IC Markets Broker Reviews and Full Information

What are IC Markets?

In 2007, the company was established in Sydney by a group of financial professionals. Their goal was to provide trading solutions for both institutional and retail clients. The broker has grown to be one of Australia's leading traders and also serves European and international clients.

IC Markets Pros and Cons

IC Markets has a good reputation and a great selection of platforms including MT4, MT5 or cTrader platforms. They also offer education and support 24/7. You can choose between spread basis or raw spread accounts. There are also many instruments available.

We found spreads that were higher than the average.

10 Points Summary

| Headquarters | Australia |

| Regulation | ASIC and CySEC |

| Platforms | cTrader, MT4, MT5 |

| Instruments | FX, Equities and Commodities Futures CFDS Stocks and Bonds Crypto Trade |

| Demo Account | Available |

| Minimum deposit | 200 US$ |

| Spread EUR/USD | 1 pip |

| Base currencies | There are 10 currencies available |

| Education | All included on a complimentary basis |

| Support for Customers | 24/7 |

What kind of broker is IC Markets and what are their responsibilities?

IC Markets, an ECN Trading Environment Provider, offers true spreads starting at 0.0 pip from liquidity suppliers from more than 50 banks and dark pool liquidity providers across 60 forex pairs. IC Markets is a great choice for scalpers, EA traders, and traders who trade high volumes. They also offer a transparent environment that allows you to enjoy spreads as low as 0.0 pips from liquidity suppliers.

Execution brings speed and low latency to traders orders through fiber optic. This connects them to the market via servers in the NY4 and LD5 Equinix Data Centers New York and London.

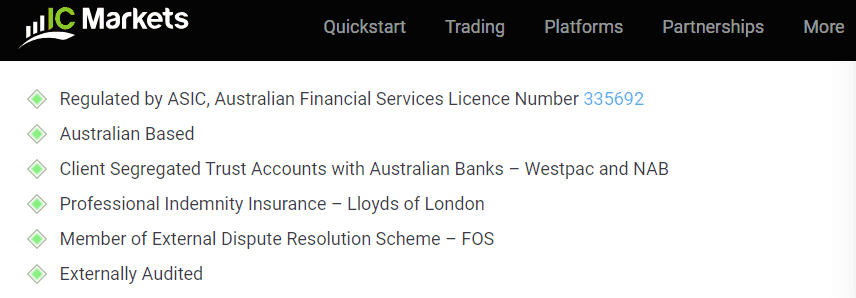

Is IC Markets a scam or safe?

IC Markets is considered a safe broker because the licensed and regulated trading firms are continuously monitored and audited externally by reputable authorities.

Is IC Markets legal?

IC Markets is an Australian-incorporated broker. It does its service as regarded by the Australian Securities and Investments Commission's (ASIC) license. IC Markets also operates a Cyprus-regulated trading service that is legally and officially licensed for European clients.

IC Market traders can be confident with a license from ASIC and regulation from ASIC. ASIC is one of the most strict and demanding financial regulators. Money protection is provided by multiple regulated methods and includes the client cash segregation. Clients can only access the accounts for the purpose of trading.

IC Markets is also a member the Financial Ombudsman Service, which is an approved Australian scheme for external dispute resolution that resolves disputes between members and consumers.

Leverage

IC Markets offers leverage from 0 to 500, which opens up the Forex market to Retail traders who have a small or low initial deposit to cover margins. Leverage can increase gains, but remember that losses could also exceed your initial deposit.

- Maximum 1:500 is available for Australian clients

- European traders are allowed to trade at 1:30

- International proposals: 1:500

The broker gives leverage to traders to allow them to trade with more capital and maximize their potential gains. We recommend that traders use tools smartly and carefully read how to set up the correct leverage for a specific instrument or trading strategy.

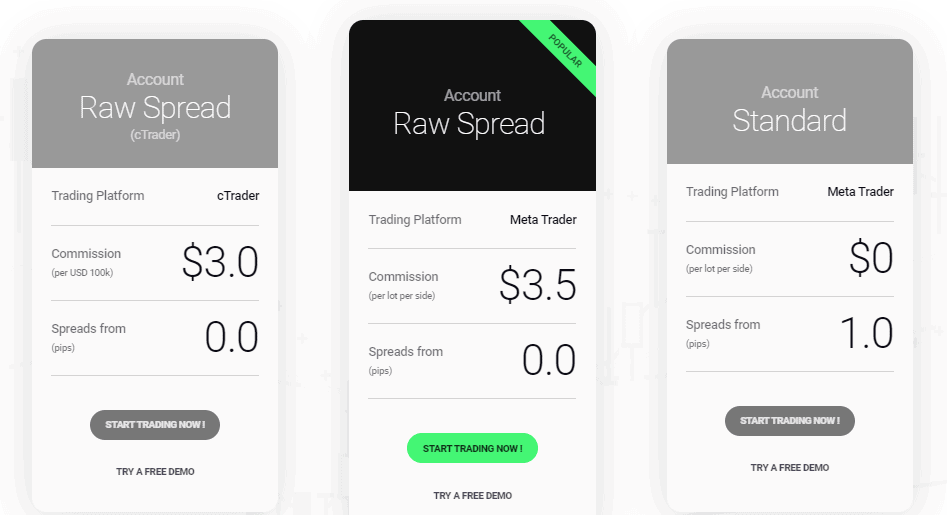

Types of accounts

There are three main account types. They all have the same compatibility, power and are made to suit different trading styles. The two first accounts offer raw spread conditions and a commission per trade. You can also choose from MT4 or cTrader.

Accounts are available in multiple currency options, up to 10. They are completely segregated from company funds and are supported by multilingual customer service. Traders who adhere to Sharia rules may sign for Swap or Islamic accounts. This option is available at IC Markets along with a risk-free demo account that allows you to practice the trading strategy.

Fees

IC Markets has different pricing options for trading fees. The fees are slightly different depending on which account type you choose and the platform you use. Be aware that different IC Markets entities may have their own trading conditions. Make sure you check this out.

| Fees | Fees for IC Markets | AvaTrade Fees | eToro Fees |

|---|---|---|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity Fee | Yes | Yes | Yes |

| Ranking of fees | Low | Average | High |

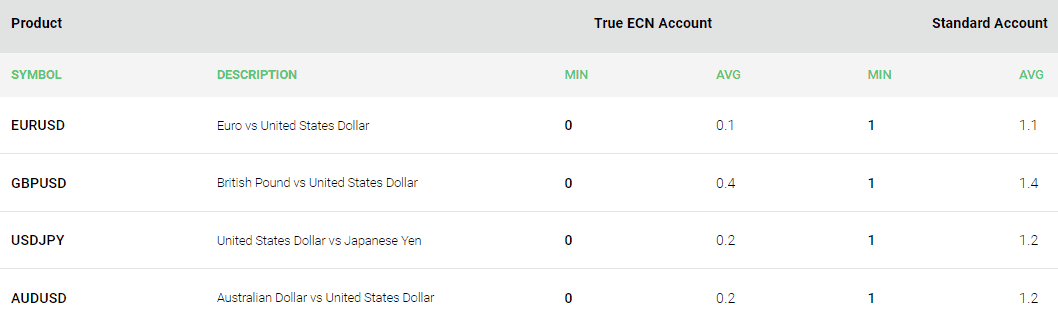

Spreads

The Standard account is enabled via MetaTrader4 with Cross-Connect and spreads only on 1.0 pip. The True ECN Raw Account permits micro lot trading starting at 0.01 sizes, deep institutional liquidity, and ECN spreads starting at 0. 3.50$ for every 100k traded is also available at MT4.

Spreads for EURUSD average at about 0.1 pips per day (24/5 according to IC Markets expert advisers) which is the current tightest average EURUSD spread globally.

cTrader ECN account offers approximately the same features as MT4, with the exception that it is used primarily by professional traders of larger sizes. Equinix LD5 executes the trades through Equinix ECN5, and the spread is 0.0 pip.

Trading Fees for IC Markets

| Asset/ Pair | Spread of IC Markets | AvaTrade Spread | Spread eToro |

|---|---|---|---|

| EUR USD Spread | 1 pip | 1.3 pip | 3 pip |

| Crude Oil WTI Spread | 5 pip | 3 pip | 5 pip |

| Spread the Gold | 1 point | 40 | 45 |

Overnight Fee

IC Markets overnight fees or aswap rates determined by the overnight difference between the currencies in the pair. It also depends on whether the position is a sell'short or buy 'long. Although the fee may vary from one currency to the next, you should keep in mind that it can bring you either a negative or positive impact on your account.

Here's a quick snapshot of IC Markets fees

Trade Instruments

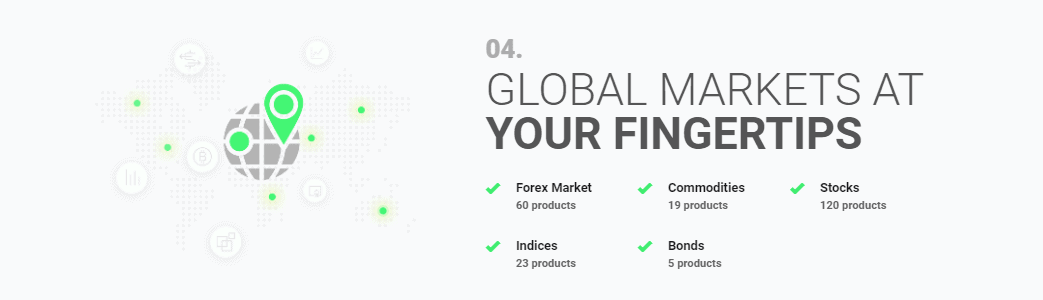

Markets offer a wide range of instruments that can be traded. FX, Equities and Commodities, Futures CFDS Stocks and Bonds are the asset classes. The IC Markets Bitcoin trade allows trading pairs with Bitcoin and Ethereum, Dash and Litecoin.

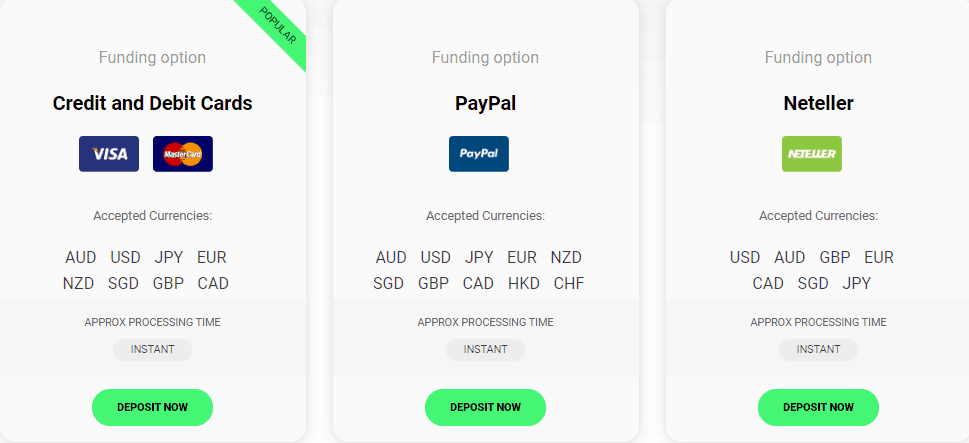

Withdrawals and deposits

IC Markets has 10 flexible financing options in 10 major base currencies AUD. GBP. JPY. SGD. NZD. CHF. CAD. EUR. USD. This is great because you can choose the right one for yourself and avoid any conversion fees.

Deposit Options

You can deposit and withdraw funds from the client secure area.

- Cards,

- PayPal,

- Bank Transfer, including local.

- Neteller, Skrill, WebMoney, Qiwi,

- China UnionPay, FasaPay, and many more

Minimum deposit at IC Markets

IC Markets requires a minimum deposit of 200$ to open a Standard Account on MetaTrader4 and other account types at IC Markets.

IC Markets Minimum Deposit vs Other Brokers

| IC Markets | All Other Brokers | |

| Minimum Deposit | $200 | $500 |

Withdrawals

IC Markets withdrawals allow you to use popular Bank Transfer and WebMoney cards and e-wallets. IC Markets doesn't charge any additional fees for deposits and charges 0$ for withdrawals. IC Markets will pay the transfer fees of the company bank institution for International Bank Wire withdrawals. This fee is around AUD20 and is deducted from your withdrawal amount.

What is the average time it takes to withdraw money from IC Markets

Various payment options will process withdrawal money within the time specified. IC Markets accounting staff confirms transactions very quickly within 1-2 days.

Trade Platforms

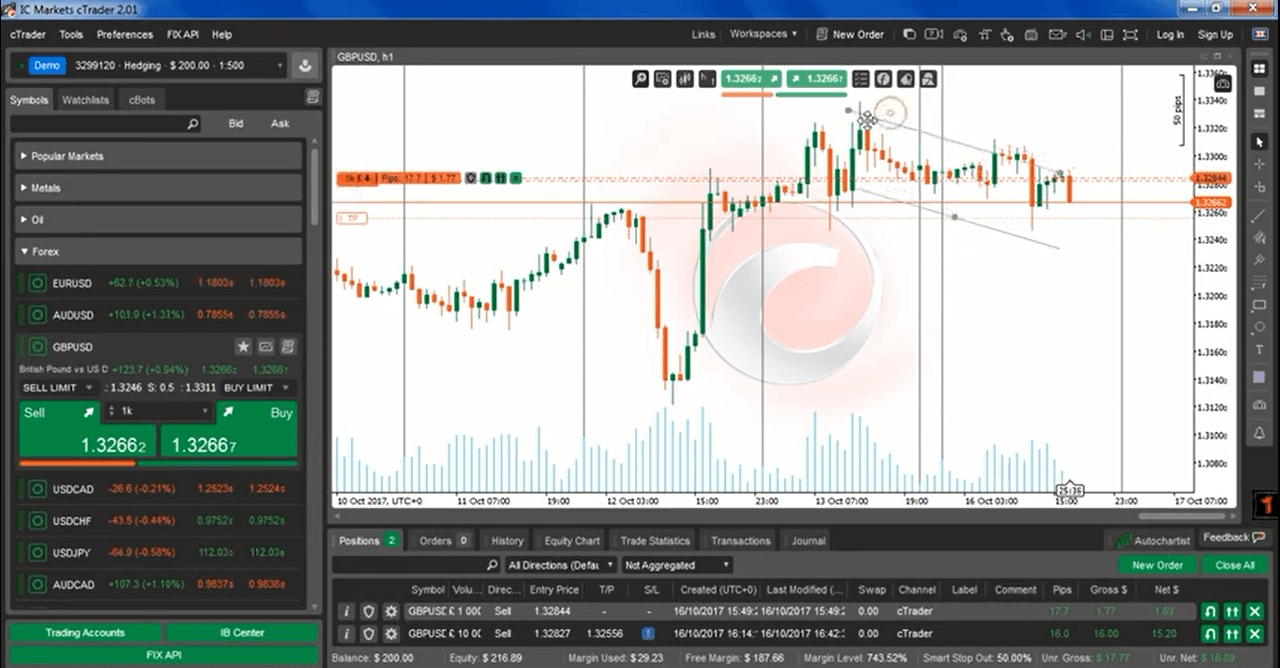

IC Markets also offers advanced software options, in addition to the highly technical optimization of execution by the leading technologies. MetaTrader4 and cTrader, are two of today's best trading platforms. IC Markets has both direct access to the ECN trading environment.

You can trade MetaTrader5 a new and improved version, which is packed with brand-new features, if you wish.

| Pros | Cons |

|---|---|

| The mainstays of an industry are MT4 or MT5 | No proprietary platform |

| Raw spreads available for cTrader | |

| Design that is friendly to customers | |

| A wide range of advanced tools | |

| Automated trading and PAMM capabilities | |

| There are no restrictions on the strategies |

Desktop Platform

It is unnecessary to go into detail about each platform's features as they all offer powerful trading features. You can use the Web Platform to access each platform, or download the Desktop version to customize MetaTrader and cTrader.

Overall, IC Markets is a great platform for trading. It offers a wide range of tools and extensions, including IC Markets' one-click trade module, market depth and spread monitor , trade risk calculator, and advanced orders that were previously unavailable on MetaTrader 4.

Mobile Platform

Mobile apps are also available. They are extremely useful for traders who want to keep up with market conditions wherever they are. Similarly, MT4, MT5 or cTrader can be accessed via Android and iOS devices. This allows account management and control of the positions.

Auto Trading

Auto trading is compatible with all broker platforms. EAs at MT4 and MT5 myfxbook are available at cTrader platform. ZuluTrade can also be used. ZuluTrade allows you to pick from thousands of skilled traders and follow their trading signals free of charge.

MAM and PAMM offer flexible and simple-to-use tools to help you enter into a partnership with the broker. FIX API offers a great opportunity to high volume traders. VPS (Virtual Private Server), allows you to run a variety automated trading strategies and can be used for free if you reach a minimum volume of 15 round turns (FX) per calendar month.

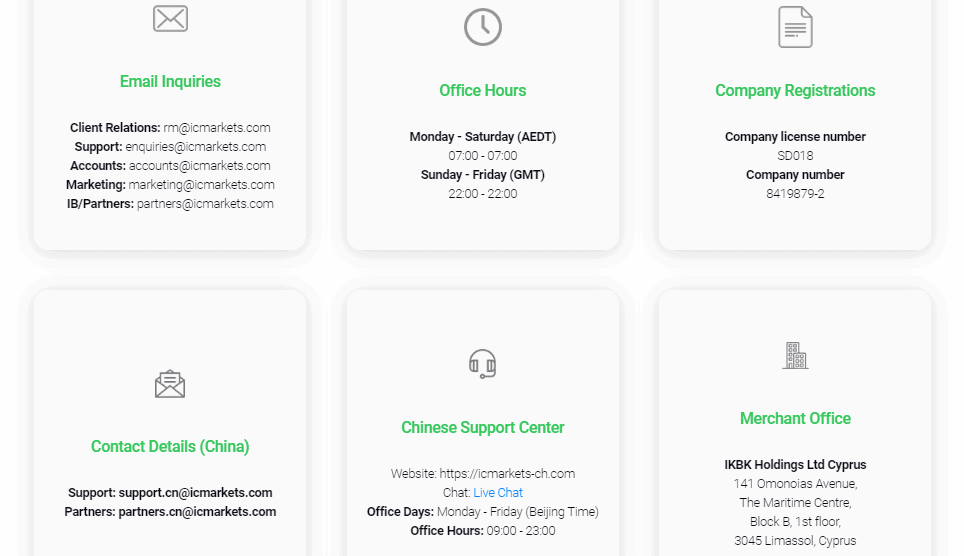

Customer Support

IC Markets is committed to providing the best technology solutions, but also understanding the importance of quality customer service. The broker support is available 24 hours a day and has customer offices located in different regions. This ensures that everyone around the world can be reached by IC Markets.

Education

Eventually, the IC Markets team gained significant experience in the forex industry and understands exactly what traders need. Free educational materials that allow you to gain a clear understanding of the topic through regular technical analyses reports, video tutorials informational tools, webinars, and other resources.

There are also many research tools available, including inbuilt analysis tools within platforms.

Conclusion

IC Markets has a unique trading platform that allows you to choose from a variety of tailor solutions for almost all trading parameters. You can also choose which trading instrument, platform to use, account type, account to open, use auto trading, social trading, or become a partner. IC Markets technical Optimization is the best in execution, platform optimization and tools.

| Properties | Values |

|---|---|

|

Name

|

IC Markets |

|

Minimum Diposit

|

$ $200 |

|

Leverage

|

1:30 | 1:500 |

|

Regulation

|

ASIC (Australia),CySEC (Cyprus),,,,,,,,,,,,, |

|

Headquarters

|

Australia |

|

Established

|

2007 |

|

Address

|

International Capital Markets Pty Ltd Level 2 / 2 Bligh Street Sydney NSW 2000 Australia |

|

Platform

|

MT4,MT5,cTrader,,,,,,,,,,,,, |

|

Payment Method

|

Paypal,Visa,Mastercard,Credit Card,Wire,Western Union,Skrill,Neteller,Perfect Money,Webmoney,Fasa Pa |

| Properties | Values |

|---|---|

|

Spreads

|

Fixed 1-3 |

|

Min Position size

|

0.01 |

|

Broker Type

|

ECN (electronic communications networks),NDD (Non Dealing Desk),Market Execution,,,,,,,, |

|

Account Type

|

Scalping,,,,,,,,,,,,, |

|

Brokers by Country

|

Australian Forex Brokers,,,, |

|

Techniques

|

Scalping Forex Brokers,Mobile Trading Brokers,,,,,,,,,,,,, |

|

Instruments

|

Gold Trading Brokers,CFD Trading Brokers,Stock Trading Broke,Oil Trading Brokers,Metal Trading Brokers,Indexes Trading Brokers,,,,,,,,,,,,, |

|

Account currency

|

USD,EUR,AUD,CAD,,USD,,USD,,USD,,USD,,USD,,USD,,USD,,USD,,USD,,USD,,USD,,USD, |

|

Tools

|

Economic Calendar,Charting Software,Pip Calculator,Margin Calculator,Profit Calculator,,,, |

|

Website Languages

|

en,en-GB,en-US,,,,,,,,,,,,, |

|

Support languages

|

en,en-GB,en-US,,,,,,,,,,,,, |

|

Bonus

|

Yes |

|

Reviews Rating

|

5.00 |

|

Withdrawal Fee

|

Yes |

|

Trading Signals

|

Yes |

|

Free Education

|

Yes |

|

Daily News

|

No |

|

Demo account

|

Yes |

|

Swapsr

|

Swap free |

|

Pors

|

1. Mainstays on an industry known MT4 and MT5 2. cTrader offered with raw spreads 3. Customer friendly design 4. Advanced range of tools 5. Automated trading and PAMM capabilities 6. No restrictions on strategies |

|

Cors

|

1. No proprietary platform |

|

Display Analysis

|

Yes |

|

Serving country

|

CA,IR,IL,JP,NZ,US,,,, |

|

Not Serving country

|

,,, |

|

Contests

|

No |

|

Market analysis

|

Yes |

|

Copy Trading Brokers

|

Yes |

|

Bitcoin Forex Brokers

|

Yes |

|

Social trading

|

Yes |

|

Web trading

|

Yes |

|

Forex pairs

|

Yes |

|

CFDs

|

Yes |

|

Crypto

|

Yes |

|

Hedging

|

Yes |

|

PAMM

|

Yes,,,,,,, |

|

Mobile Trading

|

Yes |

|

Scalping

|

Yes |

|

Automated Trading

|

Yes |

|

Partnership Programs

|

Yes |

|

Free Phone

|

1300 600 644 |

|

Customer Support

|

24/7 |

Exness Broker reviews & comments (0)

Add a review

Your email address will not be published. Required fields are marked *