Hirose Financial Broker Reviews and Full Information

What is Hirose Financial?

Hirose Financial UK is an investment company that was established to enhance the FX services provided by Hirose Tusyo Japanincorporated in 2004. The company is considered to be among the largest and most prestigious OTC broker within Japan. The UK operations began in 2010, and in addition the Global group has service offices located in Hong Kong and Malaysia to meet the needs of demands of customers.

It is part of the Hirose group has served more than 200 000 customers across the globe with a focus on the stability of trading, enhanced by the latest technology, including the execution of NDD and the most popular industry platform MT4 as well as LION Trader (ActTrader) for trading Forex instruments, including currencies.

The broker performs orders via 15 liquidity providers which can be fed to an aggregator with the fee included in the variable spread without commissions, so it is a good choice.

10 Points Summary

| Headquarters | Japan, UK |

| Regulation and License | FCA, IBFC, JFSA |

| Instruments | Currencies, Commodities |

| Platforms | MT4, LION Trader |

| Costs | 0.8 Pips |

| Demo Account | Provided |

| Base currencies | GBP, EUR, USD etc |

| Minimum deposit | 20 $ |

| Education | Manuals for trading, the most important elements of trading Overviews of technical analysis economic indicators |

| Customer Support | 24/7 |

Are Hirose Financial safe or a fraud?

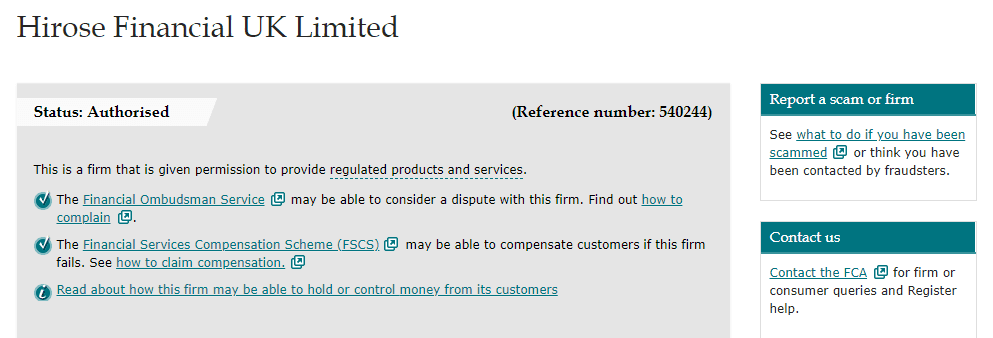

Hirose Financial is a multi-regulated broker with licenses from every jurisdiction it has offices in and provides trading services. This makes it a reliable business that follows strict guidelines.

These licenses come with supervision by the Ministry of Finance in Japan and the Malaysia company Hirose Financial MY Ltd authorized by Labuan FSA, while the UK branch is monitored by the UK's respected regulator, the FCA.

This is why Hirose is considered to be a safe broker since one of the main concerns of all authorized firms is the protection of the client's funds as well as the protection of operating norms.

Alongside requirements for operational standardization and the requirements to run trading services, Hirose maintains safety measures for client funds, and the funds are kept in banks that have separate accounts for trusts. Alongside that, every regulation supports traders through differing methods and having regulatory requirements regarding how to treat clients or on what steps to take.

Therefore, when you trade through the UK branch, every customer is covered under the Financial Services Compensation Scheme (FSCS) which protects the customer in the event insolvency of the company up to PS50,000.

Leverage

When trading through Hirose Financial you are offered the leverage option that could increase your profits because of the growth of the size of your trading that you manage. In addition, with the unique advantages leverage also increases risk which is why it's crucial to choose it carefully. To this end, regulations requirements and restrictions, such as that in the case of Hirose Financial is the UK licensed broker, require less leverage for retail traders.

So the maximum leverage allowed for retailers is limited at 11:30 in the case of Major Currency pairs, and 1:10 in the case of Commodities. However, professional traders can be able to apply for higher leverage, that goes up to 1:100 in the case of Forex instruments as well as leverage levels could be higher when trading with a different Hirose company as the regulatory limitation differs from one jurisdiction to the other.

Account Types

The accounts, in turn, were available on the platform exclusively and the corporate client can negotiate specific trading terms. Hirose Financial didn't place a minimum deposit on each of the accounts and, therefore, those who are just beginning their journey or those who are professional can get started trading easily and comfort. Additionally, it is possible of trading using tiny lots and micro lots, which is a excellent feature for beginners.

Fees

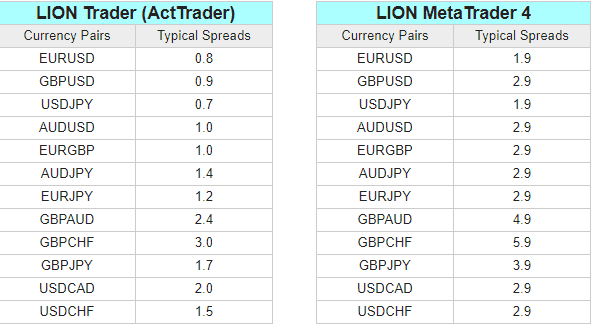

Hirose The financial costs of Hirose are incorporated into a competitive spread which differs based on the type of account or platform, while the broker is always on a tight and low spread approach without any hidden charges.

The average spread for the EUR/USD is 0.3 percent and commodities are offered with low margins of 0.5 percent. Standard Account and Pro Account costs are the same. Pro Account, Standard Account as well as the Pro Account cost is all incorporated into the flexible spread and the Prime Account offers lower spread however, it comes with a commission per transaction.

Spreads

Hirose Financial spread are indeed extremely well-designed and you can see an example of the typical spreads here, and look into the other agent Blackwell Global.

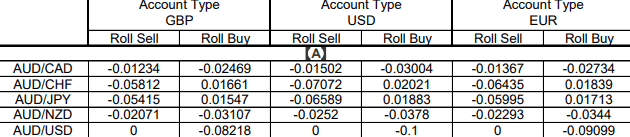

Trading Swaps

Furthermore, you must be aware of the rollover, swap or overnight fees as a cost of trading. Rollover Financing refers to the rate of interest that is paid or earned when opening a position for an extended period of time. Every currency pair and instrument has its own rate that are also influenced by the platform you are using to trade. Rollover rates can be verified on the platform or online on the Hirose Financial website, yet you can see an example of Hirose rollovers below.

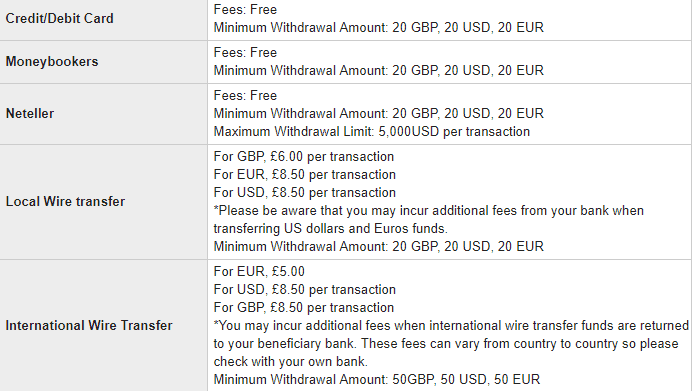

Payment Methods

Hirose Financial offers a number of methods to add funds to your trading account and withdraw money at a reasonable cost and speed. You can make payments in GBP, EUR, and USD. Funding methods include Skrill or Credit/Debit cards, or Neteller transfer along with the Bank Wire Transfer.

Minimum deposit

Hirose Financial minimal deposit is 20-50$ with no specific requirements, while all charges are paid through Hirose. Credit or debit card transactions might not be accepted in certain countries, and the type of card that is accepted will vary from one country to another.

Hirose Financial minimum deposit in comparison to other brokers

| Hirose Financial | Most Other Brokers | |

| Minimum Deposit | $0 | $500 |

Withdrawals

Hirose Withdrawals are processed using an online form and are can return to the institution where you made the original deposit made. Typically, there aren't any fees charges for the process of withdrawal however, wire transfers made to international or local banks could need an additional processing charge approximately 10 dollars.

But, never forget that, in certain circumstances, other organizations will charge the business to facilitate payments and withdrawals and this cost will be passed along as an administrative fee to the customer.

Trading Platforms

Hirose gives you the choice of two leading platforms on the market that are MetaTrader4 and ActTrader LION Trader which was upgraded with distinctive specifications, such as trade hours, order types and margin call information as well as PC tools.

In addition, being an t2chnological brokerage, Hirose trading execution stands at the top of the line as well as orders are processed by Japan cluster Technology which expands nodes.

For more information, LION Traderoffers the option of mobile, download and portable versions that allow you to utilize any trading strategy , and various Risk management orders like Stop Limit OCO as well as trailing stop and more.

It is easy and ideal for traders from novices to experienced traders. It can trade with just one click and has the most effective indicators. This platform is great in the field of scalpers and also for hedging as it has access to more than 50 currency pairs and the most comfortable and reliable costs. In addition it is possible to make use of Expert Advisors using the Actfx language.

Desktop platform

Although MT4 doesn't require any introduction,apart from its advanced charts and indicators which can be fully customizable, MT4 support most progressive market for automated trading via MQL4 language, and hundreds of EAs to pick from.

Instruments for trading that trade include 46 currency pairs that are margined beginning at 0.33 percent and average spreads starting beginning at 1.9 pip. There are several versions of MT4 that can be accessed via PC or mobile, which permits trading anywhere and manage your Forex positions with ease.

Customer Support

All traders of all levels will find their advantages and the necessary tools on Hirose Financial. Educational materials highlighting the array of tools available and includes trading guides and essential trading elements, technical analysis overviews, economic indicators as well as Demo accounts to help improve your capabilities. There is a multilingual customer assistance available 24 hours a day.

Conclusion

Hirose Financial Review presents a subsidiary business founded on Japan experience and its great success and offers financial investment services that include market execution as well as a selection of top competitive products. The favorable conditions are highlighted for beginner traders as they do not have a minimum deposit required and a wide option of different platforms, educational and the straightforward cost system that includes all costs as part of the spread. But, professionals will benefit too because of the clear operating policy and the extensive technology plans, and one of the highest-quality trading prices

| Properties | Values |

|---|---|

|

Name

|

Hirose Financial |

|

Minimum Diposit

|

$ 50 |

|

Leverage

|

100:1 |

|

Regulation

|

FCA (United Kingdom),,,, |

|

Headquarters

|

United Kingdom |

|

Established

|

2004 |

|

Address

|

25 Finsbury Circus, London, EC2M 7EE, United Kingdom |

|

Platform

|

MT4,ActTrader,,,, |

|

Payment Method

|

Visa,Mastercard,Wire,Neteller,,,, |

| Properties | Values |

|---|---|

|

Spreads

|

0.8 Pips |

|

Min Position size

|

0.01 |

|

Broker Type

|

NDD (Non Dealing Desk),,,,,,, |

|

Account Type

|

Mini account,Standard,,,, |

|

Brokers by Country

|

UK Forex Brokers,,,, |

|

Techniques

|

Scalping Forex Brokers,Hedging Forex Brokers,Spread Betting Brokers,Automated Trading Brokers,,, |

|

Instruments

|

Forex Trading Brokers,Gold Trading Brokers,Crypto Trading Brokers,Stock Trading Broke,Oil Trading Brokers,Commodity Forex Brokers,Metal Trading Brokers,Indexes Trading Brokers,,, |

|

Account currency

|

USD,EUR,GBP,XAU,BTC,,USD,,USD, |

|

Tools

|

Economic Calendar,Charting Software,Calculators,Pip Calculator,Margin Calculator,Profit Calculator,,,,,,, |

|

Website Languages

|

en,,, |

|

Support languages

|

en,,, |

|

Bonus

|

Yes |

|

Reviews Rating

|

3.2 |

|

Withdrawal Fee

|

No |

|

Trading Signals

|

No |

|

Free Education

|

Yes |

|

Daily News

|

Yes |

|

Demo account

|

Yes |

|

Swapsr

|

Yes |

|

Pors

|

1. Used by over 10,000 Hirose Financial users and traders 2. Established in 2004 3. Regulated by Financial Conduct Authority (FCA) 4. Min. deposit from $20 |

|

Cors

|

1. Not CySEC regulated |

|

Display Analysis

|

Yes |

|

Serving country

|

GB,,, |

|

Not Serving country

|

AL,BB,BE,BW,BG,KH,CA,KY,HT,IR,IL,JM,JP,KP,MY,MT,MU,MA,MM,NI,PK,PA,PH,SN,SD,CH,SY,UG,UA,US,YE,ZW,,, |

|

Contests

|

Yes |

|

Market analysis

|

Yes |

|

Copy Trading Brokers

|

No |

|

Bitcoin Forex Brokers

|

Yes |

|

Social trading

|

Yes |

|

Web trading

|

Yes |

|

Forex pairs

|

Yes |

|

CFDs

|

Yes |

|

Crypto

|

Yes |

|

Hedging

|

Yes |

|

PAMM

|

Myfxbook Auto trade,Mql5 signals,,, |

|

Mobile Trading

|

Yes |

|

Scalping

|

Yes |

|

Automated Trading

|

Yes |

|

Partnership Programs

|

Yes |

|

Free Phone

|

+0203 687 0348 |

|

Customer Support

|

24/7 |

Exness Broker reviews & comments (0)

Add a review

Your email address will not be published. Required fields are marked *