Fineco Bank Broker Reviews and Full Information

What is Fineco Bank?

Fineco Bank brings access to trading on the internet since 2004 it is also an Italian market leader with more than 250,000 customers who are trading as well as greater than 1.1 million clients. According to Global Finance Award, financial magazine, 2016, It is said that Fineco Bank is the Best Digital Bank of Italy.

In addition to its trading services, Fineco was established as a bank that gained the top spot on the Italian as well as European marketplaces.

Additional details Fineco extends its offer the possibility to trade on CFDs for 26 markets around the world, Indexes and the US shares for free and also Forex via 50 currency exchanges, Futures and Options using three platforms that are multifunctional at the fixed commissions for global traders.

Fineco Bank Pros and Cons

Fineco Bank is a highly trustworthy broker, as they have an European Banking license with high trust and confidence. The trading conditions and proposals are satisfactory, they have a large instruments available, including Indices and Stocks. The platform is well-developed with excellent research.

However there isn't any proper training or popular MT4 available.

10 Points Summary

| Headquarters | Italy |

| Regulation | CONSOB, ESB |

| Platforms | Powerdesk, Stock Screener |

| Instruments | 26 CFDs, Indeces and the US shares Forex, Futures and Options |

| EUR/USD Spread | 10% commission |

| Demo Account | Provided |

| Minimum deposit | 100$ |

| Base currencies | A variety of currencies are available |

| Education | It is provided on a free basis. |

| Customer Support | 24/5 |

Are Fineco Bank safe or a scam?

Absolutely not, Fineco is a not an enigma, it's an honest brker that has a Banking license and very low risks Forex trade.

Is Fineco bank legit?

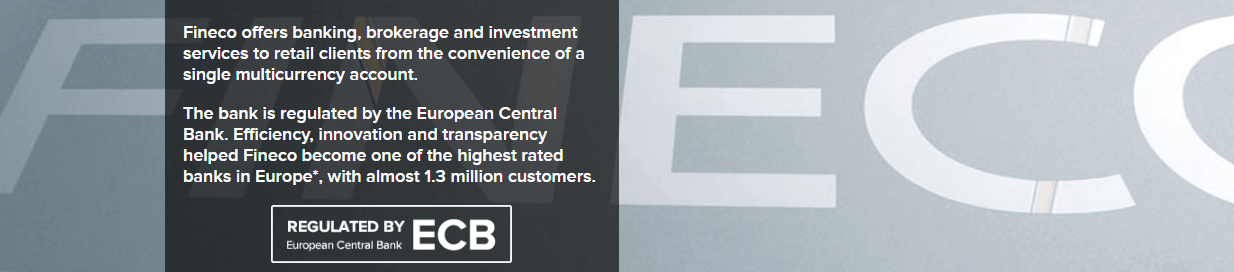

FinecoBank S.p.A. is member of the UniCredit Banking Group enrolled in the Register of Banking Groups, with its headquarters at Milan, Italy. In reality, UniCredit Bank is one of the biggest groups in the world that is the member of both the National Compensation Fund and the National Interbank Deposit Guarantee Fund. Therefore, Fineco Bank is not only regulated as a trading or brokerage company, but also as a banking institution that is subject to more strict authorization for its services from The European Central Bank, Bank of Italy and cross-regulation across Europe as well as the UK.

What are the security measures?

In simple terms, this implies that that you can trade using an trust knowing Fineco Bank is constantly overseen and certainly not a fraud. To safeguard their customers, the bank employs various levels of security beginning with data encryption and ending with various security regulationsin regard to personal data, storage of funds and funds as well as the execution guidelines.

All client funds will be held in separate accounts. The accounts are managed both internally and externally. This assures the maximum security of the account holders.

Leverage

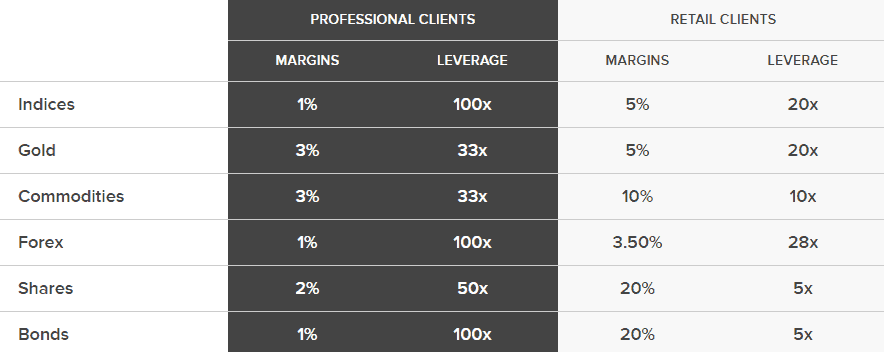

As being a European Bank and broker, Fineco Bank falls under the ESMA regulation and requirements that have recently restricted the maximum permitted leverage. Thus, retail traders can use a maximum leverage of 1:20 for Forex instruments 1:10 for currencies that are minor,, and 1:10 in the case of commodities.

However the professional trader can seek greater leverage levels after confirming his or her status. See the example below.

Types of accounts

Fineco Bank has one account that includesShares CFDs, CFDs, FX Futures & Options, Bonds, ETFs, CWs and certificates, as well as hundreds of markets that are available to trade. Alongside the trading options Multicurrency accounts offer the brokerage, banking, and investment services for every retail client that can maximize your options.

Furthermore, reaching a total of 500,000 euros or more, the clients are granted an exclusive status that provides more advanced terms of an exclusive account with a dedicated rate of Credit Lombard, Mortgages as well as Advisory services. lower prices on trading in securities as well as the card reserved exclusively for private customers.

Fees

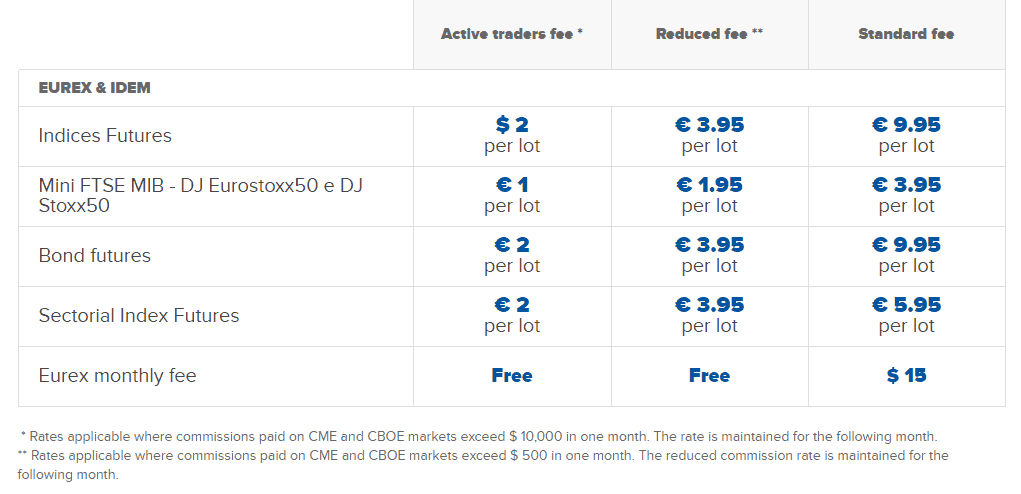

What's interesting is the way Fineco bank or broker developed its cost-management strategy and with just 1 order each month, you'll pay less than 10EUR for each order, and it can even go down to 2.95EUR when the size of your trade grows. This means there's a huge chance for beginning and advanced traders . All instruments are designed to be used by professionals trading, in addition to short and long intraday, and multiday margin-setting.

Option as well as Futures are available for 1.95EUR per batch. CFDs as well as FX CFDs. Super CFDs that have zero commissions , however only with the spread.

| Fees | Fineco Fees | Dukascopy Fees | FXTM Fes |

|---|---|---|---|

| Deposit fee | No | No | No |

| Withdrawal fee | No | No | No |

| Inactivity fee | Yes | Yes | Yes |

| Fee rating | Low | Low | Average |

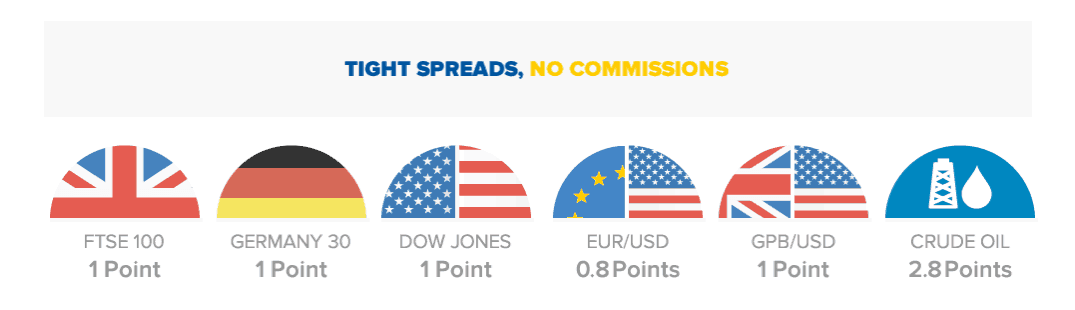

Spreads

Fineco trading fees dependent on your selection from the many international shares, stocks currency, ETFs, futures, or options there is a unique and easy pricing designed to appeal to the the most committed traders. The prices of commissions, spreads, or spreads on offer at Fineco are reasonable.

In general, there are three pricing models which start with Standard fees, Reduced fees, and active fees.

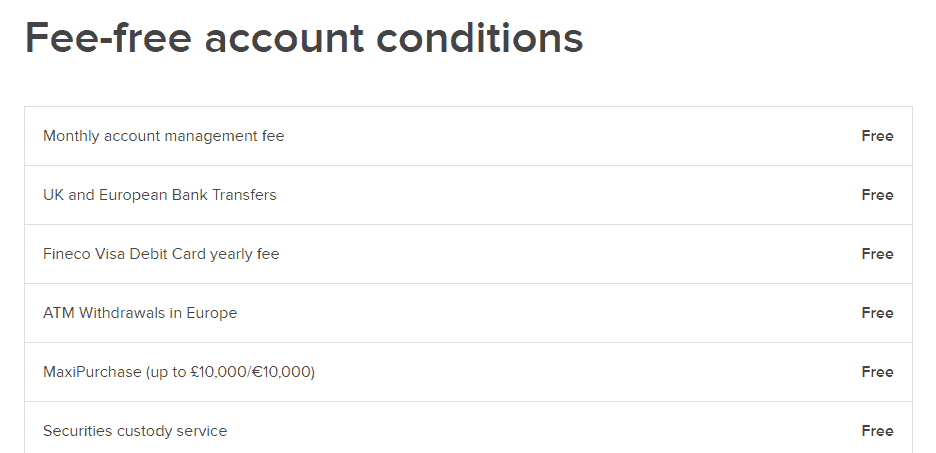

Deposits and Withdrawals

When it comes to money transfers, you'll definitely locate one of the easiest and efficient ways to transfer funds with ease because the Bank offers automated deposits that are available via UniCredit and Fineco Bank ATMs. The Smart withdraw service is cost-free service that is available through the Fineco app for mobile phones which allows cash withdrawals without the need for a credit card.

Withdrawal

Additionally, Deposits and withdrawals are completely free and the UK, Italy and European Banks transfer as well as the Fineco Visa debit cards are completely free of cost. Other countries and regions could apply fees for international transfers that you must confirm with customer support.

Minimum deposit

There aren't any minimal requirement for Fineco therefore the amount you transfer is you feel is appropriate to your requirements, simply verify the conditions of your preferred instrument to ensure that you are enough to cover the necessary margins.

Fineco Minimum deposit, compared to other brokers

| Fineco | Most Other Brokers | |

| Minimum Deposit | $0 | $500 |

Trading Platforms

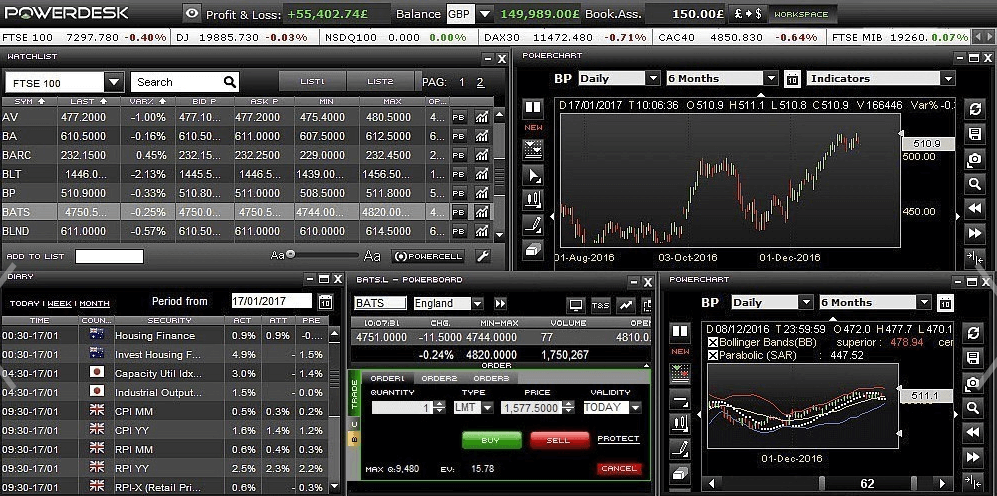

Fineco is among Europe's most renowned trading platforms on the internet that is the result of a robust execution of orders, narrow spreads and easy access to liquidity, and of course, the continuous innovation Fineco uses.

It's just a click to open an account and begin trading, with the broker's service provides sophisticated trading solutions such as the Powerdesk platform, a unique user-friendly tool to study the markets and Stock Scnreener, and mobile apps.

So let's take an examination of each option and Powerdesk being the most popular. Powerdesk is the cutting-edge software that allows trading with its simple interface for pushing markets margin setting CFDs, margin setting, and automated orders with advanced charts and news, spread views and much more. Its personalization allows you to customize listings and tools , while also allowing users with a user-friendly interface that does not require installation.

Through the stock screener, you'll be allowed to invest in bonds with filters separated into five main categories, and search concepts which allow exploration of the market using predefined search terms. So, you'll be able to instantly identify bonds of your interest, then choose the right fundamental, technical, or sectorial data for the trade.

The second is an app called Fineco that ensures the tools you require are available at any moment and is able to transfer funds top-ups stocks market orders, top-up transfers and much more. All at any time, without additional charges.

Customer Support

In terms of the Fineco bank customer service, it provides highly skilled assistance with a portfolio of more than 96% happy customers. In addition, more than 200 employees are on hand along with more than 2600 individual financial advisers who can assess and meet your investment needs.

Additionally, you can opt on Fineco Learningthat provides information on markets, accounts trading, and investing that are can be clearly explained by experts.

Conclusion

The conclusion we have reached is positive. Fineco is the highest-rated Italian bank offering reliable financial and trading solution with no doubt about its strict regulatory requirements. The more functional platform provides many options and options to make trading more efficient. But, PowerDesk requires a monthly cost if the user isn't able to reach the required trade volume. It could therefore be an better choice for professional and active traderalong with affordable pricing and commission-free offers. Additionally, Fineco Bank offers reliable trading proposals and banking services that merit considering.

| Properties | Values |

|---|---|

|

Name

|

Fineco Bank |

|

Minimum Diposit

|

$ 100 |

|

Leverage

|

1:30 |

|

Regulation

|

CONSOB (Italy),FCA (United Kingdom),, |

|

Headquarters

|

United Kingdom |

|

Established

|

1999 |

|

Address

|

20131 Milan - P.zza Durante, 11 - General Management 42123 Reggio Emilia , United kingdom |

|

Platform

|

Advanced Trader 1,Moneta Markets WebTrader,, |

|

Payment Method

|

Visa,Mastercard,Credit Card,Wire,, |

| Properties | Values |

|---|---|

|

Spreads

|

commission of 10$ |

|

Min Position size

|

0.01 |

|

Broker Type

|

MM ( Market Maker),ECN (electronic communications networks), |

|

Account Type

|

Mini account,Fixed Spread,High Leverage,Islamic account,Standard,, |

|

Brokers by Country

|

UK Forex Brokers,, |

|

Techniques

|

Scalping Forex Brokers,Hedging Forex Brokers,Carry Trade Brokers,Spread Betting Brokers,Automated Trading Brokers,Mobile Trading Brokers,Day Trading Brokers,, |

|

Instruments

|

Forex Trading Brokers,Futures Trading Brokers,CFD Trading Brokers,Commodity Forex Brokers,Indexes Trading Brokers,Options Trading Brokers,, |

|

Account currency

|

USD,EUR,GBP,AUD,CAD,JPY,NZD,,USD, |

|

Tools

|

Economic Calendar,Charting Software,, |

|

Website Languages

|

en,, |

|

Support languages

|

en,, |

|

Bonus

|

Yes |

|

Reviews Rating

|

2.5 |

|

Withdrawal Fee

|

No |

|

Trading Signals

|

No |

|

Free Education

|

Yes |

|

Daily News

|

Yes |

|

Demo account

|

Yes |

|

Swapsr

|

Yes |

|

Pors

|

1. Low non-trading fees 2. Great mobile trading platform 3. Rock-solid background |

|

Cors

|

1. Only bank transfer for deposit 2. Limited educational tools 3. Poor charting tools |

|

Display Analysis

|

Yes |

|

Serving country

|

IT,GB,, |

|

Not Serving country

|

US,, |

|

Contests

|

No |

|

Market analysis

|

Yes |

|

Copy Trading Brokers

|

No |

|

Bitcoin Forex Brokers

|

No |

|

Social trading

|

No |

|

Web trading

|

Yes |

|

Forex pairs

|

Yes |

|

CFDs

|

Yes |

|

Crypto

|

No |

|

Hedging

|

Yes |

|

PAMM

|

Mql5 signals,, |

|

Mobile Trading

|

Yes |

|

Scalping

|

Yes |

|

Automated Trading

|

Yes |

|

Partnership Programs

|

Yes |

|

Free Phone

|

+44 (0)20 7065 7555 |

|

Customer Support

|

24/5 |

Exness Broker reviews & comments (0)

Add a review

Your email address will not be published. Required fields are marked *