CornerTrader Broker Reviews and Full Information

What is CornerTrader?

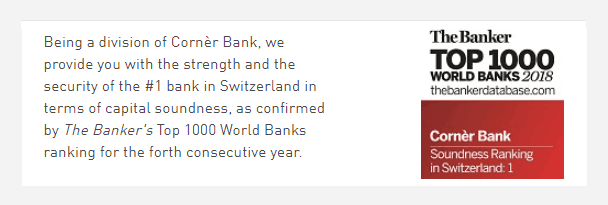

The trustworthiness of the services along with the appealing offerings is from it being the case that CornerTrader is part of the Corner Bank Group that has been deemed to be an strongest banks within Switzerland. Corner Bank Ltd is an independent Swiss private bank and is the top institution in Switzerland according to regards to capital stability founded in 1952 according to The Banker's Top 1000 World Banks ranking.

With the introduction of CornerTrader in 2012, the bank expanded the reach of its solutions and services to the market that is growing towards online trading.

Since its launch, CornerTrader gives access to the world's financial markets with a wide range of flexible tools, functions and resources with solid knowledge and top operational standards that recognize Swiss finance.

10 Points Summary

| Headquarters | Switzerland |

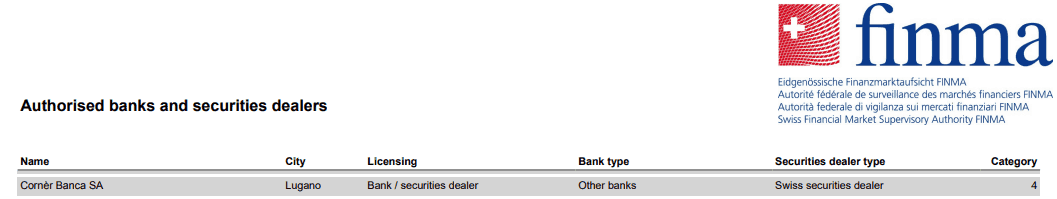

| Regulation | FINMA |

| Platforms | CornerTrader Platform |

| Instruments | Forex, FX Options, CFDs, ETFs and Stocks, aContract Options and Futures. |

| EUR/USD Spread | 1.2 pip |

| Demo Account | Available |

| Minimum deposit | 0 $ |

| Base currencies | USD, EUR, GBP |

| Education | Insights and webinars are provided. |

| Customer Support | 24/5 |

Is CornerTrader secure or is it a fraud?

CornerTrader as part of the Corner Bank which is monitored through one of the toughest regulators Switzerland FINMA. Thismeans that it's completely in compliance with the regulations and measures that are required. In reality, in order to function as a broker, any company operating in Switzerland requires a banking license. This is difficult to obtain due to the extremely high standards and the numerous regulations that govern a general system of operation that extends to a board of directors.

Thus, CornerTrader is a trusted broker, and should not cause you to doubt the reliability and trustworthiness of CornerTrader and comes more than sixty years of operations within finance. Furthermore, CornerTrader and Corner Bank is a member of the Esisuisse Depositor Protection Scheme which guarantees that the deposits of clients with Swiss banks are secured.

As per the scheme, Esisuisse members ensure the transfer of all amounts required in excess of CHF 6.8 billion, in event of a company's insolvency. The clients receive protection from fund loss that can be as much as 100,000 CHF.

Trading Instruments

A trading product of CornerTrader provides its proprietary platform, which offers thousands of assets which include over 160 Forex classes as well as FX Options as well as a plethora of ETFs, CFDs and Stocks from 22 worldwide exchanges, along with the option of Contract Options along with futures.

Leverage

In the case of Leverage, it is a tool that lets you trade larger amounts of money than your trading account. In reality, it's an kind of loan provided through the broker for the trader. Leverage lets you increase quantities that can boost the chances of earning more, however it also works in reverse.

In this regard, FINMA and various regulatory standards limit the amount of leverage to safeguard clients. As an retail trader, you have the option of using maximal leverage levels of of 1:30 to Forex instruments and professional traders must verify their status may opt higher leverage levels.

Types of accounts

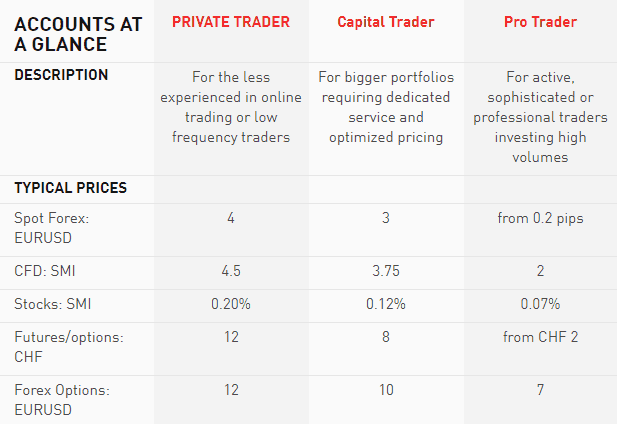

CornerTrader provides three different types of accounts each of which can be complemented by various extra services. They are can be purchased in EUR USD, USD, CHF, and more.

Fees

The approach is as flexible as the user desires and needs, since CornerTrader offers a broad assortment of trading instruments, such as CFDs, stocks, contracts and futures which allow traders to trade Forex in spot form, Forex options - both Vanilla and Binary and Forex futures.

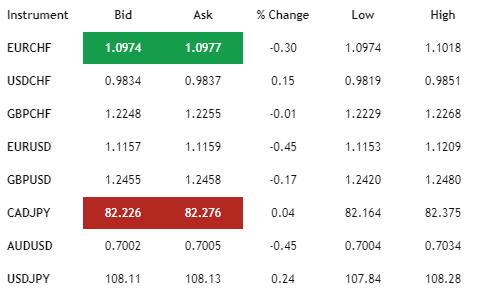

The offer also include Cryptocurrencies that include Bitcoin in addition to Ethereum trading with commissions starting at 0.07 percent for Professional traders. Forex trading is facilitated with global reach, nimble orders tickets, and an incredibly flexible combination of pricing and liquidity with no re-quotes and a range from attractive spreads 0.2 pip in the case of EURCHF or 0.4 on GBPUSD pair. Also, due to the minimal margin requirements for FX tied margins as low as 1.1% on majors as well as dedicated liquidity.

Spreads

The CornerTrader fee structure, also known as spread and commissions are dependent on the level of service indicated by the account type. In reality, Cornertrader has been widely recognized to be the top competitive service of spreads and commissions in Switzerland. Check out a sample spreads below, also compare fees with other Swiss provider Dukascopy.

Deposits and Withdrawals

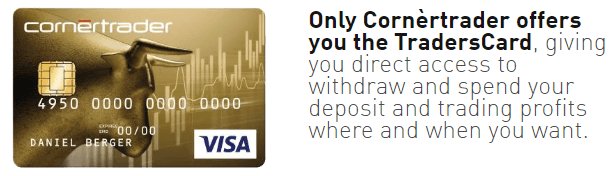

If you are a customer of CornerTrader and CornerTrader, you will automatically benefit from Swiss banking, as well as transfers of funds are performed through using the Corner Bank IBAN. CornerTrade only offers an exclusive TradersCard that is connected to the account used for trading, giving the customer the option to withdraw funds immediately at every ATM counter.

Withdrawal

CornerTrader doesn't charge a commission on cash withdrawals and the money is delivered to CornerTrader Card which makes withdrawal an easy procedure.

Minimum deposit

CornerTrader CornerTrader Minimum standards for initial funding However, it is recommended to consider the type of account you pick as some might need minimums in order to access the designed features and also cover margins required by law.

CornerTrader Minimum deposit is different from other brokers

| CornerTrader | Most Other Brokers | |

| Minimum Deposit | $0 | $500 |

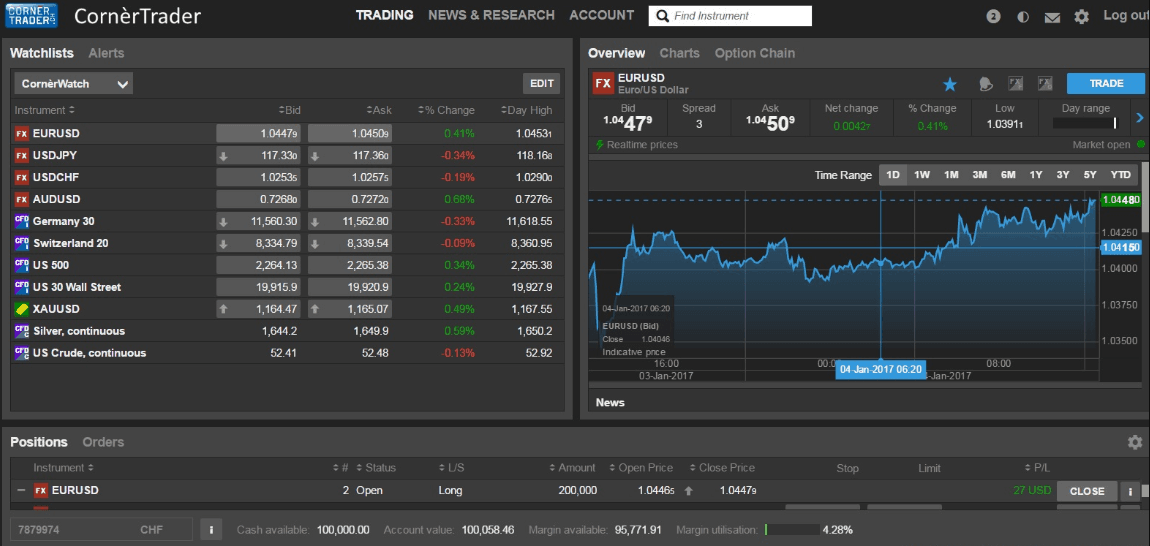

Trading Platforms

The award-winning platform has powerful capabilities created to maximise impact with advanced tools that give you access to the global markets, and intelligent thinking to guide your trading strategy. The platform is awash with an intuitive interface and strategy development capability that is accessible from any device such as a phone, desktop as well as tablets.

With CornerTrader offers you access to an aggregated liquidity source from Tier-1 banks, as well as access to more than 80 trading sites around the world with real-time pricing execution, and fee-based commissions that are competitive.

Research

The essential information required to make trading successful is accessible by way of insights Forex information, news charts and analysis, as well as controls to control and monitor the margin demands along with access to a complete account overview and fees report.

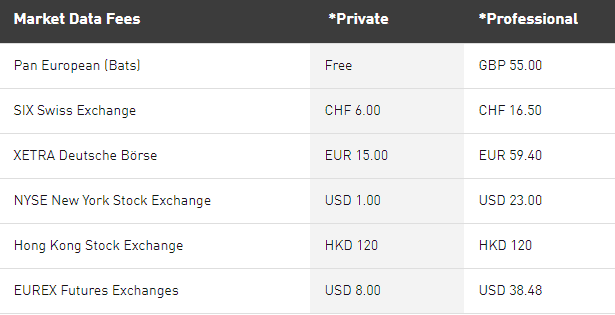

You'll have access to the ability to stream liquidity, leverage, and global access , in addition to the additional flexibility that Forex Options provide for trading every market movement that is available to professional and institutional traders, and also investing opportunities with PaMM. Be aware that CornerTrader has a charge for market data like the many futures brokers do depending on the market you decide to trade on.

Education

With the ability to implement any of a variety of trading strategies, customers can count on personal support and service given by Account Executives who specialize in trading on world markets. Additionally being supported by educational materials, insight that are accompanied by webinars and meetings developed by CornerTrader.

Conclusion

CornerTrader review reveals an extremely well-regulated Swiss multiasset Bank as well with its brokerage services competitive that have created a vast range that includes trading tools. In CornerTrader you'll discover an attention to detail for each customer with a wealth of assets as demonstrated through over 60 years of service in the financial industry. The prices for trading are extremely competitive with the markets that offer traders a variety of sizes, making it an excellent option to pick from. The company, however, does not need a minimum deposit and could be a good starting point for new traders, or even an option to active trader.

| Properties | Values |

|---|---|

|

Name

|

CornerTrader |

|

Minimum Diposit

|

$ 0 |

|

Leverage

|

1:30 |

|

Regulation

|

FINMA (Switzerland), |

|

Headquarters

|

Switzerland |

|

Established

|

1952 |

|

Address

|

Cornèr Bank Ltd. Tödistrasse 27, CH-8002, Zurich - Switzerland |

|

Platform

|

Alternative Non-MT4,Advanced Trader 1, |

|

Payment Method

|

Visa,Mastercard,Wire, |

| Properties | Values |

|---|---|

|

Spreads

|

1.2 pips |

|

Min Position size

|

0.01 |

|

Broker Type

|

MM ( Market Maker),,,, |

|

Account Type

|

Cent account,Scalping,High Leverage,Standard, |

|

Brokers by Country

|

European Union Brokers, |

|

Techniques

|

Scalping Forex Brokers,Hedging Forex Brokers,Carry Trade Brokers,Automated Trading Brokers,Mobile Trading Brokers, |

|

Instruments

|

Forex Trading Brokers,CFD Trading Brokers,Commodity Forex Brokers, |

|

Account currency

|

USD,EUR,GBP, |

|

Tools

|

Economic Calendar,Charting Software, |

|

Website Languages

|

en, |

|

Support languages

|

en, |

|

Bonus

|

Yes |

|

Reviews Rating

|

3.2 |

|

Withdrawal Fee

|

No |

|

Trading Signals

|

No |

|

Free Education

|

Yes |

|

Daily News

|

No |

|

Demo account

|

Yes |

|

Swapsr

|

Yes |

|

Pors

|

1. FINMA regulated Broker. |

|

Cors

|

1. No MT4, MT5 Trading Platform. |

|

Display Analysis

|

Yes |

|

Serving country

|

CH, |

|

Not Serving country

|

US, |

|

Contests

|

No |

|

Market analysis

|

No |

|

Copy Trading Brokers

|

No |

|

Bitcoin Forex Brokers

|

No |

|

Social trading

|

No |

|

Web trading

|

Yes |

|

Forex pairs

|

Yes |

|

CFDs

|

Yes |

|

Crypto

|

No |

|

Hedging

|

Yes |

|

PAMM

|

Myfxbook Auto trade,Mql5 signals, |

|

Mobile Trading

|

Yes |

|

Scalping

|

Yes |

|

Automated Trading

|

Yes |

|

Partnership Programs

|

No |

|

Free Phone

|

+41 58 880 80 80 |

|

Customer Support

|

24/5 |

Exness Broker reviews & comments (7)

cheap rx drugs https://canadianpharmaceuticalshelp.com/ canadian pharmacies

legitimate canadian pharmacies online https://canadianpharmaciesshop.com/ canadian online pharmacy reviews

no script pharmacy https://canadianpharmacypoint.com/ pharmacy price comparison

Add a review

Your email address will not be published. Required fields are marked *