CPT Markets UK Broker Reviews and Full Information

What exactly is CPT Markets UK?

CPT Markets UK is a brokerage firm that was established with the UK with the intention to provide the most effective options for different sizes or levels of international traders who want to have a wide range of trading options. One of the most important goals for CPT Markets UK is to provide secure and transparent settings for trading that is also supported through CPT Markets UK specialization in CFDs and FX trading in accordance with the FCA Regulation.

As we discovered, over more than 10 years of expertise with Forex trading, CPT Markets UK has achieved its success by focusing on its core quality of its investment opportunity because it offers a simple method to trade CFDs without complication regarding conditions or a complicated management.

Alongside that, CPT Markets designed customized solutions for personal retail trading and special conditions for institutions. trading that are based on principles of reliability, respect and top performance.

CPT Markets UK Pros and Cons

CPT Markets UK is a excellent standing broker that offers STP execution as well as spread-based fees, there are many trading platforms and instruments Good research and customer support.

On the negative side spreads are slightly greater than the average, and education is a necessity.

10 Points Summary

| Headquarters | UK |

| Regulation and License | FCA |

| Instruments | 50 Markets, including Forex, Precious Metals, Cash Indices and Energy Futures |

| Platforms | MT4 |

| Costs | 1.8 pip |

| Demo Account | It is a service that is offered |

| Base currencies | EUR USD, GBP, EUR |

| Minimum deposit | 100$ |

| Education | Tools for research, analysis |

| Customer Support | 24/5 |

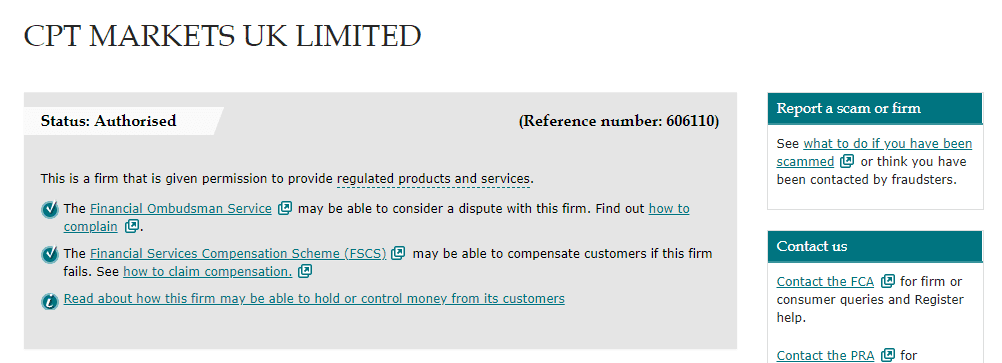

Are CPT Markets UK safe or is it

CPT Markets UK is a business and trading name that is used to refer to the Citypoint Trading Limited company which is registered within England and Wales and is also registered under the UK's FCA as a low-risk trading broker that is not a fraud. Read more about on the benefits of trade through FCA brokers that simply means that the brokers operate with a high degree of security and reliability as a result of FCA constantly monitoring its regulations. In reality, FCA is one of the most revered authorities around the globe and is able to maintain a high financial standing and conducting audits of finance companies.

CPT Markets is also operating an additional business that is conducting international business under the name CPT Markets and is registered in Belize as licensed as an IFSC investment company.

Even though Belize is an offshore area within which we don't recommend trading along with FCA implemented guidelines for investing, Belize is considered to be a secure option.

So, as CPT Markets' UK firm, CPT Markets' each customer is covered under the Financial Services Compensation Scheme (FSCS) that guarantees clients the funds they need at 50,000GBP in an unlikely event of a loss. Also, funds are kept separate from active accounts of the business, which meaning they cannot be employed for operational reasons thus making money management a clear system.

Trading Instruments

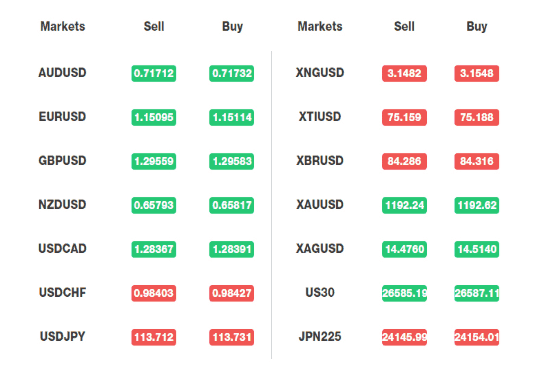

If you are looking to invest, CPT Markets UK offers custom solutions to construct and manage portfolios by providing access to more than 50 Markets which include Forex, Precious Metals, Cash Indices and Energy Futures. Along with a wide selection of portfolios, CPT Markets built low margins and spreads and also has the option for leveraged positions thus offering the chance to increase your profits.

Also, you can increase your knowledge with and increase your understanding with research materials CPT Markets provides keeping you up-to-date on market developments and news.

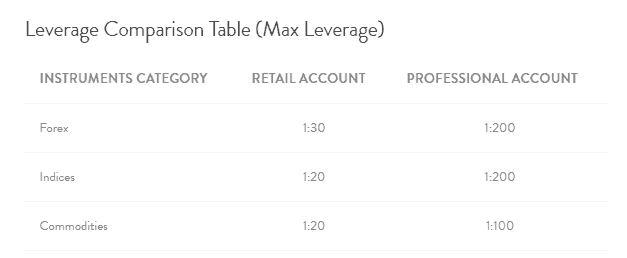

Leverage

In terms of trading leverage terms, CPT Markets UK as an UK authorized firm must comply and adheres to FCA regulations, therefore, chooses the most efficient route to enhance the potential of its offering by leveraging.

- In actual fact, European authorities strictly restrict leverage to the maximum of 1:20 on major currency pairs 1:20 in the case of minor currencies, and 1:10 for commodity pairs.

In the event that you're not a resident of Europe there is the option to trade Forex via CPY Markets international entity with the possibility of investing with higher leverage ratios , which you can inquire about with the Customer Service directly.

Types of accounts

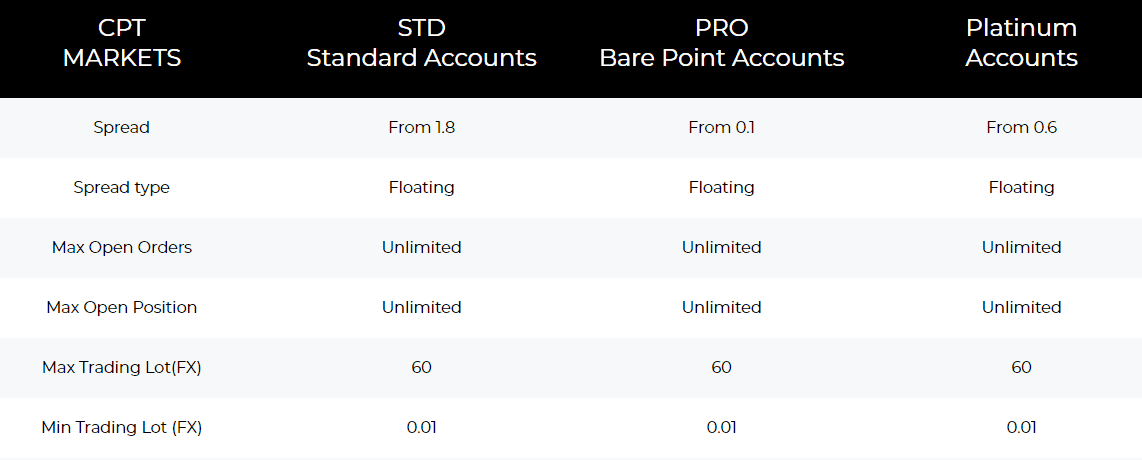

There isn't any distinction between types of accounts, unless it is defined by the kind of trader himself. That means there's an account called a Standard Account designed for retailers, and Professional accounts for professionals , respectively and then there is the Platinum account which is designed to be an exclusive solution for institutions.

In terms of the vital issue regarding trading cost, CPT Markets UK builds very competitive conditions for professional and retail traders. But, make sure you check the entity under which CPT Markets you trade, since different jurisdictions might have slightly different rules.

Fees

CPT Markets charges are usually integrated into a spread that has no commission. To see the full price, check out other fees such as withdrawal and deposit fees as well.

| Fees | CPT Markets UK Fees | City Index Spread | BDSwiss Spread |

|---|---|---|---|

| Deposit Fee | No | No | No |

| Fees for withdrawal | No | No | No |

| Fee for Inactivity | Yes | Yes | Yes |

| Fee position | Average | Low | Average |

CPT Markets UK Spread

CPT Markets UK costs mainstay on the basis of a variable (or floating spread beginning at 1.8 per cent in standard Accounts.

Below are the the typical trading charges for the most the most popular instruments. Also, examine Core Spreads trading fees to another broker that is popular HYCM..

| Asset | CPT Markets UK Spread | City Index Spread | BDSwiss Spread |

|---|---|---|---|

| EUR USD Spread | 1.8 pip | 0.5 pip | 1.5 pips |

| Crude Oil WTI Spread | 5 | 4 | 6 |

| Gold Spread | 40 | 0.3 | 25 |

Withdrawals and Deposits

CPT Markets UK and its global counterpart, as the majority of brokers offer the most commonly used payment options and support for withdrawals and funding through cards as well as wire bank transfers. E-wallets Skrill, Neteller.

Minimum deposit

CPT Markets has a small minimum deposit of 100$ for opening a Standard account. Professional accounts and institutions obviously require a larger amount that you can verify directly with customer support. But, make sure to check the margin required to trade particular instruments and then as a result, decide on the amount you wish to invest.

CPT Markets minimum deposit, compared to other brokers

| CPT Markets | Many Other Brokers | |

| Minimum Deposit | $100 | $500 |

Fee for withdrawal

CPT Markets commission and transaction charges for withdrawals that involve transfers and deposits on cards are not subject to fees from CPT Markets for withdrawals and deposits. But, you must consult with your credit card company in the event that any fees are not waived by your bank.

Trading Platforms

For the trading software, CPT Markets supports a market well-known and renowned platform called MetaTrader4. In fact, MT4 does not require an introduction because with its professional and comprehensive method of trading there are a lot of possibilities to automate, learn as well as copy and paste positions.

The platform meets the most essential trading requirements, but without causing an effort to make sense of the many expensive tools, and is well-known for its user-friendly design. Additionally the platform is accessible via either a PC or a mobile Phone through its apps designed for all types of devices.

In the end, CPT Markets UK offering the most powerful combination of among the most efficient executions, advanced technology, and lower commissions for all kinds of customers, and of course, a complete technical solution offered by the platform. There are a variety of EAs that automate trading is permitted to choose the best method for trading and also the possibility of managers using the MAM.

Conclusion

In the end, CPT Markets UK is an excellent opportunity for traders of varying sizes and portfolios. It offers everything that is needed to be successful trading an effective platform with competitive spreads as being regulated by the broker itself. A simple account opening process and money transfer to and from the account is also merit a mention. CPT Markets UK, which is a good broker worth considering.

| Properties | Values |

|---|---|

|

Name

|

CPT Markets UK |

|

Minimum Diposit

|

$ 100 |

|

Leverage

|

1:20 |

|

Regulation

|

IFSC (Belize),FCA (United Kingdom),, |

|

Headquarters

|

United Kingdom |

|

Established

|

2008 |

|

Address

|

40 Bank Street, 30th Floor, Canary Wharf, London, England,, E14 5NR , United Kingdom |

|

Platform

|

MT4,, |

|

Payment Method

|

Wire,, |

| Properties | Values |

|---|---|

|

Spreads

|

1.8 pips |

|

Min Position size

|

0.01 |

|

Broker Type

|

STP (Straight Through Processing),,,, |

|

Account Type

|

Cent account,Mini account,Scalping,Islamic account,Standard,, |

|

Brokers by Country

|

UK Forex Brokers,, |

|

Techniques

|

Hedging Forex Brokers,Carry Trade Brokers,Automated Trading Brokers,Mobile Trading Brokers,, |

|

Instruments

|

Forex Trading Brokers,Gold Trading Brokers,CFD Trading Brokers,Stock Trading Broke,Oil Trading Brokers,Commodity Forex Brokers,Metal Trading Brokers,, |

|

Account currency

|

USD,EUR,GBP,,USD, |

|

Tools

|

Charting Software,, |

|

Website Languages

|

en,, |

|

Support languages

|

en,, |

|

Bonus

|

Yes |

|

Reviews Rating

|

3.1 |

|

Withdrawal Fee

|

Yes |

|

Trading Signals

|

Yes |

|

Free Education

|

Yes |

|

Daily News

|

Yes |

|

Demo account

|

Yes |

|

Swapsr

|

Yes |

|

Pors

|

1. CPT Markets UK is a excellent standing broker that offers STP execution as well as spread-based fees, 2. There are many trading platforms and instruments Good research and customer support. |

|

Cors

|

1. Spreads are slightly greater than the average, and education is a necessity. |

|

Display Analysis

|

Yes |

|

Serving country

|

BZ,GB,, |

|

Not Serving country

|

US,, |

|

Contests

|

No |

|

Market analysis

|

Yes |

|

Copy Trading Brokers

|

No |

|

Bitcoin Forex Brokers

|

No |

|

Social trading

|

Yes |

|

Web trading

|

Yes |

|

Forex pairs

|

Yes |

|

CFDs

|

Yes |

|

Crypto

|

No |

|

Hedging

|

Yes |

|

PAMM

|

Myfxbook Auto trade,, |

|

Mobile Trading

|

Yes |

|

Scalping

|

Yes |

|

Automated Trading

|

Yes |

|

Partnership Programs

|

Yes |

|

Free Phone

|

+44 (0)203 988 2277 |

|

Customer Support

|

Exness Broker reviews & comments (0)

Add a review

Your email address will not be published. Required fields are marked *