FxPro Broker Reviews and Full Information

What is FxPro?

FxPro was established with an online broker for forex and has since then, it has improved its services significantly, based on its goal and commitment to a client-centric approach. In actual fact, FxPro now serves retail and institutional customers from over 170 countries, with over 1,866.000 trade accounts which makes it one of the top Forex Brokerages.

FxPro Pros and Cons

FxPro has a long time of operations and is a controlled Broker. Opening an account is simple and they offer a variety of account types and a wide choice of trading platforms with low costs and have different pricing models. FxPro research and education is top-quality and welcomes beginners.

On the other hand, the proposals have different conditions for every jurisdiction and deposit options aren't available in some areas.

10 Points Summary

| Headquarters | UK |

| Regulation | FCA, CySEC, FSCA and SCB |

| Platforms | MT4, MT5, cTrader, FxPro Edge |

| Instruments | Forex and CFDs on six asset classes, and more than 250 instruments |

| EUR/USD Spread | 1.2 pip |

| Demo Account | Unlimitless access |

| Base currencies | EUR, USD, GBP, CHF, PLN, AUD, JPY, ZAR |

| Minimum deposit | 100 USD |

| Education | Education for professionals and free research tools |

| Customer Support | 24/5 |

Awards

There are plenty of clients from all over the world and general feedback have led to the realization that FxPro gained trust over time in the business and earned the top positions. In addition international awards from the most prestigious financial institutions and organisations made it clear that the way FxPro executes it's operations in the NDD area and operation deserves acknowledgement too.

Since 2008, the company has was awarded numerous awards, and to date, it has received more than 85 UK and international awards, in addition to taking an active role in sponsorships.

- 'Best FX Provider' | Online Personal Wealth Awards

- 'Most Trusted Forex Brand UK' | Global Brands Magazine

Is FxPro safe or a scam?

Yes, FxPro is not a fraud. FxPro is thought to be a secure broker to trade with. It is licensed and regulated by top financial authorities, including FCA, CySEC. It is therefore safe and safe trading FX as well as CFD using FxPro.

Is FxPro legit?

In the end, FxPro is an established brokerage firm across several jurisdictions, and therefore is licensed and regulated not just by one regulatory agency but by a variety of regulators that provide it with additional layers of protection and is always in the best interest of traders.

FxPro Group Limited is the holding company which consists of FxPro Financial Services Ltd., FxPro UK Limited FxPro Global Markets MENA Limited and FxPro Global Markets Limited. The headquarter of the group is located in the UK However, the FxPro has offices in The UK, Cyprus, Monaco and Bahamas. As a licensed broker, FxPro is subject to the strictest European regulations, and provides financial services that are backed by legitimate regulatory bodies like CySEC as well as FCA .

| FxPro entity | Regulation and License |

| FxPro UK Limited | FCA (UK) registration no. 509956 |

| FxPro Financial Services Limited | CySEC (Cyprus) registration no. 078/07 |

| FxPro Financial Services Ltd | FSCA (South African) registration number. 45052 |

| FxPro Global Markets Ltd | SCB (Bahamas)registration no. SIA-F184 |

What are the best ways to protect yourself?

The legal status of the broker, first it ensures that the broker is legitimate and a periodic check on the operation by the reputable authority, and ensures the customer's deposits are protected by a set of safeguards. Client funds are held in separate bank accounts of European high-quality banks, while the broker is a participant in the settlement of investorsin the event of FxPro bankruptcy, and also trades with the protection of negative balances.

Leverage

Leverage is a feature of FxPro provides a dynamic Forex leverage system that can be adjusted to different levels based on the requirements of a particular entity and the broker must follow. We've already mentioned, FxPro offers trading access through three major trading platforms that automatically adjust the trading strategies of clients and thus, you can select the appropriate level for you and adapt to your trading strategy.

The maximum leverages provided through FxPro entities are described below as conditions vary depending on the regulatory obligations of the entity and applicable rules , and vary between

- 1:30 for European Clients

- as high as 1:200 for international traders

Types of accounts

FxPro Accounts are a single accountwith an array of benefits offered by FxPro and also the Micro Account and Swap free accounts are also available. Demo Account to practice is in use with the Live account, with an the simple switch between the Live and Demo accounts directly on the website.

Fees

FxPro trading charges are built in FxPro's tight spread. FxPro narrow spread which is the difference between the bid and the ask price. But to fully comprehend the situation, look up all fees charged by brokers too such as additional commissions for withdrawals or deposits, as well as other fees that are not related to trading. Find FxPro charges below.

| Fees | FxPro Fees | Go Market Fees | XM Fees |

|---|---|---|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity Fee | Yes | Yes | Yes |

| Fee rating | Low, Average | Low | High |

Additional charges

It is also worth considering the FxPro's overnight fees that is charged by the broker, in conjunction with spread for Forex pairs, the expense or the income are calculated as interest rate. Also, the difference between the Next Deposit Rate and the two currencies involved, in addition to the commission that the broker charges.

It's based on the kind of position you choose to use, either short or long as well as the instrument you are using so you could benefit or lose out on the rollover or swap.

Spreads

FxPro has both the option of variable as well as fixed spread, while fixed is only available through the MT4 platform. FxPro cTrader also offers market execution that has an average spread of EUR/USD 0.3 and a commission of 45$ per $1 million traded.

All in all, FxPro spreads and costs are regarded to be among the best in the offerings of the industry such as checking and examine FxPro charges with those of its competitors FP Markets..

| Asset/ Pair | FxPro Spread | GO Markets Spread | XM Spread |

|---|---|---|---|

| EUR USD Spread | 1.2 Pips | 1.2 pip | 1.6 pip |

| Crude Oil WTI Spread | 5 | 1.9 | 5 |

| Gold Spread | 27 | 1.4 point | 35 |

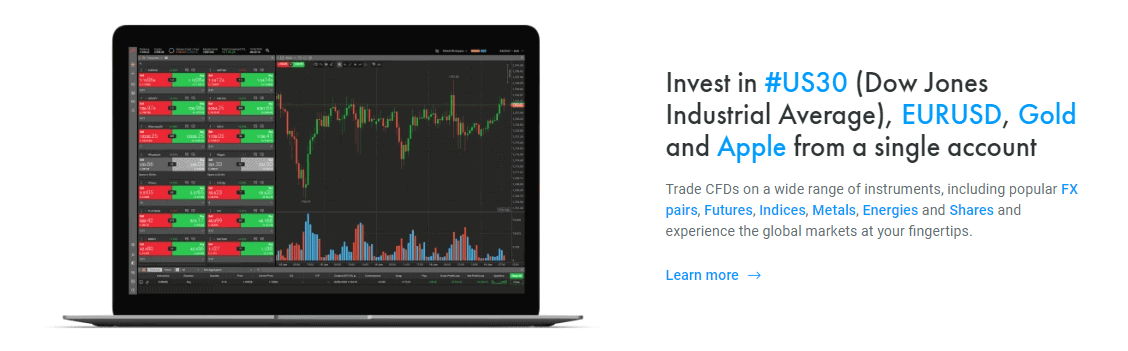

Instruments

In the beginning, FxPro was initially an online forex broker. It later began to expand into offering CFDs for six asset classes, and more than 300 instruments. We can see in the FxPro Review that the broker is continuing to grow by introducing more instruments and thus influencing the growth of the business too.

It is the FxPro Cryptocurrencies provide the possibility of speculation on CFDs using the most well-known cryptos This is an incredible feature too.

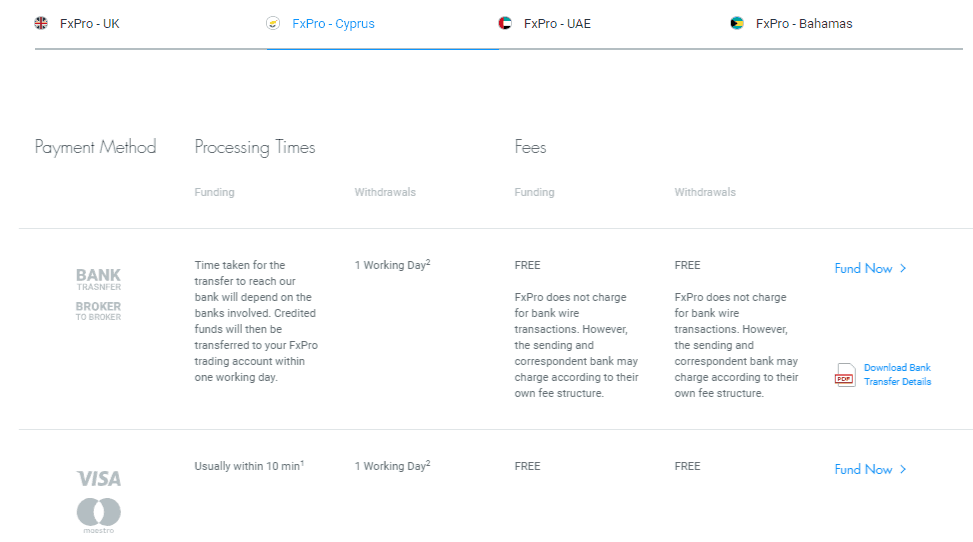

Deposits and Withdrawals

There are many methods to fund your trading account and to benefit from no fee for money transfer but ensure you are aware of the terms as per the FxPro company you trade through.

Deposit Options

Presently, FxPro offers 6 different payment methods.

- Bank wire transfer,

- Credit Cards,

- PayPal,

- Skrill,

- Neteller

- UnionPay

Alongside the popular currency base for accounts, customers can deposit using different currencies, including USD, Euro, KWD AED, SAR and RMB that means you will not be charged for to convert. Each entity has different deposit options, for more details, check the FXPro's official website. FxPro.

How much is the minimal amount of deposit to open an FxPro account?

FxPro's Minimum Depositis set at 100$, however the broker suggests depositing at minimum 500$ to fully enjoy the features of the trading.

Withdrawals

FxPro Fee for withdrawaland deposits chargesas an excellent addition to FxPro is zero, which that is, there is no fee for withdrawal using one of these payment options. For withdrawals, the process usually takes 1 day, using the same method of payment that was used to deposit the funds.

Trading Platforms

Let's look at the specific FxPro product and discover why traders around the globe prefer this particular option.

The first of all platforms offer the most robust software, with a choice to meet your specific requirements, either through the market-leading FxPro MetaTrader4 or the most recent Version FxPro MetaTrader5. You could also choose to use the highly advanced software FxPro's cTrader or the exclusive software FxPro Edge to use for Spread betting.

| Pros | Cons |

|---|---|

| MT4, MT5, Proprietary FxPro Edge, and cTrader | Conditions can differ based on the entity and the platform |

| Copy Trade, Social Trading and Technical Indicators | |

| Excellent selection of programs that can be used by any kind of trader | |

| There are no restrictions regarding strategies | |

| Speedy execution and selection among its methods | |

| Platforms are available in different languages |

Web Platform

Before we dive into the specifics of each platform, the general conditions that offer different execution options, either Instant or Market Execution using tied order liquidity.

Each platform comes with Web Platforms that have different limits or stop out levels, which may differ slightly in the instruments offered or charge spread-only or charge commission per trade, but with a smaller spread (read the Fee section for more information).

Desktop Platform

The desktop platform is can be downloaded and is suitable for all devices, but with the desktop platform you get the complete package and the sophistication that each platform can provide.

Another option for technology and the benefits of FxPro is available for every platform and depends on the trader which method you prefer to employ.

However, we can suggest is that there are many possibilities, tools, and add-ons that can be used with automated trading, without limitations on scalping, or the option to employ established managers and tested trading strategies that comply with all the major risk management guidelines.

Additionally trading partners are able the opportunity to avail a VIP package of services which comes with numerous benefits like Free VPS-server, No charges for deposits, SMS-notifications about the margin, no-cost updates and numerous other.

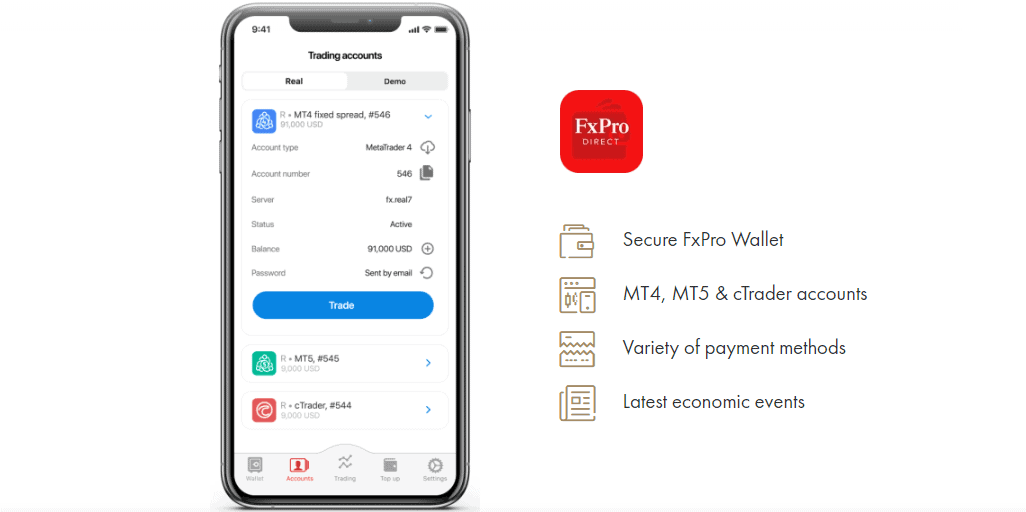

Mobile Platform

Another benefit is that you can use the powerful mobile apps FxPro developed, in which you'll have full access to your account. It is easy to switching between Demo as well as Live modes and capable of performing fundamental analysis, trades and analysis. Everything is accessible from your smartphone.

Customer Support

FxPro provides a customer service team that is multilingual and accessible 24 hours a day, with a goal to assist you with any assistance that any trader could require. In reality, FxPro shows quite good scores and has been praised for the level of service it provides to customers and the general public also that is definitely an advantage.

In addition, FxPro is available around the clock in a variety of nations due to its presence and operation of support service centers So, you can reach FxPro via any of the methods that work for you, such as live chat, international email and phone lines as well.

Education

Beginners are welcomed at FxPro This is the reason why the broker offers professional education training and materials designed by the level of expertise. Fundamental, technical , and other analysis reports are also are available as well as educational webinars, videos ebooks, as well as other necessary tools.

Additionally, you'll receive special trading tools FxPro in its offer which offers Economic Forex Calendar, Technical Analyses performed through Trading Central, 8 FxPro calculators, and much many more.

Conclusion

In general FxPro can be described as a user-friendly broker that , in addition its excellent reputation and credibility, thanks to the strict regulations, gives an advantage to traders of various levels and experience. Trading conditions are favorable cost-effective and an extremely well-organized company's analysis and education is organized in an amazing manner.

| Properties | Values |

|---|---|

|

Name

|

FxPro |

|

Minimum Diposit

|

$ 100 |

|

Leverage

|

1:30 | 1:200 |

|

Regulation

|

SCB (BS) (Bahamas),CySEC (Cyprus),FSCA (South Africa),, |

|

Headquarters

|

United Kingdom |

|

Established

|

2006 |

|

Address

|

13-14 Basinghall str., City of London, EC2V 5BQ, United Kingdom |

|

Platform

|

MT4,MT5,cTrader,,,,,,,, |

|

Payment Method

|

Paypal,Visa,Wire,Skrill,Neteller,Union Pay,, |

| Properties | Values |

|---|---|

|

Spreads

|

1.2 pips |

|

Min Position size

|

0.01 |

|

Broker Type

|

NDD (Non Dealing Desk),Instant Execution,,,,, |

|

Account Type

|

Mini account,High Leverage,Islamic account,Standard,, |

|

Brokers by Country

|

UK Forex Brokers,,,,,, |

|

Techniques

|

Scalping Forex Brokers,Hedging Forex Brokers,Automated Trading Brokers,Mobile Trading Brokers,, |

|

Instruments

|

Forex Trading Brokers,Futures Trading Brokers,Gold Trading Brokers,CFD Trading Brokers,Crypto Trading Brokers,Stock Trading Broke,Oil Trading Brokers,Commodity Forex Brokers,Metal Trading Brokers,Indexes Trading Brokers,, |

|

Account currency

|

USD,EUR,GBP,AUD,CAD,JPY,XAU,BTC,,USD, |

|

Tools

|

Economic Calendar,Charting Software,, |

|

Website Languages

|

en,, |

|

Support languages

|

en,, |

|

Bonus

|

Yes |

|

Reviews Rating

|

3.2 |

|

Withdrawal Fee

|

No |

|

Trading Signals

|

Yes |

|

Free Education

|

Yes |

|

Daily News

|

Yes |

|

Demo account

|

Yes |

|

Swapsr

|

Yes |

|

Pors

|

1. Superb account opening process 2. Great customer service 3. Free deposit and withdrawal |

|

Cors

|

1. Only CFDs and forex 2. High trading fees for some stock CFDs 3. Inactivity fee |

|

Display Analysis

|

No |

|

Serving country

|

BS,CY,MC,ZA,AE,GB,, |

|

Not Serving country

|

CA,IR,IL,US,, |

|

Contests

|

No |

|

Market analysis

|

Yes |

|

Copy Trading Brokers

|

No |

|

Bitcoin Forex Brokers

|

Yes |

|

Social trading

|

Yes |

|

Web trading

|

Yes |

|

Forex pairs

|

Yes |

|

CFDs

|

Yes |

|

Crypto

|

Yes |

|

Hedging

|

Yes |

|

PAMM

|

PAMM,MAMM,Myfxbook Auto trade,Mql5 signals,, |

|

Mobile Trading

|

Yes |

|

Scalping

|

Yes |

|

Automated Trading

|

Yes |

|

Partnership Programs

|

Yes |

|

Free Phone

|

+44 (0) 203 151 5550 |

|

Customer Support

|

Exness Broker reviews & comments (0)

Add a review

Your email address will not be published. Required fields are marked *