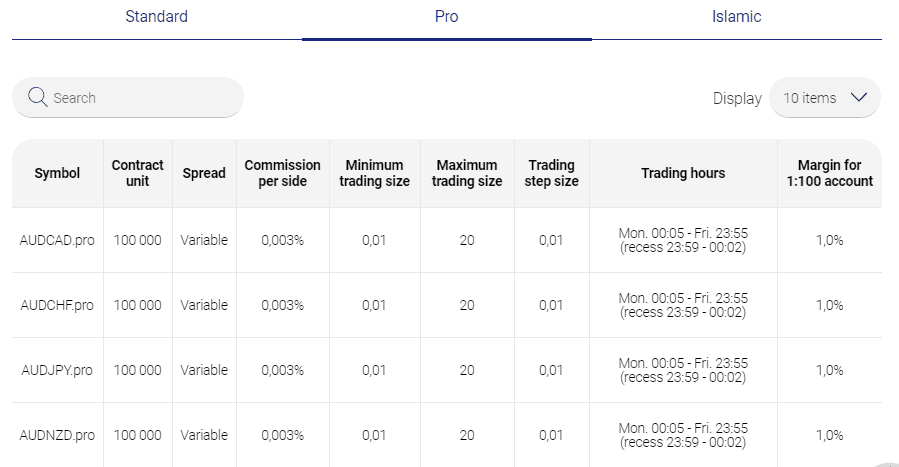

Accounts

Another essential aspect to consider when selecting the right broker is the trading fee and features. So let's examine the IFGM offering. The accounts are designed are designed to meet the needs of various types of traders who can select the most suitable one of the three types of accounts - Standard Account and Professional Account along with an Islamic Account., and allowing maximum leverage up to 1:500 with the adjustable wide spread.

In terms of the costs for trading, the Standard account trader is charged a spread and has access to nearly every instrument. Pro accounts are for professional traders. Pro accounts specifically designed specifically for professionals and active traders include commissions for the instrument being traded and an interbank spread starting at 0.0 pip.

The Islamic Account alternatively brings only the option of trading day-to-day according to the Sharia law stipulates with no swap fees or commissions.

Fees

Spread of IFGM table of the most traded instrument gives you an example of the minimum spreads. The costs are not guaranteed and is provided as a reference only because the price may fluctuate in accordance with the market situations and liquidity.

You can also look up and examine IFGM costs with the fees of its competitor Plus500..

| Asset/ Pair | IFGM Fee Terms |

| EUR/USD | 1.1 Pips |

| Gold | 0.50 |

| BTC/USD | 50 |

It is something you need to consider the the IFGM the overnight charge that is charged by the broker, in addition to the fee for trading, when you hold a the position for a long time.

IFM EUR/USD overnight feesdepending on the open positions. Buying a lot is priced at -1.22 while selling 0.62 or 0.62.

IFGM Prestige Club

Furthermore to that, the IFGM created the Prestige Client Club that offers benefits and more chances to earn profits. Members of the VIP club can benefit from the lower cost of trading, the possibility of negotiating spreads, and more advanced training through private classes and a personal dedicated account managers.

However, the customer is offered an exclusive opportunity by meeting the balance requirement , which turns the account into a VIP account and is worth 100k$ with a minimum trade volume of 50 lots per month.

Leverage

Leverage, also known as a loan granted through a broker the trader , opens up an array of trading options due to the multiplied size of the initial capital, many possibilities become accessible.

However, leverage dramatically increases the chance of higher gains , and also increases the risk of loss as well. So, leverage can be risky when you do not set it correctly, particularly at the most extreme levels.

There are some regulations that limit the use of certain ratios under certain regulations, the majority of global traders are able to use just a few ratios. However, IFGM leverage remains at the maximum limit of 1:500 in Forex instruments in the sense that ASIC continues to allow Australian traders to take advantage of this.

Deposits and Withdrawals:

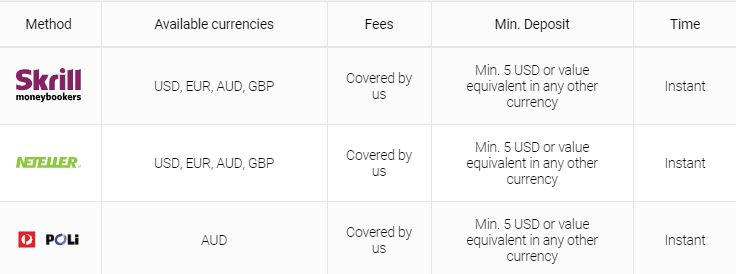

The variety of methods for funding actually allows you to fund a bank account anytime and at a convenient pace. The method is based on IFGM choices include debit and credit cards as well as bank wire transfers, locally-based bank transfer, UnionPay as well e-payments PayPal, Skrill, Neteller and BPay, POLi.

Minimum deposit

IFGM the minimum amount to deposit begins at 200$, but it is accessible for Standard Account. A Pro Account designed for active traders provides more competitive conditions however, it requires maintenance starting at 1,000dollars.

Withdrawal

The IFGM withdrawal and the deposits fees from the side of the company are covered, which is certainly a benefit for the client. All manipulations are performed through the secure connection to Client Portal. Client Portal.

Conclusion

Overall the IFGM Evaluation reveals that the brokerage business is a completely reliable one that provides their trading services according to the regulation guidelines and in complete compliance with the law. This gives a peaceful mindset, so that the traders are able to concentrate on trading process, which is offered at a high-end quality.

| Properties | Values |

|---|---|

|

Name

|

IFGM |

|

Minimum Diposit

|

$ 200 |

|

Leverage

|

1:500 |

|

Regulation

|

ASIC (Australia), |

|

Headquarters

|

Australia |

|

Established

|

2012 |

|

Address

|

350 George St, Sydney NSW 2000, Australia |

|

Platform

|

MT4,MT4 WebTerminal, |

|

Payment Method

|

Visa,Mastercard,Wire,Skrill,Neteller,Union Pay,Bpay,Poli,Local bank transfer, |

| Properties | Values |

|---|---|

|

Spreads

|

1.1 pips |

|

Min Position size

|

0.01 |

|

Broker Type

|

STP (Straight Through Processing),,,, |

|

Account Type

|

Mini account,Scalping,High Leverage,Standard, |

|

Brokers by Country

|

Australian Forex Brokers, |

|

Techniques

|

Scalping Forex Brokers,Hedging Forex Brokers,Mobile Trading Brokers,Day Trading Brokers, |

|

Instruments

|

Forex Trading Brokers,CFD Trading Brokers,Stock Trading Broke,Oil Trading Brokers,Commodity Forex Brokers, |

|

Account currency

|

USD,AUD, |

|

Tools

|

Economic Calendar,Charting Software, |

|

Website Languages

|

en, |

|

Support languages

|

en, |

|

Bonus

|

Yes |

|

Reviews Rating

|

3.5 |

|

Withdrawal Fee

|

Yes |

|

Trading Signals

|

No |

|

Free Education

|

Yes |

|

Daily News

|

Yes |

|

Demo account

|

Yes |

|

Swapsr

|

Yes |

|

Pors

|

1. Regulated trading broker 2. Various account funding options 3. Sophisticated trading platforms 4. Educational resources |

|

Cors

|

1. No EU, UK or US clients allowed 2. Limited trading instruments 3. A minimum deposit of $200 |

|

Display Analysis

|

Yes |

|

Serving country

|

AU, |

|

Not Serving country

|

AE,GB,US, |

|

Contests

|

Yes |

|

Market analysis

|

Yes |

|

Copy Trading Brokers

|

No |

|

Bitcoin Forex Brokers

|

No |

|

Social trading

|

No |

|

Web trading

|

Yes |

|

Forex pairs

|

Yes |

|

CFDs

|

Yes |

|

Crypto

|

No |

|

Hedging

|

Yes |

|

PAMM

|

Myfxbook Auto trade,Mql5 signals, |

|

Mobile Trading

|

Yes |

|

Scalping

|

Yes |

|

Automated Trading

|

Yes |

|

Partnership Programs

|

Yes |

|

Free Phone

|

+61 1300 735 125 |

|

Customer Support

|

24/5 |

Exness Broker reviews & comments (6)

order prescription medicine online without prescription https://canadianpharmaceuticalsplus.com/ pharmacy drugstore online

canadian pharma companies https://canadianpharmaciesshop.com/ cheap medications

Add a review

Your email address will not be published. Required fields are marked *