Core Liquidity Markets CLM Broker Reviews and Full Information

What exactly is Core Liquidity Markets CLM?

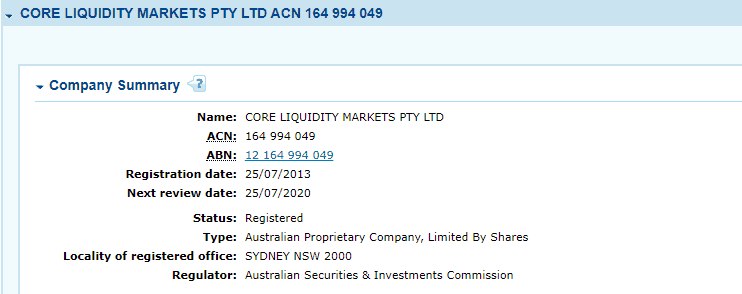

Core Liquidity Market or CLM is an brokerage company that was established in Australia and also as the sole operating company through off-shore Saint Vincent and the Grenadines with a goal of international reach. The business has been in operation since 2013, and has since it has gained an excellent standing in the business community, along with many traders they service across the globe.

10 Points Summary

| Headquarters | Australia |

| Regulation | ASIC |

| Instruments | Equity, Commodities, FX, Indices Cryptocurrencies and Gold |

| Platforms | MT4 |

| Spread EUR/USD | 1.3pips |

| Minimum deposit | 100 $ |

| Demo Account | Available |

| Base currencies | USD, USD |

| Education | Research and education materials are included |

| Customer Support | 24/5 |

Do you think Core Liquidity Markets CLM safe or is it a fraud?

We are now moving to the most important section of the Core Liquidity Markets CLM review the license that the company starts its trading business and offers services.

As we have previously criticized, Core Liquidity Markets operates through two different locations. One firm is located within Australia and is therefore authorized to ASIC. The second one is located in the offshore region of Saint Vincent and the Grenadines that is merely registering financial institutions and doesn't have strict supervision.

Even so, in conjunction with solid and reputable operating guidelines from ASIC We consider Core Liquidity Markets as a reliable broker to trade with.

There are many established standards companies must adhere to prior to obtaining their ASIC license. It is then monitored in relation to its credibility. Additionally, ASIC being one of the most flexible regulatory bodies, is aware of the needs of traders and assists various ways, including the safety of money, educational resources and support at all times.

Thus, when trading with an Australian licensed broker you can be with confidence knowing that you will be protected and have unbeatable conditions for trading.

Leverage

Additionally, when trading with Liquidity Markets or CLM you will be using CLM, you will have a higher leverage rate in the sense that ASIC permits these levels even for traders who are retail. So, some Forex instruments are available with a ratio of 1:500 and each instrument comes with its own specific level that is set by the business and restrictions imposed by the regulatory authorities.

However, you must be aware of how you can leverage wisely since unintentional use could increase your risk significantly.

Instruments

Core Liquidity Markets CLM trading plan is a safe option for traders regardless of the strategy you use, or at what the level at which you're. CLM also diversifies its portfolio with a variety of options for access and market selection that includes the following: Equities Commodities such as FX, Indices Cryptocurrencies as well as gold.

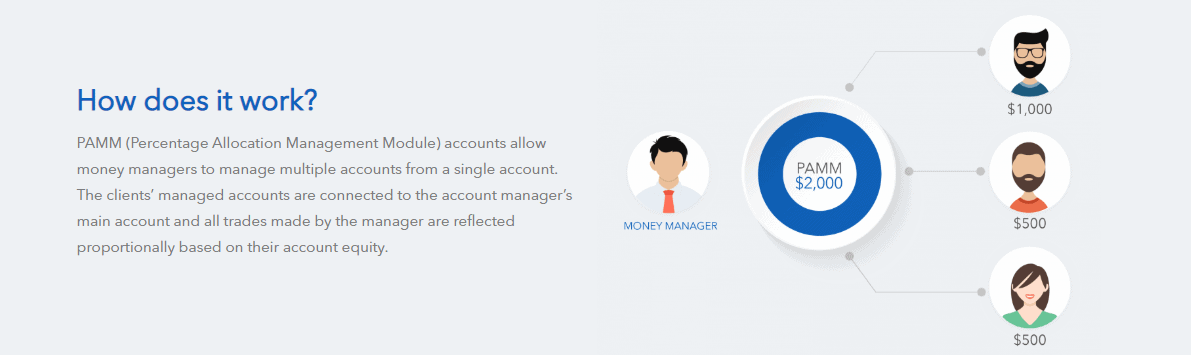

Additionally, there's a Money manager program that has been developed comprising MAM and accounts with PAMM which provide access to a variety of services with a customized trading conditions.

Types of accounts

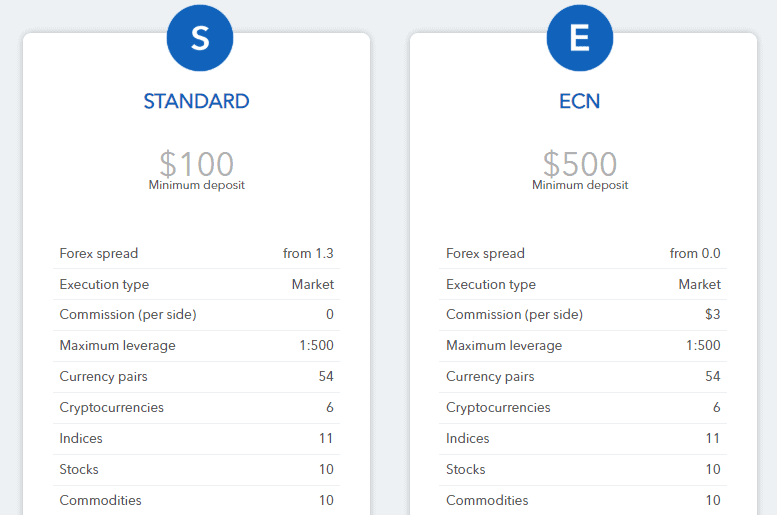

Core Liquidity Markets offers two different types of accountswith the possibility to start trading with relatively modest initial deposits to both accounts Standard and ECN. Additionally, both accounts let you choose the one that is most appropriate to your preferences in trading, or with all expenses included in a spread, or the raw spread, plus commissions per trade.

Fees

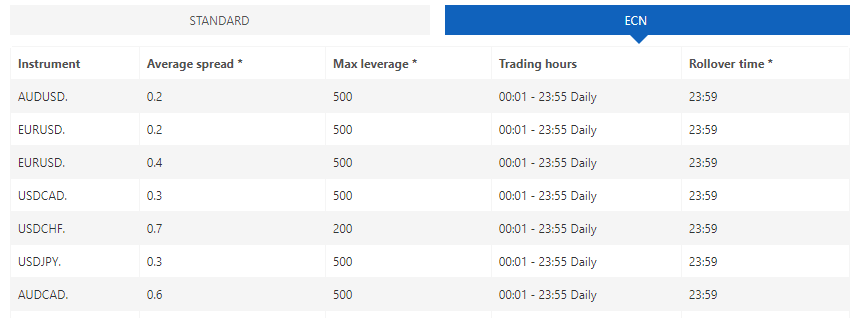

We have mentioned that Standard account comes with spread-only basis, with spreads start from 1.3pips, and ECN account spreads start at zero pips however they are charged an additional commission of $3 per side.

Take a look at some CLM spreads below. You might want to go to Blueberry Markets to get a better understanding of the pricing of the business.

Additionally, when you are in any position for longer than one day, you could gain the benefit of an interest-rate or pay an additional fee if you decide to go long. This rate of interest, often referred to as the rollover fee or overnight fee.is distinct for each instrument, and is calculated on the base rate.

What payment method does Central Liquidity Markets CLM uses?

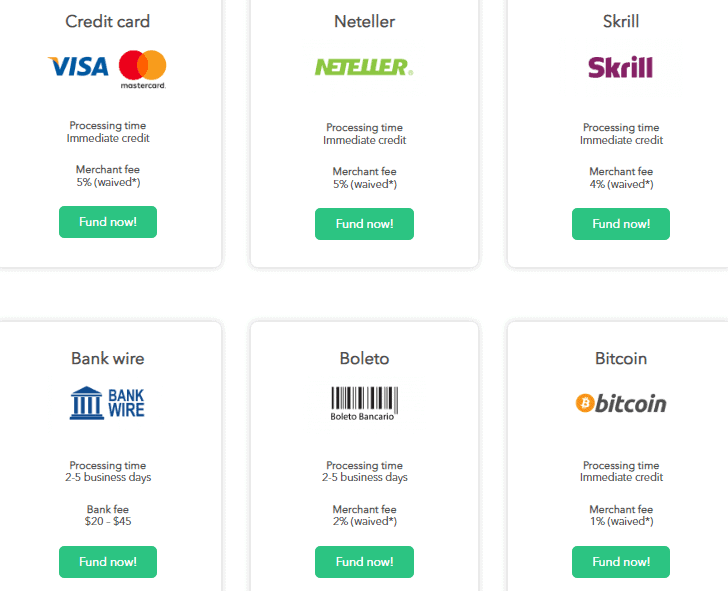

Transferring funds into the Core Liquidity Markets account is eventually a breeze, since the broker is able to accept a variety of methods , such as Bitcoin payment, Credit, debit cards, Bank Wire Transfer or Skrill, Neteller, Boleto.

Minimum deposit

The minimum amount for Core Liquidity Markets is 1000dollars for the Standard Account, and $50,000 for the Platinum account. While the deposit requirement is very high and is attainable mostly for high-volume or professional trader, CLM targets are primarily these customers.

Core Liquidity Markets minimum deposit in comparison to other brokers

| CLM | The majority of other brokers | |

| Minimum Deposit | $250 | $500 |

The fee for withdrawing

The majority of payment methods that are offered by the Core Liquidity Markets CLM waived fees which were usually set by the service provider, so you will benefit in no cost deposits, too. However, depending on the country of origin or another the payment method, small fees might be in place, or withdrawals will be subject to at least 5$ for any withdrawal.

Trading Platforms

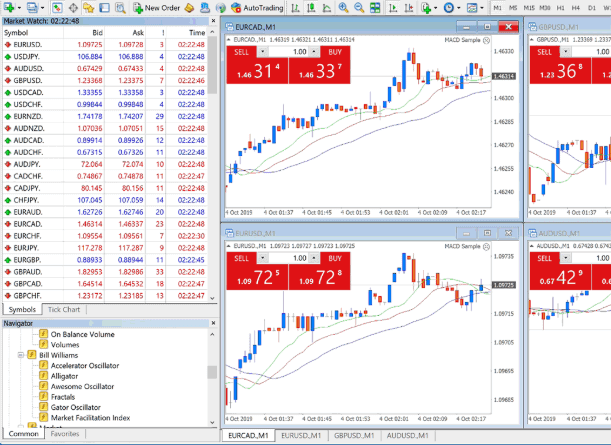

It is evident that Core Liquidity Markets made the decision to be a majorstay on the largest charts platform and one that is well-known to traders around the world. The platform used can be described as MetaTrader4 it is a program that is appropriate for both professionals and beginners, preferred by traders who use either automated or manual strategies developers, developers, and others.

Alongside its powerful trade capabilities MT4 provides access to more than 100 trading instruments that are accessible from an interface and account that is shared by. The broker servers are also are located within the LD4 region provide lightning-fast speeds for executions as well as connecting quotes from a variety of liquidity providers to ensure the best results.

Conclusion

In conclusion of Core Liquidity Markets CLM Review We see a business which offers trading conditions that are that are suitable for novice traders and professionals as well as Money Managers. The cost of trading is also maintained at an acceptable level, which means you can use a wide range of trading instruments. Being an ASIC controlled firm, it provides the stability of your account, where the security is in place.

| Properties | Values |

|---|---|

|

Name

|

Core Liquidity Markets CLM |

|

Minimum Diposit

|

$ 100 |

|

Leverage

|

500:1 |

|

Regulation

|

ASIC (Australia),, |

|

Headquarters

|

Australia |

|

Established

|

2012 |

|

Address

|

Suite 305, Griffith Corporate Centre Beachmont, Kingston, St. Vincent |

|

Platform

|

MT4,MT4 WebTerminal,, |

|

Payment Method

|

Visa,Mastercard,Credit Card,Wire,Skrill,Neteller,, |

| Properties | Values |

|---|---|

|

Spreads

|

0.3 PIPs |

|

Min Position size

|

0.01 |

|

Broker Type

|

ECN (electronic communications networks),, |

|

Account Type

|

Cent account,Mini account,Scalping,High Leverage,Standard,, |

|

Brokers by Country

|

Australian Forex Brokers,, |

|

Techniques

|

Scalping Forex Brokers,Hedging Forex Brokers,Automated Trading Brokers,Mobile Trading Brokers,Day Trading Brokers,, |

|

Instruments

|

Forex Trading Brokers,Gold Trading Brokers,Oil Trading Brokers,Commodity Forex Brokers,Indexes Trading Brokers,, |

|

Account currency

|

USD,,USD,,USD, |

|

Tools

|

Charting Software,, |

|

Website Languages

|

en,, |

|

Support languages

|

en,, |

|

Bonus

|

Yes |

|

Reviews Rating

|

3.8 |

|

Withdrawal Fee

|

No |

|

Trading Signals

|

Yes |

|

Free Education

|

Yes |

|

Daily News

|

Yes |

|

Demo account

|

Yes |

|

Swapsr

|

Yes |

|

Pors

|

1. Demo trading account available for 30 days 2. Regulated by St. Vincent and the Grenadines 3. Upwards of 90 Tradable Instruments Available to Clients 4. Minimum Account Deposit of £100 |

|

Cors

|

1. No MetaTrader 5 2. No FCA Regulation 3. Stocks Are Listed, but No Stocks Are Available |

|

Display Analysis

|

Yes |

|

Serving country

|

AU,, |

|

Not Serving country

|

US,, |

|

Contests

|

Yes |

|

Market analysis

|

Yes |

|

Copy Trading Brokers

|

No |

|

Bitcoin Forex Brokers

|

No |

|

Social trading

|

Yes |

|

Web trading

|

Yes |

|

Forex pairs

|

Yes |

|

CFDs

|

Yes |

|

Crypto

|

No |

|

Hedging

|

Yes |

|

PAMM

|

PAMM,MAMM,Mql5 signals,, |

|

Mobile Trading

|

Yes |

|

Scalping

|

Yes |

|

Automated Trading

|

Yes |

|

Partnership Programs

|

Yes |

|

Free Phone

|

+44 2 035 146 538 |

|

Customer Support

|

24/5 |

Exness Broker reviews & comments (0)

Add a review

Your email address will not be published. Required fields are marked *