Core Spreads Broker Reviews and Full Information

What is Core Spreads?

Core Spreads is a brokerage company. Core Spreads as a brokerage firm was founded within the UK in the aim to provide the most effective opportunities to active investors.

The approach outlined by the Core Spreads is designed to provide the highest value in the business while cutting cost by reducing "first necessity" extensions. Their proprietary platform is designed to provide an honest , low cost for every client.

A closer look at the offer the product itself Core Spreads combined years of experience in the market , while providing spread betting and CFD trading with the most basic of features that are facilitated through strict as well as fixed spreads and help maximise return.

Core Spreads Pros and Cons

Core Spreads is a trusted broker that has been it is regulated by the highly secure FCA located in UK. It is a simple account opening procedure, and the spreads are among the lowest with floating or fixed proposal.

From the side of cons Core Spreads instrument range is quite limited and there is no support available 24/7.

10 Points Summary

| Headquarters | UK |

| Regulation | FCA |

| Platforms | CoreTrader2, MT4 |

| Instruments | Foreign exchange (including Spread Betting for UK residents), Shares, Indices, Commodities and Cryptocurrencies |

| EUR/USD Spread | 0.7 Pips |

| Demo Account | Available |

| Minimum deposit | 0 US$ |

| Base currencies | USD, EUR, GBP |

| Education | Provided |

| Customer Support | 24/5 |

Awards

A further aspect of the business is their team of service professionals that will provide an individual service that traders require We like the fact Core Spreads consistently receives positive feedback from their traders. Core Spreads continuously receives positive reviews from their customers and has also won an honorable award: Best Value Broker 2017 | UK Forex Awards 2017

Are Core Spreads safe or a scam?

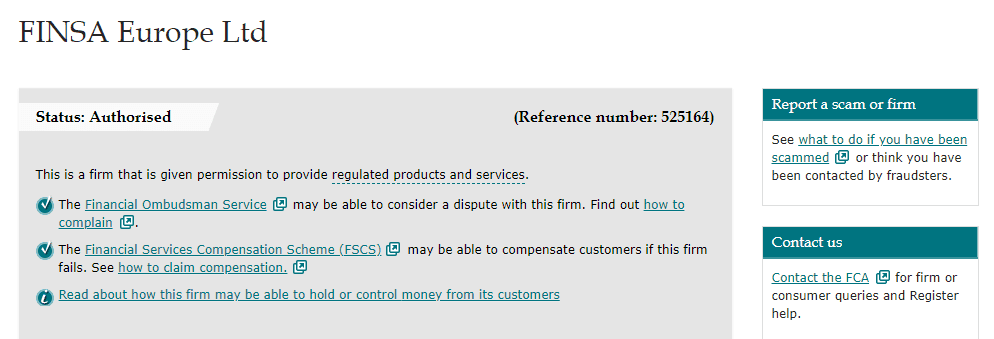

Yes, Core Spreads is not an enigma, it's an official trading name of Finsa Europe Ltd, which is a registered business in the UK that is a as a low risk trading business because of regulation.

Finsa Europe Ltd. is subject to Financial Conduct Authority (FCA) regulation in the UK and enforces some of the most stringent rules of the financial market which are widely accepted. In accordance with the rules set by the Financial Conduct Authority, Finsa Europe Ltd. is bound by an obligation to conduct business in honesty, fairness and professional manner , and be in customer's most beneficial interests.

How can you be protected?

Furthermore, every client is covered under this scheme is protected by Financial Services Compensation Scheme (FSCS) according to FCA guidelines which guarantees customers' cash up to the amount of 50,000 pounds in an likely event. Also, funds are stored separately from actives of the business, which meaning they cannot be employed for operational reasons and are stored in separate bank accounts at Barclays which protects your account.

Trading Instruments

The market offers cover the most significant instruments, bringing trading access to 30 currencies at Forex (including Spread Betting for UK residents) and a vast selection range of Shares, Indices, Commodities and Cryptocurrencies

Leverage

In terms of the leverage for trading limitations, Core Spreads chooses the best way to maximize the value of the offer through leverage that also conforms to FCA regulation. In reality, European authorities strictly restrict leverage to a maximum limit of

- 11:30 to show major currencies

- 1:20 in minor currency

- 1:10 in the case of commodities.

Additionally, the recently announced Core Spreads, the newly presented Core Spreads possibility to trade cryptocurrency offers the chance to speculate on cryptos at a leverage of 2.5:1 however, it is available to only professionals.

Account types

Core Spreads has one account type. The company sticks not to separate their customers and offers every customer great conditions. The littleest difference could occur on different systems Core Spreads operate.

Fees

Core Spreads's prices and MT4 provides different spreads as well as low commission fees. All customers at Core Spreads are treated as retail customers, however, you can be a professional, that requires experience and a significant volume of transactions. In the reverse, you can get the status of a professional with appealing conditions, lower prices and the ability to participate in programs.

| Fees | Core Spreads Fees | AvaTrade Fees | Plus500 Fees |

|---|---|---|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity Fee | Yes | Yes | Yes |

| Fee position | Low | Average | Low |

Spreads

CoreTrader spreads are high-quality, but some of them lower spreads that can be fix. This is why it's an excellent choice that you can choose from the options and decide which fee structure is the most suitable for you.

Check out the below average Core Spreads trading spreads for well-known instruments. You can also examine Core Spreads trading fees to another well-known broker HYCM..

| Spread | Core Spreads Spread | AvaTrade Spread | Plus500 Spread |

|---|---|---|---|

| EUR USD Spread | 0.6 pip | 1.3 pip | 0.6 pip |

| Crude Oil WTI Spread | 3 pip | 3 pip | 2 Pips |

| Gold Spread | 4 | 4 | 2.9 |

| BTC/USD Spread | 0.70% | 0.75% | 0.35% |

Deposits and Withdrawals

Core Spreads offer for your convenience the most popular payment options, while also offering the option to deposit and withdraw cash via card payments or wire bank transfer and through an e-wallet Skrill.

Minimum deposit

There's an absence of a minimum investment required in the case of Core Spreads account opening. In order to trade, you have to make a'margin' that is basically money to protect yourself in the event that you lose funds on the trade instead of gaining. The margin you need for the account is proportional to the amount of trade. Occasionally, it is less than one percent.

Core Spreads minimum deposit, compared to other brokers

| Core Spreads | Most Other Brokers | |

| Minimum Deposit | $0 | $500 |

WIthdrawals

Core Spreads withdrawals are that are similar to deposits Bank Wire and Card payments The transaction fees associated with transfers and deposits made with cards are not subject to costs from the business for withdrawals and deposits. However, it is important to inquire with your bank to determine if fees can be not waived by your bank.

Trading Platforms

For this trading program Core Spreads offering, there is the option of choosing between CoreTrader2's custom-built Platform CoreTrader2or the option to select the industry-standard platforms such as MetaTrader4. With this option the pricing method has been developed between fixed or variable spreads that are varied through platforms.

CoreTrader is CoreTrader offers some of the most affordable fixed spreads on the market, with no commission when you trade via applications or on the web. The platform is equipped with the essential requirements for trading without causing confusion among many expensive tools. It it is a reliable and fast software that executes quickly and is an excellent tool for clients of spread betting.

The MT4 itself doesn't require any explanation, but it is available at Core Spreads offering a powerful combination of among the most flexible spreads and low commissions of only 1.5dollars each lot to all customers as well as the most comprehensive technical solutions available through the platform. Automated trading using EAs are also allowed, as is MT4 is available on the mobile and desktop apps.

Conclusion

Our final thoughts on Core Spreads, one of the principal advantages that we like about Core Spreads is their spreads offer that they've created on a par basis, along with the choice to pick floating or fixed spreads. Core Spreads doesn't offer education materials, nor does it offer sophisticated tools, however, it provides clear and transparent trading processing. The conclusion is exactly the same as the company's position the same way - not much noise, just narrow spreads across hundreds different markets.

| Properties | Values |

|---|---|

|

Name

|

Core Spreads |

|

Minimum Diposit

|

$ 1 |

|

Leverage

|

30:1 |

|

Regulation

|

FCA (United Kingdom), |

|

Headquarters

|

United Kingdom |

|

Established

|

2015 |

|

Address

|

9th Floor, 30, Crown Place, London, EC2A 4ES, United Kingdom |

|

Platform

|

MT4,MT4 WebTerminal,cTrader, |

|

Payment Method

|

Visa,Mastercard,Wire, |

| Properties | Values |

|---|---|

|

Spreads

|

0.7 pips |

|

Min Position size

|

0.01 |

|

Broker Type

|

MM ( Market Maker),Instant Execution,,,, |

|

Account Type

|

Mini account,Standard, |

|

Brokers by Country

|

UK Forex Brokers, |

|

Techniques

|

Scalping Forex Brokers,Hedging Forex Brokers,Automated Trading Brokers,Mobile Trading Brokers, |

|

Instruments

|

Forex Trading Brokers,Gold Trading Brokers,CFD Trading Brokers,Crypto Trading Brokers,Stock Trading Broke,Oil Trading Brokers,Commodity Forex Brokers,Metal Trading Brokers,Indexes Trading Brokers, |

|

Account currency

|

USD,EUR,GBP, |

|

Tools

|

Economic Calendar,Charting Software, |

|

Website Languages

|

en, |

|

Support languages

|

en, |

|

Bonus

|

Yes |

|

Reviews Rating

|

3.2 |

|

Withdrawal Fee

|

No |

|

Trading Signals

|

No |

|

Free Education

|

Yes |

|

Daily News

|

No |

|

Demo account

|

Yes |

|

Swapsr

|

Yes |

|

Pors

|

1. FCA Regulated. 2. MT4 Trading Platform Available. |

|

Cors

|

1. Customer Support 24/5. |

|

Display Analysis

|

Yes |

|

Serving country

|

AU,BS,ZA,GB, |

|

Not Serving country

|

AF,AL,DZ,AS,AD,AO,AI,AQ,AR,AM,AW,AT,AZ,BS,BE,BZ,BJ,BM,BT,BO,BA,BW,BV,CZ,DK,DJ,DM,DO,EG,SV,GQ,ER,EE,FK,FO,FJ,FR,FX,GF,TF,GA,GM,GE,DE,GH,GI,GR,GL,GP,GU,GT,IT,JM,JP,JO,KW,KG,LV,LB,LS,LY,LT,MO,MG,MW,MY,MT,MQ,MR,MU,FM,MD,MN,MS, |

|

Contests

|

No |

|

Market analysis

|

Yes |

|

Copy Trading Brokers

|

No |

|

Bitcoin Forex Brokers

|

Yes |

|

Social trading

|

No |

|

Web trading

|

Yes |

|

Forex pairs

|

Yes |

|

CFDs

|

Yes |

|

Crypto

|

Yes |

|

Hedging

|

Yes |

|

PAMM

|

Myfxbook Auto trade,Mql5 signals, |

|

Mobile Trading

|

Yes |

|

Scalping

|

Yes |

|

Automated Trading

|

Yes |

|

Partnership Programs

|

Yes |

|

Free Phone

|

+44 203 475 4830 |

|

Customer Support

|

24/5 |

Exness Broker reviews & comments (0)

Add a review

Your email address will not be published. Required fields are marked *