GMG Markets Broker Reviews and Full Information

What exactly is GMG Markets?

Global Markets Global or GMG Markets offers a wide range of financial products that are traded globally via its enabling STP-based model with the spreads and commissions are competitive in trading across various types of assets. Presently, GMG is one of the top-performing brokers around the world with a variety of clients spread across Europe, Asia, South America, Africa and Australia with its headquarters located within London, UK.

Instruments for Trading

In addition to GMG's technological platform, GMG markets offer wide trading instruments, comprising Forex, Indices, Gold, Silver, Energy, Treasuries while they are all accessible through one platform accessible across multiple devices.

One of the essential aspects in trading problems is support for traders. Therefore, the company offers unbeatable customer service, backed by more than 20 years of expertise in the field and the company's increasing image. Therefore, you can get support via the phone or live Chats anytime you like, as well as the free education resources that are accessible to all that are enhanced by one-on one trading capabilities.

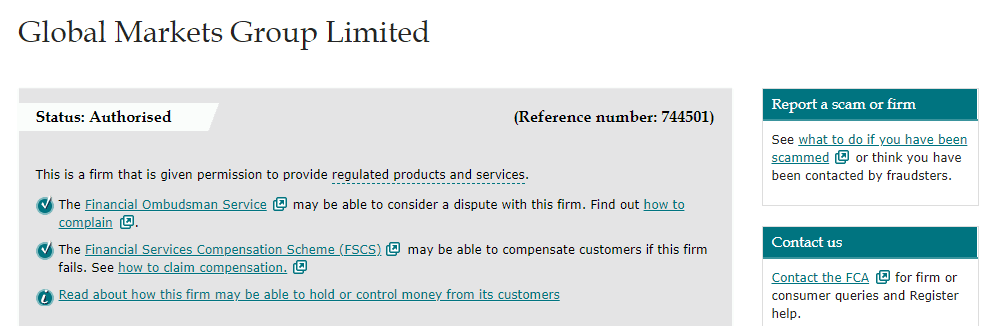

Are GMG Markets safe or a fraud?

As a UK licensed broker, GMG Markets is a fully licensed and authorized through the FCA (Financial Conduct Authority) broker that allows a business to provide an open and secure trading environment. Being one of the best reputable regulators in the industry, the process of obtaining of a license is a complex process or regulations and standards that must be observed with a view to safeguard investors and clients in any way. Integrating strict security and technological solutions that provide what is essential for the trader the trader - trading.

Fund protection is provided through segregated accounts that are held in banks of Tier One banks, with a commitment for keeping the money safe and operate in accordance with the European regulations as well as capital adequacy requirement. In the case of failure, client funds are secured through FSCS and GMG acts as a security GMG acts as acting as an intermediary between clients exchange, liquidity providers and the client.

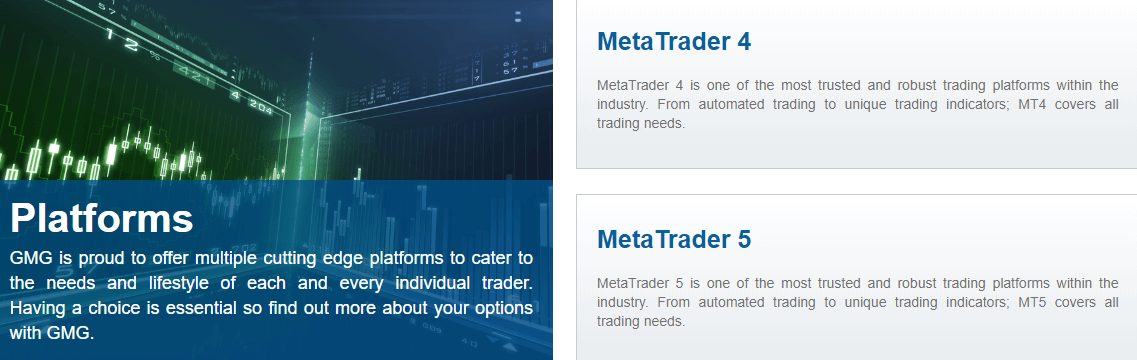

Trading Platforms

The proven technology of the industry MetaTrader4 is an GMG Markets company mainstay and offers the possibility to numerous trading strategies that can be executed. There is also the alternative to trade with its more recent versions MetaTrader5 as well as using the STP execution model allows access to liquidity providers via servers with low latency and no the requotes policy.

Furthermore, you'll get access to trade using any device that is suitable whether it's a computer, laptop mobile or tablet versionwith the various cutting-edge platforms that adapt to the preferences and preferences of every trader.

Additionally to that, there are many options to improve your trading and, in general, to ensure to ensure that you never miss an market movement again. You can utilize to use the GMG MetaTrader 4 app on Apple iOS, Android, Blackberry or Windows mobile phones.

Additionally, the company provides the services of Fund Managers and Corporate investors the chance to diversify their portfolios through the using PAMM as well as MAM Software. Additionally, the FIX API connects prices into a third-party GUI that makes use of special order types, or accessing current rates.

Accounts

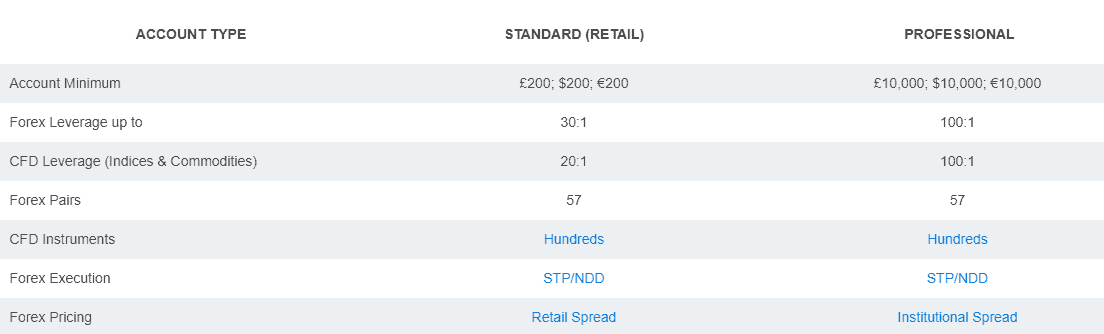

GMG Markets due to their diverse trading selection, and various account types that cater to traders of all kinds either novices or experienced ones. The basic account is suitable for those who want a less expensive account that includes the entire trading expenses in the range of. or the Pro Account which offers ECN model trading with a low commission forex pricing , including interbank wholesale rates, but with a commission per trade.

Fees

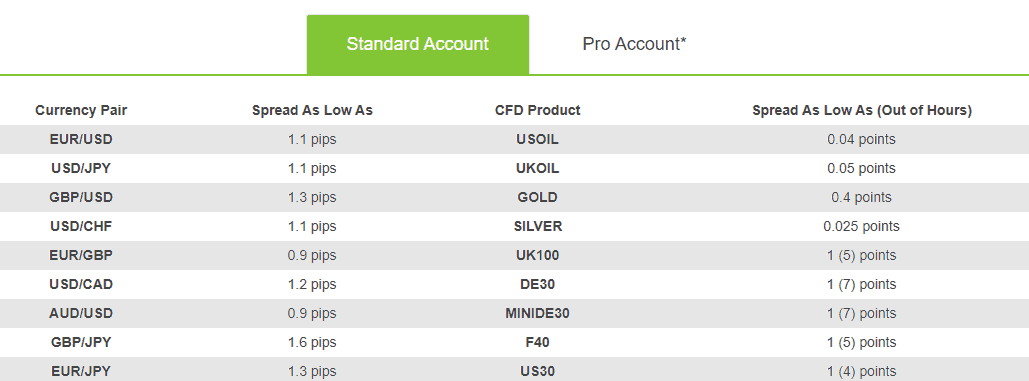

The trading costs are an adjustable tiered commission rate that are based on volume, and also the pricing competition of liquidity providers in the Top of Book. But, even though the trading costs differ from trade one to the next due to the varied spread nature, the common Standard Account features spread for EUR/USD of 1.1 pip, while the Pro Account offers spreads of EUR/USD of 0.1 pip.

For more information on the Standards GMG Markets spread , refer to the table below. You can also look at its rates against other well-known brokerage Financial Spreads.

Leverage

For the levels of leverage, GMG Markets offers leverage as per the regulation restrictions that it is in compliance with and also as determined by your own professional level. Thus, retail traders can make use of a maximum of 1:20 in major currencies. 1:20 for lesser ones, and 1:10 for the commodities. Professional traders, however, can be used for leverage as high as 1:400.

Payment Methods

The payment options comprise the most popular and safest methods of transferring money that is credit and Debit Card or Bank Wire transfer.

minimum deposit

The Standard account is only required to deposit 200$ for the initial deposit in the beginning The Pro Account maintenance is at minimum 10,000dollars.

The withdrawal fee

In general, there aren't charges by the company on withdrawals or deposits. However it is recommended to check with the service provider you are using to determine if any charges for transactions are to be added to.

Conclusion

Overall all, the GMG Markets Review is about a very secure controlled, UK business that offers vast opportunities for investment for all types of investors, including corporate, retail and experienced traders, whether novice or expert through its integrated STP system that executes.

The broker gives advanced trading options via its broad trading instruments collection, which includes you can choose between such as MT4 or MT5 as well as the trading account, as well as the professional support offered by the company. This means that there is a possibility for the trader of any size and strategy to participate in trading and develop its trading capabilities with the assistance.

.

| Properties | Values |

|---|---|

|

Name

|

GMG Markets |

|

Minimum Diposit

|

$ 200 |

|

Leverage

|

1:30 |

|

Regulation

|

FCA (United Kingdom),, |

|

Headquarters

|

United Kingdom |

|

Established

|

2007 |

|

Address

|

4th Floor 33-35 Cornhill LONDON, EC3V 3ND United Kingdom |

|

Platform

|

MT4,, |

|

Payment Method

|

Visa,Mastercard,Wire,, |

| Properties | Values |

|---|---|

|

Spreads

|

0.1-5 Pips |

|

Min Position size

|

0.01 |

|

Broker Type

|

STP (Straight Through Processing),,,, |

|

Account Type

|

Mini account,High Leverage,Islamic account,Standard,, |

|

Brokers by Country

|

UK Forex Brokers,, |

|

Techniques

|

Scalping Forex Brokers,Hedging Forex Brokers,Automated Trading Brokers,Mobile Trading Brokers,, |

|

Instruments

|

Forex Trading Brokers,CFD Trading Brokers,Commodity Forex Brokers,, |

|

Account currency

|

USD,EUR,GBP,AUD,JPY,NZD,,USD, |

|

Tools

|

Charting Software,, |

|

Website Languages

|

en,, |

|

Support languages

|

en,, |

|

Bonus

|

Yes |

|

Reviews Rating

|

3.5 |

|

Withdrawal Fee

|

Yes |

|

Trading Signals

|

No |

|

Free Education

|

Yes |

|

Daily News

|

Yes |

|

Demo account

|

Yes |

|

Swapsr

|

Yes |

|

Pors

|

1. FCA Regulation 2. Competitive fees 3. MetaTrader4 4. High leverage |

|

Cors

|

1. High Minimum Deposit |

|

Display Analysis

|

Yes |

|

Serving country

|

GB,, |

|

Not Serving country

|

US,, |

|

Contests

|

No |

|

Market analysis

|

Yes |

|

Copy Trading Brokers

|

No |

|

Bitcoin Forex Brokers

|

No |

|

Social trading

|

Yes |

|

Web trading

|

Yes |

|

Forex pairs

|

Yes |

|

CFDs

|

Yes |

|

Crypto

|

No |

|

Hedging

|

Yes |

|

PAMM

|

Myfxbook Auto trade,Mql5 signals,, |

|

Mobile Trading

|

Yes |

|

Scalping

|

Yes |

|

Automated Trading

|

Yes |

|

Partnership Programs

|

Yes |

|

Free Phone

|

+44 203 873 74 94 |

|

Customer Support

|

24/5 |

Exness Broker reviews & comments (0)

Add a review

Your email address will not be published. Required fields are marked *