Financial Spread Broker Reviews and Full Information

What are the definition of Financial Spreads?

Financial Spreads is a launched UK broker firm that's history is more than a decade long of their successful business. The principal service offered by the company clients the opportunity to profit from the many suggestions from the company and constant advancements while also allowing clients to make investments in the larger spreads betting on financial markets and CFD trading.

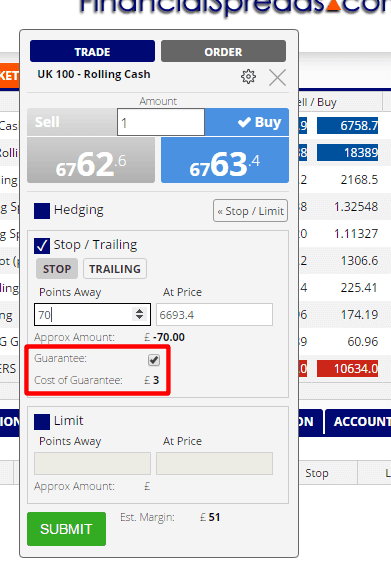

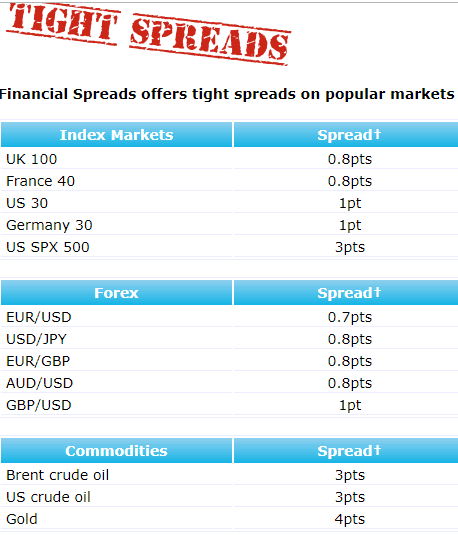

Therefore, when trading using Financial Spread you may choose from the most suitable trading instrument, as well as the cheaper costs and the Guaranteed Stop option in the event that the order is actually utilized. The broker follows a strict spread method, and there are no commission charge and all margins are included in the spread.

The CFDs that do not charge commissions are an appealing feature for those who prefer to invest in this type of derivative market which provides an easy and clear pricing system for a variety of well-known markets like shares, Forex, Stocks and Cryptocurrencies.

10 Points Summary

| Headquarters | UK |

| Regulation and License | FCA |

| Instruments | Stocks and Shares Forex Securities, Cryptocurrencies and Shares |

| Platforms | Private WebTrader, Mobile App |

| Costs | 0.7 Pips |

| Demo Account | It is a service that is offered |

| Base currencies | EUR USD, GBP, EUR |

| Minimum deposit | 250$ |

| Education | Research, Education |

| Customer Support | 24/5 |

Awards

But, because trading on the market is challenging enough, traders are not the only ones in their struggle however, they are they are supported by the business to be an effective trader with an comfortable trading environment with the variety of trading platforms with fixed spreads always stable in any market environment and, of course, the highest level of security and privacy.

Are Financial Spreads safe or a fraud?

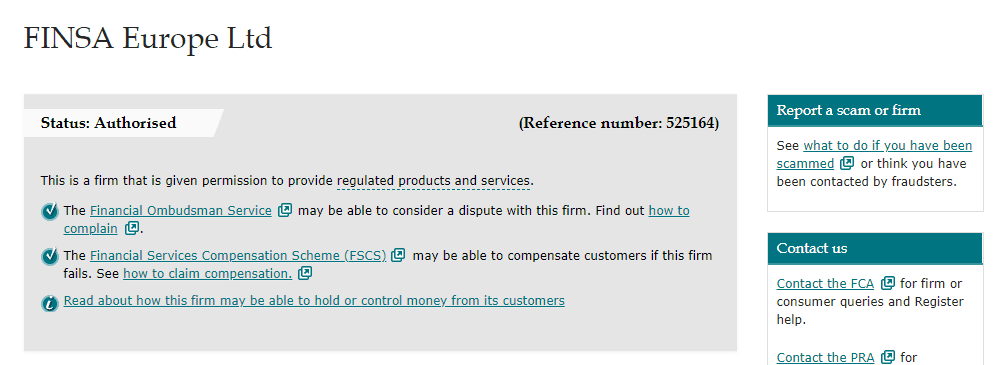

Financial Spreads is a trading name of Clear Investor Ltd. which is an appointed representative of FINSA Europe Ltd. It is based at the UK. FINSA Europe Limited. is licensed and controlled under the supervision of the Financial Conduct Authority. In reality, FCA regulation is one of the authorities with the highest rigors that offer a high degree of performance, security measures, and is closely monitored constantly that gives you as the trader secure conditions.

In addition, over the course of operation, the business has improved its services and the way it delivers the trading to clients, and consequently changing platform providers, but traders were always trading using the UK licensed brand and unbeatable conditions.

This is why you are able to rest assured of your compliance with all essential laws and regulations in addition to the security of your funds. Funds have been secured in separate accounts while the client is covered by the protection of the security and client money as well as the protection that is provided under the Financial Service Compensation Scheme (FSCS).

Trading Platforms

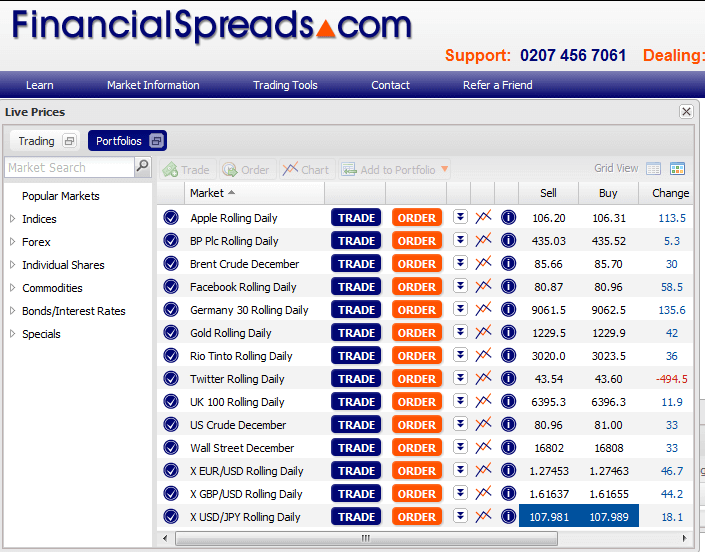

At the beginning of business's history The broker has changed platforms. Currently, they have further decided to integrate the most effective tools available on market. They decided to combine the best of what is available at market and developed their own program to integrate all the tools needed together.

Overall all, overall, the financial Spreads platform provides strong trading capacities for traders of all levels, along with the integrated Risk management instruments, the advanced charting software, and extensive trading features.

Web Platform

This platform can be available from any device because of its web-based and is an innovative feature in the mobile app. The mobile application was developed specifically to meet the current demands of modern trading and offers a high-tech level of trading while on the move and the trading is accessible at any time and from any location.

A Demo platform that is free to try out the trading strategies offered to all clients in addition to improved risk management has been implemented by Financial Spreads help in risks when Stop Loss orders are automatically linked to new traders. Additionally is that you can select a the Guaranteed Stop Loss option when opening the position for an affordable cost and protects you from whatever market situation and can be highly recommended.

Accounts

There aren't any alternatives among the different types of accounts, such as Financial Spread offering one account to make it easy for you can access all types of products available products at Financial Spreads products from a single account. All costs are included in your set spread when trading CFDs.

and spread betting provides you with numerous possibilities to trade without tax and is extremely developed and on a high professional standard on Financial Spreads, however, it is only available to UK residents.

Fees

Since the broker is a mainstay at the spread basis, you will always have the most competitive offer to trade markets, beginning at 0.7 per cent to EURUSD and 0.8 pip in the UK100. Additional examples are available below, and you can also examine the Financial Spreads Costs with other brokers like EverFX.

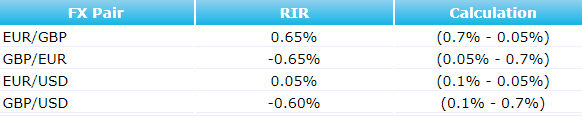

Financial Spreads Rollover

Another expense to be taken into consideration is the overnight or rollover charge, which is imposed on the balance that has been held for longer than one day. Usually, the cost or refund is determined by the interbank rate and a certain percentage of The Financial Spreads. Check out an illustration for Financial Spreads rollover calculation below.

Leverage

In terms of the leverage levels which permit you to run more trading size, it is the normal Financial Spreads leverage obliged to the restrictions of the regulation. Therefore, under Financial Spreads' FCA certification, Financial Spreads may offer for you and your retail customer the possibility of 11:30 in major currencies. 1:20 for lesser ones, and 1:10 for commodity currencies.

Payment Methods

In terms of payment options that are available, Financial Spreads traders getting access to the most convenient method to fund trading accounts, which includes wire bank transfer and Credit or Debit Card E-wallets, Payments and Skrill.

Financial Spreads minimum deposit

The minimum amount that will permit you to open an account and begin trading live trading is set at the competitive amount of 250$. The deposit you make will grant you the ability to trade CFDs as well as Spread betting, if applicable however, make sure to verify the margin required for the instrument you're contemplating using to trade.

The withdrawal fee

Usually, there aren't costs for the company to conduct an money transaction whether it is a withdrawal or deposit. But, it is recommended to look up your official sources and double-check whether there are any fees to be paid and can differ from one method to the next.

Conclusion

In the end all, the Financial Spreads offer an extremely secure and reliable choice to participate in trading and the variety of options includes more than just trading of CFDs however, they also allow you the users to take advantage of the popular UK spread Betting, which is tax-free trading.

The firm is based on the Fixed Spread strategy, which brings an orderly and secure condition for trade regardless of market conditions or in high volatility. Furthermore, there is no commission additional for traders to trade CFDs and all costs are included in a spread that is beneficial to many traders.

In conclusion, the business is a great choice to select from with its reliability, due to the long duration of operations. The only issue could be the lack of their own educational materials, which might be not cause a major problem for the newest trader.

| Properties | Values |

|---|---|

|

Name

|

Financial Spread |

|

Minimum Diposit

|

$ 250 |

|

Leverage

|

1:30 |

|

Regulation

|

FCA (United Kingdom),, |

|

Headquarters

|

United Kingdom |

|

Established

|

2007 |

|

Address

|

Office 701, Tower Bridge Business Centre, 46-48 East Smithfield, London E1W 1AW, UK. |

|

Platform

|

MT4,MT4 WebTerminal,Meta Trader Mobile,, |

|

Payment Method

|

Visa,Mastercard,Wire,Skrill,Neteller,, |

| Properties | Values |

|---|---|

|

Spreads

|

0.7 pips |

|

Min Position size

|

0.01 |

|

Broker Type

|

MM ( Market Maker),,,, |

|

Account Type

|

Mini account,High Leverage,Islamic account,Standard,, |

|

Brokers by Country

|

UK Forex Brokers,, |

|

Techniques

|

Scalping Forex Brokers,Hedging Forex Brokers,Automated Trading Brokers,Mobile Trading Brokers,, |

|

Instruments

|

Forex Trading Brokers,Crypto Trading Brokers,Stock Trading Broke,Commodity Forex Brokers,, |

|

Account currency

|

USD,EUR,GBP,AUD,XAU,JPY,BTC,,USD, |

|

Tools

|

Charting Software,, |

|

Website Languages

|

en,, |

|

Support languages

|

en,, |

|

Bonus

|

Yes |

|

Reviews Rating

|

3.5 |

|

Withdrawal Fee

|

No |

|

Trading Signals

|

Yes |

|

Free Education

|

Yes |

|

Daily News

|

Yes |

|

Demo account

|

Yes |

|

Swapsr

|

Yes |

|

Pors

|

N/A |

|

Cors

|

N/A |

|

Display Analysis

|

Yes |

|

Serving country

|

GB,, |

|

Not Serving country

|

US,, |

|

Contests

|

No |

|

Market analysis

|

Yes |

|

Copy Trading Brokers

|

No |

|

Bitcoin Forex Brokers

|

Yes |

|

Social trading

|

No |

|

Web trading

|

Yes |

|

Forex pairs

|

Yes |

|

CFDs

|

Yes |

|

Crypto

|

Yes |

|

Hedging

|

Yes |

|

PAMM

|

Zulu trade,Myfxbook Auto trade,, |

|

Mobile Trading

|

Yes |

|

Scalping

|

Yes |

|

Automated Trading

|

Yes |

|

Partnership Programs

|

Yes |

|

Free Phone

|

+44 (0) 203 301 0483 |

|

Customer Support

|

24/5 |

Exness Broker reviews & comments (0)

Add a review

Your email address will not be published. Required fields are marked *