GMI Broker Reviews and Full Information

What is GMI?

Global Market Index or GMI is among the most well-known internet-based leveraged Forex trading firms which was founded at the time of Shanghai and later after expansion opened a number of representative offices in China and in Auckland and an enabling offices in the financial hub of London.

The profile of the company is defined as an technology-driven brokerage solutionalong that with transparent prices, advanced technology, numerous customer support and many software options. The product's description states that it's a pure ECN STP connection which provides immediate, fast connection to a variety of top-quality liquidity providers, offering extensive liquidity and customized trade solutions.

GMI Pros and Cons

GMI is a reputable broker offering a good trading proposition, which includes Institutions as well as Money managers. There's a wide selection of trading platforms, MT5 bridges tools, and technology that are available at GMI. There are a variety of options for depositing or withdrawing funds.

On the other hand, there isn't a 24/7 service as well as education is basic.

10 Points Summary

| Headquarters | Shanghai |

| Regulation and License | FCA, SFC |

| Instruments | FX, Indices, Cryptocurrencies, CFDs for Crude Oils, Metals and Indices |

| Platforms | MT4, Alpine Trader, ClearPro, MTF, Currenex |

| EUR/USD Spread | 1 pip |

| Base currencies | USD, EUR, GBP, AUD |

| Demo Account | Provided |

| Minimum deposit | 2,000$ |

| Education | Research, Education, analysis, and research |

| Customer Support | 24/5 |

Awards

In addition to the retail trader offering, GMI provides the most sophisticated proprietary software , which includes bridges between MT4 and 5 and customized partnerships designed for Institutional Trader, Money Managers and White Label APIs, and APIs that are connected to the FIX the connectivity network.

It is evident that the primary benefit of GMI is its software and technology that was also acknowledged by a variety of awards given to individuals for their successes in the industry as well as overall rating.

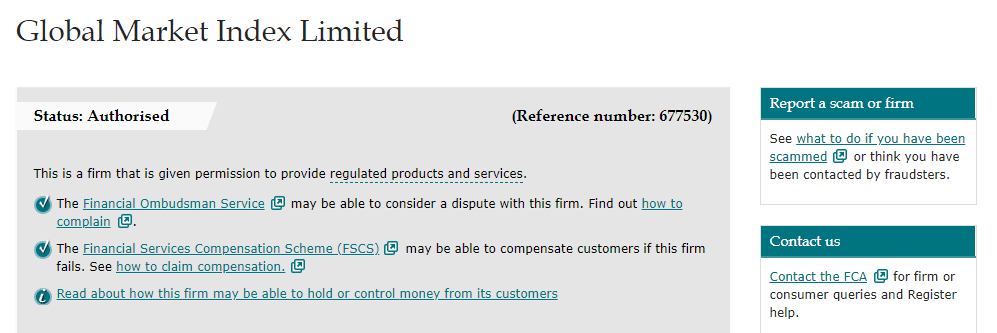

Is GMI an authentic company or a scam?

GMI does not represent a fraud it is a licensed broker with top-of-the-line approval from FCA.

GMI Group of companies includes the entities and firms that are registered in a variety of countries, and use the name of shortcut trading for Global Market Index Limited. GMIUK is a trading name used by GMI, a trading name of the Global Market Index that is located at London as well as approved through the Financial Conduct Authority.

Other brands, including GMINZ the trading name of the company that is registered within New Zealand, the GMIVN is a registered company in Vanuatu and GMI Limited is registered in Hong Kong.

Although the broker is overseen by the most respected world authorities, of the UK's FCA and the traders are able to rest in mind knowing that the broker is completely compliant regarding its business practices and the way in which it conducts business. Additionally, the funds of the customer are protected at all times and are kept in top Banks separate accounts, and are protected by compensation plans in the event of bankruptcy.

Trading Instruments

Additionally, the GMI's multi-platforms provide ultra-low delay as well as FIX API integration, and the array of trading instruments includes FX Indices, Cryptocurrencies CFDs on the Crude Oils, Metals and Indices. Forex trading is a vast array of currency pairs, which include some unique options such like FX Minors. This allows you to be flexible by matching strategies for both short and long-term positions, with the potential for high investment.

Leverage

The leverage levels offered by GMI obviously depend on the regulations and the company of GMI you trade with. This is because of the different security measures that each authority has in place to minimize risks, particularly for retail traders.

- Thus, trading with an UK brokerage will be subject to the regulations set out in the European ESMA and permits only lesser the leverage level of as high as 1:30 for Forex instruments one:20 in the case of minor currencies, and as high as 1:10 on Commodities.

If you do open an account in Hong Kong or Vanuatu entities levels are soaring to extremely high leverage as high as 1:200, or even 1:300 however, make sure to check with customer support to find out the regulation that you will get into.

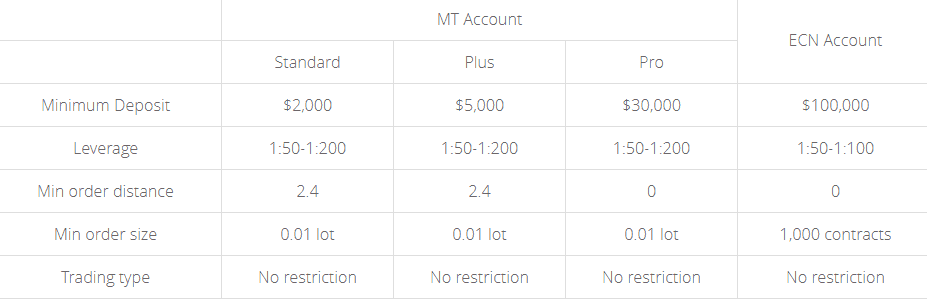

Types of accounts

There are four accounts designed by GMI and the three are all MT4 accounts with an STP connection and the fourth provides ECN Bridging Technology. Trading accounts are created using an ultra-customizable mode and you can select between the flexibility of leverage and size for trading as well as extremely tight spreading spreads that are floating and fast connectivity for the markets.

Each account is diversified by the deposit amount, and the size of trading, which allows to select the most appropriate version , with affordable pricing that is that is incorporated into the spread or interbank spread and commission per transaction.

Fees

GMI applies different charges in accordance with the account used for trading and the volume you trade. There is the option of spread only or commission-based and also tailor-made solutions for traders with greater dimensions. Additionally, think about additional charges such as funding charges or inactivity.

| Fees | GMI Fees | XM Fees | BCR Fees |

|---|---|---|---|

| Deposit fee | No | No | No |

| Withdrawal fee | No | No | No |

| Inactivity fee | Yes | Yes | Yes |

| Fee rating | Low | Average | Average |

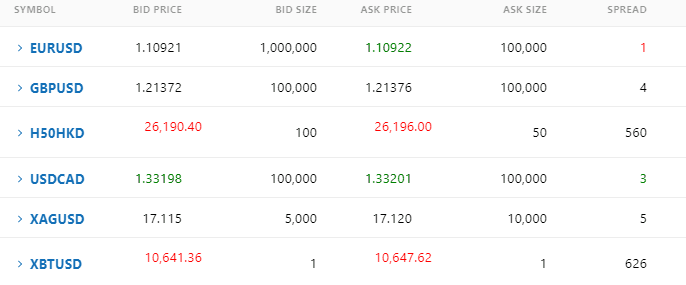

Spread

GMI spread is considered as the most competitive spread offered by the market. Based on our research. See below for a comparison of some well-known instruments, and also examine fees in comparison to another popular brokerage the LCG. Also, you should take into consideration the rollover fee or overnight fees as a price of around -2% for positions that last longer than the duration of a day.

| Asset | GMI Spread | XM Spread | BCR Spread |

|---|---|---|---|

| EUR USD Spread | 1 Pips | 1.6 Pips | 1.6 pip |

| Crude Oil WTI Spread | 5 | 5 | 4 |

| BTC Spread | 626 Pips | 60 | 45 |

Deposits and Withdrawals

For you to begin Live trading you need to make a deposit to meet the initial balance requirement which can be set at various levels based on the type of account you choose. Transfer options include a variety of payment methods like Debit and Credit Cards as well as Bank Transfers and electronic payments Skrill.

Minimum deposit

The GMI minimum deposit amount is 2,000 dollars which is very high for novice traders, however a reasonable amount for professionals. Due to the super advanced technology used by GMI the broker can be widely regarded as the best ideal choice for professional or active traders.

GMI the minimum amount of deposit in comparison to other brokers

| GMI | Most Other Brokers | |

| Minimum Deposit | $2,000 | $500 |

Withdrawal

GMI is not liable for additional charges for withdrawals or deposits However, the service provider might consider deposits to be cash advances and therefore charge additional fees, and requires a written check to be submitted on the matter.

Trading Platforms

Since the executions driven by technology require sophisticated tools that is why GMI offers traders the option of five platforms. They are separated according to connection type. STP is compatible with GMI MT4 and GMI Alpine Trader platforms, as well as ECN connection is made via GMI ClearPro, GMI MTF, GMI Currenex.

Desktop platform

• GMI MT4 allowing great stability and is the most favored global retail marketplace. Alongside its robust charting features and enabling EA trading and EA trading, GMI upgraded it by incorporating hosting VPS and collocation configuration to enable smart order routing.

-- GMI Alpine Trader is an user-friendly interface platform that has the ability to trade fixed dollar amounts using OCO orders as well as server-based pip-by-pip trailing stops. This platform, however, is not available to GMIUK clients.

-- GMI ClearPro is an institutional platform that has VWAP (Value Weighted Average Pricing) which allows you to select the size of an order, along with daily settlement between banks and the order reverse.

-- GMI MTF is designed for the ECN platform to support various asset classes and flexibility in connectivity. It is also enhanced by an ultra-high orders acceptance rates and an extremely low rate of latency, with no rejections.

-- GMI Currenex is an automatic matchmaking system that offers a broad range of order types as well as an ESP quote system, and a the largest liquidity pool. But, it is not accessible to GMIUK customers.

Conclusion

Overall, the Global Market Index or GMI Review concludes that it is a well-regulated company that has offices across the world's top financial centers, while also providing clear conditions thanks to the technology connectivity. There are however a few cons, which include foremost the absence of information on the site and no support for education along with a rather large initial deposit that is 2,000 dollars. What is enjoyable is GMI is the wide array of platforms is their wide that offer many options for almost every trading enthusiast, whether beginner or experienced, either retail or institutional.

| Properties | Values |

|---|---|

|

Name

|

GMI |

|

Minimum Diposit

|

$ 2,000 |

|

Leverage

|

1:30 | 1:200 |

|

Regulation

|

SFC (Hong Kong),FCA (United Kingdom),,,,,, |

|

Headquarters

|

Vanuatu |

|

Established

|

2009 |

|

Address

|

Govant Building, BP 1276 Port Vila,, Vanuatu |

|

Platform

|

MT4,,,,,, |

|

Payment Method

|

Skrill,Neteller,Perfect Money,Fasa Pay,,,,,,,, |

| Properties | Values |

|---|---|

|

Spreads

|

1 pip |

|

Min Position size

|

0.01 |

|

Broker Type

|

STP (Straight Through Processing),ECN (electronic communications networks),,,, |

|

Account Type

|

RAW Spread,Scalping,,,,,, |

|

Brokers by Country

|

US Forex Brokers,,,,,, |

|

Techniques

|

Scalping Forex Brokers,Mobile Trading Brokers,,,,,, |

|

Instruments

|

Forex Trading Brokers,Gold Trading Brokers,Oil Trading Brokers,,,,,, |

|

Account currency

|

USD,EUR,GBP,AUD,CAD,XAU,JPY,NZD, |

|

Tools

|

Economic Calendar,Charting Software, |

|

Website Languages

|

en,,,,,, |

|

Support languages

|

en,,,,,, |

|

Bonus

|

Yes |

|

Reviews Rating

|

4.5 |

|

Withdrawal Fee

|

No |

|

Trading Signals

|

Yes |

|

Free Education

|

Yes |

|

Daily News

|

No |

|

Demo account

|

Yes |

|

Swapsr

|

Yes |

|

Pors

|

1. Acclaimed best broker especially for institutional clients 2. Award-winning broker |

|

Cors

|

1. The website is not informative with regards to fees and spreads 2. High minimum deposit 3. Commission information not provided 4. Additional fee information not available |

|

Display Analysis

|

Yes |

|

Serving country

|

GB,VU, |

|

Not Serving country

|

US, |

|

Contests

|

Yes |

|

Market analysis

|

Yes |

|

Copy Trading Brokers

|

No |

|

Bitcoin Forex Brokers

|

No |

|

Social trading

|

Yes |

|

Web trading

|

No |

|

Forex pairs

|

Yes |

|

CFDs

|

Yes |

|

Crypto

|

No |

|

Hedging

|

Yes |

|

PAMM

|

MAMM,Myfxbook Auto trade,Mql5 signals, |

|

Mobile Trading

|

Yes |

|

Scalping

|

Yes |

|

Automated Trading

|

Yes |

|

Partnership Programs

|

Yes |

|

Free Phone

|

1800 282260 |

|

Customer Support

|

24/5 |

Exness Broker reviews & comments (0)

Add a review

Your email address will not be published. Required fields are marked *