Hantec Markets Broker Reviews and Full Information

What is Hantec Markets?

Hantec Group is a global service provider for specialized financial services. They are provided under the Hantec Markets brand name with its well-established subsidiaries and enterprises across China, Japan, Australia, New Zealand and Europe as well as its its headquarters are located is located in Hong Kong since 1990. But, the company's operations have been mostly managed by an UK company and are specialized according to the regulations of that entity.

Additionally, as a result of the company's expansion and growth during its period of operating, the broker obtained licenses from local regulatory authorities , and has also improved their trading options online in order to improve the performance of their business.

So, because of Hantec global presence and the differences in laws and regulations they abide by to, there are differences in the specifics of suggestions to traders from one particular location, so be sure to know under which regulations you'll fall and what conditions you are able to count on.

Hantec Markets Pros and Cons

Hantec Markets is recognized and respected broker in the world with a long experience. It is heavily monitored in a variety of jurisdictions, such as that of the UK FCA and Hong Kong. It is a broker that offers trading on a wide range of instruments. The company offers a customized proposal for beginners and experienced traders, with powerful trading software and professional training resources and research.

For Cons, there's no customer support 24/7 and the conditions vary based on the company.

10 Points Summary

| Headquarters | Hong Kong, UK |

| Regulation | ASIC, FCA, JFSA, FMA, CGSE, JSC |

| Instruments | CFDs and Forex 50 currency pairs CFDs for commodities, index, spread betting and bullion accessible to UK residents |

| Platforms | MT4, Currenex, AgenaTrader, ZuluTrade |

| Demo Account | Offered |

| Base currencies | Several currencies available |

| EUR/USD Spread | 0.2 pip |

| Minimum deposit | 1,000$ |

| Customer Support | 24/5 |

| Education | Professional education , Market analysis and |

Awards

Hantec offers an unbeatable offering to traders worldwide in almost all countries in addition to its appealing cost-saving opportunities and overall trading performance. It is also proven by the sheer number of traders they support and the numerous awards that have been awarded for its international recognition.

Does Hantec Markets safe or a scam?

Hantec Markets is a reliable broker. The members of the Hantec Group is covered by a variety of registrations and regulations, including the top-tier FCA, ASIC etc. It's low-risk trading Forex and CFDs through Hantec Markets.

What is the procedure for regulating Hantec Markets? Hantec Markets is regulated?

The mother company , located within Hong Kongperforms its operation through the approval of the Chinese Gold and Silver Exchange Society (CGSE), and a second broker has was granted the license to provide Japanese finance services with JFSA.

In addition the broker has continued to expand its global expansion, and that the UK established branch, under the name Hantec Markets Limited obtained a reliable licence from FCA that allowed accessibility for European clients. At present, the the main proposition and operations are conducted through this particular company.

In addition, to enhance its global network, to strengthen its international network, the Hantec Group approved Australia businesses under the ASIC regulation and, in addition to the moves and the running the operation of offices within New Zealand, also expanded to the MENA region, which includes an entity that is fully regulated located in Jordan.

What are the best ways to protect yourself?

Although the Hantec Global members hold licenses from the top regulators, Hantec Global operation is registered in Mauritius with the Financial Services Commission, which doesn't have a strict regulatory framework and serves numerous customers across the globe.

However, it shouldn't be a problem for the broker, as various international regulations support the transparency that are a part of Hantec Markets and the general model of operation they use that are in complete compliance with the most effective protection measures. Each broker has its own standards for security for customers, as well as the necessary laws and obligations, but the majority of them respect the openness of trading and protection of customers in all conditions.

Leverage

In terms of the leverage requirements, Hantec Markets chooses the best way to maximize the value of the offer through leverage that is in compliance with specific regulations in each country.

- UK and European clients governed by the FCA regulation can use a restricted leverage, with a maximum of 1:20 in major currencies 1:20 when it comes to minor currencies, and 1:10 for commodity.

- Hong Kong, Australian, Japan and other regulations permit higher leverage that can reach 1:500 maximum for instruments used in Forex

- Jordan traders can use a the maximum of 1:200

- An international company of Hantec Markets offering ratios up to 1:200 to retail traders.

So, traders of different countries can apply for an opportunity to leverage at a maximum as determined by the rules. However, you must be sure to know how to leverage your leverage wisely because this tool could also work in reverse and may not just multiply your profits but also losses too.

Types of accounts

There are two types of accounts with base the currencies of EUR, USD EUR or GBP. One one is an Standard account with all expenses included in floating spread. The second one has a lower spread with a commission per trade lot.

The accounts are premium, or VIP provide custom-designed solutions with exclusive opportunities , and an advantage in larger-sized trading. Through the Hantec Portal trader gets full control over their trading accounts by allowing them to manage and monitor performance all in one spot. The portal also offers solutions for partners as well as management operations.

Islamic Trading Account or Swap-free accounts with no terms are available for all types of accounts this opens up the possibility to Middle East investors or those who adhere to Sharia rules to participate in online trading.

Step by step

Fees

Hantec created the offering to offer very attractive prices that can meet the needs of all levels of trading, either included in an spread, or using a a commission fee for each lot.

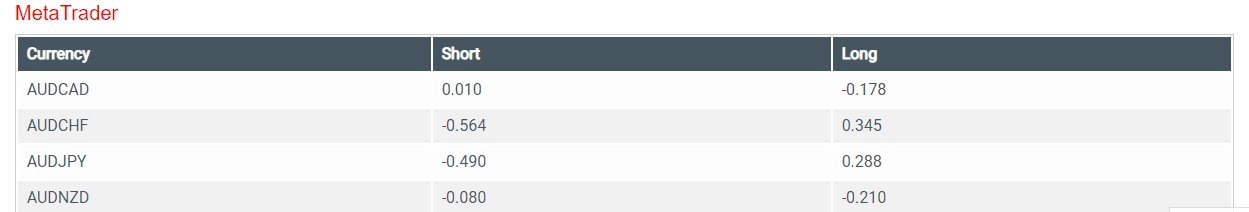

Additional charges

Other costs are included in the swap fee or the overnight fee and is due when the trade is opened over the course of a single day. You can check rates on the trading platform or on the Hantec official Hantec website.

| Fee | Hantec Markets Fees | InstaForex Fees | AvaTrade Fees |

|---|---|---|---|

| Deposit fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity Fee | Yes | Yes | Yes |

| Fee position | Low | High | Average |

Spreads

Retail traders employ a spread-condition basis in which the entire cost is built in a spread variable which is very inexpensive and competitive.

Check out the typical fees for trading for popular instruments. You can also examine Hantec Markets trading fees to another well-known broker and HYCM and other brokers in the table below.

| Asset/ Pair | Hantec Markets Spread | InstaForex Spread | AvaTrade Spread |

|---|---|---|---|

| EUR USD Spread | 0.2 Pips | 3 pip | 1.3 Pips |

| Crude Oil WTI Spread | 5 pip | 5 pip | 3 pip |

| Gold Spread | 50 cents | 1.3 point | 40 |

Instruments

Hantec Markets provide access to immediate execution using the Straight to Process model with quotes from 16 of the world's largest banks that offer Forex and CFDs, including 50 currency pairs index, commodity CFDs, index as well as spread betting, bullion, and accessible to UK residents only.

There are conditions and plans for portfolios can differ based on the area and the organization that Hantec Markets you trade through the rules that apply to Over the Counter Markets enable traders to trade a certain asset.

Deposit and Withdrawal Methods

The withdrawals and deposits are secure and simple transactions at Hantec Markets and 100% automatized, but the different payment methods are used from one country to the next.

Deposit methods

The most commonly used payment methods are supported and comprised

- Transfers to banks,

- cards,

- e-wallets,

- BPay for Australia and many more.

How much is the minimal amount of deposit for Hantec Markets?

Minimum amount to deposit, Hantec Markets requires 1,000$ to begin. Indeed, the amount isn't the most suitable option for novice traders, however it's a sensible amount to cover different margins, and also to access diverse trading instruments.

Hantec Markets minimum deposit in comparison to other brokers

| Hantec Markets | Most Other Brokers | |

| Minimum Deposit | $1,000 | $500 |

Withdrawals

Hantec Markets offers no commissions for the transfer of funds however, various financing providers might charge transaction costs, which you must examine by contacting the support center of your Hantec organization.

The withdrawal options are the same as deposits. They can be requested through your account online where you can follow the process which is quick but it also depends on local laws.

Trading Platforms

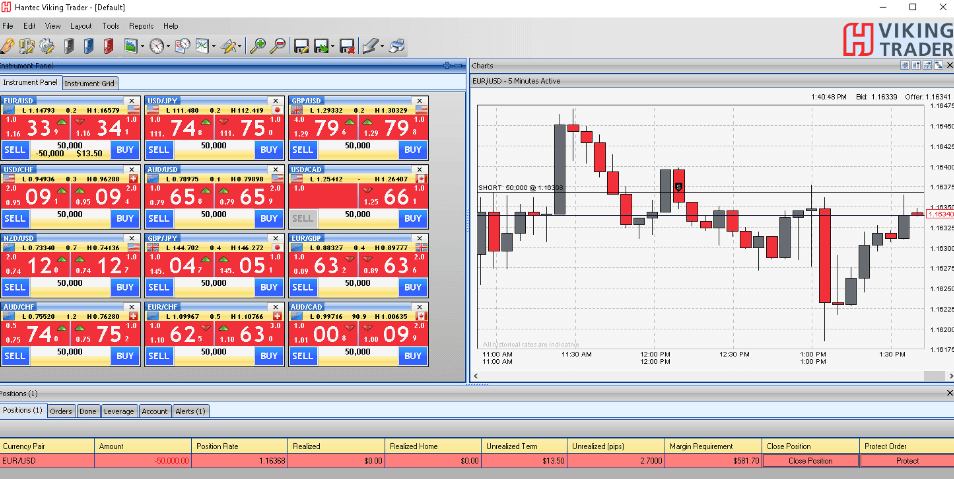

There's a wide selection of robust and reliable trading platforms that offer the most cost-effective options in the market. MetaTrader4 Currenex as well as Multi-Account Management (MAM). These platforms allow access to a range of instruments. However, certain differences could occur in asset proposals, accessibility and capabilities.

| Pros | Cons |

|---|---|

| Software for trading that is user-friendly and easy to use | Proposals or conditions based on the organization |

| Platform for trading MT4, Currenex, ZuluTrade and MAM trading | |

| Versions suitable for Web Mobile, Desktop and Web trading | |

| App for iOS and Android | |

| Clear Look and Fee Report | |

| Advanced capabilities in trading and types of orders | |

| Languages available in a variety of languages. |

Web Trading

It is a platform that does not require presenting. MT4 Platform does not require any presentation, and is the preference of majority of traders that brings the full power of technology, with no limitations on EAs, APIs, or APIs. Access is available via any device from your web browser or the downloaded version, which also includes Mobile App.

Desktop platform

The full capabilities of all provided platforms is Of course, they are accessible via desktop versions that include all tools and options are can be found.

Another excellent software from Hantec Markets is a Currenex platform specifically designed to serve professionals and experienced trader by offering Classic as well as Viking variants that have been extensively designed, but still require a greater balance - 5k$ for Classic version, and 10,000$ for the Viking one.

The platforms offer the ability to execute and change the parameters between OCO as well as IFD orders as well as market depth views and seamless execution when trading bullion and FX.

Mobile Platform

To keep up to date while on the move, you can download and personalize the Mobile app that works on any device. We found it well-designed with clear design and simple use.

Research

For the tools for trading. Hantec provides the option to utilize trading signals supplied by Trading Central, which is the leading 3rd third party supplier of trading signals to various assets. Of course, clients from different jurisdictions need to be aware of the availability of the software or one other, as well as the requirements of a specific trading strategy or style of trading to be used.

Additionally, there is a social trading and copy trading option that is available through market-leading ZuluTrade, where you can choose master or professional accounts to follow. All trades are replicated automatically.

Customer Support

Alongside international phone lines that are available In addition to international phone lines available in addition to international phone lines in the UK, China, Thailand, Nigeria, Pakistan and Jordan you can also contact Hantec Markets customer support in various ways, including live chat and email. We have found our Hantec Markets Review service quite efficient and professional, with prompt and pertinent responses, which is an additional benefit to the overall proposition.

Education

For other important trading features, consider a proposal from Hantec includes educational material and continuous customer service offered by the variety of resources for free such as market analysis, expert opinions, and online tutorials which are available to each client.

There's educational content to meet your trading needs, whether you're looking for beginner's guidebooks or market analysis, there is it on Hantec Markets academy, which is certainly a major positive.

Conclusion

In the end, Hantec Markets review has identified the company that has an extensive history, as well as having multiple offices across the main financial hubs and the required regulations and clear conditions they provide. In general, Hantec is among the the most affordable pricing strategies with execution via STP and a robust trading platform with advanced technologies, assistance and a broad array of tools. However, some ambiguities regarding the services offered because the various jurisdictions have separate plans of trading terms as well as costs and capabilities. Therefore, while opening an account with Hantec you must be aware the specific brand under which you'll be operating.

| Properties | Values |

|---|---|

|

Name

|

Hantec Markets |

|

Minimum Diposit

|

$ 1,000 |

|

Leverage

|

1:30 | 1:500 |

|

Regulation

|

ASIC (Australia),FMA (Austria),JSC (Jordan),,,,,, |

|

Headquarters

|

Hong Kong, UK |

|

Established

|

1990 |

|

Address

|

United Kingdom, Cyprus, Mauritius |

|

Platform

|

MT4,MT4 WebTerminal,Currenex,,,,,, |

|

Payment Method

|

Visa,Wire,Skrill,Neteller,,,,,, |

| Properties | Values |

|---|---|

|

Spreads

|

0.2 pips |

|

Min Position size

|

0.01 |

|

Broker Type

|

STP (Straight Through Processing),NDD (Non Dealing Desk),,, |

|

Account Type

|

Scalping,,,,,, |

|

Brokers by Country

|

US Forex Brokers,Cyprus Forex Brokers,,,,,, |

|

Techniques

|

Scalping Forex Brokers,Mobile Trading Brokers,,,,,, |

|

Instruments

|

Forex Trading Brokers,Gold Trading Brokers,CFD Trading Brokers,Crypto Trading Brokers,Stock Trading Broke,Oil Trading Brokers,,,,,, |

|

Account currency

|

USD,EUR,GBP,AUD,CAD,,USD,,USD,,USD,,USD,,USD, |

|

Tools

|

,,,, |

|

Website Languages

|

en,,,,,, |

|

Support languages

|

en,,,,,, |

|

Bonus

|

No |

|

Reviews Rating

|

3.5 |

|

Withdrawal Fee

|

Yes |

|

Trading Signals

|

Yes |

|

Free Education

|

No |

|

Daily News

|

No |

|

Demo account

|

Yes |

|

Swapsr

|

Yes |

|

Pors

|

1. Large range and reliability. Its regulators include FCA (UK), ASIC (Australia), and FSA (Japan), which are considered some of the strictest regulators in the world. 2. Segregated accounts and partner banks are Barclays and Lloyds. Deposits of traders are insured by the Financial Services Compensation Scheme for £85,000. 3. A relatively small entry threshold for trading stock and commodity assets is just $0-$100. 4. Relatively small floating spread — from 0.2-0.5 pips. |

|

Cors

|

1. The high minimum deposit for trading currency pairs is $1,000. 2. Lack of reversal competitive advantages. 3. There are no proprietary technological developments, copyright applications, or passive investment services. 4. Lack of comprehensive presentation of information on trading terms. |

|

Display Analysis

|

Yes |

|

Serving country

|

,,,,,, |

|

Not Serving country

|

,,,,,, |

|

Contests

|

|

|

Market analysis

|

No |

|

Copy Trading Brokers

|

No |

|

Bitcoin Forex Brokers

|

Yes |

|

Social trading

|

No |

|

Web trading

|

No |

|

Forex pairs

|

No |

|

CFDs

|

Yes |

|

Crypto

|

Yes |

|

Hedging

|

No |

|

PAMM

|

No,, |

|

Mobile Trading

|

Yes |

|

Scalping

|

Yes |

|

Automated Trading

|

Yes |

|

Partnership Programs

|

Yes |

|

Free Phone

|

+442070360850 |

|

Customer Support

|

24/5 |

Exness Broker reviews & comments (0)

Add a review

Your email address will not be published. Required fields are marked *